Author: Zoltan Vardai, CoinTelegraph; Compiler: Wuzhu, Golden Finance

Solana, the fourth-largest blockchain by total locked value (TVL), is becoming a leading network for institutional adoption.

Wormhole Foundation co-founder and chief business officer Robinson Burkey said that more and more financial institutions will integrate with the Solana blockchain to "future-proof their products."

Burkey wrote in a research report:

"Solana and institutional partnerships make sense. Industry leaders such as PayPal, Stripe, and Visa must ensure that their products are future-proof. The best way to do this is to meet the most forward-looking users on the platforms they adopt. You may see more institutional moments for Solana in the coming years."

On May 28, PayPal expanded its PayPal USD stablecoin to the Solana network, marking its first move toward a blockchain outside the Ethereum ecosystem.

The integration will enable Solana users to use PYUSD for cheap transactions on the network, aiming to expand the usefulness of stablecoins for everyday purchases.

In September 2023, global payments giant Visa launched USD Coin on the Solana blockchain, the second network to support stablecoins after Ethereum.

Solana to Gain More Institutional Adoption - Fireblocks

Solana is one of the most scalable blockchain networks, capable of handling a large number of transactions.

Solana has a theoretical throughput of up to 65,000 transactions per second (TPS), with an average transaction cost of $0.0025, exceeding Ethereum's 15 TPS, and significantly higher gas fees, starting at more than $1 and reaching up to $50 during network congestion.

Ran Goldi, VP of Payments at Fireblocks, wrote:Solana’s infrastructure can easily integrate with the existing processes of traditional payment institutions, which will lead to more institutional adoption:

“With confidential transfers, a fundamental payment requirement for large processors, we will see more companies incorporate blockchain into their processes. In my view, the key is to ensure your blockchain can support the compliance, regulatory, and privacy requirements of payments ‘behind the scenes’.”

Goldi added that the addition of confidential transfers could unlock more institutional partnerships for Solana:

“Doing this, combined with speed and massive liquidity, [Solana] can become a powerful weapon in the hands of payment institutions.”

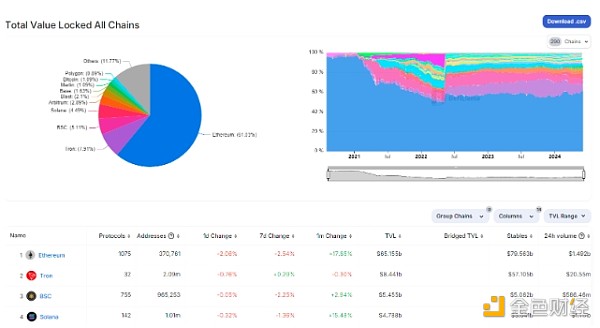

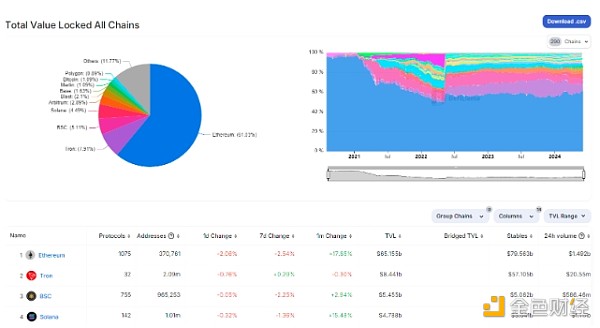

Solana is currently the fourth largest blockchain network with over $4.7 billion in TVL, accounting for 4.49% of the total TVL of all blockchains, according to DefiLlama.

TVL on all chains. Source: DeFiLlama

Is Solana ETF Next?

In addition to increasing institutional adoption, Solana could also be the next cryptocurrency to get a spot exchange-traded fund (ETF), according to Zeta Markets founder Tristan Frizza.

Frizza wrote in a note:

“Solana is viewed as one of the ‘big three’ cryptocurrencies alongside BTC and ETH, and many analysts expect a Solana ETF to launch soon.With major partners like Visa, Stripe, Shopify Pay, and PayPal on board, merchant and institutional adoption of Solana is likely to increase.”

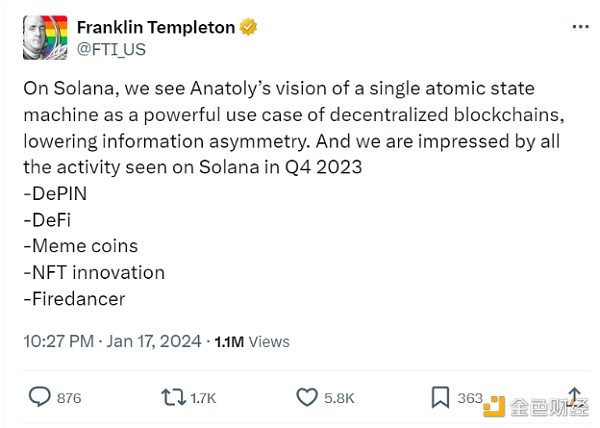

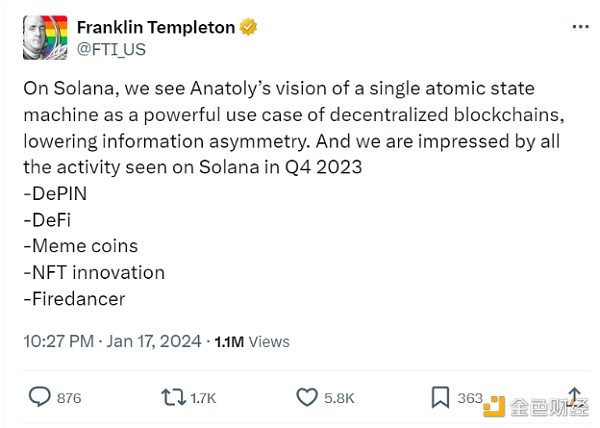

Hopes for a Solana-based ETF were first fueled in January after trillion-dollar asset manager Franklin Templeton praised Solana’s holistic approach to blockchain scaling, according to a Jan. 17 X post. took a holistic approach to blockchain expansion, calling it a “powerful use case for decentralized blockchains.”

Solana Innovation. Source: Franklin Templeton

Crypto investor and CNBC Fast Money trader Brian Kelly also speculated that Solana could be the next cryptocurrency to get a spot ETF in the U.S.

JinseFinance

JinseFinance