Although the market is now focused on the BTC and Solana ecosystems, the ETH ecosystem is relatively unknown. However, when eigenlayer officially goes online and raises the ETH ecological benchmark interest rate, funds will still flow back to the DeFi ecosystem. As the saying goes, buy when no one cares, and ambushing the future Restaking ecosystem through agilely at this time is a choice with high odds.

Foreword

After Ethereum was transferred to POS, Lido Warpped ETH issued by staking underlying protocols such as Rocket Pool brings a 4% risk-free interest rate derived from POS to the Ethereum ecosystem, while EigenLayer decouples the security of Ethereum staking nodes from the network and provides it to multiple users through retake POS network. Although it has not yet been officially launched, it is foreseeable that retake can further increase the base interest rate in the Ethereum ecosystem to 6%-8%. Adding leverage on top of this base interest rate, we can expect users to obtain a long-term risk-free return of approximately 10%. Agilely is the first protocol among many LSDFi protocols to embrace Restaking Token.

About Agilely

In short, agilely is A stablecoin $USDA issuance protocol. USDA is a full-chain interest-bearing stablecoin based on the Liquidity model. Through multiple innovative mechanisms, it ensures that users can earn interest by holding it while ensuring that USDA is always anchored at $1, ensuring the coexistence of income and circulation attributes.

After the rise of the LSD track this year, interest-bearing stablecoins that combine liquidity, stability and profitability have quickly gained favor among DeFi players. The first shot was launched by Lybra in May this year, followed by Gravita, Raft, and Prisma. The total TVL reached $400m, and it has grown into a force that cannot be ignored. Agilely draws on the strengths of many experts and not only maintains the most innovative points in product design, but also ensures that the tokens can capture the real income of the protocol in terms of token design. This is an advantage that protocols on the same track do not have.

The stablecoin model based on CDP (Collateral Debt Position, debt collateral position) was first proposed by MakerDAO. Users over-mortgage their assets in the agreement as a guarantee. Thereby lending the stablecoins issued by the protocol. However, the mortgage rate as high as 250% results in underlying capital efficiency.

DAI’s Collateral Ratio (Source: https://daistats.com/#/overview)

Liquity then proposed the most classic CDP stablecoin model, which uses hard and soft dual anchoring and a three-layer liquidation model to achieve an MCR as low as 110% and achieve excellent capital efficiency. The stablecoin LUSD issued by Liquity has experienced two years of bull and bear fluctuations in the market and its price has always been anchored at $1, which shows the perfection of its mechanism design. agilely uses Liquidity's price stabilization mechanism to ensure USDA's price stability.

Liquity Stabilization Mechanism Review

Before we introduce USDA , first of all, review the stability mechanism of Liquidity to give readers a better understanding. Liquity’s CDP stablecoin LUSD design mainly includes the following aspects. Soft/Hard Peg brings LUSD price anchoring, stable pool-debt redistribution-recovery mode ensures protocol security, and changes in supply and demand through minting rate and redemption rate changes Take control. These modules work together to ensure the stability of LUSD and make it the best model for stablecoins based on CDP.

Liquity’s price stabilization mechanism

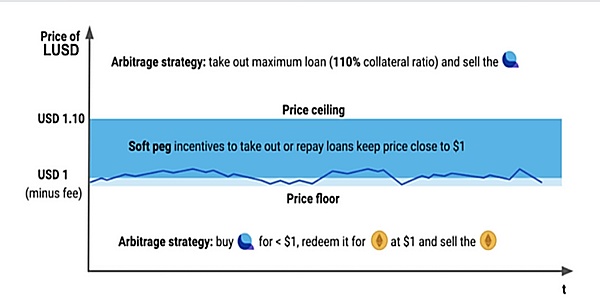

LUSD as an anchor The most important and core attribute of the U.S. dollar stablecoin is stability. Its price stabilization mechanism is divided into two parts, Hard Peg and Soft Peg. The Hard Peg part shapes the price cap to $1.1 by determining a minimum collateralization rate of 110%. If the LUSD price exceeds $1.1 then users can mint LUSD by staking Ethereum (110% collateralization rate) and sell it on the market to obtain risk-free arbitrage; By providing a hard redemption/repayment channel to constrain the price lower limit to 1, if the LUSD market price is lower than 1, then anyone can purchase LUSD in the market to redeem ETH/redeem collateral from the Liquidity protocol for risk-free arbitrage. By providing an open arbitrage channel, the price of LUSD is stabilized between $[1-redemption rate, 1.1].

The Soft Peg part is divided into several parts. The first is the long-term market psychological strengthening led by the protocol. The Liquidity system strengthens people's value of 1LUSD is 1USD. Users In the long-term game, the Schelling point of 1LUSD=1USD will also be reached (the tendency of people to choose without communication in game theory), and as long as the price range of LUSD is developed in the minds of market users [1-redemption rate, 1.1 ], then users will not buy LUSD at a high price (the maximum loss for buying LUSD at $1.09 is 9%, and the maximum profit is 1%), and they will not sell LUSD at a high price (risk-free arbitrage can be done in the Liquidity protocol) , then the price of LUSD will not be close to the upper and lower price limits; in addition, there is a one-time issuance fee determined by the algorithm as an additional stabilization mechanism. Compared with raising interest rates, increasing the issuance rate can more directly affect the new increase The number of LUSD minted, please see the "Supply and Demand Control Mechanism" section below for details. The issuance rate and redemption rate are used to control the issuance quantity of the base currency, thereby regulating the market price of LUSD.

Taken together, the price stabilization mechanism of LUSD can be described as follows.

LUSD’s price stabilization mechanism

Facts have proven that this stabilization mechanism works Effective.

Liquity’s liquidation mechanism

As mentioned in the previous article , Liquidity’s liquidation mechanism consists of a stable pool-position redistribution-recovery model as the protocol’s security defense line. In normal operations, liquidating users (i.e., those whose collateral ratio drops below 110%) typically have the stability pool as their liquidation counterparty. However, if the LUSD resources in the stable pool are insufficient to support the liquidation of positions, the system will initiate a position reallocation mechanism. Finally, when the mortgage ratio of the entire system drops below 150%, the system will switch to recovery mode.

In this liquidation process, the stability pool serves as the first line of defense and is also the most commonly used protection method. The debt redistribution and recovery model is mainly a protocol security protection mechanism in extreme situations.

Stable pool: exists as a counterparty for clearing users at the protocol level. LUSD holders deposit LUSD into the stable pool. When a position needs to be liquidated, the external liquidator calls the stable pool for liquidation. The liquidator receives 0.5% of the collateral and a gas subsidy of 50LUSD. The remaining 99.5% of ETH is owned by Stability Pool depositors. Theoretically, stable pool depositors can obtain a maximum ETH income of 10% (liquidate as soon as it falls below the 110% liquidation line, and obtain 1.09945 times ETH relative to the burned LUSD). However, it should be noted that this action is actually If you buy ETH in the falling range of ETH, you may suffer losses if the price of ETH continues to fall and you do not withdraw and exchange the proceeds in time.

Position reallocation: When the LUSD in the stable pool is consumed, the system will reallocate the ETH to be liquidated and the LUSD to be repaid in proportion. to all existing positions. The higher the mortgage rate, the more debt and collateral will be received, thereby ensuring that the system will not suffer from serial liquidations. So far, the system has not initiated position redistribution even during several market crashes.

Recovery mode: When the total mortgage ratio of the system is lower than 150%, the system will enter recovery mode and reduce the overall mortgage ratio of the system to Quickly pull back above 150%. In recovery mode, the liquidation behavior is more complicated and will not be described in detail in this article. Generally speaking, positions with a mortgage rate lower than 150% may be liquidated, but the protocol sets a 10% upper limit for users’ maximum losses. Liquidity entered recovery mode during the 5.19 crash. Details were revealed later in Liquidity’s official summary: How Liquity Handled its First Big Stress Test.

Liquity’s supply and demand control mechanism

As a stable currency, LUSD is similar to traditional currencies, controlling the money supply through money market operations. Specifically, the supply and demand of LUSD is controlled by adjusting the interest rates of casting and redemption. The casting rate and redemption rate will be adjusted according to the time and cycle of redemption. More specifically, when no one redeems, the system's casting and redemption rates will be adjusted. The redemption rate will decrease. When redemption activity increases, the redemption rate will also increase. Compared with traditional money market operations, this mechanism is more defensive and focuses on preventing large-scale redemptions by increasing redemption rates.

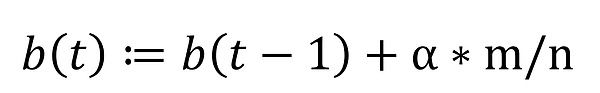

Only one-time minting and redemption fees are charged in Liquidity, and they are calculated based on the global variable BaseRate in the protocol. The minting fee is numerically equal to BaseRate*minting amount, and the redemption fee is numerically equal to (BaseRate+0.5%)*the value of the redeemed ETH.

When no redemption occurs, BaseRate will decay to 0 over time, with a half-life of 12 hours. When a redemption occurs, BaseRate is calculated according to the following formula, where b(t) is the BaseRate at time t, m is the number of LUSD redeemed, n is the current supply of LUSD, and ? is a constant parameter.

By adjusting the fees incurred for redemptions, it has an impact on the price floor in the hard anchor. In the calculation of the Liquidity white paper, based on the quantitative theory of money, setting ? to 0.5, the profit-maximizing arbitrageur will redeem the LUSD required to restore the peg. For the specific derivation process, see Derivation.

Overall, Liquity ensures the normal operation of the overall system through excellent mechanism design. Facts have also proved the feasibility of this system. Since its launch, Liquity has been Maintaining good operation, LUSD has reached the ultimate in stability and capital efficiency.

Agilely mechanism innovation based on Liquidity

Collateral

At the collateral level, users in agilely use interest-bearing assets such as ETH, mainstream wrapped ETH and GLP as collateral to mint USDA. Restaking Token will also be connected to inherit its own interest rate into USDA, thereby increasing the USDA interest rate.

Interest rate model

This section mainly discusses the Rates, including minting, redemption and borrowing fees. Minting and redemption fees are one-time fees, and borrowing fees are fees that accrue over time on outstanding debt.

Minting fee: refers to the one-time fee that users need to pay when minting stable coins in the protocol. Agilely chose to use Liquidity's BaseRate model and modify it. (For a detailed discussion of BaseRate, please see the "Supply and Demand Control Mechanism" section of this article's "Liquity Mechanism Review"). An attenuation factor is added to the part where BaseRate decays over time, and a different attenuation factor is determined for each instance, and it is The formulaic description is as follows:

Redemption fee: refers to the fee required for users to repay the loan and get back their own collateral from the agreement, which is usually higher than the minting fee. Agilely's minting fee is BaseRate+0.5%;

Borrowing fee: refers to the fee accumulated by users over time for outstanding debts. Part of the agreement is for To encourage users to choose not to charge for long-term borrowing, agilely innovatively designed ADI (Agilely Dynamic Interest) to regulate the total amount of currency.

Stability mechanism

This section mainly discusses agilely as a stable The currency's stability mechanism is mainly divided into two parts: Hard Peg and Soft Peg.

Hard Peg: Provide 110% MCR on ETH collateral Guarantee the price upper limit and provide a redemption channel to guarantee the price lower limit

Soft Peg: In addition to relying on the long-term market psychology brought about by the dominance of the agreement Game to reach the Schelling point of 1USDA = 1USD, Agielly also embeds ADI (Agilely Dynamic Interest) to regulate the price at a macro level by regulating the market release of USDA (see the "Interest Rate Model" in the previous section for details).

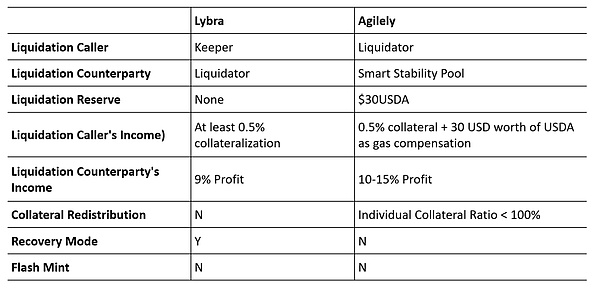

Liquidation mechanism

In the discussion of the liquidation mechanism, we use Liquidity’s three-layer liquidation mechanism (stable pool-position reallocation-recovery mode) as the benchmark and summarize agilely’s modifications above it.

Agilely is fairer while ensuring system security. The liquidation interface is placed on the front end to lower the threshold and allow more people to participate. Unlike Lybra, which requires running a professional bot to participate in liquidation, Agilely further integrates the conventional Stability Pool Optimized for the Smart Stability Pool, the USDA invested by users will be placed in the Stability Pool that is most likely to be liquidated and has the largest collateral for potential liquidation funding gaps.

PSM

In addition to Ethereum’s staking income, Agilely It is also committed to capturing RWA income to diversify the agreement's income. By setting up the PSM module to increase the interest rate, it can realize the siphoning of DAI and combine the collected DAI with MakerDAO, so that the agreement can capture MakerDAO's treasury bond income.

Value flow within the agreement

There are multiple business incomes within the Agilely protocol, including minting/redemption and lending fees. The transaction fees of PSM, the additional fees of the stability pool, the income from collateral and the income from RWA in PSM will flow out in the following three ways

ABI (Agilelly Benchmark Interest) flows to USDA pledges from USDA holders, LP (USDA-ETH pool on uniswap and Curve USDA-3Pool) and stable pool

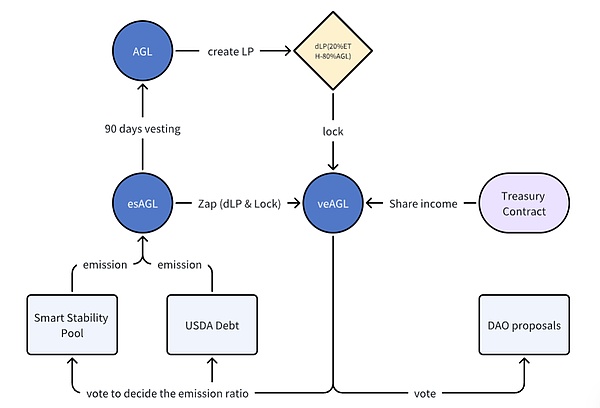

veAGL: In addition to governance rights, users who pledge dLP to obtain veAGL can also capture the real benefits of the protocol;

Stability pool income: remaining business income is allocated to the stability pool as pledge income;

Token Design

In this section, We will sort out and compare the designs at the protocol token level. It mainly focuses on the distribution method of protocol tokens and the actual utility of the tokens. Token-related designs are usually related to the vital interests of protocol users, so we can analyze the sustainability of agilely from these perspectives.

Token utility

The importance of tokens as a protocol Whether its design can capture the real value generated within the protocol directly determines the price of the token and affects the subsequent development of the project. In DeFi, the value support of tokens usually comes from two major aspects, governance and income. The income is that token holders can sustainably share the income brought by the protocol, which is the basis of everything; governance is mainly based on the participation of long-termists in the project, but it is more based on income. Next Let’s sort out agilely’s token AGL from these two perspectives.

Governance

User lock Balancer AGL/ETH 80: 20 Pool's LP can be converted into veAGL in the protocol to obtain voting rights. The voting rights are proportional to the time of locking the number of dLP, and can be reversely converted into AGL after the lock-in period expires. At the governance level, veAGL can determine the incentive allocation of AGL on different collateral positions.

Income

With LSD CDP projects currently on the market The difference is that AGL is designed to capture real returns, rather than the Ponzi logic of essentially mining the second pool. AGL is mainly distributed in the form of esAGL as an incentive for each mortgage pool. esAGL has a 90-day unlocking period. And veAGL holders can capture the revenue generated by the protocol business, including minting/redemption, lending fees, PSM redemption fees, and additional fees for staking in the stability pool.

Summary

Although the market is now focused on the BTC and Solana ecosystems, the ETH ecosystem is unknown, and Balst has no influence on the entire ecosystem. DeFi's vampire attack has caused the DeFi track to be inconspicuous in terms of currency prices. However, when eigenlayer is officially launched and the ETH ecological benchmark interest rate is raised, funds will still flow back to the DeFi ecosystem. By then, agilely will surely become the first choice for DeFi users to use leverage with its excellent products and token design. As the saying goes, buy when no one cares about it. Agilely ambushing the future Restaking ecosystem at this time is a choice with high odds.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund Bitcoinworld

Bitcoinworld Kikyo

Kikyo Beincrypto

Beincrypto Bitcoinworld

Bitcoinworld Others

Others Beincrypto

Beincrypto Bitcoinist

Bitcoinist