From the deployment to the Bitcoin mainnet in early April to now, in less than a month, more than 300 crypto assets have been issued through the RGB++ protocol, and the number of addresses holding the first RGB++ asset SEAL has reached 16,850, with a cumulative transaction volume of more than 180 BTC.

In addition, RGB++'s ecological development has also begun to take shape, and the necessary infrastructure such as wallets, browsers, DEX, Launchpad, and asset managers can be used.

However, there are still many people who don't know enough about the RGB++ protocol and its gameplay, and want to participate but don't know where to start. Therefore, today's article will be divided into 3 parts. The first part introduces the relevant knowledge of the RGB++ protocol in plain language, the second part introduces the ecology and gameplay of RGB++, and the third part is FAQ, hoping to help everyone get started quickly.

Basics of RGB++ protocol

1. What is the RGB++ protocol? Is it the same as the RGB protocol? What is the difference with the recently launched Runes protocol?

RGB++ protocol and RGB protocol are two completely different protocols. The author of RGB++ protocol is Cipher, who is also the co-founder of CKB, while RGB protocol is currently mainly led by Dr. Maxim Orlovsky.

RGB++ is positioned as a Bitcoin layer asset issuance protocol, which means that you can use the RGB++ protocol to issue encrypted assets on the most secure and consensus-strong Bitcoin blockchain. After issuing the asset, you transfer the asset to others, and the recipient does not need to run the client to verify it. This is because the assets issued through the RGB++ protocol will generate corresponding shadow assets on the CKB blockchain. If we use the physical body and shadow as an analogy, transferring RGB++ assets on the Bitcoin blockchain is equivalent to the physical body moving, and its corresponding shadow will also move with it, and the movement of the shadow will be verified by the PoW miners of the CKB blockchain. Therefore, we can believe that as long as the shadow moves correctly, the corresponding physical body transfer is also correct (of course, you can also choose not to trust the CKB miners and choose to verify whether the physical body transfer is correct).

The Runes protocol, like RGB++, is a Bitcoin layer-one asset issuance protocol, but there is not much competition at present, because the entire market is small, and it is most important for everyone to make the pie bigger together. At present, Runes lacks programmability. If it cooperates with RGB++, it will bring a win-win effect: RGB++ can bring programmability to Runes, and Runes can bring more attention to RGB++.

2. The Bitcoin chain is too congested and the handling fee is too expensive. What solution does the RGB++ protocol have?

When minting RGB++ assets, transactions will be generated on both the Bitcoin blockchain and the CKB blockchain. Transactions on the Bitcoin chain are used to shape the physical body of the asset, and transactions on the CKB are used to generate the corresponding shadow. Therefore, when minting, users need to spend more BTC handling fees (because a small part is used to purchase CKB and generate the corresponding shadow).

After the asset is minted, if the Bitcoin chain is too congested and the handling fee is too high, the physical body of the asset can be Leaped to the CKB blockchain, so that both the physical body and the shadow are on the CKB chain. The average block time of CKB is about 10 seconds, and the handling fee is also very low. Under normal circumstances, one CKB can pay the miner's fee for more than 5,000 transfers. Therefore, RGB++ assets from Leap to CKB blockchain can enjoy the high speed and high performance brought by CKB, and can complete thousands or tens of thousands of transfers on CKB and then Leap back to the Bitcoin blockchain.

In addition, the CKB blockchain is Turing complete, and various DeFi and GameFi applications can be built on it. This means that RGB++ assets from Leap to CKB blockchain can also participate in these applications, earn more revenue, and achieve a wider range of application scenarios.

3. What is Leap operation? Is it a cross-chain bridge?

No, RGB++ assets from the Bitcoin blockchain Leap to the CKB blockchain or vice versa do not use any cross-chain bridges or introduce external trust assumptions.

A common cross-chain bridge is that everyone transfers encrypted assets to a multi-signature wallet or contract, and then sends you the corresponding asset certificate on another chain. Its disadvantage is that it is centralized, and users have to trust that the operator of the cross-chain bridge will not do evil. If the cross-chain bridge is hacked, the user's assets may suffer losses: in July 2021, the cross-chain asset bridge project ChainSwap was attacked and lost nearly $8 million in assets; in January 2022, the Qubit Finance cross-chain bridge was hacked and lost more than $80 million; in February 2022, Wormhole was hacked and lost more than $320 million...

Leap transfers assets from one blockchain to another peer-to-peer, which will be more secure and more decentralized.

RGB++'s ecology and gameplay

RGB++'s ecology

The RGB++ protocol was deployed to the Bitcoin mainnet in early April. It has now realized the core functions that the protocol itself should cover, including the issuance and transfer of fungible and non-fungible assets, leap operations, SDK, etc.

RGB++'s ecological development has also begun to take shape:

Wallets: JoyID, REI Wallet (plug-in wallet), etc.

DEX: HueHub, Omiga, JoyID's built-in DEX, etc., and the upcoming AMM DEX

Launchpad: HueHub

DID: .bit

DeFi: Stable++ (stablecoin protocol)

Well-known projects: Nervape, SEAL, etc.

Others: Haste (RGB++

How to play RGB++

1. How to issue RGB++ assets?

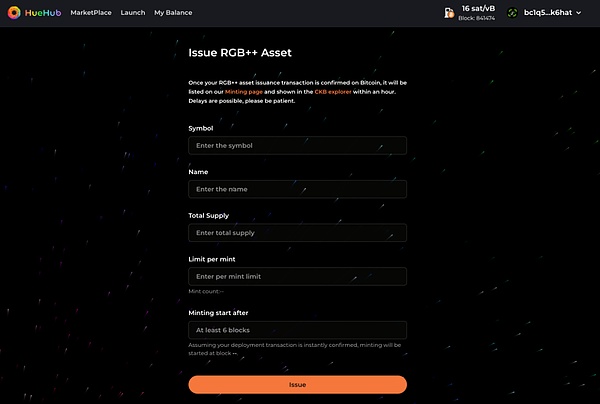

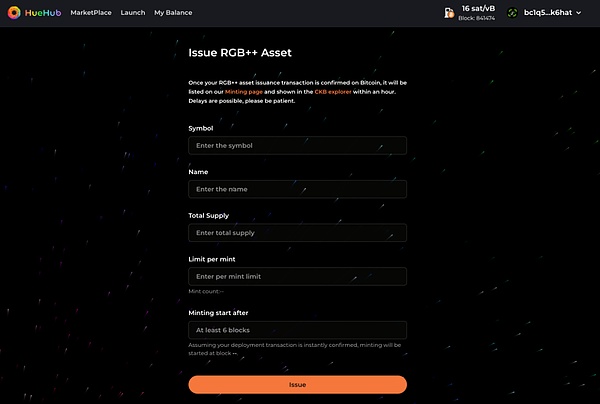

Currently, you can directly use HueHub to issue RGB++ assets.

Open the HueHub website (https://huehub.xyz), connect your wallet (UniSat, OKX or JoyID) and make sure there is enough BTC in your wallet, click "Issue a RGB++ token", and then fill in the token name, symbol, total supply, number of mints each time, and how many Bitcoin blocks after which mint starts. After filling in the information, submit and pay the BTC fee. It is very simple and easy to operate.

2. How to mint RGB++ assets issued by others?

If the RGB++ assets issued by others have a dedicated mint website, you can directly open the corresponding website and follow the instructions to complete the minting.

The second way is to open the Fair Mint page of HueHub (https://huehub.xyz/fair-mint), connect the wallet, find the asset you want to mint, and click the mint button next to it to mint.

3. How to trade RGB++ assets?

If you want to trade RGB++ assets on Bitcoin Layer 1, you can directly use HueHub's Marketplace. If you want to buy, click "Buy Now" in the Market, and if you want to sell, select "List for sale".

If you want to trade RGB++ assets on Bitcoin Layer 2 (i.e., on the CKB chain), there are currently multiple options. One is to use the DEX built into the JoyID wallet, which can be seen in the "Market" of the wallet; the other is to use Omiga's Marketplace (https://omiga.io/market). Both of these DEXs are order book models, and community team members are also working on AMM-based DEXs, which are expected to be launched in the near future.

4. How to Leap RGB++ assets on the Bitcoin chain to the CKB chain?

JoyID wallet already supports the Leap function of RGB++ assets. After logging in to JoyID, switch to the Bitcoin network, then click on your RGB++ asset (such as SEAL), select "Bitcoin L2 (CKB)" on the sending interface and enter the CKB address and amount, select the mining fee, and finally click "Send" and sign to confirm. The video tutorial is as follows:

https://x.com/joy_protocol/status/1780505146067448176

It should be noted that in order to ensure security (to prevent block reorganization), the entire Leap process takes about 1 hour. After completing Leap, the RGB++ assets are on the CKB blockchain, and you can use the built-in DEX of the JoyID wallet or Omiga's Marketplace for trading.

5. How to Leap RGB++ assets on the CKB chain to the Bitcoin chain?

The current version of JoyID wallet does not support this function yet. You need to wait for a while. It is expected to be launched before the end of May.

In addition, it is not recommended to use some tools made by community members to perform Leap operations, because it is easy to burn assets (which will be described in detail below).

FAQ

1. When minting RGB++ assets or transferring BTC, why is it not displayed in the mempool?

One of the reasons is that the node has not completed the broadcast, which is a common situation. If this is the reason, just wait for a while.

Another reason is that the transaction fee is set too low. Mining nodes will queue up according to the transaction fee from high to low, and prioritize those with high fees. If the fee is too low, after a certain period of time, such as three days, it has not been its turn, the mining node will generally delete such low-fee transactions from its own memory pool. If any node deletes your transaction, they will not notify your wallet, the transaction will not be returned, and your wallet will not automatically display the balance before you sent the transaction. If this is the case, you can only use the "transaction acceleration processing service" launched by some mining pools, which requires additional fees.

2. Why are RGB++ assets burned?

The assets issued through the RGB++ protocol are "parasitic" or "bound" to the UTXO of Bitcoin, more specifically, to the UTXO of 546 satoshis. If this UTXO is spent, the corresponding RGB++ assets will also be spent.

So how to avoid the UTXO bound to RGB++ assets from being spent by users by mistake? JoyID wallet sets a threshold, which is currently 1200 satoshis. UTXOs below this threshold will not be spent as mining fees or ordinary BTC transfers. Of course, different wallets set different thresholds, so in order to avoid being spent by mistake, it is recommended that you use JoyID wallet to store and send and receive RGB++ assets.

As mentioned above, it is not recommended to use some tools made by community members to transfer assets from CKB chain to Bitcoin chain. This is because some tools do not follow the RGB++ standard when binding Bitcoin UTXO - binding to UTXO of 546 satoshis. If they bind assets to UTXO of more than 1200 satoshis, then when users use JoyID wallet to send BTC transactions, the wallet will easily spend this UTXO as a mining fee or ordinary UTXO.

3. Since JoyID wallet plays such an important role in RGB++ ecosystem, how can I improve the security of the wallet?

The current version of JoyID wallet does not support mnemonic backup, so in order to prevent accidental deletion of wallet or Passkey, it is recommended that you must upgrade your account, which can be associated with multiple devices of different brands.

After logging into the JoyID wallet, select "Security" in the settings, click the "+" sign next to "Trusted Devices", click "Upgrade", and then pay 150 CKB or other amounts of other tokens to complete the account upgrade. After the upgrade is complete, click the "+" sign next to "Trusted Devices" to add devices of different brands. For example, the JoyID wallet created by an Apple phone can add an Android phone as a backup login device.

JinseFinance

JinseFinance