Authors: Wei Xincheng, Cui Rong, Li Chong

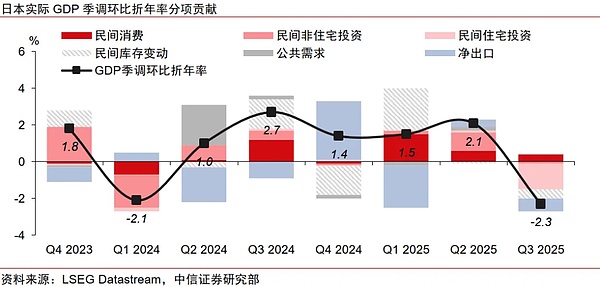

Japan's virtuous cycle of inflation has become relatively stable, and the Bank of Japan is about to raise interest rates again. The global market turmoil following Japan's interest rate hike last summer was mainly caused by US factors such as rising recession expectations and the erosion of the AI narrative. The reversal of carry trades was only a secondary factor that exacerbated risk aversion at that time, and last year's "Black Monday" is unlikely to be repeated this year.

Against the backdrop of policy differences between the US and Japanese central banks, US factors are the core theme of current global liquidity and dollar asset pricing. Currently, market skepticism about the AI narrative is concentrated in a few companies with more aggressive business models, while most AI leaders with more stable financial conditions can still maintain market trust. The industrial intelligence boom should continue to support the performance of US stock leaders in the short to medium term.

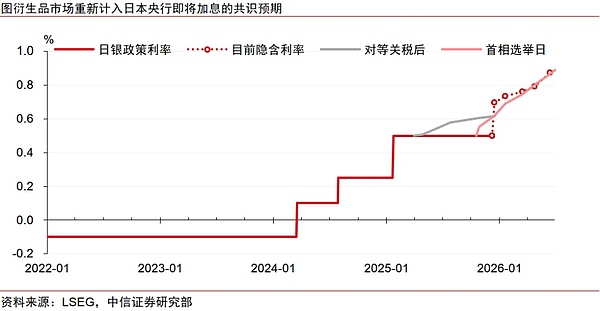

The impact of the Bank of Japan's interest rate hike on global liquidity is not terrible.

Many investors are still wary of the "Black Monday" following the Bank of Japan's interest rate hike last summer, worrying whether a new rate hike will again "bring down" global markets.

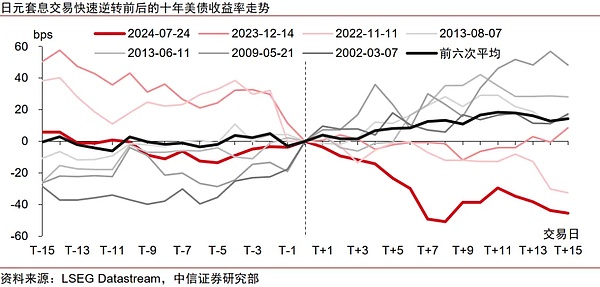

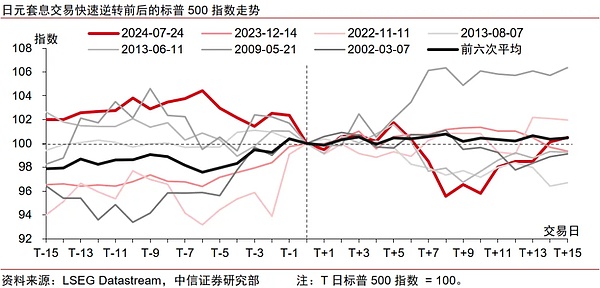

By summarizing the experience of seven rapid reversals of yen carry trades since the beginning of this century, we find that while rapid reversals of yen carry trades can indeed suppress the performance of US Treasuries, their impact should not be exaggerated. Their disturbance to US stocks is usually short-lived, and the spillover effect of a jump in long-term Japanese bond yields is limited to major bond markets and Southeast Asian stock markets. Furthermore, overseas funds may not necessarily flow back to Japanese equity and bond assets after the Bank of Japan raises interest rates.

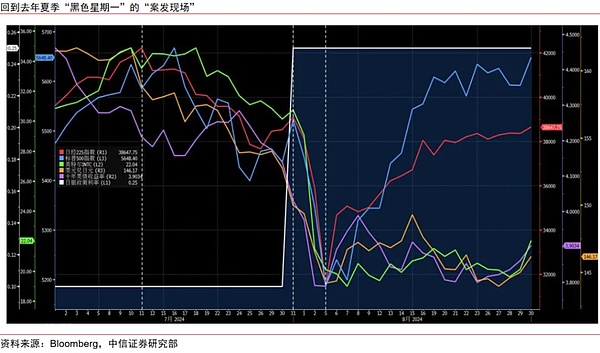

Looking back at the timeline, we believe that last summer's "Black Monday" was mainly caused by US factors such as rising recession expectations and a wavering AI narrative, while the reversal of yen carry trades was only a secondary factor that exacerbated market risk aversion at the time.

The turmoil in global markets during the Bank of Japan's interest rate hike last summer is unlikely to be repeated this year.

On the one hand, unlike last year, the short-term funding cost of the Swiss franc is now lower than that of the yen, and the Swiss National Bank may intervene in the foreign exchange market to promote the depreciation of the Swiss franc. Therefore, the yen is no longer the preferred funding currency for global carry trades, and existing yen positions in carry trades may have been gradually absorbed by the Swiss franc.

On the other hand, if previous experience still holds true, then even if the yen carry trade reverses again, the potential impact of the Bank of Japan's interest rate hike on global market liquidity should not be too drastic.

Against the backdrop of policy divergence between the central banks of the US and Japan, the US factor is the core theme of dollar asset pricing

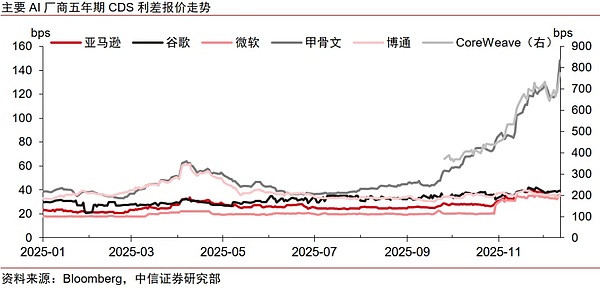

Regarding US stocks, the market is constantly concerned about the fragility of the AI narrative. Recently, the five-year CDS spreads of Oracle and CoreWeave have risen significantly. However, the CDS of most other leading companies in the AI industry chain remain relatively stable. This indicates that market concerns about an AI bubble may be concentrated on a few companies with more aggressive business models, while companies with more stable finances can still gain market trust.

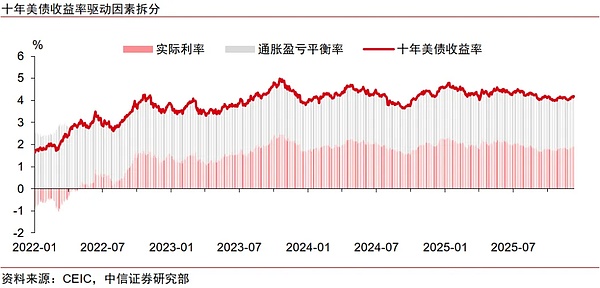

In an environment where the Fed's rate-cutting cycle is not yet over, the overall financial risk of the AI industry chain may be relatively small, and the industrial intelligence boom should continue to support the performance of leading US stocks in the short to medium term. Regarding US Treasuries, the Fed has a strong ability to stabilize employment during this round of risk-management rate-cutting cycle, and the resilience of the US economic fundamentals should continue to support real interest rates. Long-term US Treasuries do not offer much investment value, while short-term US Treasuries may benefit from the technical improvement in liquidity brought about by reserve management purchase operations (RMP). Therefore, short-term bonds are better than long-term bonds.

Catherine

Catherine

Catherine

Catherine Miyuki

Miyuki Miyuki

Miyuki Weiliang

Weiliang Alex

Alex Miyuki

Miyuki Alex

Alex Miyuki

Miyuki Weiliang

Weiliang Alex

Alex