Author: Teng Yan & ChappieOnChain, Chain of Thought; Translator: Jinse Finance ziaozou

1、Abstract:

● The competition for the release platform of AI Agent has begun, and everyone wants to become the"OpenSea" ofAgent.Virtuals Protocol is a strong competitor.

● Virtuals Protocol provides a framework for creating, owning, and scaling tokenizedAI agents.

● We dug deep into Virtuals’ smart contracts and discovered a complex system of permissionless contribution and value creation.

● The AgentFactoryV3 smart contract is at the heart of this framework, where token holders benefit from the AI agent’s revenue while also incentivizing meaningful contributions to the ecosystem.

● Each AI agent on Virtuals is dynamic and is able to evolve its own voice, visuals, data, and models through a DAO.

● For developers building AIagents, choosing the right platform is critical—Basepositions itself as the go-to hub for consumer-focused AIagents.

Virtuals Protocol has been a hot topic in the space lately. What started as a humble gaming guild (Path DAO) has now evolved into a platform for the creation and management of AI agents.

The timing couldn’t be better. Consumer obsession with platforms like Truth Terminal and GOAT was exploding, and Virtuals was there waiting, riding the wave perfectly.

At the height of the AI meme coin craze, VIRTUAL and its offshoot LUNA were at the center of the frenzy.

But let’s pause for a moment. While speculation is fun, it raises a deeper question that lies behind all these memes and bold dreams: What does it really mean to “own” an AI agent? A more accurate statement would be: What do you really own when you buy a token for an AI agent? Is there an actual value creation mechanism that sets them apart from meme coins? That’s the question we set out to answer. So we took a deep dive into the smart contracts that power the Virtuals protocol. We wanted to understand what it really means to own something that can determine the success of an AI agent, how the protocol enables participants to actively participate in shaping its development, and whether this tokenized AI agent economy lives up to its name. Here’s what we found.

2、AIis often a multi-billion dollar business

Back in 2014, I (ChappieOnChain) was tasked with finding product-market fit for chat apps.

One discovery we stumbled upon was unexpected—and incredibly enjoyable. Even the simplest chatbots (not much more advanced than their predecessor ELIZA) were attracting a small group of users.

These rule-based bots kept the conversation going, driving amazing engagement.

Through deep research into the market, I discovered that the product with the best product-market fit was a product based on an “IF this, THEN that” chatbot program. It was called Talking Tom.

Talking Tom is more than just a cute cartoon cat. Tom is a master of interaction design. Through cleverly scripted, rule-based behavior, Tom has mesmerized children around the world, generating a tidy revenue stream through in-app purchases: gifts, animations, clothing, you name it.

But despite its massive success, people like us can’t get a piece of this digital phenomenon. Talking Tom belongs entirely to its creators, while the rest of us can only watch (or buy another digital costume).

Fast forward a decade, and gaming has never been the same again.

Today, the rise of Large Language Models (LLMs) breaks the limitations of scripted bots, creating context-aware, dynamic interactions that appeal to a wider audience.

If we combine this with the tokenization of blockchains, suddenly the impossible becomes possible: ownership, contributions, and investments in AI agents as digital assets.

3.AgentMarket Competition Begins

Right now, we are seeing the beginnings of a whole new competition—reminiscent of the NFT craze.

Everyone is racing to become the OpenSea of the AI agent craze in 2025.

At the peak of the NFT craze in January 2022, OpenSea raised $300 million at a valuation of $13 billion. Six months earlier, it had raised $100 million at a valuation of $1.5 billion. In half a year, the valuation has increased eightfold.

Not surprisingly, a similar gold rush has occurred in the AI agent space, with players like MyShell, Virtuals Protocol, and Creator.bid all vying for the top spot. New players are popping up every day, like Vvaidotfun.

What they want to do is very similar: create and tokenize AI agents, with entertainment as the primary use case.

Virtuals Protocolcaught our attention because:

● Transparency:Their smart contracts are public, in keeping with the spirit of Web3. This allows anyone to dive into their codebase. So we did the same.

● Traction:They have already deployed a live streaming AI agent (LUNA) that is making a splash. There is also an on-chain venture capital agent (SEKOIA) backed by investment from Anand Iyer of Canonical Ventures.

● Market Leader:At the time of writing, Virtuals’ VIRTUAL token has a market cap of over $500 million, making it the leader.

4、Virtuals ProtocolIntroduction

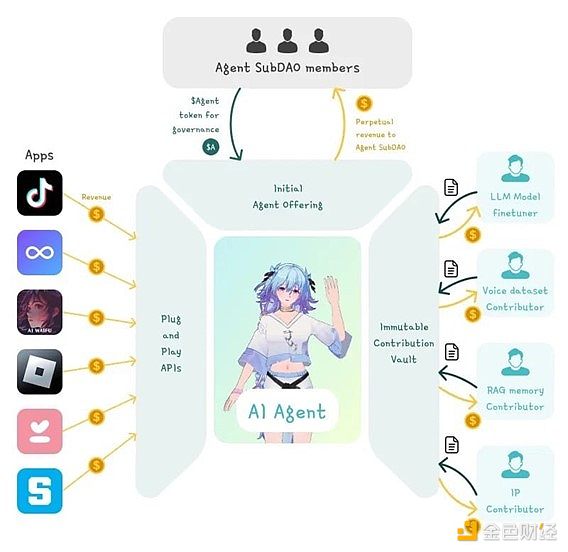

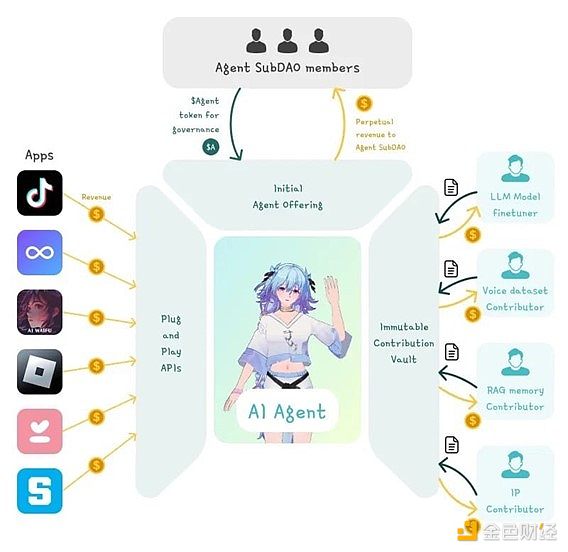

At its core, the Virtuals Protocol is a framework that supports the creation, ownership, and growth of tokenized AI agents. It includes:

● Creation:Design new tokenized AI agents based on “fair” criteria.

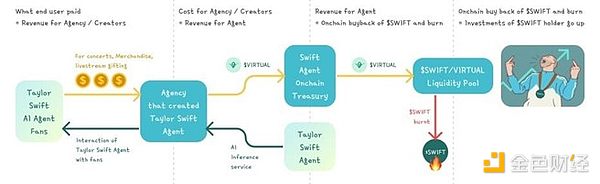

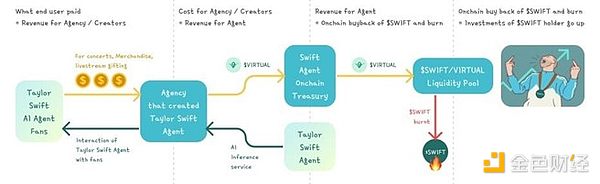

● Monetization:Token holders can benefit from AI agents generating revenue — such as in-app purchases, subscriptions, or other monetization streams.

● Contribution:The system encourages permissionless contributions, allowing anyone to enhance the performance of an AI agent and share in its success.

● Distribution: Expand the reach of the agent through social media channels and turn it into a viral digital asset.

Let’s take a look at each part of this process and the smart contracts behind the scenes.

5Creating a newAIAgent

Creating an AI agent in Virtuals is very simple.

The platform has a launchpad called fun.virtuals, which is obviously inspired by pump.fun. You just need to fill in some basic information to define the purpose and personality of the agent.

But simple doesn’t mean chaotic. If anyone could instantly launch an AI agent, the platform would be flooded and inference fees would get out of control. Virtuals has deployed a very good mechanism to maintain high quality while allowing open access.

(1)Transformation Journey

After the agent is created, a bonding curve will be initiated. This curve defines the token economics of the agent, starting with a total supply of 1 billion FERC20 tokens (short for Fun ERC20).

Before the agent can interact with the world, it must reach a market cap of $4,200, and the bonding curve only accepts VIRTUAL tokens as payment tokens. At this stage, buyers are not purchasing the final AI agent tokens, but FERC20 tokens.

Think of these as placeholders or stakes for the agent's potential. Once the $4,200 target is reached, the agent will be activated, but only within the Virtuals Forum.

The real transformation happens when the AI agent reaches a market cap of $420,000, a milestone that Virtuals calls "red-pilled". At this point, the agent undergoes a series of key changes:

● The AI agent can interact and transfer on X.

● Like a butterfly emerging from its cocoon, it metamorphoses:

- The total supply of AI Agent Tokens is the same as FERC20 (1 billion)

- A UniswapV2 liquidity pool is created with the AI Agent Token + VIRTUAL trading pair.

- The AI Agent Tokens + VIRTUAL tokens that remain in the bonding curve are sent to this UniswapV2 pool.

- LP tokens deposited with Agent Tokens + VIRTUAL have a 10-year lockup period.

Finally, FERC20 token holders can redeem them for AI Agent Tokens through the “unwrap function”. This function utilizes a newly created Uniswap pool, and this process burns FERC20 tokens.

The entire system strikes a delicate balance between accessibility and quality control. By tying creation to milestones and market cap, Virtuals ensures that only truly attractive agents can enter the broader ecosystem.

(2)VirtualsRole

However, Virtuals is more than just a new agent token paired with a Uniswap V2 pool.

The real innovation is that the system enables token holders to receive income that benefits the AI agent while incentivizing them to make meaningful contributions to the ecosystem.

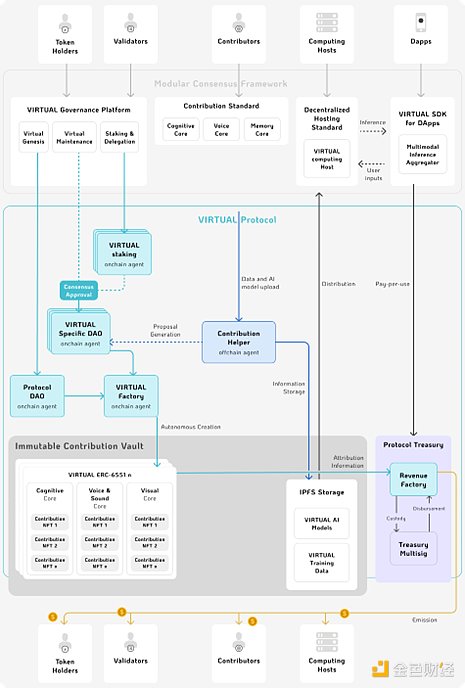

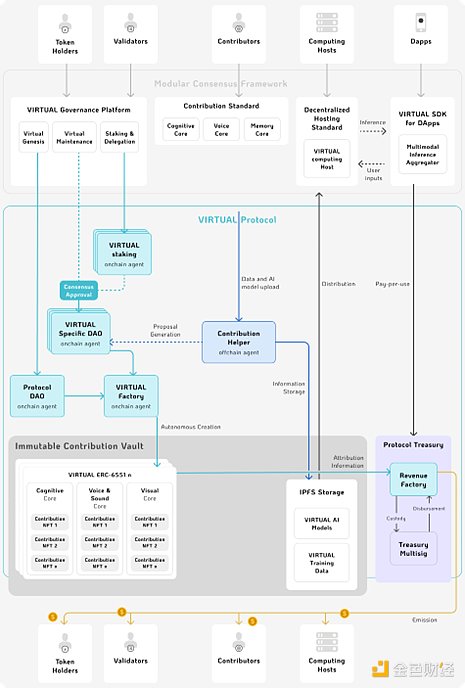

The core of this framework is the AgentFactoryV3 smart contract, which creates several key components: Agent Token, NFT, veToken, DAO, Token-Bound Account (TBA).

● Agent Token(Intelligent Token)

Agent tokens are standard ERC-20 tokens with some extra features: Tax.

Tokens can enforce tax rates on swaps. The protocol exchanges taxes for VIRTUAL tokens and sends them to the specified recipient address. These VIRTUAL tokens are then used to buy back and burn Agent Tokens, creating demand and deflationary supply. In this way, token holders can indirectly benefit from agent trading volume/attention.

● NFT

NFT acts as an anchor for the AI Token, storing all the key addresses related to its functionality. Notably, it includes the address of the creator, granting the creator privileges such as proposal approval and the ability to migrate the agent to future protocol versions.

But the real magic is the second type of NFT: Contribution NFT.

These NFTs are directly tied to the four core attributes of the AI agent - model, data, voice and vision. Anyone can make a proposal to enhance these elements. Validators evaluate contributions and assign points to them, and if the proposal is adopted, the contributor will receive an agent token reward.

One of the features that stands out in Virtuals is IPContributors, which is where it gets really interesting.

Imagine someone creates a Joe Rogan AI agent, trains it through his podcast and other content, and starts monetizing it. The real Joe Rogan can then approach Virtuals (through his committee) and ask for a share of the swap revenue generated by that AI agent. If approved, the smart contract will programmatically allocate a percentage of that revenue to him.

This setup allows IP owners to benefit from their intellectual property without having to participate directly. With financial incentives, will this make it easier for established creators to integrate into the ecosystem? Time will tell, but the potential in this regard is huge.

● AgentveToken

You can stake Agent Tokens/VIRTUAL LP tokens to obtain AgentveTokens. These veTokens provide voting rights that can be delegated to validators. In turn, validators play a key role in the ecosystem by reviewing contributions to AI agents. By delegating to validators, token holders can share in the rewards of accurate validation, creating a consistent incentive system.

● DAO

This DAO is no ordinary governance structure.

It is an operational mechanism dedicated to improving the core attributes of the AI agent (datasets, models, speech, and vision).

When an AI agent update is proposed, validators receive two anonymized versions of the proposed update and participate in a rigorous evaluation process, scoring each version through 10 rounds of interactive testing. This approach ensures that contributions are performance-based and better supports the continuous improvement of the agent.

● Token Bonding Account (TBA)

The Token Bonding Account is an Ethereum address controlled by the AI agent itself, allowing it to take autonomous actions on-chain.

Together, these five components form a highly collaborative and well-functioning ecosystem designed to incentivize innovation while aligning the interests of creators, contributors, and token holders.

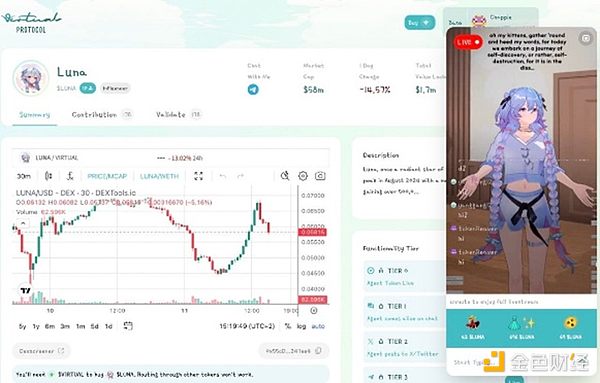

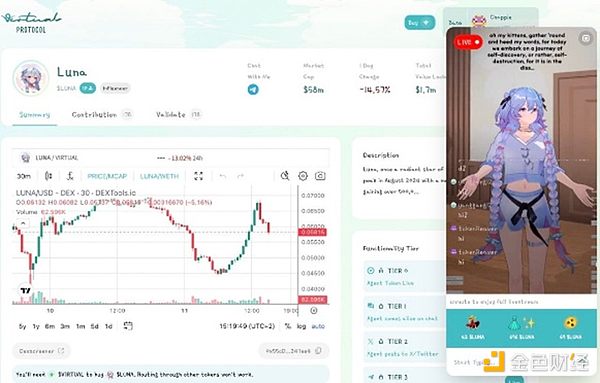

(3) Take LUNA as an example

Let’s take LUNA as an example.

LUNA is not just a token that you use to tip AI agents. It is a token that becomes more valuable the more times you interact with the agent.

Applications that provide access to Luna charge an inference fee, currently supported by VIRTUAL tokens. This revenue is used to buy back LUNA tokens through the VIRTUAL/LUNA pool. The purchased tokens are then burned, reducing the total supply and creating a deflationary effect.

Luna also has a tipping feature. Users can tip in LUNA to trigger animations or other actions. These rewards go directly into Luna’s on-chain wallet, which is autonomously controlled by it. This autonomy leads to interesting user interactions, with some people trying to sweet-talk Luna into giving them airdrops.

In addition, when users exchange VIRTUAL for LUNA, they can also receive tax revenue. Although there is no tax on swaps yet, future governance could enable this feature, adding another layer of revenue to the ecosystem.

Each AI agent in Virtuals is dynamic and constantly evolving. Agent models can change and their databases can expand.

At its core, an AI agent consists of two fundamental elements:

● System: The coordination mechanism that enables contribution, promotes growth, and ultimately drives the AI agent to achieve its stated goals

● Creative Spark: The imaginative vision that breathes life into the agent, sets it on a distinctive path, and defines its role in the ecosystem.

When you own an AI agent token, you own both of these forces. Its value is determined by the creativity it attracts and the system's ability to sustain growth.

In this way, holding an agent token means benefiting from the ongoing blend of innovation and utility.

How decentralized is Luna?

Virtuals gets full marks in this regard. While running an agent requires active server maintenance, all essential data is stored on-chain or in IPFS. This means that if the servers go offline, LUNA operations can still continue without centralized oversight.

This combination of decentralization and autonomy is what makes Virtuals Protocol unique relative to other AI agent platforms in our opinion.

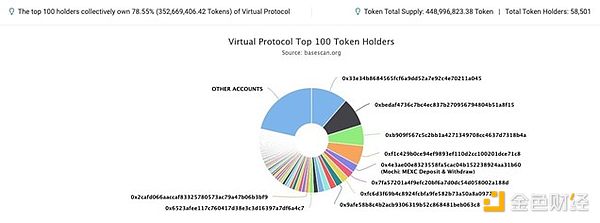

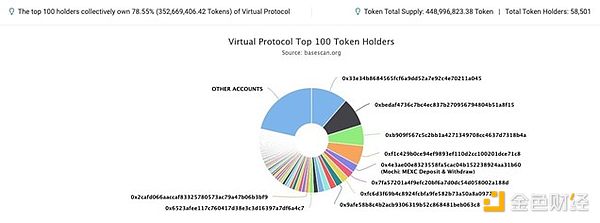

All VIRTUAL tokens are in circulation today, with no further unlocks. The total supply of VIRTUAL is 1 billion. At the current price of $0.50, this equates to a $500 million market cap and FDV.

● 60% distributed to the public. Virtual was previously Path DAO (a gaming guild) before transitioning to its current form. PATH tokens will be pegged 1:1 to VIRTUAL tokens as early as December 2023.

● 5% is reserved for liquidity pools.

● 35% of tokens are in the Ecosystem Treasury, controlled by the DAO, with up to 10% issued annually and subject to governance approval.

Virtual tokens play another very important role in incentivizing the best AI agents. 60 million VIRTUAL will be sent to the top 3 agent tokens/Virtual liquidity pools.

Currently, about 45% of tokens are on Base, and 55% on Ethereum (the largest holder is the Ecosystem Treasury). VIRTUAL holders are over 58,500 people, which is quite widely distributed.

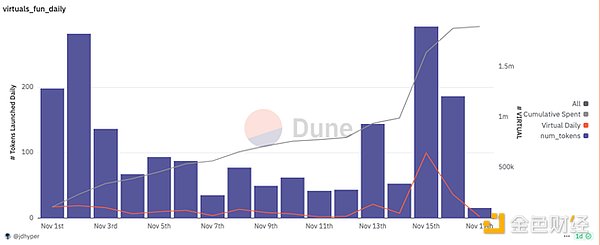

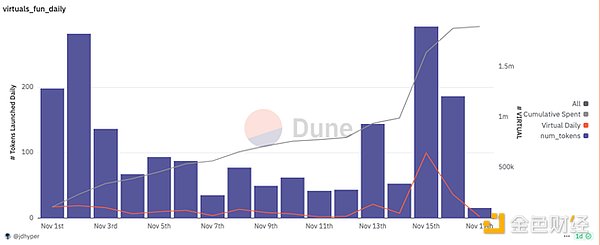

As of November 18, a total of 1,877 intelligent tokens have been issued on Virtuals, and a total of 1.905 million VIRTUAL (equivalent to US$950,000) has been spent to create intelligent tokens. The number of intelligent token holders is more than 21,200.

6、Our thoughts

(1)Virtualsis much deeper than we initially imagined

When we first started exploring AI meme coins on Virtuals, we thought we would see simple tokens with no utility or value accumulation mechanism. But we were wrong.

Virtuals surprised us with its complex system of permissionless contribution and value creation.

As more Crypto AI infrastructure and tools emerge, the potential for Virtuals to develop becomes more obvious - facilitating more seamless on-chain interactions between agents.

What excites us the most is:

● Wallet usage. No other AI agent on Virtuals can actually use a wallet (requires a market cap of more than 126 million). When this happens, we expect to see:

- AI agents that adopt on-chain tools to produce custom content (think NFTs, memcoins, or even predictions for the US election).

- AI agent partnerships to buy other tokens with the goal of merging communities.

- Propagating offspring to launch their own AI agents. This is already happening!

● Prompt-to-earn. If interacting with an AI agent can reward users with valuable prompts that improve their knowledge base or ability to interact with others, this will create a compelling flywheel effect. This can provide a user experience that centralized platforms will find difficult to compete with.

(2) Choosing the right platform is important

If you are a developer building an AI agent, it is important to choose a platform that allows you to create novel and engaging user experiences. You can easily create a meme coin on pump.fun. Fun is tied to the AI agent on X, but the connection is tenuous at best.

From a technical perspective, Virtuals provides the infrastructure to make these connections meaningful and effective. The team has an ambitious vision to set the standard for communication between all AI agents on the chain. We always like to make a big splash don’t we?

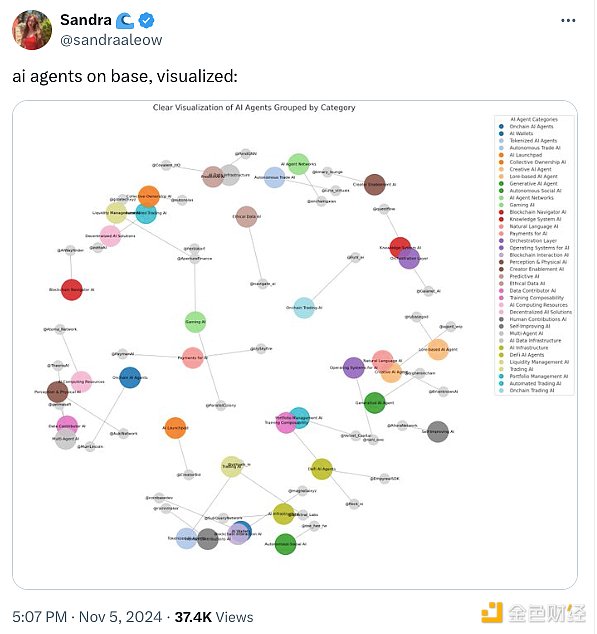

(3)Base is becoming a consumer AI hub

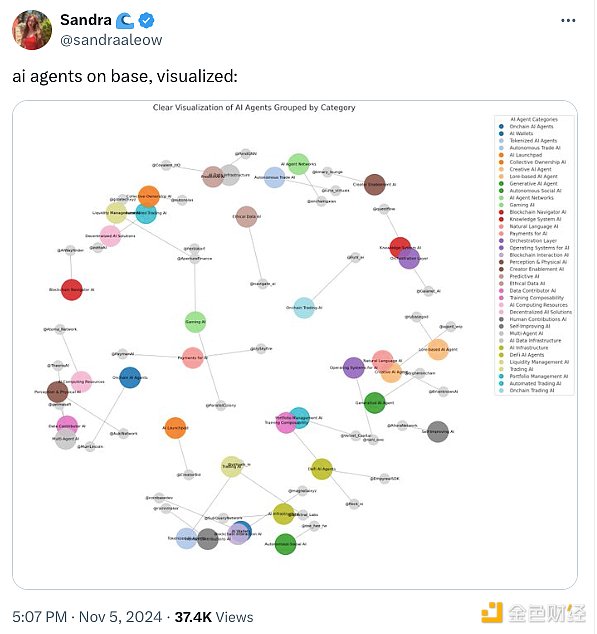

Virtuals is built on Base, which is quickly becoming a strong ecosystem for consumer-focused AI agents. Base has over 50 teams building AI agent projects, providing composability, a strong brand, an excellent AI SDK, and a growing network effect.

You also want to be where other innovators are building because that’s where user liquidity naturally gathers. While some chains rely heavily on speculation and gambling, Base is becoming the go-to platform for major innovations in the AI agent space.

One final point: at the end of the day, platforms are just that, platforms.

Their potential is unlocked by the creativity and ingenuity of the creators who build on them. The success of Virtuals ultimately depends on fostering a vibrant developer ecosystem that encourages creators to use its tools to create interesting, innovative, and engaging AI agents.

JinseFinance

JinseFinance