Author: The DeFi Investor Source: X, @TheDeFinvestor Translation: Shan Ouba, Golden Finance

Recently, many people have lost hope that this bull cycle can continue. Given that many top altcoins have fallen by more than 60% in the past few months, you can't really blame them. It's hard to survive in this market during a downturn like this.

But there are many factors that suggest that this cycle is not over yet. Of course, nothing is certain to happen in financial markets. But I believe that the risk/reward of being bullish is very attractive.

In this issue, I will cover why I expect an altcoin trading season to occur later this year, and what I am doing now to maximize profits in the next parabolic phase.

Why I am still bullish on cryptocurrencies

There are many reasons for this.

In a nutshell, the main points are as follows:

Stock markets are at all-time highs

The Federal Reserve is expected to cut interest rates later this year

Total stablecoin supply continues to increase

U.S. presidential candidates now support crypto

TradFi institution (BlackRock) is starting to pay attention to crypto

~$16 billion in cash will be distributed to FTX creditors in the coming months - many of whom may put this money to work

Historically, the third quarter is the worst quarter for cryptocurrencies, which may explain the recent decline.

But I am very excited about Q4.

With the US election, Fed rate cuts, and FTX cash redemptions scheduled for Q4, I can't imagine a scenario where BTC has already peaked.

BTC dominance has only risen a little bit so far this cycle. When this trend reverses, the altcoin season usually begins, which I think may happen in Q4.

Betting on the Right Projects

Now that I’ve shared my bull thesis, I also want to talk about my strategy for identifying the tokens that are likely to perform best in the next market phase.

A great way to become a better investor is to study the market’s past.

For example, I think the best way to learn how to catch 10x gems is to first analyze what the tokens that have already done 10x have in common.

The following 5 currencies have seen returns of over 100x in the last bull run:

SOL - The most popular non-EVM blockchain Solana token

LUNA - The token of Terra Luna, an algorithmic stablecoin experiment that ended up going terribly wrong

MATIC - The token of Polygon, one of the most popular Ethereum L2 projects

SPELL - The token of Abracadabra.money, a DeFi Lending platform, supporting some very high yielding degen strategies

FTM - the token of Fantom, a blockchain that is one of the fastest growing ecosystems during the 2021 mania phase

I think their huge success can be attributed to a few main factors:

All 3 are extremely charismatic and have managed to build strong communities around their projects. Founders with good media presence and good personalities can contribute greatly to the success of their projects.

The retail industry loves to invest in projects with strong leaders. Most projects with cult leaders don't perform well in the long run - but you can make huge money betting on these projects before the bull run is over.

A new Uniswap fork is not necessary.

The best chance of achieving this is to bet on innovative projects that are constantly pushing the boundaries, rather than just copy-pasting competitors' projects.

This doesn't mean they have to build something completely new.

But ideally you want to bet on a project whose product is 10x better than the competition and ships much faster.

A good example that comes to mind is Pendle.

Pendle was the first yield trading protocol to support airdrop spot trading, and it gained huge benefits by implementing this feature for the first time.

The fact that its team continuously announces integrations with popular protocols has helped Pendle maintain its position as the largest yield trading protocol.

Retail investors love to see their projects announce partnerships with other large web3 projects or very popular web2 companies.

Polygon, Solana, and Terra Luna have attracted a lot of attention by doing this.

During the bull run, partnership announcements could trigger some massive token rallies.

SOL, MATIC, FTM, and LUNA are all used to pay gas fees and protect blockchain networks, while SPELL adopts a revenue sharing model.

Simple governance tokens like UNI also performed well in the first half of the 2021 bull run.

However, I believe that most of the tokens that outperform in this cycle will not be simple governance tokens, but will have some additional utility.

Here are some examples of potential token use cases:

Revenue sharing

Paying network fees

Buyback and burn mechanism

Increasing rewards for users of the protocol

Access to exclusive products (e.g. access to the web3 launchpad)

Memecoin is clearly an exception to this rule, and they perform well even without any utility. But with the exception of memecoin, I generally wouldn't buy a coin without any utility.

It's also important to check the vesting schedule. You don't want to buy a coin whose circulating supply will increase by 300%+ in the next 365 days.

Major token unlocks can significantly affect the price of a coin, and have happened multiple times this year. You can use a tool like Token Unlocks to monitor upcoming token unlocks and the vesting schedules for over 100s of tokens.

A large portion of the total supply of a coin is already in circulation, and that's a good thing.

Here are some examples of catalysts that can have a positive impact on a token’s price:

Major protocol upgrades

Token economics upgrades

Token listing on a major CEX

New product launch

Fundraising announcements

Major partnership announcements

Catalysts can significantly boost a token’s price performance, which is why I generally only invest in projects that have huge catalysts in the near future.

I often ask myself a question:

Why would someone buy the same coin as me but at a higher price?

If I can't find at least one good reason, I won't buy that coin again. Strong conviction is the bet that will really make you rich.

My plan for this cycle is to hold a maximum of 10 coins that meet the above criteria. It's not worth over-diversifying if you know what you are doing.

Airdrops: Are They Still Worth Farming?

The last few highly hyped airdrops have disappointed many people.

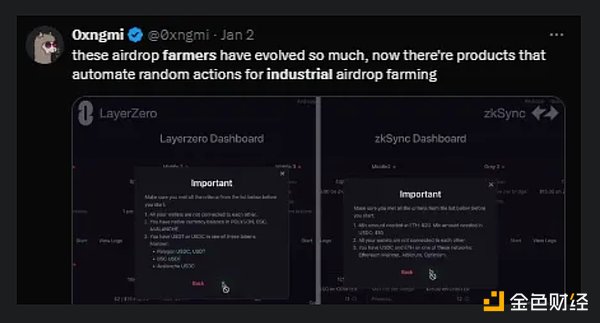

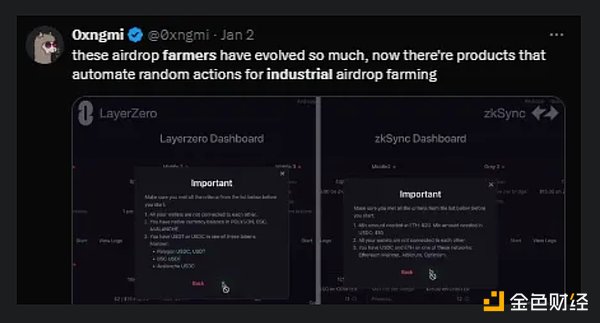

LayerZero is a recent example. As airdrop farming has become more popular over the past few years, many airdrop opportunities are now highly diluted, especially due to the emergence of industrial farmers.

Therefore, most airdrops today are distributed linearly and are no longer based on a tier system (like Jito) to avoid rewarding industrial farmers.

Is the linear distribution of airdrops a bad thing?

The problem is that whales are the ones who benefit the most from linearly distributed airdrops, which is not a good thing for users with less capital.

It is almost impossible to turn $1,000 into $50,000 through airdrops now. But I believe you can still make some money by doing it the right way.

The main criteria I look for in a tokenless protocol are as follows:

Strong community - the more active the community of the project on X, the higher the valuation of its token

Has raised funds from venture capital firms - the more funds its team has raised, the higher the valuation of the protocol token is likely to be at launch

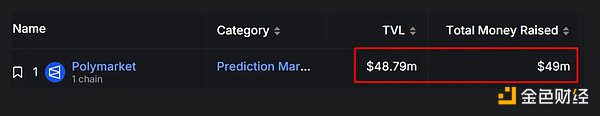

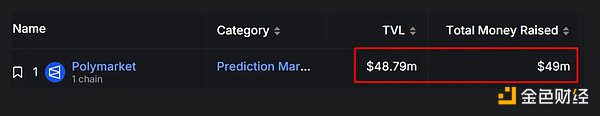

Low TVL/Total funds raised ratio compared to other tokenless projects - the lower this ratio, the better, as a high ratio can indicate that an airdrop opportunity is being overfarmed

Polymarket is a great example of a protocol with an excellent TVL/Total funds raised ratio.

Ideally, people use the airdrops of protocols because they think they are really useful, not just for airdrop farming purposes.

Every bull run creates a new generation of millionaires.

But data shows that more than 90% of people end up returning most of their profits to the market because of greed. That's why you need a realistic exit plan.

For long-term positions, I mainly take profits based on fundamental triggers.

Whenever I start seeing multiple top signals that indicated tops in previous cycles, I start selling using the inverse dollar-cost averaging strategy.

Inverse dollar-cost averaging is the opposite of dollar-cost averaging and involves selling the same amount of coins at fixed time intervals.

Some good top signals I watch for:

Jim Cramer has been promoting crypto heavily

Coinbase becomes the #1 app on the App Store

Your friends and family start talking about crypto

Celebrities start launching their own currencies

People show off Rolexes and luxury cars on your X timeline

Useless projects raise tens of millions of dollars

Finance YouTubers start talking about crypto frequently

Ponzi farms offering 5-figure APY rewards are attracting billions of dollars in TVL

The only top-level signal we’ve seen so far is celebrities launching memecoins. This makes me think we’re still in the early stages.

Taking profit when BTC or your altcoin reaches a specific price level is also a valid strategy. But I think it’s much more difficult to identify the right price level and determine when it’s a smart move to sell.

Concluding Remarks

I always try to be realistic, so here are my thoughts:

It may be much harder to succeed in this bull market than in past cycles. One reason for this is the skyrocketing number of crypto tokens.

JinseFinance

JinseFinance