Due to the crazy rise of Bitcoin, this bull market is also nicknamed the "Bitcoin Bull Market." Since the adoption of the Bitcoin ETF, a large amount of money has poured into the Bitcoin ecosystem. This is an unprecedented bull market phenomenon. Bitcoin continues to rise in response to memes, and other crypto tracks such as AI and gamefi have taken turns to pull the market, but L2 seems to still be sleeping.

On March 13, according to Etherscan data, the block height of the Ethereum mainnet has reached the Dencun upgrade scheduled epoch (269568).

The main goals of the "Dencun" upgrade are to improve the scalability and modularity of the L2 network, enhance the security features of the Ethereum network, and improve overall usability. The proposal that has attracted the most attention is EIP-4844 (Proto-Danksharding), which is a pre-plan for the full version of sharding expansion Danksharding. The entire set of sharding solutions revolves around Rollup for on-chain expansion, aiming to expand L2 Rollup, help L2 reduce fees, and Increase throughput and pave the way for full sharding.

Simply put, the biggest positive factor of Dencun is the reduction of L2 transaction fees.

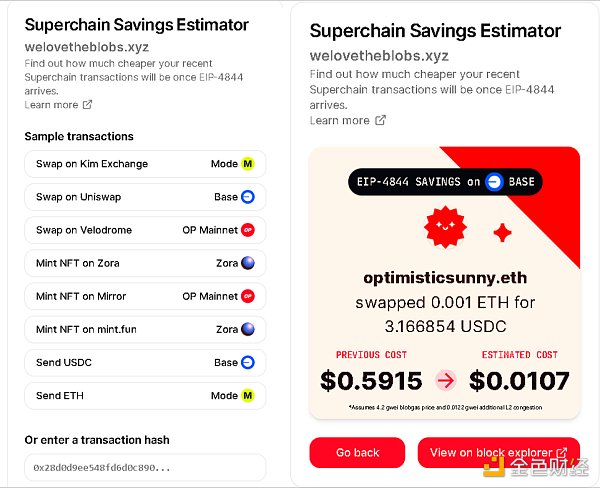

Ethereum core developer eric.eth once said that the implementation of EIP-4844 will cause the gas cost of Ethereum-based L2 transactions to drop to about $0.01. . According to a website launched by Optimism, the transaction cost of executing a swap on Uniswap will be reduced from $0.59 to $0.01 in real time.

The market rotates to Ethereum and Shanzhai

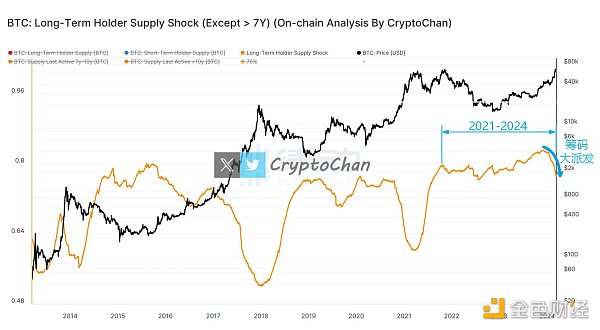

According to on-chain analyst @0xCryptoChan, as the price of Bitcoin continues to rise, the number of coins held on the chain is greater than The 155-day total BTC holdings as a percentage of the total BTC circulation are declining, which means that liquidity is shifting away from Bitcoin.

With the dual expected support of Decun upgrade and Ethereum ETF, Ethereum rose from US$2,300 to US$4,000. Now that Dencun has been activated on the mainnet, gas has been reduced, which is expected to encourage users to participate in more applications and increase their on-chain activities.

For this reason, some people in the community believe that EIP-4844 will reduce the overall income of Ethereum.

While the fees L2 pays for DA on Ethereum will indeed decrease, this reduction is unlikely to have a significant impact on Ethereum's overall fee generation. L2’s DA fees only account for approximately 7-10% of Ethereum’s total fee revenue. For example, in February 2024, of the $355 million in total fees, only $33 million was attributed to L2 publishing data on Ethereum, with the majority of fees generated by on-chain activity on the Ethereum mainnet.

In addition, with the airdrop craze in full swing, lower gas fees on L2 may further incentivize airdrop farmers to increase their on-chain interactions to increase their Opportunities to get assigned. This increase in activity, in turn, has the potential to increase the overall value generated within the network, benefiting Ethereum and its ecosystem.

On the other hand, according to @cheng_shutong, it can be seen from the contract funding rate that the rate of most altcoins has reached an annualized rate of 100% or even more High, indicating that most retail investors, stimulated by Bitcoin and Ethereum's successive breakthroughs to new highs, are competing for the collective growth of copycats.

Dencun may be beneficial to the RaaS market

One view is that after the Cancun upgrade, more Dapps will independently make a Rollup, which will be beneficial to RaaS. Market prosperity. Previously, Charles d'Haussy, CEO of the dYdX Foundation, also told BlockBeats that if ecological technology wants to develop further, it needs to build its own chain.

Dencun's hype selling point, essentially, is that EIP-4844 and Blob carry transactions introduce three key enhancements. In addition to lowering transaction fees, this includes enhancing Ethereum’s scalability and enabling the community to test the Ethereum network’s ability to handle increased data loads in production and prepare for a full sharding upgrade.

EIP-4844 and Blob carrying transactions can utilize block space more efficiently than existing methods. Additionally, since blobs are a different type of transaction entirely, they have their own fee market and are not affected by the increase in regular transaction activity on the Ethereum mainnet.

Bankless analysts pointed out in an article that in the long term, as L2 becomes cheaper, it will provide unique applications to be built on it. The program opens up the design space. For example, many applications with high throughput requirements such as AI and dePIN projects can choose to be built on L2, or even L3.

L2 is still no match for Solana?

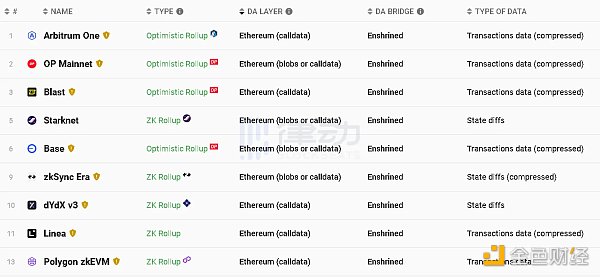

According to L2BEAT data, as of the time of writing, after the Cancun upgrade, the DA layer in the head L2 has been switched to the Ethereum mainnet Blob, with ZK Rollup ZkSync and Starknet of the system, Optimism and Base of the Optimistic Rollup system. According to actual measurements, after the switch, the gas fees of the four L2 companies dropped by 1 order of magnitude.

But @0xNing0x said that the existing gas fee reduction effect was achieved when major DA consumers Arbitrum, Blast, etc. did not switch DA layers, and the current DA fee is still two orders of magnitude more expensive than Celesita DA.

In addition, Arbitrum said ArbOS Atlas also introduces additional Arbitrum fee reductions for Arbitrum One, which will be activated on March 18. Upon activation, the L1 remaining charge per compressed byte will be reduced from 32 gwei to 0, and the L2 base charge minimum will be reduced from 0.1 gwei to 0.01 gwei.

Therefore, the specific effectiveness of the Dencun upgrade will not be judged until all head L2s have successively switched to the DA layer, and the Rollup parameters have been adjusted and the market competition strategy game has been balanced.

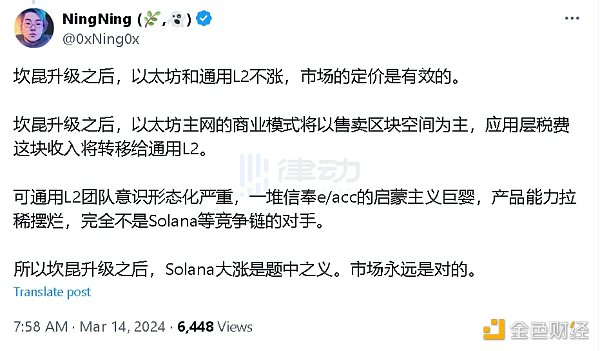

And judging from the current market performance, Ethereum and General L2 have not increased much. @0xNing0x believes that after the Cancun upgrade, the business model of the Ethereum mainnet will be based on selling block space, and the revenue from application layer taxes will be transferred to the general L2. The general L2 team is highly ideological and is no match for competitive chains such as Solana.

The price of SOL has been rising steadily in this cycle, and even the token prices of the entire Solana ecological project have also experienced a general increase. Other ecological projects have also followed Solana's pace in launching steadily, DeFi, Depin and The blooming of AI and other sectors has allowed Solana's TVL to rise all the way, with TVL reaching US$3.6 billion at the time of writing.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Alex

Alex TheBlock

TheBlock Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist