Author: Jan Wüstenfeld; Compiler: Felix, PANews

Germany's sale of Bitcoin has been a hot topic recently. In the past month, starting around June 19, the German state of Saxony began to transfer Bitcoin from wallets associated with the German Federal Criminal Police Office (BKA) for sale. The BKA legally seized nearly 50,000 Bitcoins (about $2.12 billion) from the operators of the movie piracy website Movie2k.to, which was active in 2013.

The BKA received these Bitcoins in mid-January after the suspects "voluntarily transferred the money." Since they started withdrawing bitcoin from their wallets, their bitcoin holdings have fallen to 6,894 bitcoins as of 17:00 (UTC+8) on July 12. (PANews Note: The address has been sold off and holds 0.005 BTC)

Since the outflow of funds, the price of Bitcoin has fallen by about 11%.

So, is the price drop caused by Germany? The answer is no, at least not directly. Here is a detailed explanation:

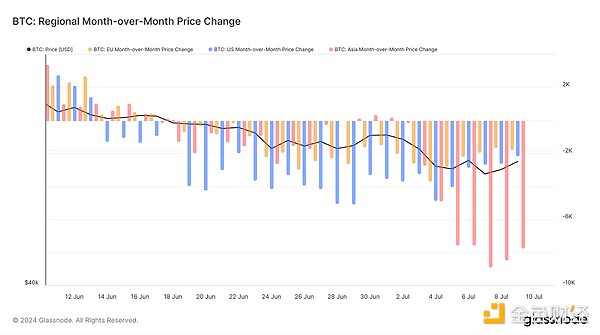

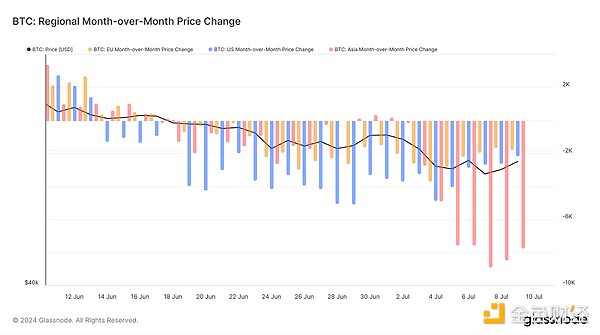

Analyzing trading hours and price changes

To better understand the situation, take a look at the trading hours and monthly price declines over the past few months. Here the chart is divided into European, Asian and US trading hours. Working hours are:

US: 8am to 8pm Eastern Time (13:00-01:00 UTC)

Europe: 8am to 8pm Central European Time (7:00-19:00 UTC)

Asia: 8am to 8pm China Standard Time (00:00-12:00 UTC)

Although the decline occurred during European trading hours, it was more obvious during U.S. trading hours. In particular, the month-on-month decline over the past five days occurred primarily during the Asian trading hours. This suggests that the German sell-off was not the direct cause of much of the price decline, as German government officials likely would not sell their Bitcoin holdings overnight.

It is worth noting that wallet flow data also supports this "fact".

Wallet flow data

Wallet flow data provides further insights. German authorities do not appear to be selling their Bitcoin holdings over the counter, but appear to be active on exchanges. This has some benefits and lends itself to further exploration of their behavior.

This article observes outflows from wallets during the day (Europe), and inflows to wallets around 6-8 pm (UTC time, which is German evening time).

Why Do They Do This? It seems that limit sell orders are set during the day, and when the officials go home at night, they close and withdraw all outstanding limit orders and transfer the remaining Bitcoin back to the wallet. This may be for security reasons, as they don't want to leave a large amount of Bitcoin on the exchange at night (at least they seem to understand the phrase "not your keys, not your tokens!").

Impact on the Market

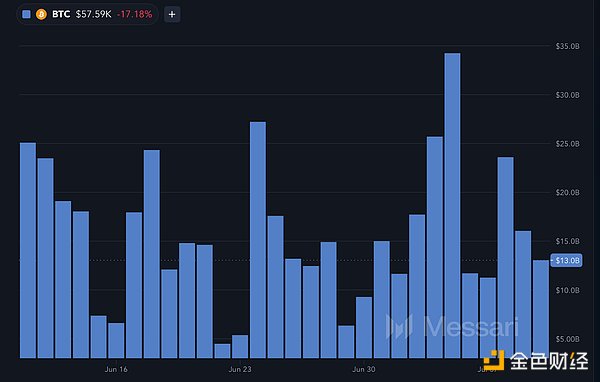

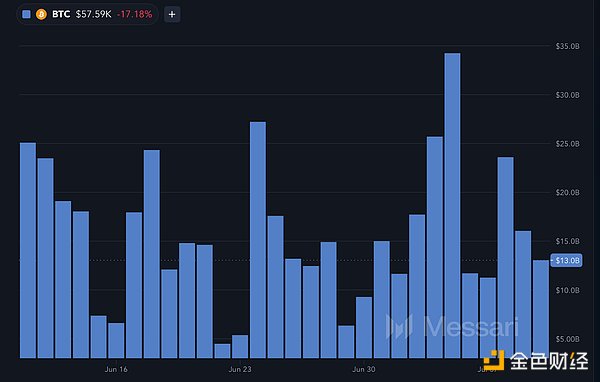

Relative to the overall market, the direct impact of the German authorities' sale of Bitcoin seems small. Even on days with large outflows, such as June 8, when about $740 million (about 123,600 Bitcoins) flowed out, this amount is small compared to the overall market liquidity. According to Messari data, actual trading volume is usually between $10 billion and $35 billion. In general, the liquidity of the Bitcoin market is very strong.

The reason for Bitcoin's recent decline is more likely to be that negative narratives have played an important role. The sell-off around Germany and the news that Mt. Gox will pay creditors may have prompted people to sell Bitcoin.

Conclusion

In summary, although the actions of the German government have had some impact, they are not the main reason for the recent price drop (at least not directly). The impact on Bitcoin's price trend is more indirect, and narratives and emotions play a greater role.

The latest data shows that the German state of Saxony has sold all 50,000 bitcoins. Will this month go down in history like Bitcoin Pizza Day? Perhaps it will be called "Bitcoin Keine Ahnung" (BKA).

Related reading: Is there no hope for the crypto market to "turn around" in July? These major positive factors will promote the reversal of the crypto market

JinseFinance

JinseFinance