Author: MiX

March 2, 2024, Runes ecological foundation The founder of the facility project Rune alpha had a discussion with Casey, the founder of the Runes protocol, in a public issue on Github.The two parties discussed how to expand the "public inscription" mechanism of the Runes protocol. Topics include:

·Should we relax the non-reservable requirement for "public engraving"?

·Pointed out the point that there is no management right for Runes that adopt the "public engraving" issuance method

·Proposed a set of issuance mechanism ideas based on the cooperation of inscription NFT and rune FT

Out of strong interest in the Bitcoin derivative asset protocol , The author of this article wrote this article based on some of the latest topics of Runes mentioned above, and conducted a developmental exploration of the past of Runes and Ordinals protocols, as well as similar asset issuance methods. I believe it can help everyone understand Bitcoin The currency ecology brings help.

What is the Runes protocol

The so-called Runes protocol, It is a protocol for issuing homogeneous tokens on the Bitcoin network. The homogeneous token scheme was rebuilt by Ordinals founder Casey after releasing the Ordinals scheme. It is built based on the characteristics of Bitcoin UTXO and the overall design idea. Very concise.

It is worth mentioning that theRunes protocol plans to halve Bitcoin in 2024 (block height 840000), which is April this year. The mainnet will be launched later in the year. The Runes protocol is still in the process of optimization and version iteration.

Before briefly popularizing the principles of Runes, let us quickly understand the context and what the so-called [public engraving] actually means.

Casey, the proposer of Runes, did not have the idea of a homogeneous token protocol at the beginning. As early asin December 2022, Casey The Ordinals protocol was released. The intention is to permanently chain NFT data to Bitcoin. Simply put, it is to record NFT metadata like an inscription in the witness data witness of Bitcoin transactions (witness mainly contains digital signature information). In this way, any form of content (such as text, images, etc.) can be engraved on the specified Satoshi.

(Image source: https://yishi.io/a-beginner-guide-to-the-ordinals-protocol/)

Subsequently, the gears of history began to turn. On March 8, 2023, anonymous developer @domodata created a set of issuance homogenization based on Ordinals, a typical NFT issuance agreement. The BRC-20 standard for tokens stipulates, in the form of inscriptions, a unified format and attributes (Token name, total supply, single maximum minting amount, etc.), and then use the indexer to parse and track this information, displaying the wallet accounts and asset amounts related to BRC-20 tokens.

Here comes the key. The issuance of BRC-20 depends on the Bitcoin inscription NFT protocol like Ordinals, so the initial issuance mechanism becomes similar to the NFT casting process, and it naturally has " "First come, first served" feature, whoever Mint first will own it, completely different from the Ethereum ERC-20 asset issuance where "the project party first deploys the asset contract, defines the asset distribution mechanism, and how the official wants to control the market It will be all right".

This Fair Launch feature gives most people a fair opportunity to participate in the initial issuance of homogeneous tokens. The project There is no reservation or lock-up, and everyone can participate as soon as the assets are initially issued. Soon, BRC20 brought about a boom in the issuance of derivative assets on the Bitcoin chain, and even directly started this bull market. It can be seen that the "public engraving" issuance method that we focus on today is very important to the Runes protocol.

But BRC-20 also brings many problems: every operation of BRC-20 assets must initiate a specific transaction on the Bitcoin chain. With the popularity of BRC-20 assets, the Bitcoin UTXO data set has also expanded rapidly, which has caused BTC core developers to openly question BRC-20.

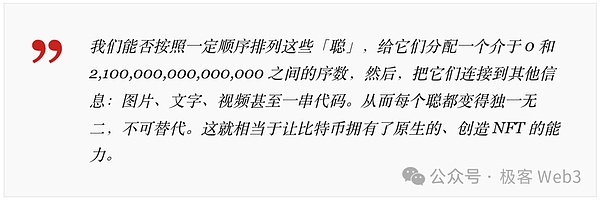

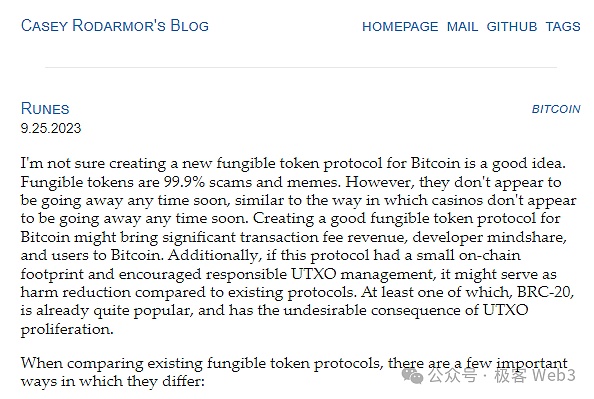

Ordinals founder Casey not only opposes BRC-20, but also does not recognize the FT assets issued based on Ordinals. However, the popularity of BRC-20 has made He feels that although 99% of tokens are scams and gimmicks, these things will still not disappear like casinos.

At the same time,BRC-20 has left “excessive traces” on the Bitcoin chain, bringing data carrying capacity to Bitcoin nodes. But if someone proposes a set of asset protocols that can "reduce the burden" of on-chain data, it may be able to alleviate the problems caused by BRC-20.

SoCasey decided to build a "better homogeneous token protocol" for Bitcoin, and then on September 25, 2023, He released the initial concept of the Runes protocol.

From a technical perspective, theRunes protocol is built based on Bitcoin UTXO and additional information.The triggering of each transaction requires the digital signature information generated off-chain on the chain. , we can carry messages in a specific format in the signature information. The Runes protocol marks "specific messages" through the OP_RETURN opcode. These specific messages are information related to Runes asset changes.

Compared with the BRC-20 protocol, Runes has many advantages, the most important of which are:

1. The transaction steps are simplified and no redundant useless UTXO is generated, which can better "reduce the burden" for Bitcoin nodes. In addition, a transfer transaction of BRC-20 only supports one recipient and one token, while Runes supports transfers to multiple recipients at the same time and can transfer multiple Runes tokens.

2.The storage and indexing of asset data is more concise:BRC-20 data is stored in the witness data of a specific transaction in JSON format , and BRC-20 is based on the account model, and the asset balance is associated with the specified account. The data of the Runes protocol is stored in the OP_RETURN field of a specific transaction, and the recording method of assets adopts the UTXO model, which can be "isomorphically bound" directly to the UTXO on the Bitcoin chain.

When confirming a person's Runes asset status, you only need to verify the special UTXO that the person owns and is bound to the Runes asset. Although It is still necessary to trace back part of the information to complete the calculation, but there is no need to scan the complete UTXO set on the Bitcoin chain like BRC-20.This lightweight approach is more friendly to data indexing.

3. Compatible with UTXO function expansion layer: Runes is based on UTXO design, making it compatible with CKB, Cardano, Fuel, etc. The function expansion layer of UTXO is better compatible. Through "UTXO isomorphic binding" similar to RGB++, the above function expansion layer can provide smart contract scenarios for Runes.

After briefly talking about technology, let’s return to the issuance mechanism discussed at the beginning of this article. Casey has designed two issuance methods for Runes, namely "fixed total amount" and "public engraving":

1. The fixed total amount means that the issuer directly inscribes all Runes and then distributes them, which is relatively more centralized.

2. Public engraving is to set parameters for the way Runes are issued, such as specifying a block height or timestamp, within a time period that conforms to the rules , how many assets the user Mint will determine the total amount of the runes in the end.

The scenarios and mechanisms corresponding to the two distribution methods are completely different. In the following, we will only talk about "public engraving".

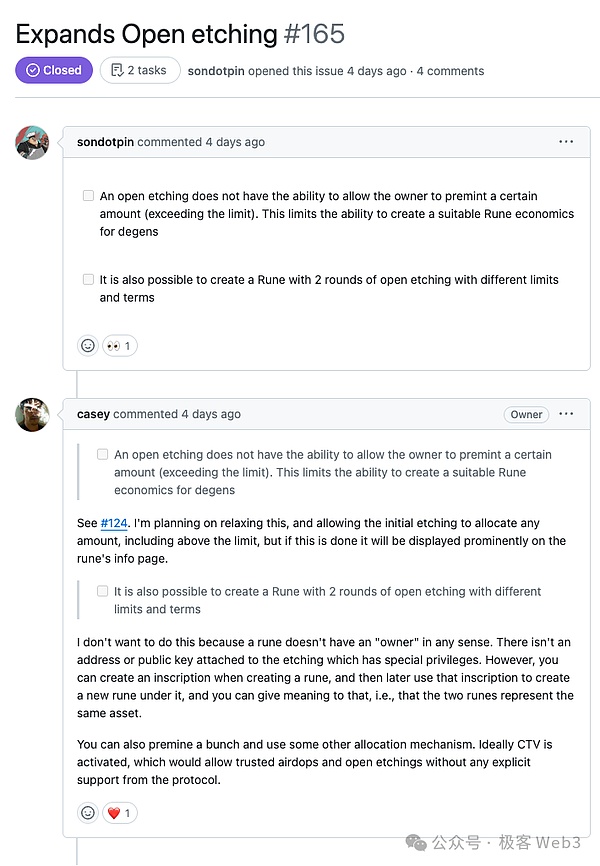

In fact, Sondotpin started discussing this topic from Issues #124 of Runes, and was recognized by Casey.

The specific content of Issues#165 is as follows:

Sondotpin: For the current public issuance, the project party/issuer cannot predict in advance Runes are left, which limits the project team’s opportunities to design excellent token economic models.

Casey:Please see previous Issues#124. I'm considering relaxing this requirement to allow publishers to arrange runes in a reasonable way at the time of release, even outside of the parameters set. If designed like this, relevant information will be displayed very prominently on the Runes details page.

Sondotpin: Is it possible to design a multiple-issuance mechanism, such as two rounds of "publicly engraved" Runes? Then set different parameters for each round of issuance?

Casey: I am not inclined to this approach, because Runes essentially do not have a "manager" . Distribution authority should not be in the hands of a single entity with special authority. But you can add an inscription when issuing runes, and then issue new runes based on this inscription, so that the runes issued twice are the same asset. Of course, you can also use pre-mining and then issue it using other distribution methods.

If the function of CTV can be launched smoothly in the future, there will be no need for protocol support. CTV can directly pre-set condition templates, and when the conditions are met, it can make Airdrop and public offering set.

Personal opinion on the discussion surrounding Casey and SonPin:

1. In the early stage of launching a project, it is indeed necessary to reserve some Tokens

In the early stage, the project party wants to achieve business goals Bootstrapping requires a certain amount of token reserves to motivate the core team and unite the community. If the agreement can be implemented according to this discussion, it will complement the fairness and universal participation value of "public inscription" and allow more valuable basic project parties to participate in the Runes ecosystem through "public inscription".

2. Whether and how to reserve is to hand over the means of self-certification to the issuer

In fact, Casey has bluntly stated in YouTube videos many times that 99.9% of homogeneous tokens are scams. Don’t pretend to be a fan of changing the world, and admit it frankly. It is an industry full of gambling and speculation, and treating each other with sincerity is good for everyone. IT’S JUST FOR FUN!

From issue#124 to #165, you can see that Casey has more recognition of the usage scenarios of homogeneous tokens. There is no need to question the method of "public engraving". Expanding on this basis, such as adding a reservation mechanism, is to hand over the right of choice and self-certification to the issuer, and is also a good way to prevent bad coins from driving out good coins.

3. Inscription NFT and Rune FT will have more room for innovation

Casey's idea of a multi-round issuance mechanism for inscription NFT and rune FT to cooperate with each other is quite interesting. As mentioned in the background knowledge, Ordinals and Runes are both protocols designed by Casey. They should be regarded as two parallel protocols. However, they are both implemented on Github. In the Ord project, there is a lot of technical crossover and cooperation, such as sharing the synchronization area. Blocks of underlying logic.

The current hot projects such as Runestone and Runecoin are also innovative combinations of inscriptions and runes. The gameplay of Runecoin is the most mainstream inscription pre-mining. Holding the RSIC inscriptions issued by Runecoin will continue to dig out the runes of the project, and then the Runes protocol will be launched at the end of April to distribute FT. We look forward to more projects in the future that can bring forth new ideas and bring more novel ways of playing.

4. There is no ownership of Runes issued using the "public engraving" method

Casey's original article only expressed that "Rune does not have ownership", but the author believes that this should specifically refer to the lack of ownership of Runes that adopt the "public engraving" distribution method. The two-round "public engraving" plan proposed by SonPin will definitely be operated by an address with extremely high authority. This is not what the Crypto encryption field wants to see.

Just like the project Runecoin, after issuing 21,000 RSIC inscription NFTs, it quickly hit the parent inscription to Satoshi Nakamoto’s address, which means that no one can do it again To use, that is, to promise not to do additional issuance through technical means. This operation itself brought a lot of praise to it, which made it very popular among passers-by.

PS:What is a parent inscription? Because the interaction speed in BTC is slow and gas is high, when the number of operations is relatively large, in order to improve efficiency, a parent inscription is usually set up first, and multiple sub-inscriptions are directly processed in batches in one transaction of the parent inscription. Inscription, this can save the storage space and processing time of the blockchain during interaction.

Finally, let’s talk about the CTV mentioned by Casey, which is “Check Template Verify”.

CTV is a proposed protocol upgrade for Bitcoin that aims to enhance Bitcoin by allowing users to specify templates for future transactions when creating transactions. Smart contracts and locking functions of the coin network. The activation of CTV will enable users to create more complex transaction types, such as trusted airdrops and open etch, without explicit support from the protocol.

ThisCTV proposal increases the programmability and flexibility of the Bitcoin network,As mentioned in this discussion, simply That is to say, you can create an unlocking condition template using UTXO, whichhas the opportunity to create more ways to play Runes. For example, through the "Runes Protocol + CTV", 10 users can jointly use CTV technology, mint runes together, and then preset some future Bitcoin payment transaction commitments.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist