Original: https://tafc.substack.com/p/comparing-the-profitability-of-dexs

The recent bear market has brought increased scrutiny of the token economics of various projects. The narrative has largely shifted from chasing reflex mechanisms that work wonders during bull markets to chasing sustainable profits that allow projects to weather periods of waning retail interest. However, it is rare to see projects that are directly compared in terms of profitability, and unfortunately there are few resources specifically designed for this purpose.

Therefore, I conducted the following research comparing the major Ethereum and Solana DEXs (focusing on the latter) based on their profitability. Profit will be defined as:

Profit = Revenue (Protocol Fee) - Fee (Liquidity Mining)

In reality, projects may have expenses other than yield farming (e.g. team salaries, marketing, etc.), but these numbers are usually not released publicly. Finding protocol fees and yield mining data for each project is hard enough; it involves joining their respective Discord servers and asking questions, sometimes on an ongoing basis. Also, not all protocols share profits with their token holders, some require you to lock up tokens to get a share. Therefore, we have defined margins in order to bypass these differences and compare protocols on a normalized basis.

The question we want to answer is:

- Is the protocol making more money than it pays out (protocol fees > liquidity mining)? This helps us assess whether the protocol's current strategy is sustainable.

- At what token price does the protocol break even (profit = 0)? This gives us a way to estimate the "fair value" of the token.

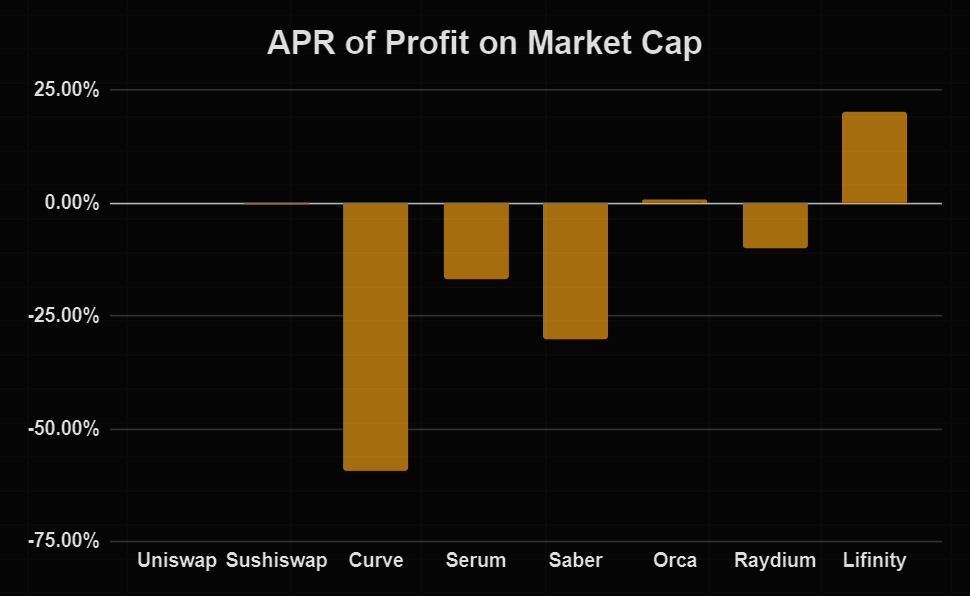

- If token holders receive a proportional share of protocol profits (annual percentage of market capitalization profits), how much will they receive? This measures the desirability of holding tokens, assuming all income is distributed to holders.

- How much profit can the protocol generate using its TVL (APR Profit from TVL)? This gives us an idea of how effectively the protocol can utilize its deposited assets.

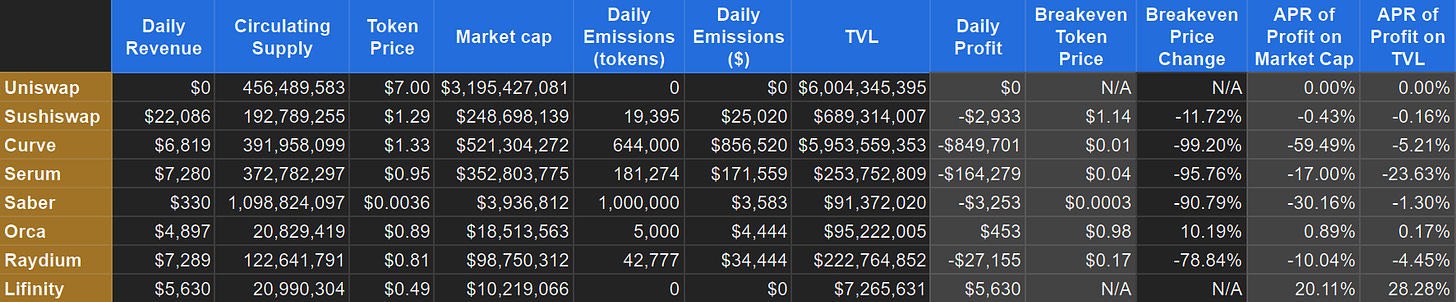

Before discussing the items individually, let's look at the overall results.

result

The highlighted columns on the right provide answers to the above questions.

Daily profit is simply revenue minus releases.

The breakeven token price is the price at which the daily profit equals 0, and the breakeven price changes the percentage change in the token price to reach that price. This is interesting, but not meant to be prescriptive; these numbers should not be interpreted as what the token "should" be worth. This is just one way to quantify the difference between the revenue earned by the protocol and the value unlocked through LM. (Note: it cannot be applied to projects without any LM.)

APR for market cap and TVL is calculated by treating daily profits as earnings generated by market cap and TVL and converting them to APR.

Uniswap

Although not interesting from a data point of view, I felt compelled to include Uniswap as it generated the most volume of any DEX.

Uniswap has neither LM releases nor agreement fees, so there is no profit or loss. However, it does have a "fee switch" that governance can decide to turn on at any time.

The opening fee will undoubtedly increase profits, but it will also cause a cycle, that is, reduce LP fees → reduce liquidity → reduce transaction volume → reduce LP fees until a balance is reached.

SushiSwap

SushiSwap is a fork of Uniswap that has expanded to provide various services.

SushiSwap appears to be one of the more sustainable protocols. I'm not very familiar with their ecosystem, so other than their relatively low LM release, I don't have anything intelligent to say about why this is the case.

Curve

Curve, the largest stablecoin DEX on Ethereum, has recently expanded to non-stablecoin trading pairs.

Of the protocols included in this study, Curve had the largest release of LM, more than 10x its revenue. Curve recently released their v2 pool, so it will be interesting to see if they can significantly increase Curve's earnings.

Serum

Serum is Solana's central limit order book.

Serum also has a lot of LM releases relative to the revenue it generates. Its market capitalization is fully diluted, even larger than Uniswap, which to some extent gives it room to provide incentives.

Saber

Saber is the largest stablecoin DEX on Solana.

While Saber generates significant transaction volume, its extremely low fees mean the protocol generates very little revenue, most of which comes from the 0.5% withdrawal fee on its USDC-USDT pool. In any case, its LM release is considerable relative to the revenue it generates.

Orca

Orca is the largest Uniswap v3 DEX on Solana.

Orca currently only charges protocol fees for its fixed product pools, and like Uniswap, does not yet charge protocol fees for its centralized liquidity pools. Turning them on increases profits, but also reduces volume, so it's hard to tell how much of an impact it will have.

Raydium

Raydium is a DEX on Solana that both has its own pool and publishes its liquidity on Serum's order book.

Raydium already incentivizes the majority of its capital pool with a steady stream of LM rewards, and LM returns far exceed its income at the moment. As pooled liquidity has become more prevalent on Solana, it has become increasingly difficult for Raydium to capture the volume share it once had for major currency pairs.

Lifinity

Lifinity is a relatively new DEX on Solana with many unique features:

- No LM release

- The protocol owns most of the liquidity it provides (and thus charges 100% for this liquidity)

- Concentrate liquidity around the oracle price, significantly lowering or even reversing IL (i.e. profiting from market making by buying low and selling high on average without any price predictions)

It’s worth noting that Lifinity was the only DEX in this study that generated significant profits.

in conclusion

All DEXs are useful infrastructure in some way; they enable market makers to provide liquidity, and traders can collect fees on that liquidity. However, the presence of LM releases is often an implicit recognition that, as the originator of any trade, the trader has the upper hand, and thus liquidity providers need additional compensation beyond just fees.

The necessity of LM release calls into question whether the protocol can capture more value than it releases. Internet protocols such as TCP/IP were also very useful, but failed to capture any of the value they created. Is this also the fate of most DEXs?

This also explains why metrics like TVL, volume, and revenue are far less useful than how often they are mentioned; these numbers can be artificially inflated by adding LM releases. At the end of the day, do these metrics matter if a protocol is not generating profits for its token holders?

Of course, profitability is not the most important thing when considering investing. How the protocol uses its profits also matters, with speculation playing a big role in whether a token appreciates in price. But there's no way to quantify that power; we just need to focus on the profits that are currently being generated. So this seems like the right starting point for the analysis, especially when compared to the aforementioned metrics.

I hope this type of data becomes more readily available and becomes a standard metric for comparing not only DEXs, but other types of protocols (loans, leveraged yield farms, etc.). I'm sure others can collect this data more effectively than I can. Ideally, someone would create a dashboard that could monitor the protocol's profitability in real time.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Catherine

Catherine Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph 链向资讯

链向资讯