SHIB and AVAV Inscription join forces to launch ERC404

Shiba Inu launches SHEboshis NFTs on ERC-404, enhancing liquidity and ownership, despite a minting bug resolved by increasing supply.

Sanya

Sanya

Part.1 Insight

In-depth analysis of Bitcoin inscriptions

Bitcoin has come a long way from its origins as “digital cash” for anonymous transactions . Since the introduction of Inscription in 2021, Bitcoin has begun to open up new possibilities in programmable money and decentralized finance, exciting Web3 pioneers as well. Leveraging an extensible scripting language to enable customizable ownership logic and on-chain state, Inscription promises to usher in a new era in which Bitcoin serves as the underlying settlement layer for downloadable data, whether images, audio, or text. Although still in its early stages, the inscription-based protocol has demonstrated the future possibilities of Bitcoin, not just as a payment instrument, but perhaps evolving into a foundational layer for programmable property rights and digital ownership. But for investors, there are still risks in the gray areas of technology implementation, market environment, and regulation.

The history behind the inscription

"Staining Colored BTC

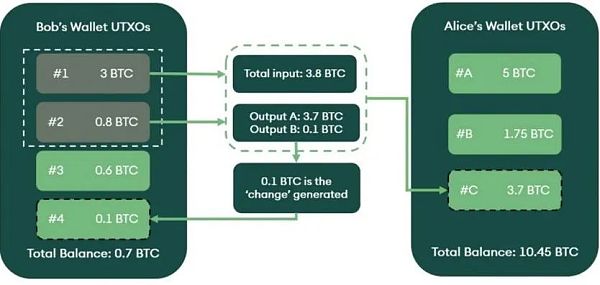

In the early days of Bitcoin, it was only used for peer-to-peer transactions and stored value. Since 2012 there have been “colored coins” – tokens marked Satoshi to represent real-world assets such as stocks or property. It colors Bitcoin’s Unspent Transaction Outputs (UTXOs) for use in other off-chain protocols. However, tracking these particular coins proved unsustainable, causing Bitcoin’s UTXO collection to bloat. Despite severely limited capacity, there are first attempts at injecting metadata via transaction scripts.

In 2014, due to the need to remove useless UTXO data, OP_RETURN output appeared, marking a 40-byte unspendable script for containing arbitrary data. The 2017 SegWit upgrade addressed transaction variability and block capacity limitations. It proposes a separate block called the witness block to inject metadata, which has a larger storage capacity. Bitcoin’s witness blocks also enhance the space for embedded data scripts.

The 2021 Taproot upgrade introduces Schnorr signatures and Merkelized Alternative Script Tree (MAST) data structures, improving efficiency, privacy, and script complexity. Schnorr signatures allow keys and signatures to be aggregated across transactions, meaning the network can process more transactions faster and cheaper. Using MAST as data storage allows the Merkle branch to only record the results of executing the script to the blockchain, rather than all possible ways to execute the script, thus greatly reducing the space occupied by transactions, especially more complex transactions. The most critical thing is that Tapscript removes the script size limit by modifying Bitcoin's scripting language to enable it to read Schnorr signatures, allowing complex inscription protocols to be encoded directly on Bitcoin's base layer. After years of incremental improvements to increase flexibility and capacity, Bitcoin has set the stage for a new era of tiered digital ownership in the cryptocurrency space.

How inscriptions work

Ordinal numbers Requirements for a protocol

The Ordinal Protocol was created by Bitcoin Core developer Casey Rodarmor and gives an order to Bitcoin’s smallest unit, the Satoshi. Before the advent of ordinal protocols, all satoshis were homogenous, with no identifiable order or unique metadata. The ordinal specification provides a way to assign a sequence number to each satoshi in turn, based on the order in which they are mined or transferred. This allows each satoshi, which would otherwise be indistinguishable, to receive a unique identifier based on its ordinal position.

According to the ordinal protocol, when making a Bitcoin transaction, the lowest numbered available satoshi will be spent first. By applying this rule consistently across the entire blockchain, every existing satoshi since the inception of Bitcoin can be assigned a verifiable order and sequence number.

Professional Bitcoin browsers and wallets follow ordinal specifications, using off-chain indexers to accurately display ordered satoshi balances in order to find the desired set of inscriptions. Users can therefore know exactly which ordinal satoshis they control and transfer specific numbered satoshis when needed.

Establishing ordinal order is critical for identifying and tracking custom Satoshi-based metadata such as inscriptions. Without ordinal numbers, there is no way to reliably pin data to a single Satoshi. The Bitcoin Inscription protocol therefore relies heavily on a centralized off-chain indexer to enable the distribution and proof of ownership of digital artifacts that are tied to numbered Satoshis.

BRC20 - the icing on the cake

March 2023, An anonymous developer using the alias @domodata launched BRC-20 based on the ordinal protocol, which sparked a speculative boom in Bitcoin dominated by meme tokens. BRC20 is a token standard introduced for the Bitcoin blockchain, inspired by the popular ERC20 specification on Ethereum. BRC20 allows users to create tokens other than BTC on the Bitcoin blockchain by allowing users to define, mint, track and transfer customizable token supplies directly on Bitcoin’s base layer.

On a technical level, the BRC20 token leverages the capabilities of Bitcoin Inscription and Ordinal Protocol Unlocking. Designating a BRC20 token involves creating specialized inscription data that labels the token parameters and minting rules. This data is burned into individual serialized satoshis.

A typical BRC20 deployment inscription will define attributes such as the token name, total supply, minting limit per ordinal satoshi, etc. Subsequent inscriptions encode relevant state changes, such as the issuance of new token supply or the transfer of tokens between addresses.

The Bitcoin transactions that move these inscribed Satoshis implement these BRC20 state changes. By tracking inscription history, BRC20-enabled wallets and block explorer software can sequence events and calculate current ownership balances. Therefore, users can issue and exchange user-defined tokens through the underlying Bitcoin ledger.

Unlike Ethereum’s account-based token balance tracking, BRC20 relies on minting and sorting through an ordinal protocol and a centralized off-chain indexer. Shift inscription chronology to explain BRC20's rule set; token balance changes are not reflected as native blockchain state changes like EVM. What was originally a storage mechanism designed to store arbitrary data has evolved into an "alternative" ledger system that is used more traditionally. Are technically non-homogeneous and can only be exchanged within a predefined set of inscriptions. But in general, BRC20 provides similar token functions directly on Bitcoin, but fails to implement smart contract functions.

Overview of the development of inscription technology

Yes Impact of other projects on the EVM chain

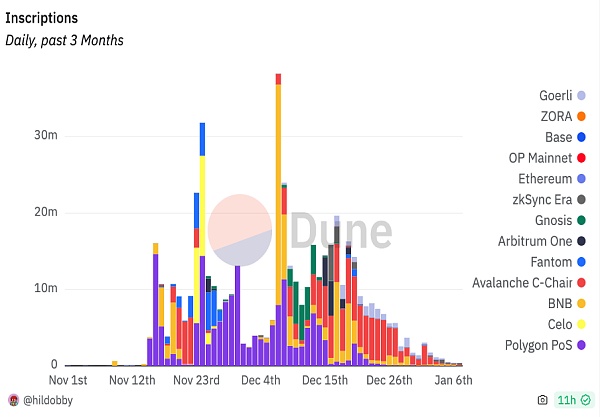

Figure: Inscriptions on EVM: https://dune.com/hildobby/inscriptions

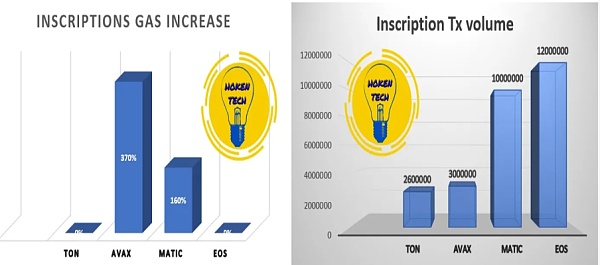

Around bits The craze for coin inscriptions has other blockchain projects racing to replicate similar features. Networks such as Ethereum, Arbitrum, and Avalanche have begun launching Inscription-like projects by encoding data into calldata and relying on external indexers.

Compared to Ordinals on Bitcoin, the price has dropped because the fees for interaction and imprinting on other chains are lower; however, compared with Smart Ordinals on Ethereum Unlike contract-driven NFTs, this method cannot achieve complex functions such as distributing royalties.

Inscriptions in EVM: https://bitpushnews.medium.com/inscriptions-a-recent-fad-or-here-to-stay-79214f66cd44

However, peak on-chain traffic in a short period of time puts some network infrastructure under great pressure. Congestion and outages on chains such as Avalanche, Polygon, Arbitrum, zKSync, Near, and Cosmos due to peak activity highlight the potential risks of putting speculative needs ahead of sustainability planning.

General pattern summary

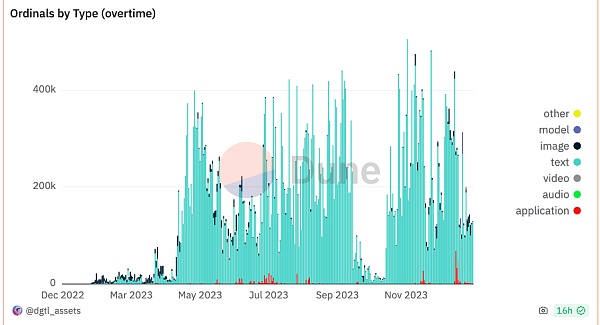

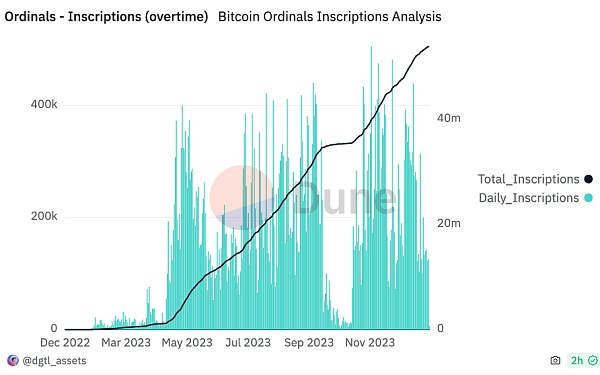

Source: https:/ /dune.com/dgtl_assets/bitcoin-ordinals-analysis

Most burned Ordinals are text, meaning they are BRC20 tokens.

Inscriptions on Bitcoin: https://dune.com/dgtl_assets/bitcoin-ordinals-analysis

Inscription technology in digital collections, tokenization, payment And autonomous identity authentication based on Bitcoin security has opened up new application scenarios. But at the same time, critics pointed out that early tools and infrastructure related to Inscription posed the risk of centralization in transaction verification, mining, wallets and software. In addition, the legal regulations on emerging on-chain activities also bring certain uncertainties.

Taken together, Bitcoin Inscription, while full of attractive possibilities, will require sustainable infrastructure and fair governance as its usage increases. Mechanics are still very critical.

Continuous Analysis

A review of recent precedents provides insights into the growth trajectory of emerging innovations like Bitcoin Inscription. Two previous cryptocurrency trends have shown clear similarities - the rise and fall of algorithmic stablecoins, and the NFT craze in 2021.

Algorithmic stablecoins promise to achieve price stability through complex incentive mechanisms without the need for collateral. However, the complex economics of tokens confuse many users who are attracted by speculation rather than their actual utility. Users are mainly attracted by the attractive consumer-oriented features of algorithmic stablecoins, such as the lack of collateral. But as market conditions change, like TerraUSD’s collapse in May 2022, these projects fail to maintain parity with the U.S. dollar as confidence erodes.

Similarly, the NFT trend quickly lost interest after the craze, having previously been temporarily filled with hype. Users struggle to find practical uses that match the scale of short-lived promotions. To maintain market share, there is increasing reliance on building actual applications before users shift their attention.

Unless the applications of inscriptions go beyond mere speculative needs, they appear to be following a similar path. Incorporating inscriptions into addressing practical needs such as transparency, credentials, identity verification, and content authentication appears to be critical to its ability to avoid repeating previous cycles of boom and bust.

Continuous community development can cultivate sustainable utility while avoiding the mistakes of the past, but technological innovation will still need to be complemented by equitable integration into the real world.

In addition to infrastructure limitations, Bitcoin Inscription also faces barriers to external adoption. The hype cycle surrounding applications such as NFT collectibles or meme tokens, although strong, proved short-lived, had no basis in practical use, and still lacked sustained long-term appeal.

The sparse peak of inscription transactions mentioned above also highlights the relative immaturity of current inscription-based products. Critics point to the lower quality of these protocols and experiences compared to other mature Web3 areas such as decentralized finance. In order to get rid of niche interests, it is necessary to improve accessibility and functionality.

At the same time, there are questions about: Do these emerging experiments go beyond financial speculation? Projects that focus solely on minting tokenized derivatives and lack practical use may be limited to the crypto trader community and struggle to reach the mainstream market.

In addition, legal jurisdictions are only beginning to understand crypto-native ownership models, and excessive interference may hinder innovation.

Overall, Bitcoin Inscription offers compelling potential, but as its usage grows, ensuring universal access, a durable foundation Facilities and equitable governance are increasingly important.

Although technologies like Taproot Innovation offers new possibilities for inscription-based protocols, but the infrastructure to scale these concepts faces certain limitations.

First, the rapid growth in the number of inscriptions may have an impact on the performance of the Bitcoin base layer. Adding non-transactional data to the UTXO set will ultimately impact storage capacity, bandwidth and computing requirements, especially for network nodes. Although storage technology has made significant progress, Internet bandwidth technology has not fully kept pace. As such, this could hinder node participation by significantly increasing the time and cost of the initial block download (IBD), potentially limiting Bitcoin's otherwise attractive scalability and usability.

In addition, complex inscription rule sets and scripts may pose cybersecurity risks if not rigorously reviewed. Attacks leveraging disguised Inscription logic have appeared in vulnerability databases - Inscription was recently listed as a cybersecurity risk in the National Vulnerability Database (NVD). Rigorous auditing and formal verification of inscriptional architecture is particularly important.

At the same time, there is a problem of centralization of the indexer. Tools provide interfaces to access inscription-based networks. Since BRC20 and ordinal protocols do not reflect token balance changes on-chain and therefore rely on off-chain and centralized indexers, these systems rely on proprietary indexes to decode on-chain transaction data into a readable and intuitive format.

It can be said that BRC20 expanded the capabilities of Bitcoin inscription too quickly, resulting in a certain degree of damage to reliability, security and decentralization at the current stage. Confidence. In contrast, focusing on the functionality of immutable data anchoring carries less risk than over-engineering a tokenized abstraction that relies on external indexer operations.

Conclusions

The above analysis is not meant to belittle The current value of the inscribed product. Especially on Bitcoin, it provides more diverse cases for the use of Bitcoin, helping to enrich its culture and ecosystem activities. For EVMs, it offers a cheaper and more secure on-chain alternative to existing NFTs, allowing any type of data to be stored on-chain, even code - an attractive option for crypto users .

However, for the overall Bitcoin ecosystem, there are shortcomings such as: low level of continued appeal, immaturity of the technology, lack of practicality, security threats, and previously observable trends. These factors make widespread adoption very difficult. It can be used to transcend current NFT standards and attract niche traders in the market, such as through NFTFi or provide better incentives for user activity (similar to airdrops), but it is not enough to become a market leader within the crypto ecosystem .

Despite the challenges of growing both technically and integrating into practical applications, Inscription appears poised to unlock Bitcoin’s future potential beyond just payments. While Inscription appears to be setting the direction to reinvent the ownership structure of digital assets through tokens, collectibles, and data anchoring, achieving this goal will require overcoming a series of challenges. Such as risks in terms of infrastructure constraints, legal uncertainty, miner centralization pressure and real economic practicality.

For investors, it is important to differentiate between a sustainable platform and "hype" when making speculative investments in Inscription-focused protocols and services during these early stages of development Very important. In the development of Bitcoin as a programmable currency network, as it transitions from early experimental stages to mature real-world applications: we also need to adopt cautious skepticism and curb the blind enthusiasm in the market.

Part.2 Investment and FinancingEvents

Re-pledge protocol Renzo completes US$3 million in seed round financing

* Restaking

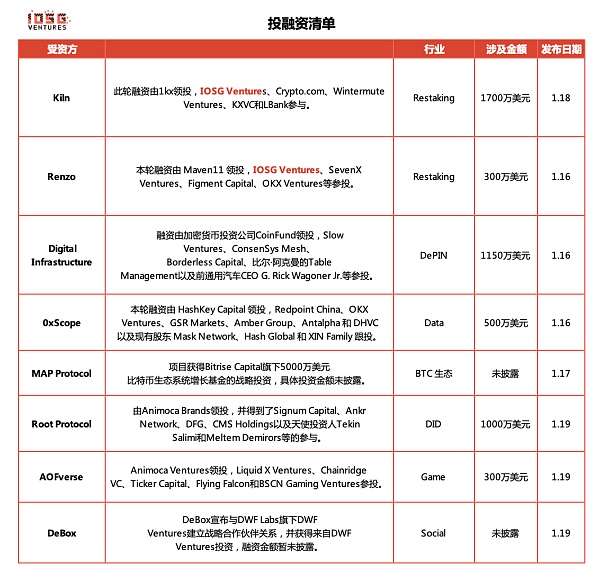

According to reports on January 16, according to The Block, Renzo, the liquidity re-pledge protocol of the Eigenlayer ecosystem, announced the completion of a US$3 million seed round of financing. This round of financing was led by Maven11,IOSG Ventures, SevenX Ventures, Figment Capital, OKX Ventures and others participated in the investment.

According to reports, the core of Renzo is ezETH, which is a liquid re-pledge token (Liquid Restaking Token, LRT). Users can use Ethereum to Or deposit LST into Renzo to mint this token. ezETH can be further used in other DeFi protocols to earn compounding returns. Renzo abstracts all the complexity for end users, allowing them to participate in re-staking in the Eigenlayer ecosystem with a low threshold.

Ethereum staking platform Kiln completed $17 million in financing

* Restaking

Ethereum staking platform Kiln has completed a round $17 million in financing. This round of financing was led by 1kx, with participation from IOSG Ventures, Crypto.com, Wintermute Ventures, KXVC and LBank. This is an extension of Kiln’s $17.6 million Series A funding round announced in November 2022. Kiln said the funds raised will be used for the company's global expansion, including opening its Asia Pacific headquarters in Singapore, and further developing its products. Kiln has raised a total of $35 million in funding from investors since its founding.

Digital Infrastructure, a decentralized automotive data network, completed $11.5 million in Series A financing, led by CoinFund

* DePIN

Focus on decentralized physics Infrastructure network startup Digital Infrastructure recently completed $11.5 million in Series A financing. This round of financing was led by cryptocurrency investment company CoinFund, with participation from Slow Ventures, ConsenSys Mesh, Borderless Capital, Bill Ackman’s Table Management, and former General Motors CEO G. Rick Wagoner Jr.. The company will use this round of funding to strengthen developers' ability to build new tools on the DIMO network to enhance its utility and value. Additionally, Alex Felix, CoinFund’s general manager and chief investment officer, will join Digital Infrastructure’s board of directors. The Series A round brings Digital Infrastructure’s total funding to $22 million.

0xScope completed $5 million in Pre-Series Series A financing, led by HashKey Capital

* Data

Web3 Knowledge graph protocol 0xScope announced the completion of a $5 million Pre-Series Series A round of financing. This round of financing was led by HashKey Capital, with Redpoint China, OKX Ventures, GSR Markets, Amber Group, Antalpha and DHVC as well as existing shareholders Mask Network and Hash Global and XIN Family also participated in the investment.

In addition, 0xScope also released 0xScope V2. The future focus is to provide data support for Web3 AI applications through the proprietary Web3 data layer, and in the process Connect AI with Web3. It also announced that Scopechat is fully open for free registration and use. This product uses AI Agent to help users complete the process of selecting Tokens, checking Tokens, and deciding whether to purchase them within three minutes.

Bitcoin Layer 2 project MAP Protocol received strategic investment from Bitrise Capital’s fund

* BTC

Bitcoin Layer2 Project MAP Protocol Announced on the X platform, the project received a strategic investment of US$50 million from Bitrise Capital’s Bitcoin Ecosystem Growth Fund. The specific investment amount was not disclosed.

It is reported that the MAP Protocol was established in 2019 and took 5 years to develop. It is a Bitcoin L2 infrastructure focusing on point-to-point cross-chain interoperability. By utilizing the security mechanism of the Bitcoin network and the Bitcoin light client technology based on ZK, the MAP Protocol Bitcoin L2 infrastructure is not only secure by the Bitcoin network, but also allows assets and users of other public chains to interact with The Bitcoin network interacts seamlessly. Currently, MAP Protocol has more than 620,000 on-chain users and a complete second-layer ecological application, covering a complete series of Bitcoin L2 applications such as project launch, asset trading, lending, asset cross-chain, on-chain games and NFT.

Root Protocol, a Web3 digital identity service provider, raised US$10 million in two rounds of seed financing, led by Animoca Brands

< p style="text-align: left;">* DIDAccording to CoinDesk, Root Protocol, a digital identity service focused on unified access to Web3 platforms, recently completed two rounds of seed financing, raising a total of US$10 million. These two rounds of financing, which raised Root's valuation to $100 million, were led by Animoca Brands, with participation from Signum Capital, Ankr Network, DFG, CMS Holdings, and angel investors Tekin Salimi and Meltem Demirors.

Root Protocol is building a Web3 operating system that will serve as a digital identity aggregator and become a "one-stop decentralized identity service station" designed to enable access The process across different Web3 platforms is more seamless.

Mobile game studio AOFverse completed a $3 million private placement round led by Animoca Ventures

* Game

Mobile Game Studio AOFverse announced the completion of a $3 million private placement round led by Animoca Ventures, with participation from Liquid X Ventures, Chainridge VC, Ticker Capital, Flying Falcon and BSCN Gaming Ventures.

According to reports, AOFverse is headquartered in London. The game studio focuses on Web3 integration and globally loved IP. The company plans to launch its PvP later this year. The game "Army Of Fortune" has received more than 1 million downloads since its soft launch in October 2023. Previously, AOFverse announced this month that it had received funding from the Arbitrum Foundation.

Web3 social platform DeBox announces investment from DWF Ventures

* Social

Web3 social platform DeBox announced a partnership with DWF, a subsidiary of DWF Labs Ventures established a strategic partnership and received investment from DWF Ventures. The amount of financing has not yet been disclosed.

It is reported that DeBox will move from the Web3 knowledge payment community to a full-stack DAO governance platform. DeBox plans to provide a series of functions to strengthen consensus management, including proposals and voting. , finance, capital management, trading, lottery, contract tools, etc.

Part.3 IOSG post-investment Project Progress

Ethereum re-pledge protocol Renzo TVL exceeds US$100 million< /strong>

* LSD

According to news on January 21, DeFiLlama data showed that Renzo TVL, the Ethereum re-pledge agreement based on EigenLayer, exceeded US$100 million, reaching US$103.96 million. According to previous news, Renzo announced the completion of a US$3.2 million seed round of financing, led by Maven11, with participation from IOSG Ventures, SevenX Ventures, Figment Capital, Bodhi Ventures, OKX Ventures, Mantle Ecosystem, Robot Ventures, Paper Ventures, etc. cast. Renzo’s post-money valuation reaches $25 million.

MetaMask is testing the "Transaction Routing" feature to provide the best execution and improve user experience

* Wallet

MetaMask A feature called "Trade Routing" is being tested to provide optimal execution and improve user experience. It is reported that the technology was developed by Special Mechanism Group, which MetaMask parent company Consensys acquired last year. “Transaction Routing” is said to transform the MetaMask wallet into an “intent-centric” protocol, meaning users will be able to rely on third parties to find the best path for transactions.

Consensys confirmed details of the project, and an early version of SMG's new routing technology has been used to support "Smart Swap", which is included in the MetaMask browser extension. A feature that helps users swap between tokens.

Consensys said it plans to expand its routing capabilities to other transaction types beyond Smart Swap in the coming months, and will also provide support to customers who want to use it themselves. open to third parties. On MetaMask, this technology will always be "optional," meaning users don't have to use it if they don't want to.

Arbitrum launches expansion plan and developer association to support the creation of customized Arbitrum Orbit chains

* Layer2

January 19 According to Japanese news, the Arbitrum Foundation and Offchain Labs announced the launch of a new Arbitrum expansion plan and the Arbitrum Developers Association. This program will provide teams interested in launching projects on the Arbitrum technology chain with a more convenient self-service path, allowing them to join the expansion plan and launch a customized Arbitrum Orbit chain. This means that any project can deploy its own customized version of the Arbitrum technology stack.

The special feature of Arbitrum Orbit is that these chains will have full control of their own governance, without the need to outsource governance or share governance with other chains and ecosystems. Through this program, teams have the freedom to customize and innovate. The two main requirements for participating in the Arbitrum scaling program are that participants need to give a portion of their profits back to the Arbitrum ecosystem, and that deployed Rollups must rely exclusively on Ethereum or a chain secured by Ethereum.

The Arbitrum Developers Association aims to help fund core Arbitrum development and attract the best development teams to contribute to the Arbitrum technology stack. The implementation of this plan is expected to further Strengthening the Ethereum ecosystem and making Arbitrum technology available to any team looking to launch L2 or L3 in the Ethereum ecosystem.

Binance Launchpool launches the 45th project: AltLayer (ALT)

* Restaking

News on January 17, Coin An announced the 45th project on Binance Launchpool - AltLayer (ALT), a platform designed to launch native and re-staking Rollups, supporting Optimistic and ZK Rollup stacks. Specific web pages are expected to be available within 24 hours of Launchpool launch. Users will be able to put their BNB and FDUSD into separate pools to mine ALT tokens over six days, with mining starting at 08:00 (Beijing time) on January 19, 2024.

In addition, Binance will also launch ALT at 18:00 on January 25, 2024 (Beijing time), and open ALT/BTC, ALT/USDT, ALT/BNB, ALT/FDUSD, ALT/TRY trading pairs. The seed tag will be applied to the ALT.

Part.4 Industry Pulse

Chainlink partners with Circle to launch cross-chain stablecoin transfer protocol

* Oracle

News on January 16, Chainlink cooperated with Circle to launch A new cross-chain stablecoin transfer protocol. This protocol aims to connect different blockchains and banking chains, providing a unified standard that enables interoperability between cryptocurrencies and traditional financial systems. The integration allows developers to build cross-chain use cases involving multi-chain transfers of Circle’s USDC stablecoin via Chainlink’s CCIP.

Stablecoin protocol Frax Finance plans to launch Layer 2 blockchain Fraxtal in February

* Stablecoin

On January 18, Sam Kazemian, founder of stablecoin protocol Frax Finance, said in an interview that the company is planning Launched Layer 2 blockchain Fraxtal in February. Kazemian said: "The current schedule is the first week of February. Etherscan will be supported via Fraxscan on day one, and a large number of projects will debut shortly after launch."

The new product will add to Frax’s existing product suite, which includes Frax (a fully collateralized algorithmic stablecoin), a lending platform, an automated market maker, and an inflation-linked stablecoin , FPI and liquid staking token frxETH. Fraxtal will use rollup technology, which executes transactions on the Ethereum mainnet, batches the data, compresses the data, and sends it back to the mainnet. Frax’s liquid staking token, frxETH, will power Layer 2 and act as the blockchain’s gas fee.

The stablecoin transfer volume of Solana Network has exceeded 300 billion US dollars so far in January, setting a new monthly high

* Layer1

On January 21, according to Cointelegraph, Artemis data showed that the stablecoin transfer volume on Solana in January It has exceeded US$300 billion, already exceeding US$297 billion in December last year. Additionally, stablecoin transfers so far in January are $303 billion, a 2,520% increase from the $11.56 billion stablecoin transfers in January 2023. Solana’s stablecoin market share now stands at nearly 32%, a significant increase from its 1.2% share a year ago. Stablecoin activity on Solana started picking up in October and has grown steadily by 650% since then.

OKX Web3 wallet DEX section now supports cross-chain transactions on the Solana network

* Wallet

News on January 17 , according to official news, the OKX Web3 wallet DEX section now fully supports cross-chain transactions on the Solana network. Users can easily cross-chain Solana assets with mainstream assets from 7 chains including Bitcoin, Ethereum, Arbitrum, Optimism, BNB Chain, Polygon, and Tron, and participate in the Solana ecosystem. In addition, the OKX Cryptopedia Solana special event is in full swing, where you can earn money from popular DApps in one stop and obtain potential future airdrops.

It is reported that in 2023, OKX Web3 wallet will successfully connect to 100+Solana ecological projects, covering many fields such as DeFi, NFT and GameFi. OKX Web3 wallet users are on the Solana network 7.29 million addresses have been created on the blockchain, and 790,000 on-chain transactions have been completed, with a cumulative transaction volume of US$230 million.

Ondo Finance launches the first batch of Ondo points program

* DeFi

On January 21, the tokenized financial product platform Ondo Foundation announced the launch of the first batch of Ondo points program, supporting the use of Flux, holding OUSG or USDY gets retroactive points, you get extra points by minting USDY, you get points by holding mUSD on the Mantle Network, etc.

Vitalik: Using efficient distributed DA can be an effective way to improve the actual security of Validium

* Data Availability

According to news on January 16, Vitalik Buterin, co-founder of Ethereum, tweeted to express his approval of Taiko CEO Daniel Wang’s new views on Rollup. Wang proposed that as long as the Rollup of other data chain DA is used, it can be considered as the Validium of Ethereum. Vitalik emphasized that the core of Rollup lies in its unconditional safety guarantee. He pointed out that if DA relies on systems other than Ethereum, such guarantees cannot be provided. Nonetheless, Vitalik believes that for many blockchain applications, becoming Validium is a more suitable choice. He also mentioned that using efficient distributed DA can be an effective way to improve the actual security of Validium.

Vitalik Buterin: Having stronger security properties than multi-signature can comply with the L2 standard

* Multisig

On January 18th, Ethereum co-founder Vitalik Buterin posted on the X platform: "For me, for those who are qualified to become L2 Something, it must have stronger security properties than multisig, even if it is not Rollup-like overall guarantee. Validiums satisfy this, optimization can, but requires rigorous analysis of the exact security gain."

Circle CEO: The United States is likely to pass stablecoin laws this year

< strong>* Stablecoin

News on January 16, Circle CEO Jeremy Allaire in Switzerland In an interview at the World Economic Forum in Davos, he said that the United States has a "very good chance" of passing stablecoin laws this year. He believes that the regulatory development of the encryption industry is accelerating globally and the United States is more likely to approve stablecoins than before. law. He said other governments began regulating the dollar before the United States and should act quickly to maintain U.S. leadership and protect consumers. Dante Disparte, chief strategy officer and global head of public policy at Circle, also agreed with Allaire’s view and believes that the United States will introduce stable currency rules in 2024.

Shiba Inu launches SHEboshis NFTs on ERC-404, enhancing liquidity and ownership, despite a minting bug resolved by increasing supply.

Sanya

SanyaDue to the complexity and novelty of the inscription protocol, various security issues arise frequently. This not only threatens users’ asset security, but also has a negative impact on the healthy development of the entire Inscription ecosystem.

JinseFinance

JinseFinanceOn February 1st, the Binance Web3 wallet was launched on the Inscription Market. Users can manage their BRC-20 assets. The performance is unsatisfactory. However, the competition in the Bitcoin ecosystem in 2024 is destined to become a roadblock between large institutions such as Binance and OKX. Long-term narrative.

JinseFinance

JinseFinanceFrom the generation and transmission of inscriptions to unique computing capabilities, to the creation of open virtual worlds through `BRC-420`, and the decentralized identification system of the `BRC-137` protocol, each protocol presents its own unique technology Characteristics and application areas.

JinseFinance

JinseFinanceSo far, I feel that the Ethereum inscription ecosystem is far inferior to the Bitcoin inscription ecosystem in both creativity and development.

JinseFinance

JinseFinanceToday we will talk about the nature, value logic and doubts of inscriptions, and what exactly is being “beaten” at Bitcoin inscriptions.

JinseFinance

JinseFinanceHit 10 billion MOVEs in three days! Is the MRC-20 "Smart Inscription" a hit? Does the inscription open a new narrative?

JinseFinance

JinseFinanceIf inscription transactions are allowed to crowd out normal BTC transfer transactions, then when inscription transactions take over the overwhelming dominant position, BTC will "change color": from "electronic gold" to "checkbook".

JinseFinance

JinseFinanceWill the recent upswing in the Bitcoin ecosystem be lasting, or is it just a blip?

JinseFinance

JinseFinanceFollowing Luke’s public statement boycotting Bitcoin Inscription on December 6, Bitcoin godfather Adam Back put forward a different view on December 17.

JinseFinance

JinseFinance