Source: Lao Miao Forum

I know it stopped abruptly, just to make a joke><

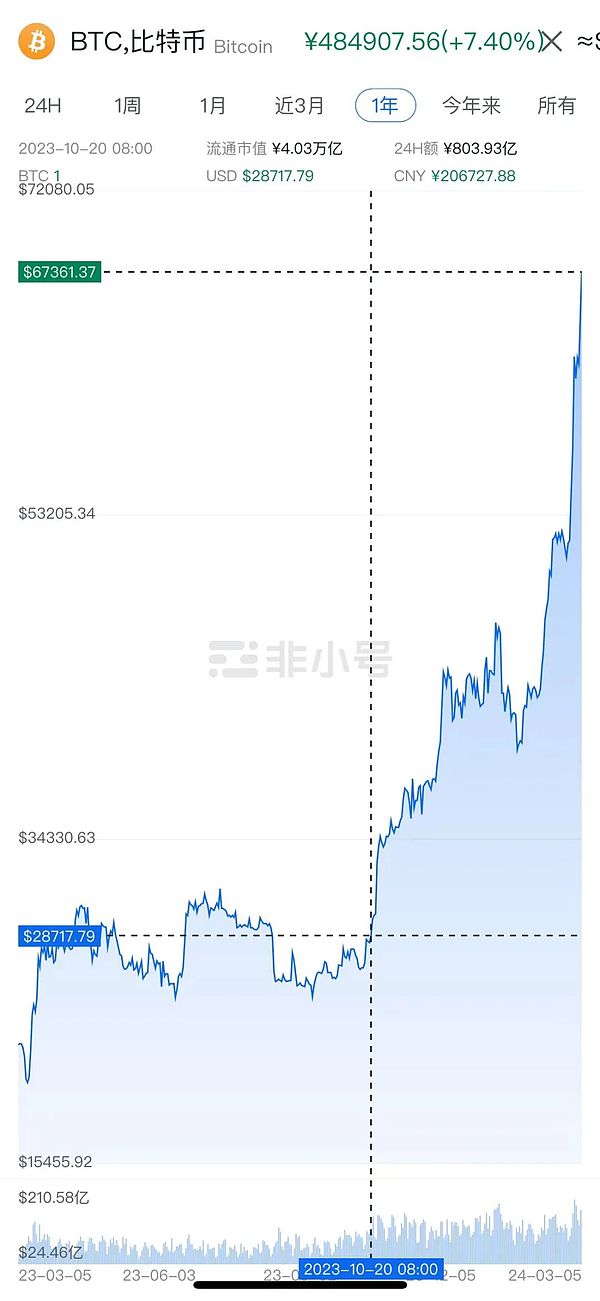

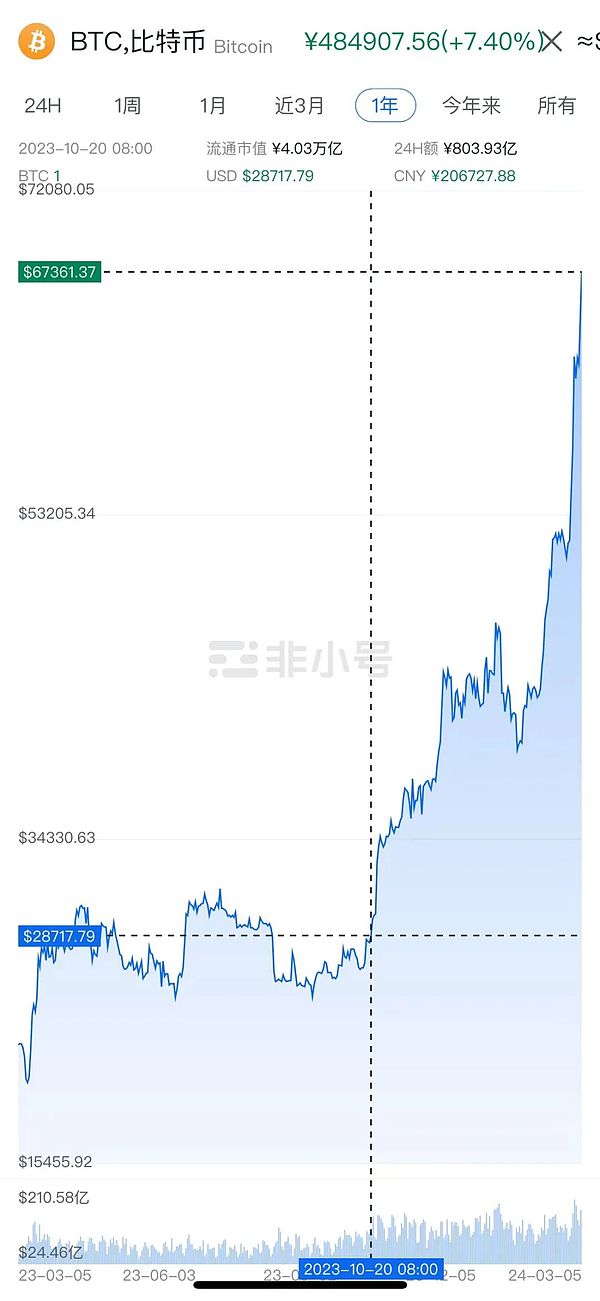

I wrote the last article on this official account On October 20, 2023, BTC was $28,000 and eth was $1,500. That year I wrote a public account.

I wrote "The world is on the opposite side of us, and time is on our side"

After the publication, the K-line of BTC looked like this:

I admit that my fans are of high quality and respond quickly, but I didn’t expect that, The guys from ETF are also paying attention to the Laomiao Forum. Are you ALL IN after reading this?

The above is Lao Miao’s accurate grasp of the turn of the bear market into a bull market, and I must boast about it.

The following is Lao Miao’s random thoughts about the turn of the bull market into a bear market. You can watch it or not.

As we all know, what is the most important thing today?

1. Selection. What you choose to buy is so important. If you are looking for a hundred-fold coin or ten ten-fold coins, you can search hard and desperately. When the secondary market is established, don’t let go of the primary market. If you are not bold in the bull market, how can you produce wallets?

2. Double investment. In the previous stage, I doubled my investment, now I quickly double my investment, make more profit, then increase my leverage, and go all the way north.

3. Enter the paid group.

Sorry, all the above is wrong.

As long as you agree with one of them, your attention to me will be in vain.

The bear market makes you full and dissatisfied with the position. If you go to the bull market and chase the highs, this is inappropriate.

While everyone is thinking about how to select funds in the bull market, how to raise prices, how to innovate, and how to start a business, Lao Miao is thinking about how to do charity.

What is charity?

When 99% of people come in to grab chips, I sell to them mercifully.

When 99% of people dump their chips and run away, I mercifully buy them away.

Lao Miao is only studying one thing this year, which is when to sell coins.

This year is also the most difficult year to study and understand in the past ten years and two and a half cycles. Because of BTC, he did not play according to the rules.

He drifted.

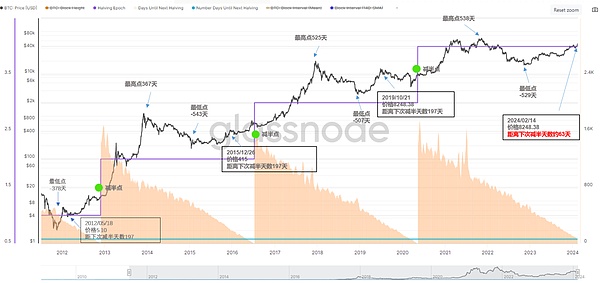

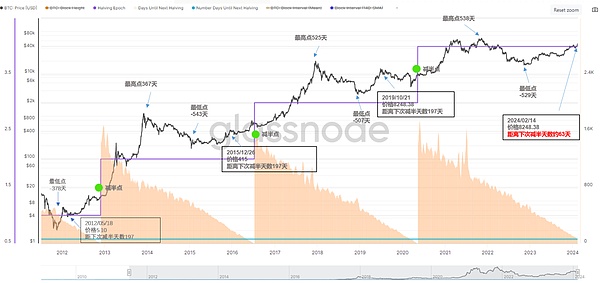

There is an iron law in the BTC cycle itself, that is, the bull market officially starts in the year after the halving, then breaks through the previous high, reaches the highest point 350-500 days after the halving, and about 200 days before the next halving. reach rock bottom.

Only this time, BTC has not yet reached the halving day, 100- It was higher before the 200-day break. As I write this, BTC has already broken 66,000 dollars, which is equivalent to the RMB exchange rate. That is not the high before the break.

So will the highest point of this bull market also arrive 1-200 days in advance?

This is the question that I think deeply about.

I think the special reasons for this round of bull market are so damn special, that is, ETFs + new highs in US stocks + expectations of interest rate cuts + the release of the US dollar. Four injections of stimulants pierced BTC's flesh at once, causing him to develop prematurely, 200 days prematurely.

Here comes the problem. Lao Miao often says that the cycle of BTC is affected by both internal and external factors. According to the cycle of internal factors, it should not rise now. According to the stimulation of external factors, it should not not rise now.

How can we analyze this next?

I really analyzed it.

Lao Miao believes that there are two possibilities:

1. External factors continue to dominate, and the efficacy of stimulants overlaps with internal factors. The highest point of the BTC bull market arrived 200 days ahead of schedule, and then entered the bear market. That is, the bull market peak that was supposed to arrive in November-December 2025 arrived in May 2025 ahead of schedule. Starting from today, it has been bullish all the way, without a big and long correction, slowly rising, slowly going sideways and then rising slowly. Internal factors gradually mature and external factors gradually join forces. ETFs passed one by one, U.S. stocks continued to soar, interest rate cuts were implemented smoothly, and the U.S. economic recession landed softly. This is script one.

2. Two-headed cow. The external bandage was too strong, the medicine was too effective, and the child was injured. The U.S. stock market went from trading interest rate cuts to trading recessions and a hard landing. The four needles were withdrawn at the same time. The internal factors of Bitcoin have not yet grown, and ETFs have also become yellow. External factors withdraw from the market, and BTC plummets, similar to 2020.3.12. The market returns to the dominance of BTC internal factors. It honestly reached its highest point in November-December 2025, and this ETF passed lightly. This is script two.

Script one is more like the bull market in 2016-2017, and script two is more like the bull market in 2020-2021.

The response is to identify the direction of development based on these two sets of ideas. Make buying and selling decisions.

Of course, Lao Miao hopes in his heart that it is the second one. This is not about eating two things with the same fish. The official account is updated twice a year, wealth is given as an ox and a bear is given, sell once, and then buy the bottom,

Timeer cattle.

Finally, I would like to say that the craziest group of people clamoring in the bull market at this time are often the most pessimistic group of people in the bear market a year ago.

Madness and despair are both signs of weakness.

Let’s make a prediction. Lao Miao predicts that in this bull market, BTC will reach a maximum of 100,000-150,000 US dollars, and eth will reach a maximum of 10,000-20,000 US dollars.

Today’s BTC: $67,000, ETH: $3,500

Alex

Alex