Author: Jason from Golden Finance, part of the content is translated from 21.co

With Bitcoin’s strong rebound at the end of this year, the cryptocurrency market has further flourished, and the world’s largest cryptocurrency exchange 21.co, the parent company of 21Shares, one of the issuers of trading products (ETP), recently released the "2023 Annual Token Financialization Status Report", reviewing the encryption and blockchain tokenization market conditions in the past year, and Golden Finance Translation compiled it as follows.

Four data overviews of the current global tokenization market

Cryptocurrencies versus traditional asset classes including fiat currencies, stocks, government bonds and real estate The integration between countries is experiencing unprecedented growth. The following four sets of data are available for the current global token market:

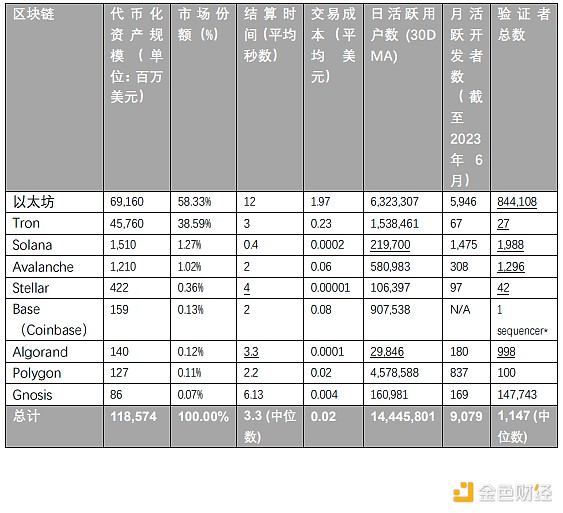

1. US$118.6 billion:The value of global public chain crypto assets has reached Approximately US$118.6 billion, of which Ethereum accounts for more than 58% of all tokenized assets, or US$69.16 billion. It has the most dynamic crypto ecosystem, with more than 6 million daily active users and nearly 6,000 monthly active developers; Tron Ranked second with over $45 billion in tokenized assets, Solana ranks third.

2. 9 asset classes: The digital dollar or USD stablecoin is the first successful financialization implementation, and its market value accounts for approximately 10% of the total market value of cryptocurrencies. , a total of nine other asset classes including U.S. Treasury securities, non-financial corporate debt, real estate funds, private equity, securities collateral, trade finance and public debt securities, have performed significantly this year on the back of decades of high interest rates. growing (>450%). However, with the exception of USD stablecoins, most current tokenization solutions remain unavailable globally due to regulatory constraints and socio-economic circumstances, including low internet penetration in emerging regions.

3. 431 million: The number of global encryption users has reached 431 million, accounting for approximately 5.36% of the world’s population. This number is equivalent to the adoption level of the Internet in 2000, when The number of Internet users reached 361 million, accounting for 5.91% of the world's population at that time.

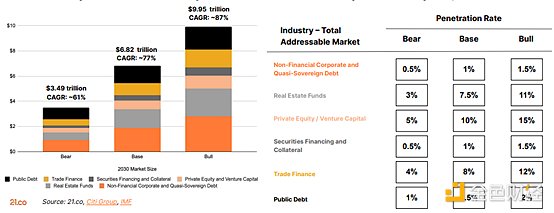

4. 3.5-10 trillion US dollars: It is expected that by 2030, the market value of global tokenized assets will be 3.5 trillion US dollars in a bear market situation and 3.5 trillion US dollars in a bull market situation. between US$10 trillion. This market value is based on estimated penetration of the total addressable market for various asset classes.

Public blockchains: Where are tokenized assets built?

Tokenization Example: Crypto-Native & Traditional Finance

In 2023, tokenized U.S. Treasury bonds grew by more than 450%, with total assets reaching $650 million. The rise of on-chain U.S. Treasuries can be attributed to the current high interest rate environment, with issuers including not only crypto-native businesses like Ondo and Backed Finance, but also established traditional financial companies like Franklin Templeton.

Stablecoins are the earliest tokenized assets with relatively good product-market fit, accounting for nearly 97% (USD 69.13 billion) of the tokenized market share in Ethereum-compatible networks, followed by It is the tokenization of commodities such as gold and the tokenization of government securities such as U.S. Treasury bonds. It is worth noting that fiat-collateralized stablecoins, like the US dollar, issuers of these products (such as Circle and Tether) basically maintain off-chain reserves of the target assets, mainly in the form of short-term US Treasuries and cash, with the ratio Depends on the issuer's asset and liability management.

Generation Tokenization: a multi-trillion dollar market

As of the end of the second quarter of 2023, global regulated open-end fund assets are approximately $70 trillion, assuming tokenization captures global assets About 10% of the net size, then by 2030, the market value of tokenized assets will be between US$3.5 trillion under the bear market scenario and US$10 trillion under the bull market scenario. The following figure shows the scale of tokenized assets , as well as the asset ratio of bull market and bear market industries.

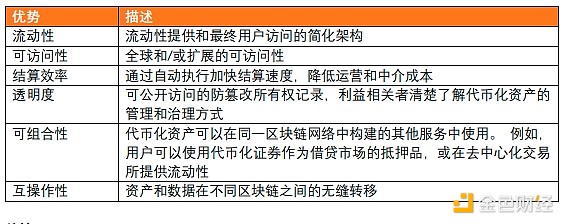

Why Traditional companies or investors want to put their assets on the chain?

Summary

Use cases such as stablecoins have demonstrated the potential of tokenization, but we are still in the experimental stages of this innovation. As the digital asset field matures, it will inevitably become more integrated with the traditional financial system. Similar to the Internet, tokenization will eventually be integrated into the financial system.

We expect cryptocurrencies to seamlessly integrate with existing financial software and build a bridge to the real world, enabling tokenization to develop into a multi-trillion dollar industry that impacts digital currencies around the world. One billion people.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinworld

Bitcoinworld Clement

Clement 链向资讯

链向资讯