Source: Liu Jiaolian

With BTC (Bitcoin) trading sideways at 43k on Christmas, Inscription has started a new wave of carnival. When BTC pulls up and moves sideways, there will be a rotation effect of capital spillover. At this time, it coincides with the holidays in Europe and the United States, and there are no new hot spots in the industry. Mingwen, which is mainly promoted by the Chinese-speaking circle, continues its performance, which is bound to make those who get off the bus and those who have not got on the bus FOMO in their hearts, and get on the bus to take over.

Such a situation as this can’t help but make people feel a little worried.

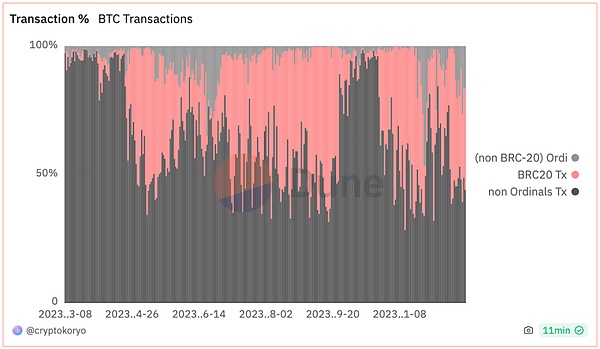

The following two pictures, the first is the proportion of Inscription in transactions on the BTC chain, and the second is the proportion of fee income contributed by Inscription.

It can be seen that the proportion of inscription transactions on the BTC chain has exceeded 50%, of which BRC20 is close to 35%; while the handling fees contributed by inscription transactions are close to 40%, of which BRC20 exceeds 20%.

Because Inscription occupies the storage space of the Segregated Witness area, it enjoys a discounted rate. Data shows thatInscription is using discounted rates, crowding out the space for normal transactions, causing normal transaction fees to become more expensive and intolerable.

The bigger crisis is that if Inscription transactions are allowed to crowd out normal BTC transfer transactions, then when Inscription transactions take over an overwhelmingly dominant position, BTC will "change color" ": From the narrative of "electronic gold" and value storage and value exchange media, it has quietly evolved into a new value paradigm of "checkbook" and gas fees.

Buffett’s criticism still rings in my ears. As early as 2014, Buffett said: Stay away from Bitcoin, it is just an illusion. The idea that it has great intrinsic value is a joke, in my opinion. Valuing Bitcoin is like trying to value a check written by a bank—it makes no sense at all.

What makes sense in Buffett’s words is that if BTC is only the value of the checkbook, rather than the value of the dollars written on the check, then BTC can indeed be regarded as worthless.

Every fool knows that the paper on the check is not worth much. What people want is the dollars written on the check.

The reason why BTC is so valuable today, up to 43,000 U.S. dollars, with a total market value of more than 850 billion U.S. dollars, exceeding the market value of Buffett’s Berkshire Hathaway, is not because BTC is a company that sells checkbooks. The value of a company is not the value of a dollar figure written on a checkbook.

If the electronic checkbook that comes with the Bitcoin system, also called the blockchain, is no longer written on BTC, but on various tokens, then BTC will eventually Reduced to a company selling checkbooks. I don't know how much such a company is worth, but it's probably far less than $850 billion.

The inscription movement has evolved into a "color revolution" that will destroy the foundation of Bitcoin's value.

If the handling fees of inscription transactions continue to rise to a dominant position, miners will be completely bribed and become allies in defending this movement. From that moment on, there may be no turning back.

The change in the value paradigm and the disappearance of the value narrative will inevitably lead to a serious decline in the valuation of BTC. There is no need for spot ETFs to be listed, because it is impossible to set up a separate ETF fund for a checkbook company, institutional capital has withdrawn, and BTC has plummeted.

The assets in the hands of BTC veterans have shrunk severely, and their purchasing power has declined severely. Why does the inscription need to spread flowers in the BTC ecosystem? Isn’t it just that the valuable BTC in the hands of the old guns is what you are looking for to take the last shot? Now that the assets of the old guns have shrunk, they are no longer able to take on the last stick. Those who beat the drum and spread the flowers dispersed like birds and beasts, and went to other ecological speculations for new markets, leaving behind a piece of BTC that was messy in the wind.

BTC miners have suffered a severe decline due to the collapse of BTC prices and the departure of speculative hot money. Miners who cannot make ends meet can only shut down their machines one after another. The computing power of the entire BTC network has plummeted, and network security has plummeted. Of course, there’s no need to complain if you seek benevolence and get benevolence. The checkbook is not electronic gold and does not require such huge computing power to maintain it. Prices fall - computing power falls - valuations fall, and the death spiral begins.

Wall Street and smart capital have discovered that if there is a better checkbook technology, obviously Ethereum, with its low-carbon financial settlement layer narrative, is the chosen one. Sun Tzu's Art of War says: Be invincible first, then wait until the enemy becomes victorious. Ethereum finally waited for the day when the Bitcoin fortress was breached from within. Ethereum took advantage of the situation to counterattack and surpassed Bitcoin in one fell swoop.

As a result, Bitcoin eventually became abandoned.

Inscription killed Bitcoin.

Cheng Yuan

Cheng Yuan

Cheng Yuan

Cheng Yuan JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Kikyo

Kikyo Coindesk

Coindesk Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph