Each economic and financial cycle has its dominant narrative logic, and the current market is caught in a tangle of conflicting narratives: Bitcoin's seasonal fluctuations and post-halving cyclical characteristics clash, the Federal Reserve's ambiguous policy stance and the stickiness of inflation create tension, and the steepening of the bond market yield curve carries dual signals of economic relief and recession warnings. This narrative "torn" is not short-term market noise, but rather a concentrated reflection of the complexity and structural contradictions of the current macroeconomic environment, which in turn determines that the market will seek a new balance amidst this volatility. Breaking down the market's volatility over time, the following clear hierarchical patterns emerge: Short-term (1-3 months): Bitcoin's "September effect" and the unique nature of the post-halving cycle form a core conflict. Historical data shows that September is traditionally a weak month for Bitcoin, with recurring declines triggered by long liquidations. However, 2025 falls after Bitcoin's halving, and the third quarter of post-halving years historically tends to show a bullish trend. This conflict between seasonality and cyclical characteristics is likely to trigger the first significant volatility of the year. Medium-term (3-12 months): The Fed's policy credibility crisis has become a key variable. Forced interest rate cuts under inflationary pressure will disrupt the traditional monetary policy transmission path and reshape the valuation logic of assets such as stocks, bonds, and commodities. The ambiguity of policy signals and the sensitivity of market expectations will further amplify asset price fluctuations. Long-term (1 year and above): The structural demand pillars of the cryptocurrency market face challenges. Unlike previous cycles that relied on retail or institutional capital flows, the core support for current cryptocurrency demand comes from corporate crypto treasuries (such as the BTC and ETH holdings of institutions like MSTR and Metaplanet). If this structural pillar reverses due to balance sheet pressure, it will trigger a transmission from demand to supply, reshaping the logic of the cryptocurrency cycle. For investors, the current market's core cognitive framework must shift from "single narrative verification" to "multiple narrative collisions." Effective signals are no longer hidden in isolated data points (such as monthly inflation data or Bitcoin's daily gains), but rather exist in the contradictions and resonances of different narrative dimensions. This also means that "volatility" is no longer a risk accessory, but a core value carrier that can be mined in the current environment.

Bitcoin: Dual Pricing of Seasonal Game and Halving Cycle

(I) The Conflict between Historical Laws and Current Particularities

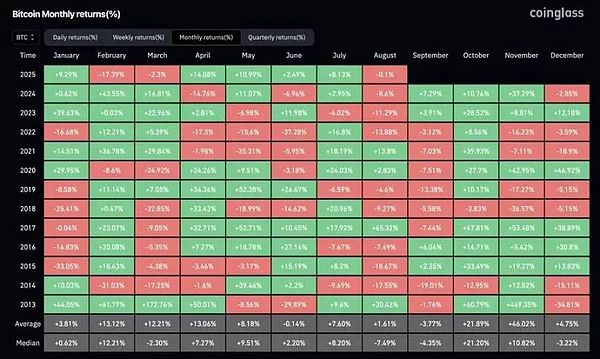

Looking back at the monthly Bitcoin yield data from 2013 to 2024, the performance in September continued to be weak: it fell by 9.27% in September 2018, 13.88% in September 2022, and 0.6% in September 2023. The "long liquidation → price correction" transmission path has recurred repeatedly. However, 2025 is unique in that it falls in the crucial year following Bitcoin's halving. Historical data shows that the third quarter (July-September) of post-halving years tends to be strong: Q3 saw a 27.7% increase in 2020 and a 16.81% increase in 2024. This clash of "seasonal weakness" and "cyclical strength" constitutes the core contradiction in Bitcoin's current pricing. (II) The Regression Logic After Volatility Compression As of August 2025, Bitcoin has yet to experience a single-month increase exceeding 15%, significantly lower than the norm of "single-month increases of 30%+" during historical bull market cycles, reflecting a period of compressed market volatility. From a cyclical perspective, bull market surges are characterized by concentrated release rather than uniform distribution—this pattern is confirmed by increases of 42.95% in November 2020, 39.93% in November 2021, and 37.29% in May 2024. This leads to the current investment logic: A return to volatility is a certainty within the remaining four months of 2025, with the only difference being the timing. A September pullback due to seasonal factors would create a dual support structure of "post-halving cyclical support + volatility recovery expectations," likely becoming the final entry window before the fourth quarter's rally. This "pullbacks as opportunities" logic essentially rebalances the weighting of "short-term seasonal disturbances" against "long-term cyclical trends," rather than simply relying on linear deductions based on historical patterns.

Federal Reserve: Policy Narrative Split and Reconstruction of the Pricing of Credibility Risk

(I) Misinterpretation of Signals and True Intentions of the Jackson Hole Speech

Federal Reserve Chairman Powell’s remarks at the 2025 Jackson Hole Global Central Bank Annual Meeting were initially interpreted by the market as a “signal of radical easing”, but in-depth analysis reveals the subtlety of his policy logic:

Limitations on the Path of Rate Cuts: Powell explicitly “reserved room for a September rate cut”, but at the same time emphasized "This move does not mark the start of an easing cycle," meaning that a single rate cut is more of a "phased adjustment under inflationary pressure" than the "beginning of a new round of easing," preventing the market from forming an inertia of expectations for "continuous rate cuts." The fragile balance in the labor market: The "dual slowdown in both labor supply and demand" mentioned by the Fed implies deeper risks. The current stability of the job market stems not from economic resilience, but from the simultaneous weakness of both supply and demand. This balance carries "asymmetric risks": if broken, it could trigger a rapid wave of layoffs, which also explains the Fed's vacillation between "rate cuts" and "recession prevention."

A major shift in the inflation framework:The Federal Reserve officially abandoned the "average inflation targeting system" introduced in 2020 and returned to the "balanced path" model of 2012. The core changes are "no longer tolerating inflation temporarily higher than 2%" and "no longer focusing solely on the unemployment rate target." Even though the market has digested the expectation of a rate cut, the Federal Reserve is still strengthening the signal of the "2% inflation target anchor" in an attempt to repair its credibility that was previously damaged by policy swings.

(2) Policy dilemmas and asset pricing impacts under a stagflationary environment

The core contradiction currently facing the Federal Reserve is “forced interest rate cuts under stagflationary pressure”: core inflation remains sticky due to the impact of tariffs (Powell made it clear that “the impact of tariffs on prices will continue to accumulate”), signs of labor market weakness are emerging, and the high debt burden of the United States (the government debt/GDP ratio continues to rise) makes “maintaining high interest rates for a longer period of time” unfeasible both fiscally and politically, forming a vicious cycle of “spending → borrowing → printing money”.

This policy dilemma directly translates into a reconstruction of asset pricing logic:

Credibility risk becomes a core pricing factor:If the 2% inflation target degenerates from a "policy anchor" to a "vision-style statement", it will trigger a repricing of the "inflation premium" in the bond market - long-term US Treasury yields may rise due to rising inflation expectations, and the "earnings valuation gap" in the stock market will further widen.

The hedging value of scarce assets is highlighted:Against the backdrop of rising fiat currency credit dilution risk, assets with “scarcity attributes” such as Bitcoin, Ethereum, and gold will have their “anti-inflation dilution” function strengthened, becoming core configuration targets for hedging against the declining credibility of the Federal Reserve’s policies. In August 2025, the yield spread between 10-year and 2-year U.S. Treasury bonds rebounded from the historically deep inversion range to +54 basis points, superficially showing the characteristics of "curve normalization", which was interpreted by some market opinions as a signal of "economic risk easing". But historical experience (especially in 2007) warns that there are two paths of steepening after an inverted curve: Benign and malignant:

Benign steepening:is due to improved economic growth expectations and positive corporate profit prospects, which push long-term interest rates up faster than short-term interest rates, often accompanied by rising stock markets and narrowing credit spreads. Vicious steepening: It is caused by the rapid decline of short-term interest rates due to the expectation of policy easing, while long-term interest rates remain high due to the stickiness of inflation expectations. In essence, it is a warning that "policy easing cannot hedge the risk of economic recession". The subprime mortgage crisis that broke out after the steepening of the curve in 2007 is a typical case of this path. (II) Determination of the Risk Attributes of the Current Steepening Combining the current structure of U.S. Treasury yields, the 3-month Treasury yield (4.35%) is higher than the 2-year yield (3.69%). While the 10-year yield (4.23%) is higher than the 2-year yield, it is mainly supported by long-term inflation expectations. The market interprets the Fed's expected September rate cut as a "passive response to stagflation" rather than a "proactive adjustment under economic resilience." This combination of "short-term interest rate decline + long-term inflation stickiness" meets the core characteristics of "malignant steepening."

The core basis for this judgment is that the steepening of the curve does not stem from the restoration of growth confidence, but from the market's pricing of "policy failure" - even if the Federal Reserve starts to cut interest rates, it will be difficult to reverse the dual pressures of core inflation stickiness and economic weakness. On the contrary, it may further aggravate the risk of stagflation through the transmission of "loose expectations → rising inflation expectations". This also means that the current bond market's "superficial health" hides significant recession warning signals.

Cryptocurrency: A test of the fragility of the structural demand pillar

(I) Differences in demand logic in the current cycle

Comparing the core driving factors of the three bull market cycles of cryptocurrency: in 2017, it relied on the ICO financing boom (incremental funds dominated by retail investors), in 2021, it relied on DeFi leverage and NFT speculation (resonance of leveraged funds between institutions and retail investors), and in 2025, it showed the characteristics of "structural demand dominance" - corporate crypto treasury became the core buyer force. Galaxy Research data shows that as of August 2025, over 30 listed companies worldwide will have included crypto assets such as BTC, ETH, and SOL in their treasury allocations. MSTR's BTC holdings exceed 100,000, and institutions like Bit Digital and BTCS continue to increase their ETH holdings as a percentage of circulating supply. This "enterprise-level allocation demand," distinct from previous "speculative demand," is considered a "stabilizer" in the current cryptocurrency market. (2) Potential Risk of Demand Reversal The current stability of corporate crypto treasuries relies on a "net value premium"—if the stock prices of related companies fall due to market volatility or performance pressure, leading to an imbalance in the ratio of "crypto asset holdings market value / total corporate market value," this could trigger a chain reaction of "forced reductions in crypto holdings to stabilize balance sheets." Historical experience shows that the end of cryptocurrency cycles often stems from a "reversal of core demand mechanisms": tightened ICO regulations ended the bull market in 2017, DeFi leveraged liquidations triggered a crash in 2021, and if corporate crypto treasuries shift from "net buyers" to "net sellers" in 2025, it will become a key trigger for a cyclical reversal. The particularity of this risk lies in its "structural transmission" - corporate share reduction is different from the short-term trading behavior of retail investors or institutions. It is often characterized by "large scale and long cycle", which may break the "fragile supply and demand balance" in the current cryptocurrency market and trigger the dual pressure of price overshoot and liquidity contraction.

Conclusion: Reconstructing the investment logic of volatility as a core asset

The essence of the current market is the "era of volatility pricing under narrative collision", and four core contradictions constitute the underlying framework of investment decision-making: Bitcoin's "seasonal pullback" and "rise after halving" collide; the Federal Reserve's "cautious statement" and "stagflation rate cut" collide; the bond market's "curve normalization" and "recession warning" collide; the cryptocurrency's "corporate treasury support" and "demand reversal risk" collide.

In this environment, investors' core capabilities need to shift from "predicting the direction of a single narrative" to "capturing volatility opportunities in the collision of multiple narratives":

Actively embrace volatility:No longer view volatility as a risk, but as a core vehicle for obtaining excess returns - such as taking advantage of Bitcoin's September seasonal pullback and arbitrage through interest rate fluctuations during the steepening phase of the U.S. Treasury curve.

Strengthen hedging thinking:Against the backdrop of declining policy credibility and rising stagflation risks, allocate scarce assets such as Bitcoin, Ethereum, and gold to hedge the risks of fiat currency credit dilution and asset valuation reset.

Track structural signals:Closely monitor "structural indicators" such as changes in corporate crypto treasury holdings, the implementation of the Federal Reserve's inflation target, and changes in the slope of the U.S. Treasury yield curve. These indicators are key anchor points for judging the direction of narrative collisions. Ultimately, the investment opportunity in the current market lies not in “choosing a winning narrative” but in recognizing that “volatility itself is an asset”—in an era of narrative collisions, being able to manage volatility, hedge risk, and capture value amidst contradictions is the core logic for building long-term investment advantages.

Alex

Alex

Alex

Alex JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Future

Future Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph