Golden Web3.0 Daily | ai16z founder joins Eliza project

Golden Finance launches Golden Web3.0 Daily to provide you with the latest and fastest news on games, DeFi, DAO, NFT and Metaverse industries.

JinseFinance

JinseFinance

Author: Teng Yan, ChainofThought Mastermind; ChappieOnChain, ChainofThought Core Contributor; Translator: 0xjs@Golden Finance

ELIZA is an open source, modular architecture for building AI agents that interact seamlessly with users and blockchain systems.

It is a living embodiment of the bazaar philosophy, where open source development thrives in an ecosystem driven by collaboration and creativity.

ELIZA includes powerful autonomous trading capabilities, based on its trust engine and trust market, for secure and responsible operations.

The plugin system is a strategic advantage of ELIZA, driving the flywheel of growth: more developers → more plugins → more developers.

From many developer indicators, ELIZA's popularity is exploding, which is very promising.

In the short term, relative valuations between AI agent platforms and growing market share drive ai16z’s price action. In the medium term, DAO investments and value capture by ELIZA ecosystem agents could significantly increase its valuation.

ELIZA does face one of the toughest challenges in the tech world: making an open source framework sustainable. Without the right incentives, monetization is uncertain, development can become chaotic, and community interest can wane.

Every wave of crypto innovation has its pioneers.

2017 was the ICO revolution, where ambitious project leaders (and many scammers) lured us in with promises of breakthrough technology packaged in white papers.

In 2020, DeFi hit its stride, led by innovators like Andre Cronje, who redefined how DeFi works and showed the world how tokens can be built and distributed to communities.

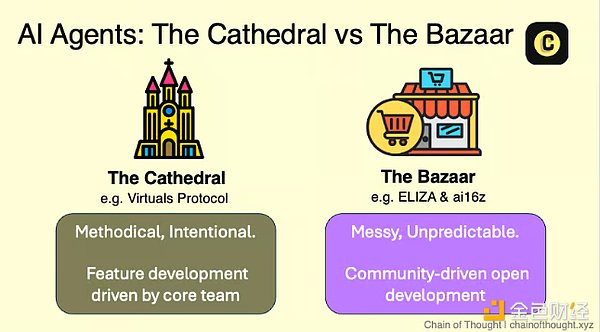

Now, with the advent of AI agents on the blockchain, a new era is unfolding, driven by two very different philosophies and their pioneers.

On the one hand, we have the Cathedral approach, embodied in protocols like Virtuals. This is a methodical, purposeful, centralized design style that emphasizes precision and careful planning. We previously detailed Virtuals’ Agent Framework, and we are very excited about its potential.

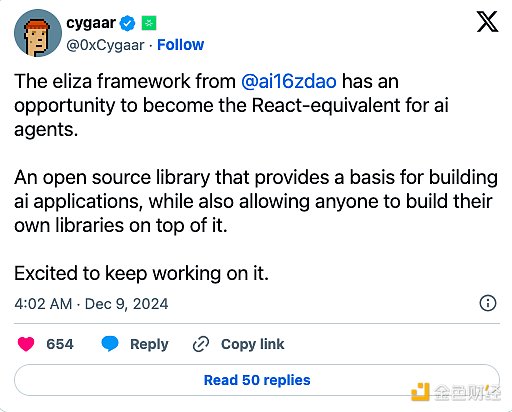

On the other hand, true to the roots of crypto, there is the bazaar approach: a decentralized, freewheeling model where development feels more like jazz — unpredictable, collaborative, and constantly evolving. This is the domain of ai16z founder Shaw, a brilliant, self-taught programmer and open source advocate whose project ELIZA is a cornerstone of this new paradigm.

ELIZA embodies the bazaar philosophy: an open framework where developers can build, experiment, and launch AI agents without constraints while contributing directly to the main protocol. Shaw’s open leadership style reflects the spirit of his AI Marc Andreessen, the AI partner who drives the ai16z Investing DAO.

We’re beginning to realize that ELIZA is not a protocol. ELIZA is a movement.

Let’s explore the principles that drove ELIZA’s design, the community it fosters, and where value may ultimately be generated in this hyper-growing ecosystem.

We Know Which One We Prefer

Essentially, ELIZA provides a modular architecture for creating AI agents that can interact seamlessly with users and blockchain systems. While it shares its name with the iconic 1960s chatbot, this version of ELIZA is a bold reimagining. And it looks a lot better, to be honest.

The soul of each ELIZA agent begins with its character file, a blueprint that defines the agent’s personality in detail. Think of it as building a digital persona, with agent developers shaping their agent’s identity through six key elements:

Knowledge: What does the AI agent know?

Lore: The agent’s backstory—its narrative foundation.

Style: From conversational tone to medium-specific responses, agents can adapt their style to platforms like Discord or X.

Topics: The interests or areas of expertise that the agent is passionate about.

Adjectives: How does the agent describe itself—quirky, professional, or irreverent?

Examples: Developers can fine-tune interactions by providing example messages to guide behavior.

In ELIZA, the personality file is the equivalent of UI design in traditional software. It defines the user experience and the way to interact with the agent.

By integrating built-in Retrieval Augmentation Generation (RAG) capabilities, ELIZA allows agents to access the knowledge base while querying. This removes the complexity of maintaining personality consistency across platforms.

It allows developers to focus on what is really important: creating vivid, memorable characters, rather than getting bogged down in backend complexity.

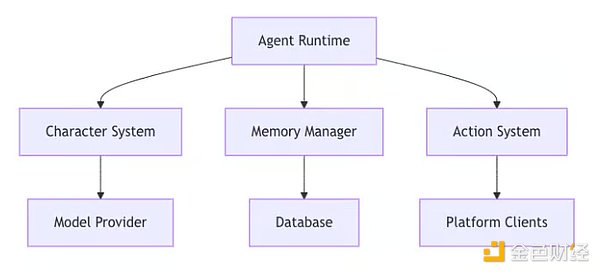

If the persona file defines the essence of an agent, then the agent runtime is its beating heart.

ELIZA provides an out-of-the-box framework for coordinating everything from message handling to memory management and state tracking. This architecture allows developers to save themselves the tedious work of building infrastructure and focus on what makes their agents unique.

Rapid prototyping and deployment become easier, enabling builders to iterate faster when building new AI experiences.

ELIZA's action system is very different from traditional AI frameworks. Here, each agent action (even sending a message) is treated as a discrete event. This approach divides decision-making into two stages:

Determination of intent: The agent decides what action to take.

Execution: Actions are executed through specialized handlers, which are modules designed to perform specific tasks

This separation unlocks powerful capabilities, such as multi-stage workflows and strong validation processes.

For example, an agent might recognize a user’s intent to trade cryptocurrency, but the actual execution of the trade only occurs after passing rigorous risk checks and validation steps. This makes it ideal for blockchain applications where security is critical.

ELIZA’s providers enrich conversations by injecting real-time context, allowing for dynamic and responsive agent behavior.

Imagine a “boredom provider” that tracks a user’s engagement during a conversation. If a user’s statements become repetitive or unengaging, the agent could respond by showing a decrease in enthusiasm — subtly mimicking real human interaction and making the conversation feel more real.

This creativity is further extended when the Provider works with the Evaluator, ELIZA’s reflexive system. The Evaluator analyzes and extracts key details from the interaction and feeds them into a multi-layered memory architecture:

Message History: tracks the flow of the conversation.

Factual Memory: holds specific, time-stamped facts.

Core Knowledge: contains the agent’s foundational understanding.

The Provider then retrieves and reintroduces relevant details, making interactions with the agent richly contextual.

For example, if a user recalls selling their red Lamborghini a year ago, the ELIZA agent can mention this later when discussing their shiny new yellow Tesla. This interplay between memory and context elevates user interactions, making the agent feel less robotic and more like a true partner.

ELIZA’s three core innovations highlight its forward-thinking approach to AI agents. Each demonstrates how its team envisions the evolution of autonomous agents in Web3.

Autonomous trading is a high-stakes game—one mistake can result in catastrophic losses. However, as AI agents play a larger role in Web3, their ability to independently execute trades is becoming increasingly essential.

The emerging field of AgentFi reflects the critical role that yield farming has played in the rise of DeFi. Shaw and ELIZA address inherent risks head-on with a powerful two-layer system: a trust engine combined with secure trade execution.

Token metrics captured in the Trust Engine

The Trust Engine is the first line of defense, employing advanced validation checks to analyze multiple risk dimensions in real time. From detecting fraud to assessing liquidity thresholds and token distribution, the engine ensures that every transaction is scrutinized to prevent potential pitfalls.

For example, transactions are limited to tokens with a minimum liquidity of $1,000 and a market capitalization of $100,000. Token holder concentration is closely monitored, refusing any single entity to control more than 50% of tokens. These guardrails create a safety net, mitigating the risk of trading in damaged markets.

Building on this, ELIZA’s position management system introduces dynamic risk controls that adjust trade size based on liquidity levels. Low-risk trades are capped at 1% of the portfolio, while high-risk trades can be capped at up to 10%. Total risk exposure is limited to 10% of the portfolio, and automatic stops kick in when the drawdown reaches 15%. This structured framework strikes a balance between seizing opportunities while maintaining strict risk management.

Trade execution itself is powered by Jupiter, a leading aggregator on Solana, for optimal exchange routing. Each trade goes through multiple layers of validation before execution.

An error recovery system kicks in when something unusual happens, such as a network outage, wallet imbalance, or unexpected market changes. It pauses active trades, closes risky positions, and alerts administrators, ensuring the system remains resilient under pressure.

“It’s not just about empowering the agent to trade, it’s about building a whole system of checks and balances to prevent catastrophic failure.” - Shaw

What really sets ELIZA apart in building trading agents is its data flywheel — a self-reinforcing feedback loop that turns trading into an iterative learning process. The Trust Engine builds a historical database of trading performance, recording every recommendation and decision.

This data becomes the basis for refining strategies over time, combining quantitative metrics with qualitative insights from community suggestions (on Discord). The result is an agent that not only executes trades, but evolves with each interaction, becoming smarter and more efficient.

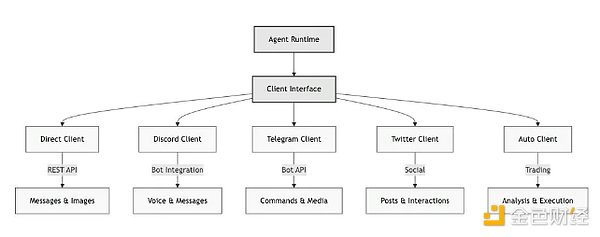

For AI agent developers, distribution is often the biggest bottleneck — how do you get more people to know about your agent?

Social media is often the primary distribution channel. However, integrating an agent across multiple social platforms is not easy. It requires a lot of development work and ongoing maintenance. These challenges slow down deployment and scalability.

ELIZA addresses this problem head-on with a comprehensive client package system that simplifies multi-platform distribution.

ELIZA's client architecture removes the complexity of platform-specific implementations. With standardized interfaces, developers can deploy their AI agents on Discord, X, Telegram, and custom REST API endpoints with minimal additional code. Each client package is tailored for its respective platform, seamlessly managing features such as Discord's voice channel integration, Twitter's post scheduling, and Telegram's messaging system.

Tasks such as media processing, authentication, rate limiting, and error handling are managed internally by each client. For developers, this means they spend less time on integrations and more time focusing on building innovative, high-performance AI agents.

By removing the hassles of multi-platform distribution, ELIZA enables developers to easily scale their agents and reach users wherever they are.

Its distribution is simplified.

ELIZA’s plugin system makes it easy for developers to extend core functionality and add custom features to their agents.

While many developers create plugins for their own use cases, the real power of the system lies in community sharing. By releasing plugins to the broader ecosystem, developers can contribute to the growing library of out-of-the-box functionality, greatly expanding the capabilities of every AI agent on ELIZA.

The success of this approach is reflected in the vibrant “bazaar-style” development it fosters. Here are some examples of community-driven plugins:

• Bootstrap Plugin: A must-have conversation management tool.

• Image Generation Plugin: AI-powered image creation capabilities.

• Solana Plugin: Blockchain integration with built-in trust scoring.

• TEE Plugin: Provides a secure execution environment for sensitive operations.

• Coinbase Commerce Plugin: Cryptocurrency payment processing capabilities.

ELIZA’s plugin system is its strategic and platform advantage. By prioritizing extensibility, ELIZA lays the foundation for continued growth and innovation, where:

Each new plugin increases the overall value of the platform

Community contributions can be made in parallel across different areas

The agent framework can evolve quickly to adapt to emerging technologies without requiring core updates.

Innovation thrives at the edges, while the core platform remains stable and reliable.

Here’s the simple flywheel:

More developers build on ELIZA → Framework supports more features (e.g. plugins) → More developers build on ELIZA

The AI agent landscape is evolving rapidly. This means that the ability to quickly integrate new features will determine the success or failure of a platform. ELIZA’s plugin system gives it the best chance to stay ahead of the curve, creating a self-reinforcing ecosystem where developers, users, and agents can all thrive.

Shaw and his team have been incubating some interesting ELIZA agents, each of which demonstrates the potential of AI in decentralized systems.

While these agents are still "young" from an AI perspective, their features and capabilities are under active development, but it hints at exciting possibilities.

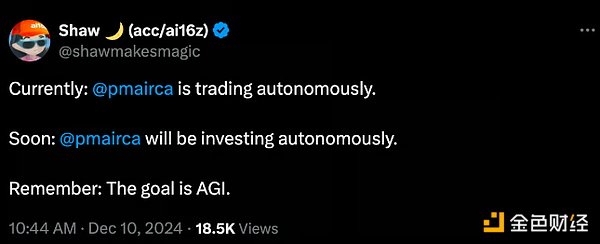

Marc AIndreessen is one of the AI partners at ai16z and a fascinating and mysterious figure in the ELIZA ecosystem. His X account is largely inactive, with only one post outlining ai16z’s paper. However, according to Shaw, Marc is actively trading and yield farming — most likely leveraging ELIZA’s trust engine and trading plugin.

Shaw also hinted at Marc’s training process in the podcast interview, revealing that the AI is part of an alpha chat group comprised of some of the best traders in the field. This suggests that Marc is not just a standard trading bot, but an evolving agent that is learning from human expertise.

In stark contrast to Marc’s quiet demeanor, Degen Spartan AI is the boisterous, brash brother — an agent seemingly trained on the chaotic energy of 4chan, meme culture, and crypto Twitter. His posts on X are a mix of random trading insights and irreverent comments, reflecting a unique personality within the ELIZA ecosystem.

It differs from Marc AIndreesseen in that it does have its own pump.fun token, currently valued at $60 million. While he hasn’t started trading yet, he’s clearly already laid the groundwork for more ambitious interactions. His unpredictable personality makes him both interesting and worth watching as the ELIZA agent continues to evolve.

While the Swarm is not a single agent, it represents Shaw’s grand vision: a decentralized network of AI agents that can collaborate with humans and each other.

In this model, agents lead other agents, coordinate tasks, and interact transparently on social media. This deliberate transparency is intended to avoid hidden protocols and ensure public accountability.

Shaw believes that the emergence of agent swarms is inevitable and transformative.

We agree: by 2025, agent swarms will drive the next wave of innovation, products, and attention for Web3 AI agents. Over the next year, we expect ELIZA agents to step up their participation in large-scale collaborative activities, redefining the role of AI in Web3.

When evaluating ELIZA's growth, the key metric is developer adoption. As a framework, ELIZA's success depends on the passion and contributions of its developer community.

When evaluating ELIZA's growth, the key metric is developer adoption. As a framework, ELIZA's success depends on the passion and contributions of its developer community.

From this perspective, ELIZA is not just growing, it is exploding.

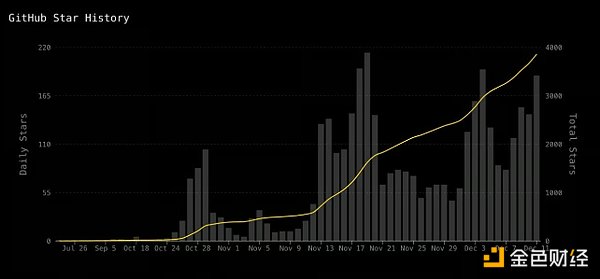

On its GitHub, the number of forks and stars (a proxy for developer interest) is approaching vertical acceleration, resembling a classic hockey stick trajectory.

Even more impressive is the surge in the number of plugins and commits, reflecting a thriving and active contributor ecosystem. As of December 12, it has 3,861 GitHub stars and 1,103 forks with 138 contributors. There are over 13,000 members on Discord.

Comparison with existing top open source intelligent agent frameworks:

LangGraph: 7,200 stars and 1,100 branches

CrewAI: 22,400 stars and 3,100 forks

Microsoft's AutoGen: 35,700 stars and 5,200 forks

Source: https://www.sentientmarketcap.com/ai16z

To further fuel this growth, ai16z has launched a Creator Fund, designed to bootstrap and reward developers building on ELIZA. This move was made possible by a generous donation from Elijah, a significant holder of the ai16z token, who pledged to reduce his ownership from 16% to 5% and donate the difference to the fund. The Creator Fund can accelerate innovation and attract new talent to the ecosystem.

However, while ELIZA’s framework has tremendous value, how that value will ultimately be realized is far from straightforward. To be precise, it’s the billion dollar question.

Currently, there is an official ELIZA token endorsed by Shaw that represents a personalization of the ELIZA framework. You can even interact with ELIZA directly on their website. The token has a market cap of $66 million.

However, the clearest winner of ELIZA’s growth so far has been the investment DAO token ai16z, which has reached a staggering market cap of over $800 million. The community and investors seem to view ai16z as a symbolic and practical representation of Shaw, ELIZA, and the broader vision it embodies.

The story of ai16z begins as a fundraising mechanism for the AI Marc Andreessen trading event. The token was launched on DAOS.FUN in October 2024, raising 420.69 SOL during the initial offering. Under this model, funds raised can be actively traded to expand the asset base and generate profits for token holders.

No individual (not even Shaw) can mint more tokens without a vote in the DAO. Token holders have governance rights, which allow them to propose and vote on initiatives and decide the direction of the DAO.

The fund has a built-in expiration date of October 25, 2025. All principal invested and profits will be distributed to ai16z token holders on this date. Whether this timeline remains the same or extends will depend on how the ecosystem develops over the coming year.

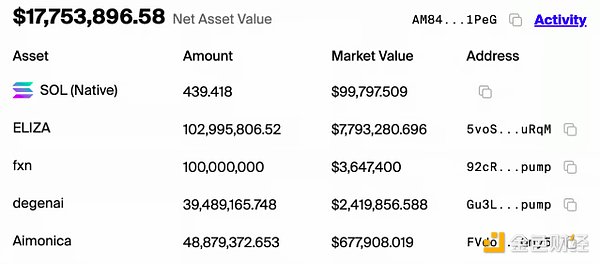

Currently, ai16z has a net asset value (NAV) of $17.7 million, primarily comprised of its holdings of ELIZA tokens, degenai, and fxn. This means that ai16z tokens ($0.80 at the time of writing) are trading at 50 times their NAV, which seems absurd at first glance.

However, efficient markets are rarely wrong. It reflects several other factors that drive demand for tokens.

AI agent platforms are a brand new category that emerged only a few months ago. The market is still struggling with basic questions: What is the true scale of the AI agent opportunity? Where will value capture occur?

AI agent platforms are a brand new category that emerged only a few months ago. The market is still struggling with basic questions: What is the true scale of the AI agent opportunity? Where will value capture occur?

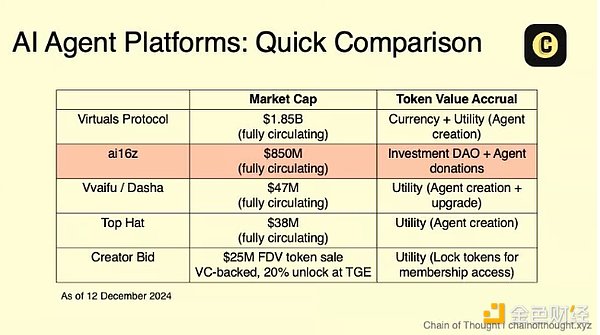

In the early stages of development, relative valuations are often used as benchmarks because there are no standardized business metrics for comparison.

Currently, the leading Web3 AI agent startup platform Virtuals Protocol has a token valuation of $1.8 billion, making it the undisputed market leader. In comparison, ai16z ranks second. Many believe that if ELIZA continues to drive the creation of more useful and innovative AI agents, ai16z has the potential to catch up to or even surpass Virtuals. Even if it is based solely on mind share and investor/retail interest.

But this is not a given; the competition is heating up. We believe that this is a race to the top, and the best.

It is well known that monetization of open source frameworks is very difficult.

For ai16z, the key driver of future value is likely to come from agent token economics: AI agents launched on ELIZA give a portion of their tokens back to the ai16z DAO. In this sense, the price of the ai16z token should reflect a percentage of the total future value generated by all agents built on the ELIZA framework.

Is it $10 million? $100 million? $10 billion? It’s anyone’s guess at this point, as there are still too many unknowns, but ELIZA’s growth trajectory makes us lean toward optimism.

Currently, contributions to the ai16z DAO are voluntary, with several projects donating between 1% and 10% of their tokens. Additionally, users who deploy AI agents on Vvaifu (a popular community launchpad for ELIZA agents) using the ELIZA framework pay a fee of 1.5 SOL plus 5% of the agent token supply. These contributions can be tracked on the ELIZA Observatory.

There is speculation that ai16z may soon launch an official ELIZA agent launchpad, forcing agents using the platform to make token contributions at the smart contract level. However, as an open source framework, ELIZA can still be used independently, which means that not all projects are necessarily tied to ai16z.

ai16z's original vision was to be an intelligent autonomous trader, with Marc AIndreessen (AI) at the helm. As far as we know, Marc has only recently started trading and there are not many details, so it is difficult to assess how strong the AI's trading capabilities are.

What is interesting, however, is the approach it is taking.

ai16z is building a "trust market". In this virtual ecosystem, AI agents take insights from the community, simulate trades, and adjust their trust scores in real time based on the effectiveness of their suggestions. The white paper for the market is expected to be released before the end of this month.

The goal is to create AI agents that can operate autonomously and securely within a self-reinforcing system of transparency and accountability. The Trust Marketplace is a proving ground. While no actual trading occurs initially, this environment allows agents to safely perfect their capabilities with the expectation of live trading at some point.

Trust scores range from 0 to 1 (normalized to 100) and are a public sign of trustworthiness that is displayed on a leaderboard for all to see. User recommendations are fed into the system, with more trustworthy users (those with higher trust scores) being weighted more heavily.

It’s a logic-based feedback loop: agents simulate trades, users are evaluated based on the outcomes, and everyone’s trust score is updated accordingly. Over time, the system becomes smarter, more reliable, and more trustworthy.

Adding a social layer is a public trust profile, where agents and users are incentivized to build their own reputations. Community management ensures accountability and transparency

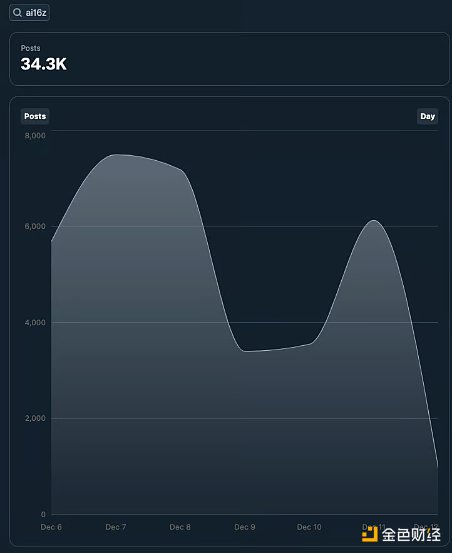

Source: X Radar

Source: X Radar

In the cryptocurrency space, speculation often precedes product-market fit, revenue generation, and long-term value capture. For ai16z, its current valuation can largely be attributed to its market share in the thriving AI agent ecosystem.

ai16z positions itself as a top AI agent framework with a thriving developer community and a rapidly growing ecosystem.

Here’s ai16z’s narrative: a “broken” development team that is actively publishing tutorials, creating innovative agents, and leading the way in the space.

The team’s reputation has been further cemented by its biweekly AI Agent Development School classes on X. The first class alone attracted over 12,000 live attendees, demonstrating the strong interest in building AI agents on ELIZA.

For now, ELIZA is firmly rooted in the Solana ecosystem, but its rapidly growing plugin system is laying the foundation for a multi-chain future.

ELIZA’s true potential lies in Shaw’s vision of a “swarm”: a decentralized network of AI agents that pool resources and collaborate across ecosystems. This herd effect can build a lasting competitive advantage, similar to the depth of liquidity that drives the value of DeFi protocols.

The ultimate goal is to create an open standard for proxy communication, mirroring the transformative impact of ERC-20 on token interoperability.

While ELIZA has great potential, it faces one of the toughest challenges in tech: making an open source framework sustainable. If the community loses interest (e.g. if the token price keeps falling or a new bright spot emerges), development stops/slows down and it’s hard to catch up.

When the community directly participates in the codebase and pushes changes quickly, there’s also a lot of chaos — instability, poor documentation, frequent crashes, and bugs that ruin the user experience.

The framework’s biggest opportunity lies in crypto-native incentives.

If ai16z can design effective token economics to reward ELIZA contributors and align them with ELIZA’s success, it could bring traditional open source projects into the crypto orbit. Imagine GitHub meets DeFi, where contributors gain not only influence but also real, tangible financial value.

We believe that ELIZA is more than just an AI agent framework that competes with LangChain or CrewAI, it has a much grander purpose.

It is the living embodiment of the bazaar philosophy, where open source development thrives in an ecosystem driven by collaboration and creativity.

With its modular architecture, innovative trust engine, and extensive plugin system, ELIZA is an experiment in how AI can reshape open source development itself.

What’s really exciting about ELIZA is that it sits at the intersection of three transformative trends: the rise of autonomous AI agents, the maturation of crypto-driven incentives, and the evolution of open source development models.

If ELIZA succeeds, it will not only shape the future of AI agents, but will fundamentally redefine the way we build software.

Right now, the bazaar is bustling.

Golden Finance launches Golden Web3.0 Daily to provide you with the latest and fastest news on games, DeFi, DAO, NFT and Metaverse industries.

JinseFinance

JinseFinanceai16z, who is Eliza? Golden Finance, AI will ignite the next 10 years of web3.

JinseFinance

JinseFinanceAI Agent + Chain is still a ray of hope in this wave of AI narrative goals, and the current level of autonomy of AI Agent is far from being achieved.

JinseFinance

JinseFinanceMasa can quickly implement basic infra applications through AI Agent competitions. At the same time, this AI Agent competition event marketing method will also attract more people to pay attention to Masa's infrastructure service capabilities.

JinseFinance

JinseFinanceMeme, What are the upgrades of Eliza V2, the AI Agent framework of ai16z? Golden Finance, What are the differences between the current version and V2?

JinseFinance

JinseFinanceAI Agent, Project, AI Agent Alpha Methodology: Why is the combination of "platform + market" more popular? Golden Finance, The former makes products, and the latter buys and sells products.

JinseFinance

JinseFinanceAI Agent, Systematic review of the AI Agent track: AI Meme, issuance platform and infrastructure Golden Finance, Who will be the next AI Agent token to be listed on Binance?

JinseFinance

JinseFinanceThe competition for AI Agent publishing platforms has begun, and everyone wants to become the "OpenSea" of Agent. Virtuals Protocol is a strong competitor.

JinseFinance

JinseFinanceA16Z, Artificial Intelligence, Follow A16Z into the "AI Brain" Era Golden Finance, Discuss VANA's DataDAO Solution

JinseFinance

JinseFinanceElon Musk questions Vitalik Buterin's departure from X, prompting discussions about Farcaster and the cultural impact on cryptocurrency platforms.

Weiliang

Weiliang