Why Kenya is Africa’s crypto pioneer

The Kenyan government has shown a cautious yet open attitude towards crypto assets.

JinseFinance

JinseFinance

The Kenyan government has shown a cautious yet open attitude towards crypto assets.

JinseFinance

JinseFinanceChinese stocks opened higher on Monday and Bitcoin surged above $64,000 as investors assessed the potential impact of economic stimulus measures announced by the Ministry of Finance over the weekend.

Miyuki

MiyukiMarket liquidity should be just right. Too much liquidity will lead to economic and market turmoil. We investors must always pay attention to the risks.

JinseFinance

JinseFinanceOn April 19, the U.S. Internal Revenue Service (IRS) released the first draft tax form specifically for digital asset transactions, 1099-DA, which is intended to report digital asset gains from broker transactions.

JinseFinance

JinseFinanceFor tokens with a specific utility, a rule of thumb is - a token should be issued when its utility is essential to the crypto project.

JinseFinance

JinseFinanceBinance, Ether.Fi, in-depth analysis: What signals does Binance’s listing of ETHFI send? Golden Finance, the ReStaking track is about to usher in a big explosion.

JinseFinance

JinseFinanceCoinbase Wallet's latest feature simplifies cryptocurrency transfers by allowing users to send money through shared links on multiple platforms, including messaging apps and social media.

Joy

JoyThe suspension comes as the country's financial, security, and data protection services delve into the legitimacy and data protection aspects of the project.

Coinlive

Coinlive Azuki Elementals NFT mint drew much discontentment despite raking in an astounding $38 million in 15 minutes. Discontent centred around the artwork, the hosting platform’s technical errors, and limited minting window.

Catherine

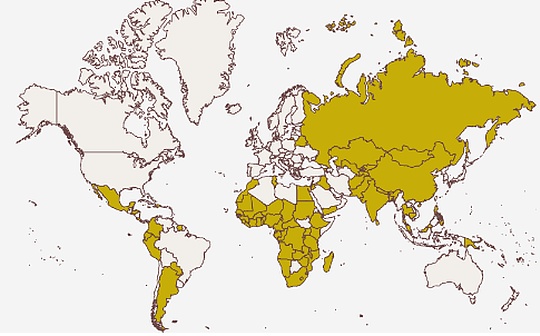

CatherineRoughly 8.5% of the African country's population owns cryptocurrencies, according to a United Nations report.

Others

Others