Source: Golden Finance, Binance, Nillion official website, Messari research report Compiled by: Golden Finance

On March 20, 2025, Binance announced that Binance Launchpool launched the 65th project - Nillion (NIL), a decentralized network that uses blind computing to achieve secure data processing and storage while protecting privacy.

Users can invest BNB, FDUSD and USDC into the NIL reward pool on the Launchpool website after 08:00 on March 21, 2025 (Eastern Time Zone 8) to obtain NIL. The activity will last for a total of 3 days.

New Coin Listing

Binance will list Nillion (NIL) at 21:00 (ET) on March 24, 2025, and open NIL/USDT, NIL/BNB, NIL/FDUSD, NIL/USDC and NIL/TRY trading markets, with seed tag trading rules applicable.

1. Launchpool Details

Token Name: Nillion (NIL)

Total Token Supply: 1,000,000,000 NIL

Maximum Token Supply: Unlimited (depending on the release type and autonomous governance, the annual inflation rate is 1%)

Total Launchpool: 35,000,000 NIL (3.5% of the maximum token supply)

Initial circulation: 195,150,000 NIL (19.52% of total token supply)

Restrictions: KYC required

Individual hourly reward hard cap:

BNB mining pool: 38,888 NIL

FDUSD mining pool: 4,861 NIL

USDC mining pool: 4,861 NIL

Reward pool:

BNB pool: total reward 28,000,000 NIL (accounting for 80%)

FDUSD pool: total reward 3,500,000 NIL (accounting for 10%)

USDC pool: total reward 3,500,000 NIL (accounting for 10%)

Event time: March 21, 2025 08:00 (Eastern Time Zone 8) to March 24, 2025 07:59 (Eastern Time Zone 8)

Reward amount distribution in stages:

2. Introduction to Nillion (NIL)

Founded in 2021, the Nillion network is a decentralized data storage and computing network, and a set of supporting tools that together help builders build novel, powerful applications that leverage high-value data in a more secure way. Its modular and flexible architecture makes it possible to achieve this using cutting-edge encryption technology, both to achieve more secure versions of existing workflows and to unlock new opportunities. Early builders in the Nillion community are creating tools for private predictive AI, secure storage and computing solutions for healthcare, storage solutions for secure data such as credentials, and secure workflows for transactional data.

Team Information

The project team includes Alex Page (CEO), former Hedera SPV partner and Goldman Sachs banker; Andrew Masanto (Chief Strategy Officer), Hedera co-founder and Reserve founding CMO; Slava Rubin (Chief Brand Officer), Indiegogo founder; Dr. Miguel de Vega (Chief Scientist), who holds more than 30 data optimization patents; Conrad Whelan (Founding CTO), Uber founding engineer; Mark McDermott (Chief Operating Officer), former Nike innovation director; Andrew Yeoh (Chief Marketing Officer), Hedera's early senior vice president partner and former UBS and Rothschild banker, etc.

Since its inception, the team has raised $50 million in private equity financing from investors including Hack VC, Hashkey Capital, Distributed Global and Maelstrom.

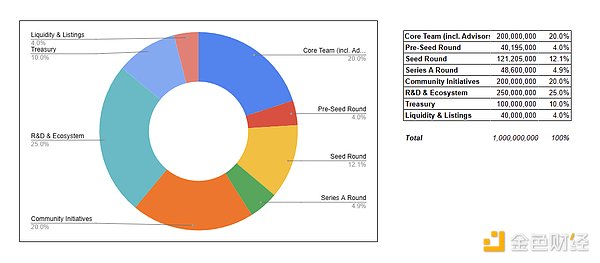

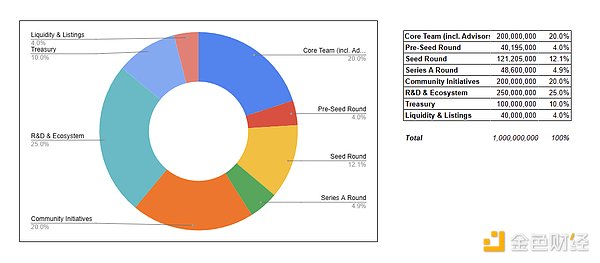

III. Nillion Token Economics

NIL token is the core of the Nillion blind computing network. It is both the utility token of the network and the governance mechanism. With a total supply of 1 billion, NIL aims to coordinate the incentives of all network participants while achieving sustainable growth of the ecosystem.

(1) Supply Side: Allocation and Unlocking

Token AllocationThe majority of the token supply (45%) will be used for community and R&D to continuously improve the technology, demonstrating a focus on sustainable growth rather than short-term gains. The protocol also reserves 7.5% of the total supply (75 million NIL) for the Genesis Airdrop to early supporters and builders, targeting those who have made meaningful contributions to the development of the network.

Unlock Schedule

Token release will follow a planned unlock schedule:

Initial circulating supply is approximately 13.9% (139.6 million tokens)

Main unlock event begins 6 months after genesis, reaching ~30% of supply

Gradually increasing to ~48% by 12 months after TGE

Long-term linear vesting of team and ecosystem allocations

Anais

Anais