Source: Intensive Reading of Research Reports

It's not yet dawn, but the skyline of Manhattan, New York, is already lit up by countless lights. Wall Street traders came to the office early as usual, but today the atmosphere was decidedly different. On the big screen, in addition to the familiar Dow Jones Index and Nasdaq Index, the price chart of Bitcoin is beating in real time. This "alternative asset" that was once scorned by Wall Street elites has now become a must-see trading target for them every day.

1. Trump’s crypto Bull Market and New Fund Wave

"This is the most significant shift in capital flows I have seen in my 25 years in the industry." James Carlton, head of digital assets at Morgan Stanley Sitting in his office on Fifth Avenue, he pointed at the large data screen in front of him. The screen shows that since Trump won the election in November 2024, more than $80 billion in institutional funds have poured into the cryptocurrency market in just two months.

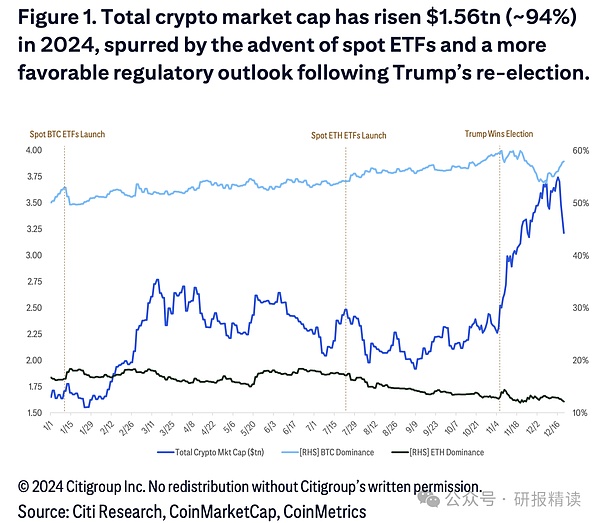

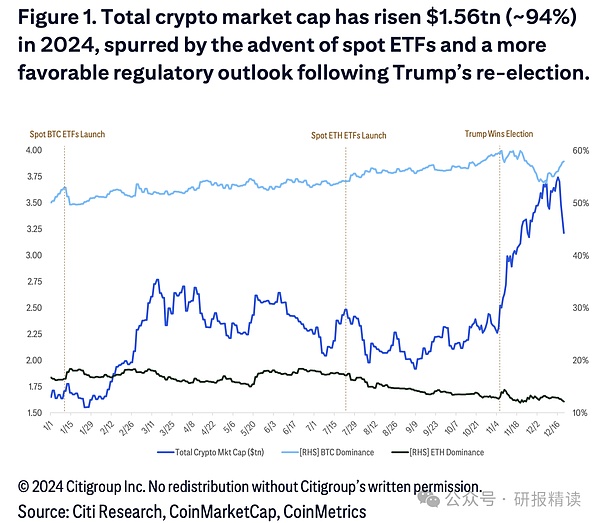

The morning when the price of Bitcoin broke through the $100,000 mark, the entire Wall Street was in a frenzy. ButWhat really caught the market's attention was not the price itself, but the fundamental change in the capital structure behind it.

"Bull markets in the past were driven primarily by retail investors, but this one is completely different." BlackRock Senior Investment strategist Sarah Mitchell analyzed this, "What we are seeing now is that pension funds, university endowments, family offices, and even sovereign wealth funds are building positions. These are 'smart money' who have never been involved in cryptocurrency in the past."< /span>

The specific data is shocking:

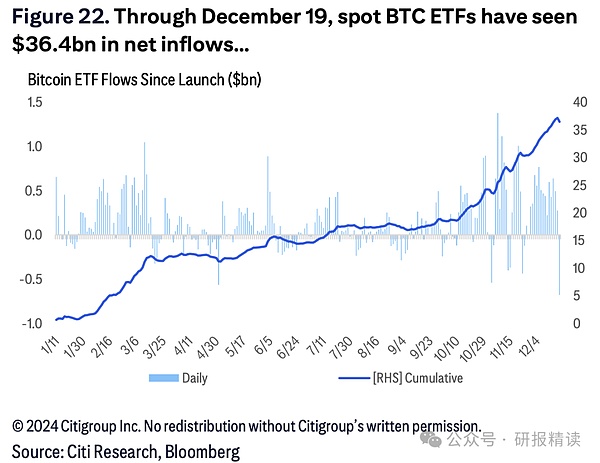

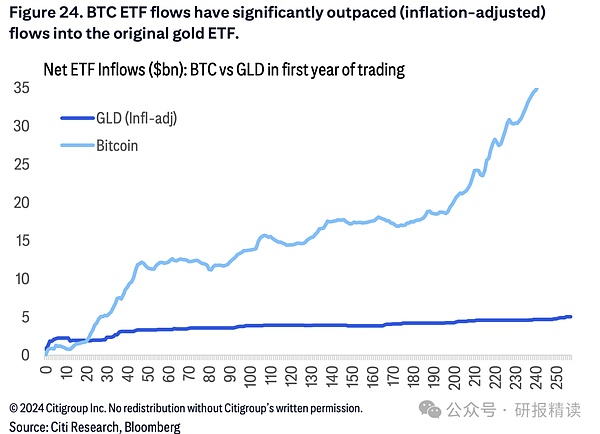

BlackRock's IBIT Bitcoin ETF raised more than $5 billion in its first month, breaking the historical record for ETF issuance

Fidelity’s digital asset department report shows that,More than 60% of institutional clients have begun to incorporate cryptocurrencies into their asset allocation

Six of the world's top ten sovereign wealth funds have begun to allocate Bitcoin, with a total allocation of more than 20 billion US dollars

"The most interesting thing is the source of funds," Tom Zhang, head of Goldman Sachs' digital asset trading department, pointed out, "According to our According to statistics, nearly 70% of funds come from traditional markets, and these are real incremental funds". span>

The policy orientation of the Trump administration has given the market a boost. The "Digital Dollar Reserve" plan proposed by the new Treasury Secretary, as well as the proposal to support the allocation of part of the national reserve in Bitcoin, have given the market hope that cryptocurrencies will gain official recognition.

"This reminds me of the historical moment in 1971 when the U.S. dollar was taken off the gold standard," said Professor Robert Williams, a famous economist. "Few people at the time realized that that decision would How to change the world's financial system. Today, we may be standing at another similar historical turning point. >However, there are also rational voices lurking behind the market excitement. Senior investment consultant Linda Chen reminded: "Yes, the entry of institutional funds has made the market more mature, but this does not mean that risks disappear. On the contrary, we need a more professional risk management system."

2. U.S. cryptocurrency regulation is coming

December 18, 2024, Washington, DC, Capitol Hill.

"The purpose of regulation is not to set Limit, but escort" The firm voice of Paul Atkins, the new SEC chairman candidate, echoed in the conference hall. The lawmakers in the audience nodded frequently. This scene was in sharp contrast to the hearing after the FTX incident in late 2022. The U.S. regulatory environment at the end of 2024 is undergoing a profound transformation.

The turning point begins in September 2024. The Ministry of Finance announced the establishment of the Office of Financial Innovation and appointed a unique head. Sarah Mitchell, a technology and finance expert who has worked in Silicon Valley for fifteen years, said: "We are not here to be the 'policeman', but to be the 'guide' for innovation."

On October 15, the SEC released landmark digital asset classification guidelines. The 108-page document brings unprecedented clarity to the market. A week later, the CFTC also released supporting policies, and the two major regulatory agencies reached a high degree of agreement in the field of digital assets for the first time.

On November 1, the "Regulatory Sandbox" plan was officially launched. This two-year pilot project provides innovative companies with a valuable experimental environment. Among the first batch of 25 selected companies, 18 have completed compliance transformation before the end of the year.

Investor protection measures will be fully rolled out after Thanksgiving. Starting from December 1, all licensed exchanges must complete three guarantees:

Purchase insurance for no less than 5% of total custody assets

Implementing separate storage of hot and cold wallets

Publish monthly reserve certificates audited by the Big Four accounting firms

States have also responded very quickly. In the fourth quarter of 2024, the battlefield turned local:

Texas passed the " The Digital Asset Innovation Act attracted 87 crypto companies to register that month. Houston's energy district became "Crypto Valley" overnight. As of December, more than 200 companies have settled there.

On November 8, the city of Miami completed its first Bitcoin tax payment, and the mayor immediately announced: "By 2029, every American city will be charting its own digital currency future."

December On the 5th, the Digital Asset Association released the first industry self-regulatory framework, which was recognized by federal regulatory agencies. The 76-page document covers every aspect from trading specifications to risk control.

International cooperation is also accelerating. On December 12, the U.S. Department of the Treasury signed the "Memorandum of Cooperation on Digital Asset Supervision" with seven major economies including the European Union, Japan, and Singapore, committing to establishing a unified cross-border regulatory framework by 2025.

"The changes in these three months exceed the sum of the past three years." Emily from Harvard University Professor White commented at the annual Fintech Forum on December 20.

A senior lawyer used a vivid metaphor: "In the last quarter of 2024, we finally see the arrival of the 'infrastructure era' of the digital asset market. It is like paving a highway in the wilderness. Only when the road is repaired can the car run. It is both fast and stable. "

3. Stablecoins are accelerating their development as a bridge between the US dollar and cryptocurrencies

In the cryptocurrency market, USD stablecoins are a category of USD stablecoins that remain consistent with the U.S. dollar 1:1 anchored digital assets maintain price stability through legal currency reserves, crypto-asset over-collateralization or algorithmic mechanisms. It is equivalent to the "digital dollar" in cryptocurrency and has become an important bridge connecting the legal currency U.S. dollar and cryptocurrency. This unique positioning allows stablecoins to maintain the convenience and programmability of cryptocurrencies while avoiding the violent fluctuations of assets such as Bitcoin, making it an important foundation for the digital economy. Facilities.

Fourth quarter of 2024, stable The currency market is ushering in a turning point. Following Trump's victory, the total market value of stablecoins exceeded the $200 billion mark for the first time, an increase of 13% from the previous month. Among them, the three major stablecoins USDT, USDC and BUSD occupy a dominant position, with a combined market value of more than 180 billion US dollars, providing sufficient liquidity for digital payments.

The market landscape is undergoing profound changes. The market share of traditional leader Tether (USDT) has dropped from more than 50% at the beginning of the year to 45%, while innovative stablecoins have risen rapidly. BlackRock-backed Ethena Labs launched a new stablecoin, and Ripple released the first RLUSD, demonstrating the confidence of institutional-level players in this field. These new products often incorporate more transparent reserve management and stricter compliance standards, driving the entire industry to mature.

The expansion of payment scenarios is particularly significant. According to Goldman Sachs data, the transaction volume settled using stablecoins will reach 10.8 trillion US dollars in 2023. Visa has partnered with Coinbase to enable real-time account recharge, and Mastercard has teamed up with Mercuryo to launch a Euro crypto debit card that supports self-hosted wallets, making digital payments closer to daily life.

In the field of cross-border payments, the cooperation between Circle and Thunes has unleashed the potential of USDC. "Stablecoins are reshaping the global payment system," Circle CEO said, "especially bringing revolutionary changes in efficiency and cost. "This trend has been recognized by traditional payment giants. Stripe restarted crypto payment support and acquired stablecoin platform Bridge, marking the payment industry's re-embracement of digital assets.

Regulatory attitudes are also turning positive. According to a JPMorgan research report, as the new U.S. government takes office, it is expected that a clearer stable currency regulatory framework will be introduced. At the same time, countries such as Singapore and Japan have begun to promote stable currency-related legislation to inject institutional confidence into the market.

"We are witnessing a reconfiguration of payment infrastructure," JPMorgan analysts noted, "Stablecoins It is transforming from a mere cryptocurrency transaction medium to an important part of the global payment system. "

4.Traditional finance. Giants are accelerating their embrace of cryptocurrency

As the cryptocurrency market matures, global financial giants are deploying the digital asset field at an unprecedented speed. Traditional financial institutions represented by BlackRock, Visa, Mastercard and Stripe are reshaping the application scenarios of crypto assets through product innovation and strategic cooperation.

In the payment field, Visa takes the lead in providing services to the United States and Europe through its strategic cooperation with Coinbase Users are provided with real-time account recharge function. This innovation significantly improves the efficiency of funds flow - traditional ACH transfers take 3-5 working days, SEPA transfers take 2-3 working days, and Visa's solution achieves Instant payment helps users seize market opportunities more flexibly. According to Coinspeaker data, in the week after the U.S. midterm elections alone, the net inflow of funds into the crypto market reached $2.2 billion, and the full-year capital inflow in 2024 has exceeded $33 billion.

Mastercard has cooperated with Mercuryo to launch a Euro crypto debit card that supports self-hosted wallets, allowing

span>

Users can directly use cryptocurrency to spend at more than 100 million Mastercard merchants around the world. This innovation solves the problem of "realization" of cryptocurrency and lowers the threshold for users to use it. The global transaction volume using cryptocurrency payments has reached 10.8 billion US dollars in 2023, showing huge market potential. Payment giant Stripe restarted its crypto payment business after six years of suspension and spent $1.1 billion to acquire stablecoins Platform Bridge demonstrates confidence in the future of crypto payments. The new feature supports businesses to accept USDC payments from more than 150 countries, with a single transaction limit of up to US$10,000 and a monthly limit of US$100,000.

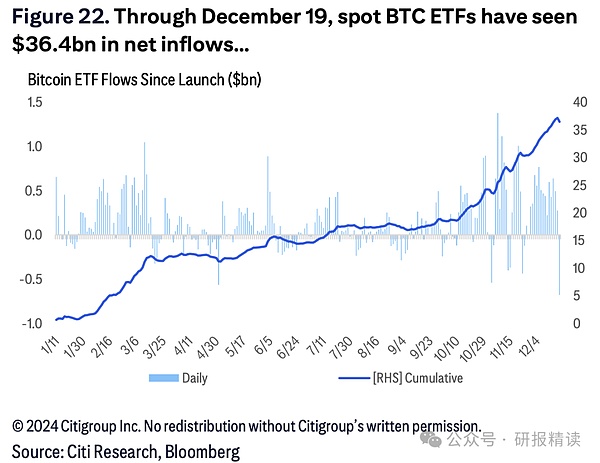

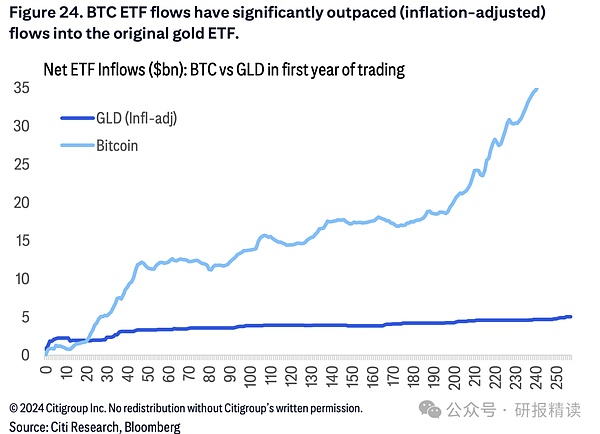

"This is not just simple product innovation," Citibank analysts pointed out, "traditional financial institutions They are building an ecosystem that deeply integrates crypto assets with the existing financial system. They no longer see cryptocurrencies as a threat, but as an opportunity to expand their business boundaries. >This shift has received a positive response from the market. Since Trump’s election, nearly $10 billion has poured into U.S. Bitcoin ETFs, pushing total assets in related products to about $113 billion. ETF products issued by institutions such as BlackRock performed particularly well, showing investors' trust in well-known financial institutions.

"We are at a turning point," JPMorgan Chase said in the latest research report, "Traditional financial institutions The joining not only brings funds and credibility, but more importantly, brings a professional risk management system and mature operational experience, which is crucial to the long-term healthy development of the entire industry. "< /p>

5. How to rationally incorporate cryptocurrency into asset allocation strategies

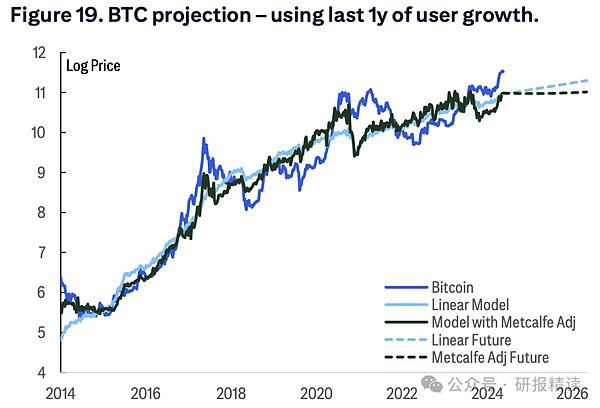

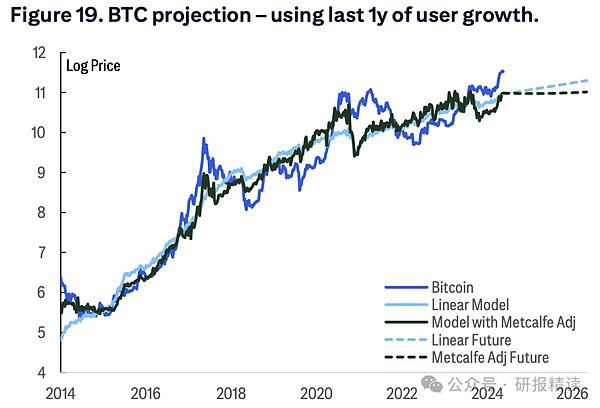

Bitcoin's long-term investment performance is impressive. Data shows that Bitcoin's annual return rate reached 75.6%, not only significantly ahead of the 11.6% of the S&P 500 Index, but even exceeded Technology stock leader NVIDIA’s 73.5%. This significant excess return has made it the focus of investors' attention.

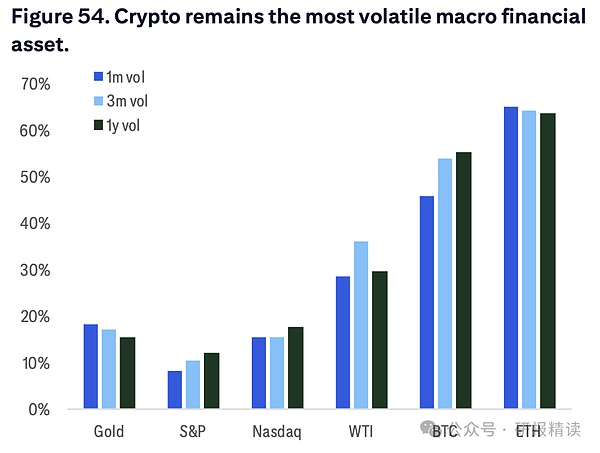

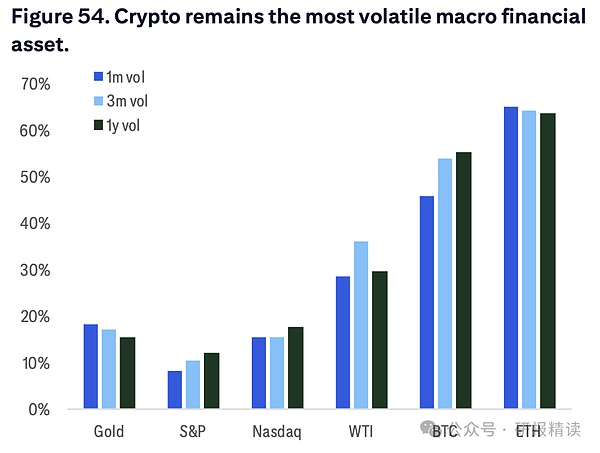

However, high returns come with significant volatility risk. Bitcoin's annualized volatility is as high as 57.9%, far exceeding the S&P 500's 11.6%. Since its birth in 2009, the Bitcoin market has experienced sharp retracements of 70% to 80% many times. Such violent fluctuations remind investors that they must pay full attention to risk management while pursuing high returns.

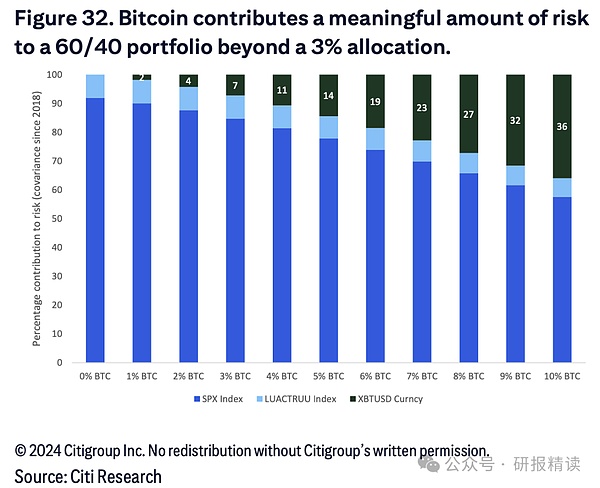

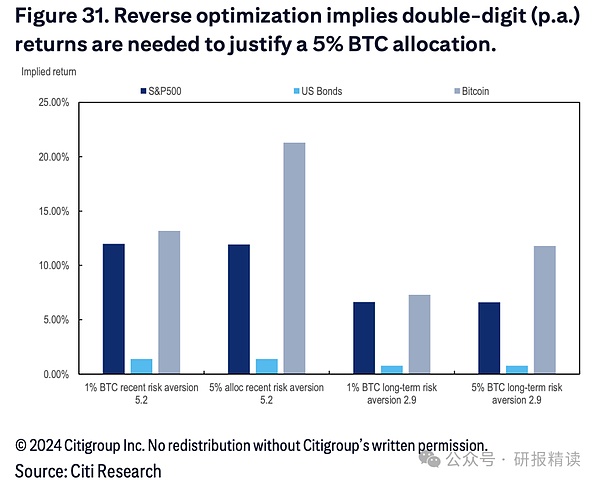

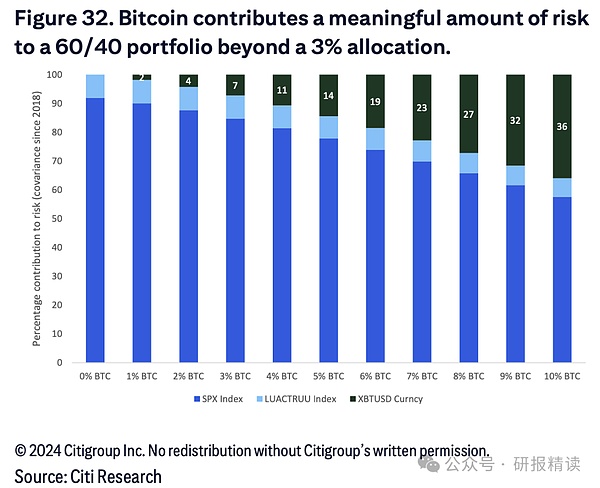

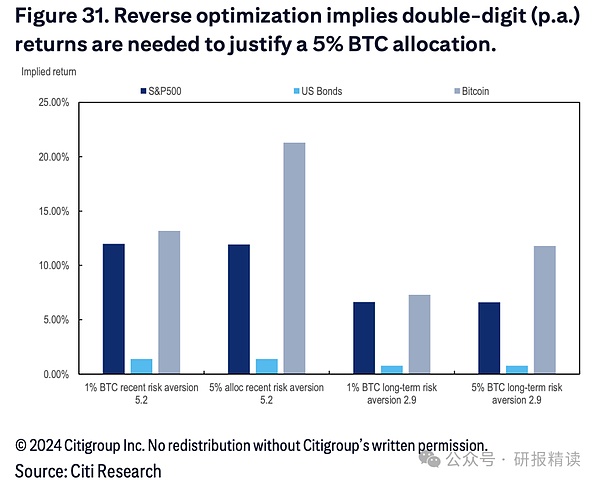

Facing this risk-return characteristic, BlackRock Investment Research Institute provides pragmatic allocation suggestions for institutional investors. Research shows that It is a "reasonable range" to allocate 1% to 2% of Bitcoin in a traditional 60/40 stock and bond portfolio. This allocation can effectively control investment opportunities while seizing them. Risk. If the allocation exceeds 2%, the risk level of the overall portfolio will increase significantly - for example, a 5% allocation to Bitcoin will increase the risk contribution from 0% to more than 10%, and an allocation of 10% will cause the volatility contribution to rise. to 36%.

The launch of Bitcoin ETF provides institutional investors with a more convenient allocation channel. Since Trump won the election, U.S. Bitcoin ETFs have attracted nearly $10 billion in capital inflows, with total assets reaching approximately $113 billion. ETF products not only provide higher liquidity and lower operating thresholds, but also provide standardized tools for introducing Bitcoin exposure to traditional investment portfolios.

More noteworthy is that Traditional pension institutions Start trying Bitcoin investing with caution. Australian pension giant AMP took the lead in allocating about 0.5% of total pension assets (approximately $17.2 million) to Bitcoin futures through its dynamic asset allocation plan. Anna Shelley, chief investment officer of AMP, pointed out that this decision reflects "structural changes" in the digital asset industry, especially after mainstream asset management institutions launched ETF products, institutional investors' acceptance of crypto assets has increased significantly.

"We are witnessing an evolution in investment philosophy," JPMorgan analysts said,"Cryptoassets are transforming from speculative vehicles into important asset allocation optionsBut the key to success is to maintain caution and restraint as part of a larger portfolio. "

"Investors need to establish a dynamic risk management framework," JPMorgan Emphasizing, "While enjoying the diversification benefits brought by crypto-assets, always put risk control first. The determination of the allocation ratio must be based on the investor's risk tolerance and investment goals, rather than simply pursuing short-term gains."

Joy

Joy