Innovation from nothing is hard to achieve in tokenomics. However, every once in a while a token is so innovative that it changes the trajectory of the industry. There were several examples of this during the last DeFi bull run. First, the Coingecko DeFi sector is a graveyard for forked, hyper-inflationary, “valueless” governance tokens. Of the 430 DeFi tokens listed there, only 80 have a daily trading volume of more than $1 million. Bear markets are brutal. But success appears again after what appears to be a total failure. The ingenuity of the new token economics will propel the industry forward and can start a new bull market. Finding an innovative token can be confusing at first. But if you take action, it can have significant financial benefits. This article will review the most innovative tokens of the last bull run. The innovations of the last bull market can inform the next bull market and teach us how to identify emerging opportunities.

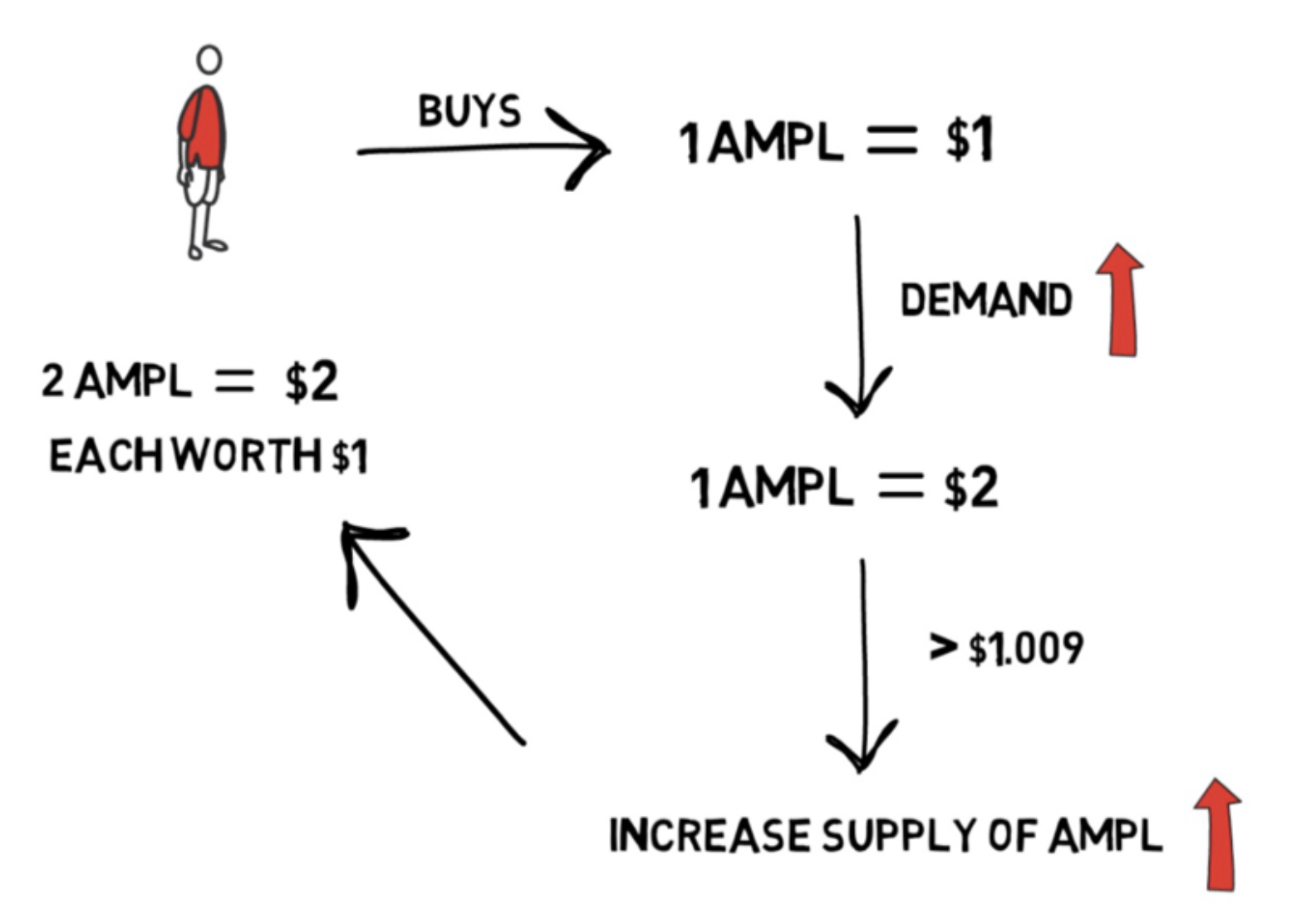

Ampleforth 's flexible supply token, AMPL , has a daily algorithmic adjustment to its circulating supply. Its target price is: 2019 US dollar purchasing power expressed by CPI (Consumer Price Index). If AMPL demand increases and the price is higher than the target price, the protocol will proportionally "airdrop" new AMPL tokens to your Ethereum address to restore the target price. The so-called "rebase" function works like magic: the token balance in your wallet changes.

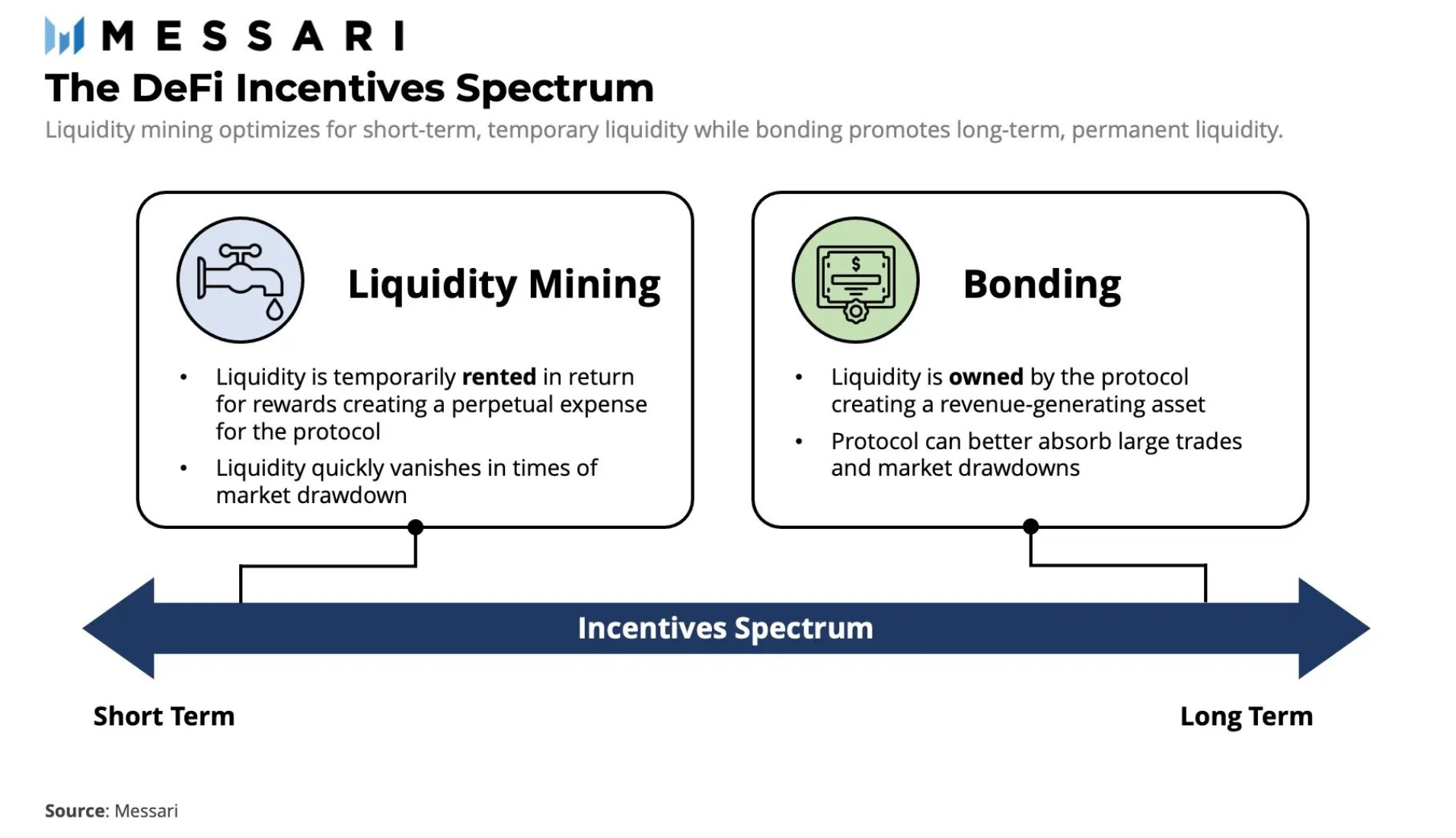

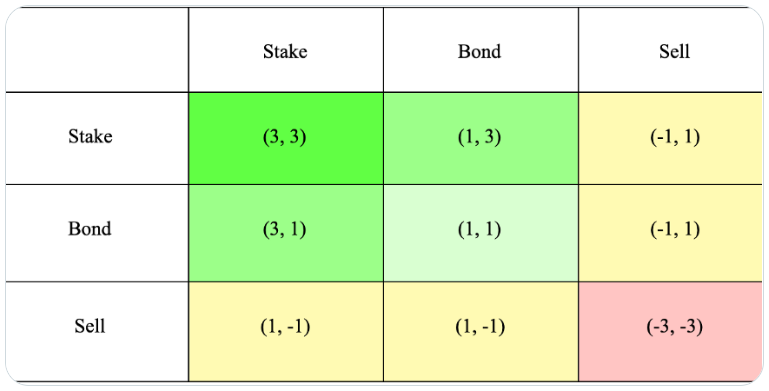

Confused? This is the crux of the matter! AMPL plays with human psychology and trading game theory. Should you sell before rebase? Or is it better to buy after the rebase when people sell their newly "airdropped" tokens? You choose. OlympusDAO 's OHM is on a mission to become a DeFi reserve currency. Olympus upends the liquidity mining game by selling OHM at a discount in exchange for LP tokens or single currency assets through "Bonding". (Users can purchase OHM from the agreement at a discount by trading with LP Token or other single-currency assets such as DAI and wETH. This process is called Bonding. Bonding is an important way for the OlympusDAO protocol to own and control liquidity. ) In this way, Olympus owns its own liquidity, rather than renting it.

Having your own liquidity was considered revolutionary, coining the term DeFi 2.0. Additionally, Olympus’ Bonding and re-staking game theory became a popular (3,3) meme on crypto-twitter. OHM's innovation attracted dozens of forked projects, several of which are still doing quite well.

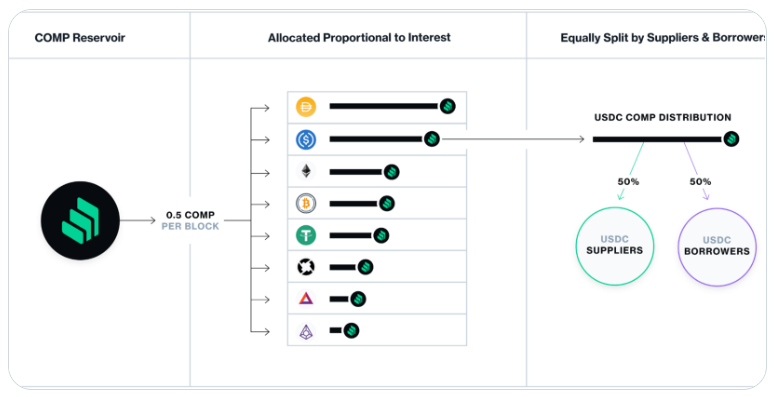

Compound Finance 's COMP It's hard to find something particularly revolutionary in the COMP token itself. The real innovation of COMP comes from its distribution method: liquidity mining. Everyone who borrows or borrows assets on Compound Finance gets free COMP tokens.

Within a week of launch, Compound’s TVL had grown from $90 million to $600 million. The COMP token became the most traded DeFi token at the time. While not the first project to launch liquidity mining, Compound’s success may have kicked off the DeFi summer. Thanks to COMP, we have Yield Farming. CurveFinance 's CRV ve token economics changes the liquidity mining game theory. The best practice for COMP liquidity mining is to regularly claim and sell COMP to obtain compound income. But Curve farmers need to lock up CRV for up to 4 years to maximize returns.

The upshot: Curve's lock-up period and vesting buys time for protocol development, adoption, and revenue. Success means that the value proposition of the CRV should be attractive enough that, after unlocking, the CRV is not sold at all. Yearn Finance ’s YFI kicked off DeFi’s “fair launch” and “valueless governance token” trends. No VC token sale, no team or advisor assignments. All YFI is distributed directly to the community. Yearn Finance hopes to combine the incentives of users and developers, so that users are willing to participate in the construction of the agreement. Founder Andre Cronje later admitted that giving away tokens was a mistake.

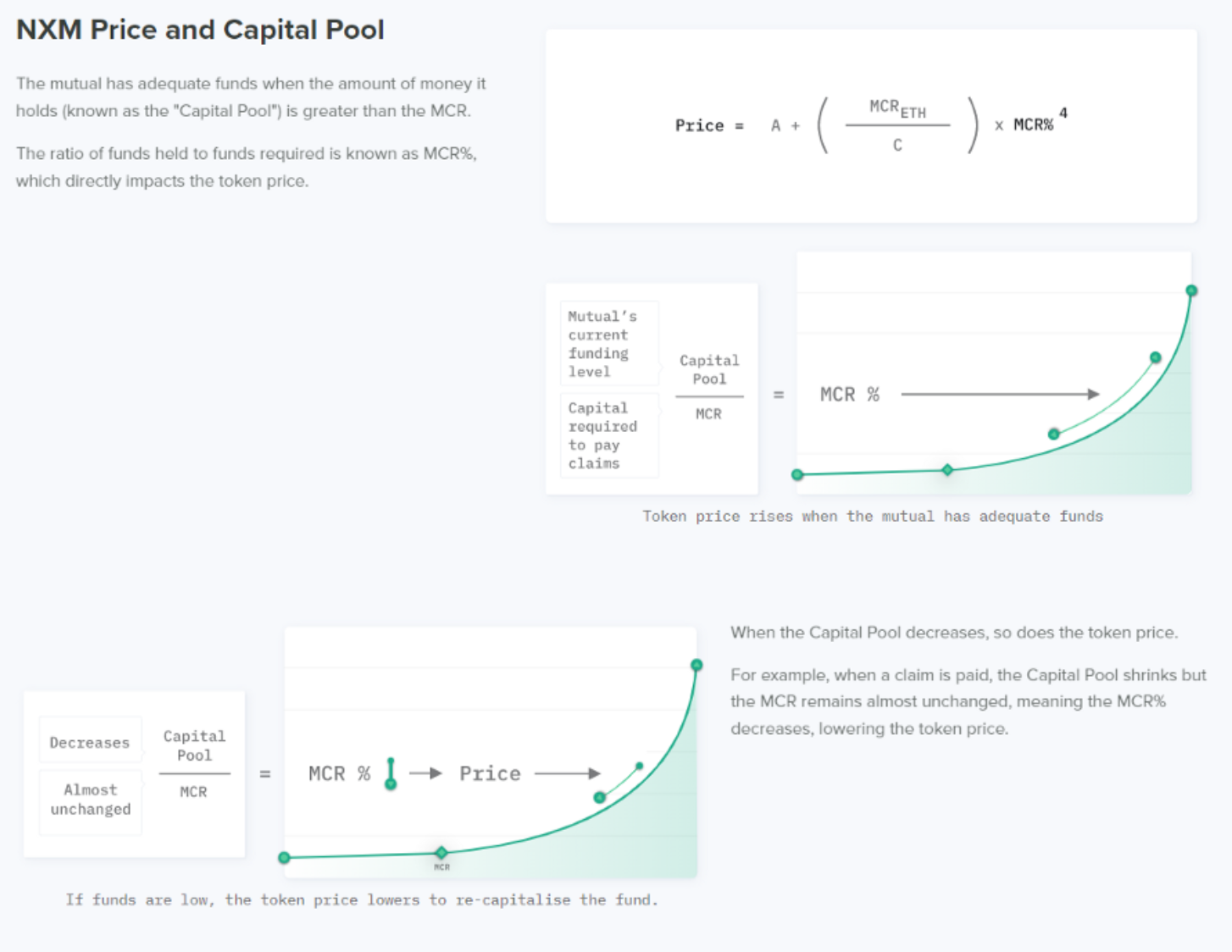

Choosing NXM over Nexus Mutual is controversial. Nexus Mutual is an on-chain insurance protocol, and NXM tokens are the tokenized membership equivalent. Members contribute ETH to the pool, and when the insurance pays out, all members share the risk with each other.

However, this membership token cannot be traded on Uniswap or any other exchange. What's the controversial part? All members must pass KYC to purchase. If the DeFi regulatory environment deteriorates, more protocols may choose the KYC token model. Synthetix ’s SNX is used to mint collateral for the synthetic stablecoin sUSD. The innovation is keeping sUSD pegged to the US dollar, backed by highly volatile SNX collateral. How? SNX holders are incentivized to pledge SNX and mint sUSD, and always keep the collateral ratio (C-Ratio) at 400%. Every week, stakers can earn additional SNX rewards and protocol fees, but they can only claim rewards when their C-Ratio reaches 400% or above. More importantly, SNX stakers incur "debt" when minting sUSD. As sUSD is used to trade other synthetic assets, its price goes up or down, and the shared debt changes as well. This means that SNX stakers take on the risk of the overall debt in the system. These are the most innovative tokens in my opinion. We can add Maker's DAI , as it invented the first successful over-collateralized stablecoin. Or, Frax ’s fractional algorithmic stablecoin.

JinseFinance

JinseFinance