Author: Route 2 FI Source: substack Translation: Shan Ouba, Golden Finance

The following are some agreements with untapped opportunities, such as income, airdrops, etc., including potential projects from different networks, whether Evm, non-Evm or cosmos, covering a wide range of Defi fields, such as derivatives, income, Dex, etc. These projects have attracted much attention due to their outstanding support, income opportunities, etc., but these should not be regarded as financial advice, and please do your research before interacting.

1.DAppOS

This is an intention execution, by creating a two-sided market, making the chain and dApp centric to the intention, dAppOS is unique in that it makes interaction with dApp seamless, user-friendly and time-saving. Imagine that you need $100 of Arb to trade on GMX. Still, your funds are tight on such chains: $50 on Arb, $30 on Bnb, and $20 on Eth, and you need to build bridges on Eth and BnB, spend time and gas to put your funds on arbitrum for GMX transactions, and this is where dAppOS comes in, with just one click, all your funds are available on arbitrum, you don’t need to worry about allocations, or specific tokens used as gas fees, all of which can be done in minutes through its interface, which may protect users from smart contract risks. They also have a group of well-known investors such as Polychain, Binance Lab, and Hashkey Capital, which completed a $15.3 million financing at a valuation of $300 million. dAppOS V2 is integrated in perp Dex like Gmx, KiloEX, you can check out more dApps in their ecosystem:

V3 is rumored to be launched with TGE, and not many people are talking about dAppOS, even the last post I found about it dates back to last year with less than 100k views:

I have interacted with some Dapps in the ecosystem, but a little tip is to keep an eye on new dApps in the ecosystem, because they launch giveaways for almost every new integration. A good example is the recent 50k Arb trading competition that ended after integrating with Aark.

2. Eigenlayer

Following the success of Eigenlayer, a giant in the rebase space with a TVL of over $18 billion. Competitors like Karak have also emerged and reached a TVL of over $1 billion in a short period of time, and the newcomer in the space is Symbiotic, which stands out in various fields with different approaches and technologies. It is permissionless and modular, which allows any protocol to launch native staking for its tokens to improve network security. The Symbiotic core contract is not upgradeable (like uniswap), which reduces governance power, and the protocol can continue to operate even if the team leaves. Last but not least, it supports multi-assets from any chain, which makes it more versatile than Eigenlayer, which only supports ETH and its derivatives. Symbiotic received a $5.8 million funding round co-led by Paradigm and Cyberfund, a company founded by Konstantin Lomashuk (founder of Lido), so the rumors of Paradigms and Lido funding an Eigenlayer competitor are true!

According to an interview with symbiotic CEO Misha Putiatin by Blockwork, he stated that “mainnet will be up and running as soon as late summer”: We might suggest that it will launch with the TGE, which means that the symbiotic token will be live before $Eigen is tradable, which could steal the re-stacking narrative of the incumbent Eigenlayer, and guess what? Symbiotic has an ongoing points program, but it has currently hit its deposit limit, the solution to this problem introduces us to another project, Mellow — an LRT built on top of Symbiotic, just like Renzo and Etherfi are built on top of eigenlayer, where you can earn both mellow and symbiotic points. Pendleintern has a great post on how to maximize your yield by depositing on Pendle:

The second way is to deposit $mETH into symbiotic when the cap is lifted, which will provide 5x powder/day for the upcoming metamorphosis event of mantle LRT ($cMETH) governance token $Cook, while earning symbiotic points.

3. Elixir

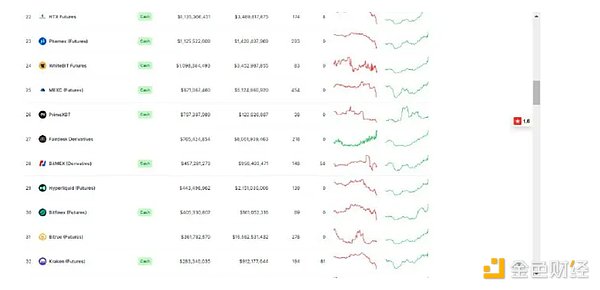

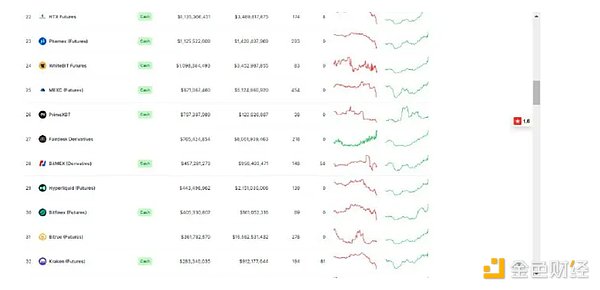

One of the reasons why decentralized Orderblock exchanges lag behind centralized exchanges is liquidity. Even the most traded derivative, Hyperliquid, ranks 29th with an OI of $440 million, which is relatively low compared to Binance’s OI of $15 billion at the time of writing.

A common unhealthy practice used by projects to attract liquidity is an airdrop program, which only attracts hired funds. Airdrop farmers transfer funds to another protocol after making a profit, or rely on a group of KOLs to promote their exchanges, etc. This is where Elixir comes in - Elixir is essentially a modular DPos network designed to provide liquidity for Orderblock exchanges. The network serves as a key underlying infrastructure that allows exchanges and protocols to easily direct liquidity into their ledgers. Elixir benefits both LPs and traders, with LPs being rewarded through the Orderblock exchange incentive program, while traders benefit from the narrower bid-ask spreads that the exchange can offer. This is not another uniswap fork, as of the last report in May, they provide 40% of the total liquidity on Defi Orderblock exchanges through partnerships with industry leaders such as Hyperliquid, Dydx, etc.

They have also raised a total of $17.6 million from Arthur Hayes of Hack VC at a valuation of $800 million (Arthur Hayes also funded another project this year through a well-executed Airdrop and PMF-Ethena)

The mainnet is said to be live in August, and for this, we are running an event - Apothecary. Users can earn "potions" by providing liquidity in various available pools. There are 3 strategies you can use to get rewards, first by locking ETH on the mainnet until the network launch in August which will earn you 50% of the rewards, by making a deposit on the ordered quantum program to get a "deed" powered by Elixir, and last but not least by being active on discord.

4.Mitosis

The proliferation of chains and protocols has been a major bottleneck for retail LPs, because you have to follow the news to find the best returns, there are losses when transferring assets from one chain to another, and most LPs are trapped in a points system where their fate depends on vague guesses with no exact formula to calculate returns. This is where Mitosis comes in, introducing a new liquidity model called Ecosystem Owned Liquidity (EOL) that enables LPs to Both the protocol and the multi-chain environment can adapt to the multi-chain environment and gain multi-chain yield exposure without manually allocating funds to them, and have a clear reward system that allows LPs to choose the best available options. Mitosis raised $7 million in financing led by amber group and Foresight Venture.

Their ongoing activities -Expedition supports Etherfi LRT weETH, after depositing you will get staking Apr + re-staking Apr + Eigenlayer points + Etherfi points + Mitosis points, of course, depositing on tokenless L2s such as scrolls, Linea and blast (Season 2) also prepares you for future drops.

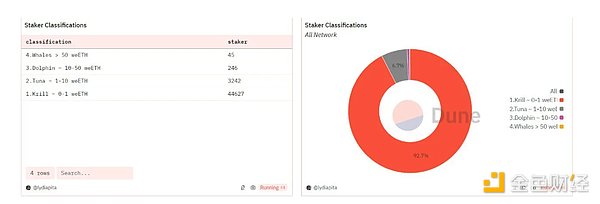

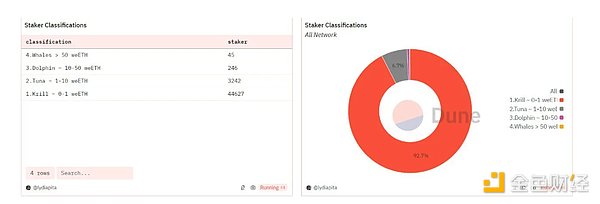

The event has gathered more than 45,000 stakers, including a large number of shrimp stakers who deposited in the 0-1 weETH range, while depositing above 1 weETH will put you in the top 3,000

5. Infinix

Some of the issues that have held crypto back from mainstream adoption are the poor user experience and learning curves faced by newbies, who need to learn about wallets, bridges, security, and more. Infinex abstracts all of this complexity to accelerate mainstream adoption by unifying decentralized ecosystems and applications under a single user experience like a CEX, built specifically for web2 users while remaining fully decentralized. Imagine a scenario where newbies don’t need to learn crypto terms like transactions, gas, etc., and can trade on-chain like a CEX, but 100% decentralized, that’s what Infinex is building. Infinex is built by the team behind Ethereum OG project synthetix → has been a top 10 derivative protocol, no raises have been announced, but according to an interview with Kain (founder of Synthetic) by Blockwork, he has invested $25 million in building Infinex, which shows his commitment and confidence in the project.

They have an ongoing project called craterun where users can win “crates”, but this isn’t a typical deposit and earn points campaign, it’s a little different, Kain explained the reasoning behind this approach:

Craterun is the last event that lasted for 5 weeks (ending July 30th) after the first event amassed over $100 million in 10 days. 5 million crates are up for grabs, each with a 50/50 chance of winning 1000 Patron NFTs, 5000 Patron Passes and a $5 million prize pool plus more rewards, so you’re not just farming crates, but for actual rewards you can deposit assets like USDe, stETH, wstETH and ezETH to get both rewards at once

6. Hyperlane

It’s the first universal interoperability layer built for a modular blockchain stack. What differentiates Hyperlane from a host of interoperability protocols like wormhole and Layerzero is that they only support EVM and non-Evm (like Solana), whereas Hyperlane supports EVm, non-Evm, and cosmos blockchains (like Tia, Inj, etc.), and it allows anyone to permissionlessly deploy Hyperlane into any blockchain environment, allowing that chain to seamlessly communicate with another chain where hyperlane is deployed. They have a lineup of high-profile investors like Circle and Kraken Venture, which have provided them with over $18 million in funding at an unknown valuation. Farming interoperability/bridges tend to perform well because it is a Defi sector with real PMF and they are making profits, a recent show is the well distributed Wormhole, which is ready for farmers even with the backlash faced by Layerzero, using this as inspiration I believe hyperlane will follow their trajectory, to maximize farming you need to do the opposite of what everyone else is doing, so here are some strategies available: most people focus on evm to evm transactions and ignore universe chains like tia, as we have seen this plays out in wormhole because everyone who interacts with non-evm gets a boost on their final distribution, it will likely be replicated on Hyperlane, you can use their official bridge - Nexus to transfer non-evm-Tia between chains, or use bridges that integrate with projects they partner with like Renzo, nautilus, forma, and complete ongoing Layer3 tasks. 7. Shogun Berachain is one of the overhyped projects of 2024, it is seen as memecoin centric like Solana, currently in testnet, I believe the mainnet will experience a surge in token deployments due to this general view, one of the very key tools is the telegram bots, as they make swaps effortless, fast to start, and a far superior comparison to the relatively slow and inefficient stock Dex UX. Shogun is building an intent-centric platform that broadcasts orders to any blockchain for fulfillment, starting with Berachain (the aggregation layer between chains), and eliminates the need for multiple exchange UIs with its intuitive telegram bot. Shogun raised an undisclosed funding round from Binance and S-rated investor Polychain led by $6.9 million.

They are waiting for the Berachain mainnet to go live, and right now there isn’t much to do except keep an eye on their discord for future positions and join their telegram beta.

According to a report by Binance Labs last year, traders lost up to $892 million on oracle-related exchanges because they were vulnerable to manipulation, with attackers driving up the price of low-liquidity tokens on the target dApp and then swapping the high-priced tokens for other tokens.

8. Infinity Pool

Imagine a decentralized exchange that provides unlimited leverage for any asset, with no liquidation, no counterparty risk, and no oracles. This is the breakthrough that Infinity Pools is building. It is built on uniswap V3 with centralized liquidity, using LP positions as a source of credit, and can repay assets with any LP assets. They are backed by well-known companies such as Dragonfly, Coinbase Venture, and Wintermute. Infinity Pools is also the winner of the Blast Bang Bang competitor. The mainnet is not yet online, you can get future updates through their Twitter and Discord notifications.

JinseFinance

JinseFinance