Author: Lugui Tillier Source: cointelegraph Translation: Shan Ouba, Golden Finance

Tokens on the Rune Protocol have fallen from their peak, but don't jump to conclusions. The protocol is less than three months old and has only just started.

The 840,000th block mined on April 19, 2024 was a big deal for Bitcoin (BTC). Not only did it mark the fourth halving of the world's largest blockchain, it also marked the launch of the Rune Protocol. Currently, the protocol is the most popular protocol on Bitcoin for creating fungible tokens.

While it is common to create tokens on blockchains such as Ethereum (ETH) or Solana (SOL), the practice is relatively new to Bitcoin and did not become popular until 2023. The tokens on the Rune Protocol were only launched in April this year.

Over the past 15 years, traditional media have repeatedly declared Bitcoin “dead.” Similarly, tokens created on the Rune Protocol have been deemed “dead” by some commentators. Looking at the daily trading volume of these assets, as well as the number of new entrants, one might think that Rune has indeed peaked. However, given previous premature pronouncements on the end of Web3 assets, this judgment is questionable.

The first thing to consider is the macro context. Since the launch of the Rune Protocol, Bitcoin has been fluctuating between approximately $60,000 and $70,000. During this period, Bitcoin’s dominance over other crypto market assets (i.e. altcoins) remained almost unchanged, showing the market’s cautious attitude when it comes to taking more risks.

This has a direct impact on the interest in Rune Standard tokens. Although they exist within Bitcoin, they fall under the “altcoin” classification and are not currently receiving much attention from the market.

However, as Roman Emperor and Stoic philosopher Marcus Aurelius said: “Focus on what you can control, not on what you can’t control.” Analyzing the development of the Rune ecosystem is crucial.

Quality of Rune Tokens

Almost all tokens created on the Rune protocol to date are memecoins. In addition to memes becoming one of the main narratives in 2024, they are also easy to create. Therefore, expect the Bitcoin blockchain to initially be flooded with memecoins rather than tokens with strong token economics or associated with large applications, as the market has not had time to create these things yet.

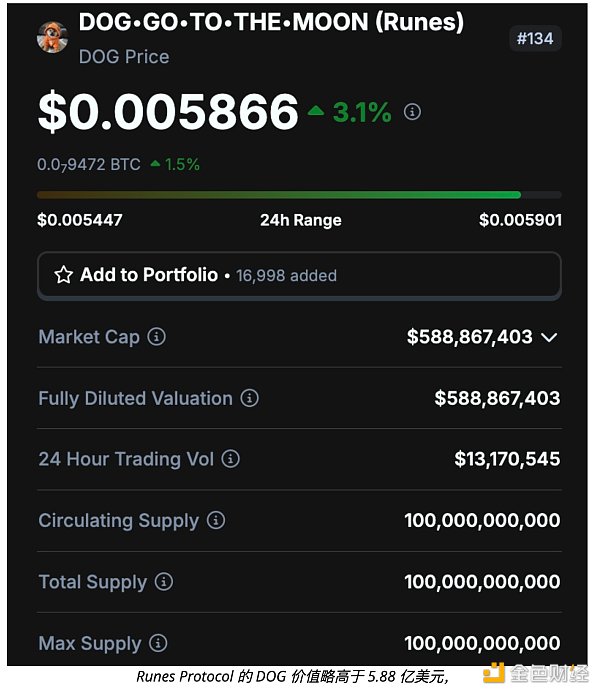

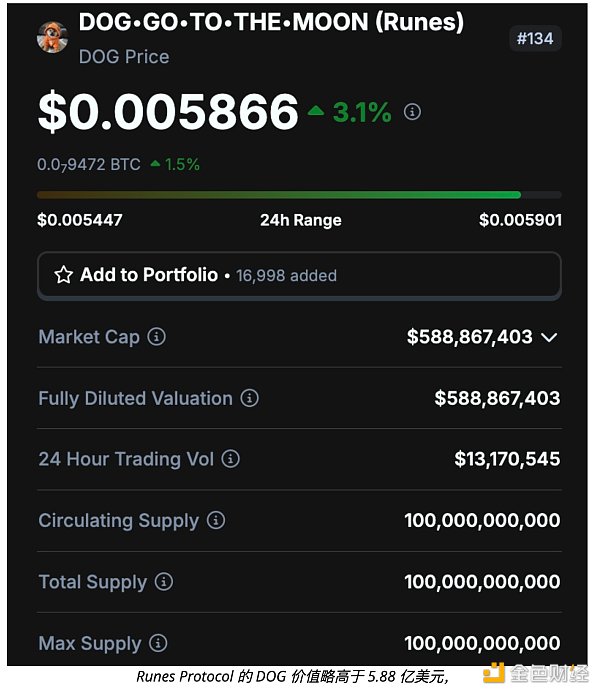

Of all the memecoins created, the most notable is the DOG token. The success of the DOG token is attributed to a fair launch and a powerful and simple narrative: Bitcoin’s Dogecoin. For years, Dogecoin has dominated the memecoin market across all networks, and now Bitcoin has its own Dogecoin.

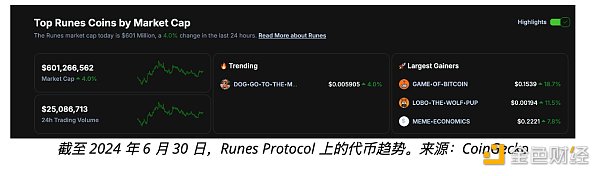

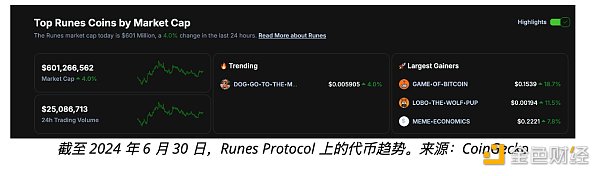

Currently, the DOG token accounts for approximately 40% of the total runecoin market value, worth approximately $600 million, with over 70,000 holders. Its dominance highlights the growth potential of the space.

Evolution of Infrastructure

Since asset issuance became popular within Bitcoin in 2023, there has been significant friction in the infrastructure to participate in these assets. In addition to the fact that wallets supporting these assets are not popular in the Ethereum or Solana ecosystems, Bitcoin also lacks smart contracts - which makes it difficult to create decentralized exchanges (DEX) and markets. For example, the experience of trading Bitcoin assets is much worse than assets on other networks.

Some major players see this as a good challenge and opportunity. By betting on these emerging Bitcoin assets, Magic Eden has found new life after losing relevance to Solana. Another player committed to the space is OKX, which has an on-chain market dedicated to Rune assets.

The next major speculation in the market right now is the creation of a decentralized exchange similar to Uniswap or Jupiter. While there are no clear predictions, it can be said that the infrastructure is being developed at a rapid pace for an asset type that did not exist three months ago.

Others have also accepted this narrative

In addition to local players and on-chain developments, centralized exchanges are also gradually accepting Rune Standard assets. The leading listing is the DOG token, which has been listed for spot on Gate.io and MEX, and for perpetual contracts on Bybit and KuCoin.

It is important to emphasize that the Rune Protocol is less than three months old, and listing Rune tokens on exchanges requires exchanges to update their infrastructure. This is why smaller exchanges move the fastest — larger exchanges will follow later.

To summarize, even in a cold market, the Rune ecosystem has made extremely interesting progress, showing that it is far from the peak of development.

Even if the "alt season" never comes, the Rune ecosystem has a strong narrative — it will stand out in the market.

Catherine

Catherine