Source: Binance official website Compiled by: Golden Finance

On April 23, 2024, Binance announced that the 53rd phase of Binance new coin mining was launched, using BNB and FDUSD to mine Renzo (EZ). A liquidity re-pledge agreement.

Users can put BNB and FDUSD into the EZ mining pool on the Launchpad website after 08:00 on April 24, 2024 (Eastern Time Zone 8) to obtain EZ rewards. EZ can be mined for a total of 6 days. The website is expected to be updated within about five hours of this announcement before the mining activity is opened.

Launchpool Details

Token Name: Renzo (EZ)

Maximum Token Supply: 10,000,000,000 EZ

Initial Circulation: 1,050,000,000 EZ (10.50% of the maximum token supply)

Total Mining: 250,000,000 EZ (2.5% of the maximum token supply)

Smart Contract Details: Ethereum

Restrictions: KYC Required

Individual hourly mining hard cap

BNB mining pool: 147,569.44 EZ

FDUSD mining pool: 26,041.67 EZ

Mining quota phase allocation

Note: The above table uses UTC time every day, which is converted to 08:00:00 am on the same day to 07:59:59 am the next day in Eastern Time.

Renzo (EZ)About

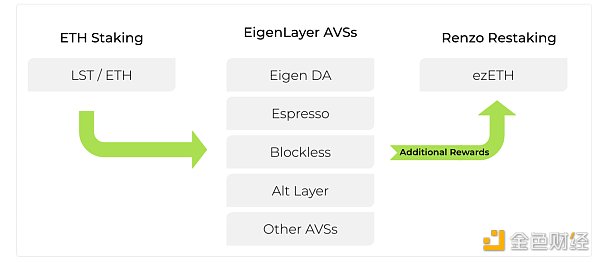

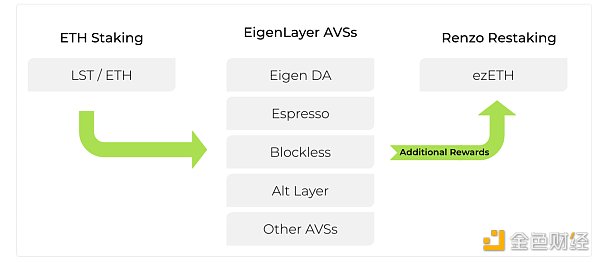

Renzo is the Liquidity Re-mortgage Token (LRT) and Strategy Manager of EigenLayer. It is the interface of the EigenLayer ecosystem, which protects the Active Validation Service (AVS) and provides higher returns than ETH staking.

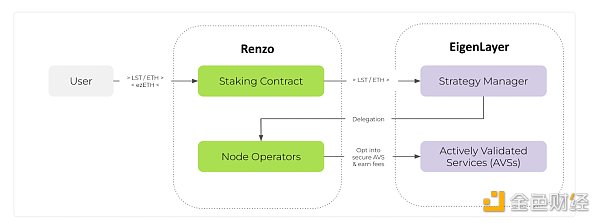

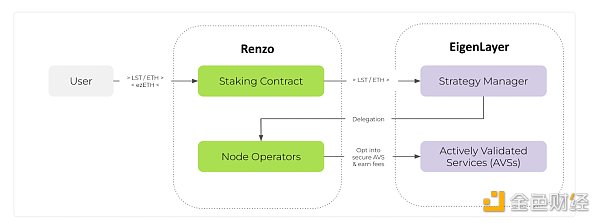

The protocol abstracts all the complexity for end users and enables easy collaboration between them and EigenLayer node operators.

Renzo is a strong advocate of EigenLayer and its goal of promoting permissionless innovation on Ethereum and programmatically gaining trust in the ecosystem.

How Renzo works

Renzo is a liquid derivatives platform built on EigenLayer. It acts as an interface to the EigenLayer ecosystem by securing the Active Verification Service (AVS) and providing higher returns than ETH staking.

For every LST or ETH deposited into Renzo, it will mint an equal amount of ezETH.

Project Mission

Renzo aims to become the main entry/exit for Ethereum re-mortgage, using a combination of smart contracts and operator nodes to ensure the best risk/reward re-mortgage strategy. Renzo was built to promote the widespread adoption of Eigenlayer.

Ecosystem

EigenLayer has 4 main components in the ecosystem:

Active Verification Service (AVS): AVS in Eigenlayer is a decentralized service that will inherit the security of Ethereum through EigenLayer. These services can support various networks, such as side chains, data layers, etc. Eigenlayer enhances security by dedicating Ethereum’s centralized resources to activities like middleware services, block construction, and transaction ordering, opening the door to innovation in areas like MEV and PBS.

Ethereum Stakers: Ethereum stakers in Eigenlayer can secure multiple networks by re-stacking their ETH. This means they can use existing funds to support multiple networks through smart contracts. While this provides additional yield, it also carries the risk of slashing if stakers fail to meet the conditions set by the services they choose to support.

Node Operators: Node operators in Eigenlayer provide computing resources to securely run a variety of services, including decentralized applications (DAs), oracles, and bridges. These operators are free to choose the services they work on and implement the recommendations provided by AVS.

Eigenlayer Protocol: The Eigenlayer Protocol consists of Ethereum smart contracts that facilitate trustless collaboration between stakeholders, node operators, and services. These contracts allow users to re-collateralize their assets, delegate them to node operators, and interact with on-chain service modules. The business module presets reward and deduction conditions to ensure smooth interaction between operators and businesses.

Project Highlights

The EigenLayer ecosystem allows Ethereum validators to re-collateralize their ETH and provide services to the network, such as a data availability layer with a specific type of node software called Active Validation Service (AVS).

Eigenlayer Operator acts as an AVS node and chooses to validate AVS by running its AVS software. AVS nodes are nodes that run AVS software as Eigenlayer Operators.

Renzo Operator Nodes are professional staking providers that ensure the security of funds belonging to protocol users and the correctness of re-staking operations.

The protocol distributes the pooled LST among all active node operators based on the weight associated with each operator. This way, a deterministic risk/reward can be set to allow for the best return based on the calculated risk.

Token Economics

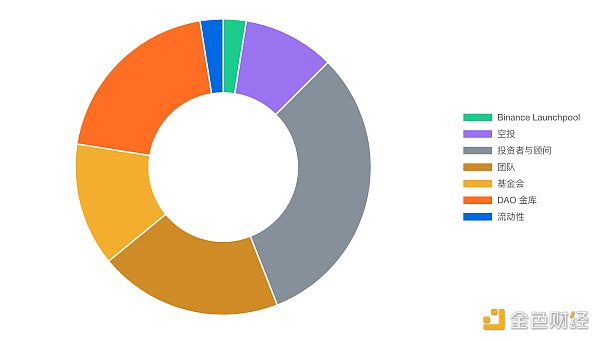

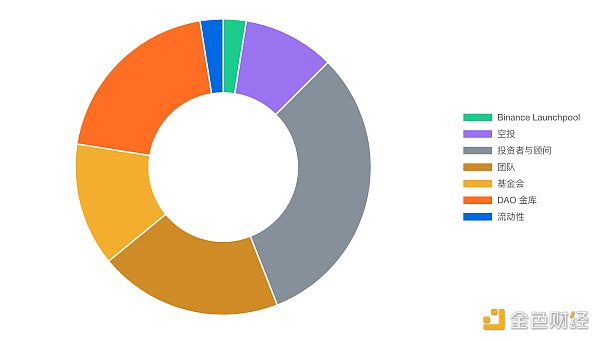

Token Distribution

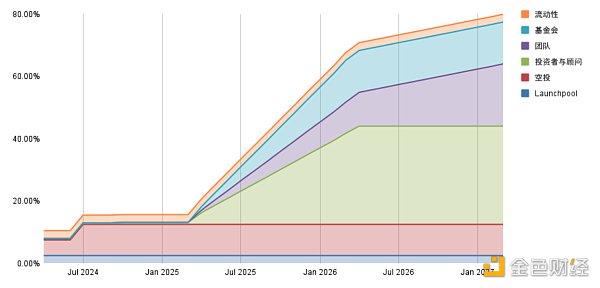

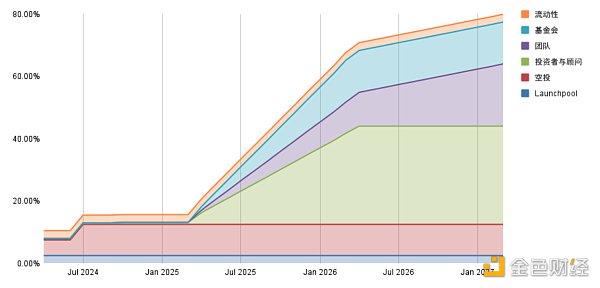

Token Issuance Schedule

JinseFinance

JinseFinance