Author: Christopher Tepedino, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

As Metaplanet continues to add Bitcoin to its coffers, mimicking the moves of Michael Saylor's Strategy (formerly MicroStrategy), its stock price has soared over the past year.

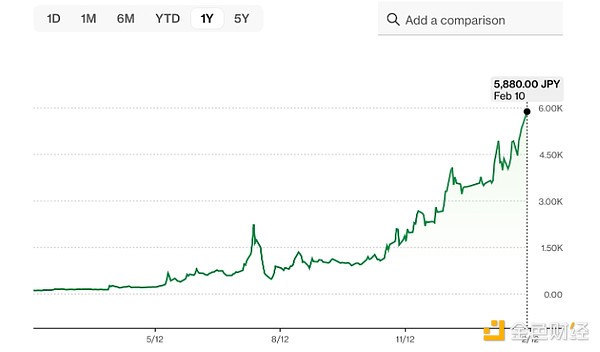

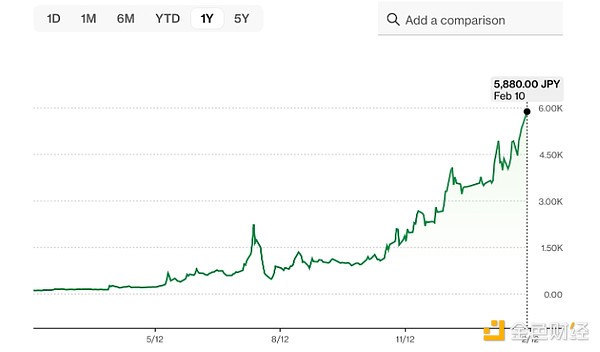

According to Bloomberg data, As of February 10, the company's shares have risen 4,800% in the past 12 months, nearly a year after the company announced its Bitcoin funding strategy in April 2024.

Metaplanet shares have risen over the past year. Source: Bloomberg

According to Metaplanet, As of January 28, the company had acquired 1,762 BTC, worth approximately $171 million. The company plans to acquire up to 21,000 BTC by the end of 2026, which means it will own one-thousandth of all Bitcoin ever created. With the help of its BTC purchases, Metaplanet recently posted its first operating profit in seven years.

The company is following in the footsteps of Strategy, which has been adding BTC to its coffers since August 2020. Since then, Saylor's company's stock price has soared from $13.49 to $332.60 at the time of writing. Other companies, such as Semler Scientific, have also adopted this strategy, sometimes sparking enthusiasm and stock price increases, and sometimes not.

According to the introduction of its Bitcoin plan, Metaplanet's shareholder count grew 500% in 2024, with 50,000 people or entities invested in the company. Its market cap has also grown by more than 6,300% during the same period, according to Stock Analysis. Observers are increasingly viewing Bitcoin as a strong alternative to holding cash on a balance sheet, as well as a hedge against inflation. At least 16 U.S. states have introduced legislation to start holding BTC reserves, and several countries, including the U.S. and Czechoslovakia, are also exploring BTC as a reserve asset. According to CoinGecko, at least 32 public companies hold BTC on their balance sheets. Some of these are native cryptocurrency companies, such as miners, while others are more traditional companies. Bitcoin has risen 133% in the past 52 weeks, driven in part by these tailwinds. BTC has a 60.5% market dominance, according to CoinMarketCap, and has been trending upward since hitting a low of 38% in December 2022.

Catherine

Catherine