Arthur Hayes:中国将如何再次影响比特币

对于那些将见证信贷创造增长的普通人来说,解药是什么?比特币。

JinseFinance

JinseFinance

Author: Arthur Hayes, Founder of BitMEX, Medium; Translator: Deng Tong, Golden Finance

Ping, Ping, Ping, this is the sound of my phone reminding me of nighttime snowfall at various ski resorts in Hokkaido that I monitor. While this sound brought me great joy in January and February, in March, it only brought FOMO.

I set out from Hokkaido in early March and have spent the past few ski seasons there. My recent experience tells me that Mother Nature starts heating up the ski resorts around March 1st. I am a beginner skier and only like the driest and deepest ski resorts. However, this season, a huge change has taken place. There was a brutal warm front in February that dispersed the snow. The cold weather did not return again until the end of the month. But the temperatures returned to cold in March, and 10 to 30 cm of fresh snow would accumulate every night. This is why my phone kept ringing.

Throughout March, I sat in various hot and humid countries in Southeast Asia, constantly and stupidly checking the app and ruining my decision to leave the ski resorts. April’s milder weather finally arrived, and with it my FOMO.

As readers know, my skiing experience serves as a metaphor for my macro and crypto trading books. I wrote before that the end of the Bank of America Term Funding Program (BTFP) on March 12 would cause global markets to plummet. The BTFP was canceled, and the vicious sell-off in the crypto space did not occur. Bitcoin decisively broke through $70,000, peaking at around $74,000. Solana continued to rise alongside various puppy and kitten memecoins. My timing was off, but like the ski season, the unexpectedly favorable conditions in March will not be repeated in April.

While I love winter, summer also brings joy. The arrival of summer in the northern hemisphere brings me the joy of sports, and I reschedule my time to play tennis, surf, and kiteboard. Summer will usher in a new influx of fiat liquidity, thanks to the policies of the Federal Reserve and the Treasury.

I will briefly outline my mind map of how and why risk asset markets will experience extreme weakness in April. The macro setup is favorable for those brave enough to short cryptocurrencies. While I will not be outright shorting the market, I have closed several shitcoin and memecoin trading positions and are taking profits. I will be in a non-trading zone between now and May 1st. I hope to return in May with dry powder, ready to deploy and ready for the real start of the bull market.

The Bank Term Funding Program (BTFP) ended a few weeks ago, but the US non-Too-Big-to-Fail (TBTF) banks have not faced any real pressure since then. This is because the high priests of scam finance have a series of tricks up their sleeves to bail out the financial system through secret money printing. I will peek behind the scenes and explain how they are expanding the US dollar fiat money supply, which will support the general rise of cryptocurrencies - until the end of the year. While the end result is always money printing, the process is not without periods of slowing liquidity growth, which provides negative catalysts for risk markets. By going through this series of tricks and estimating when a rabbit will be pulled out of the hat, we can estimate when there will be a period when the free market is allowed to operate.

The Federal Reserve and most other central banks operate a facility called the discount window. Banks and other covered financial institutions that need funds can pledge eligible securities to the Federal Reserve in exchange for cash. By and large, the discount window currently accepts only U.S. Treasury securities (USTs) and mortgage-backed securities (MBSs).

Suppose a bank is screwed because a bunch of Pierce and Pierce baby boomer stooges are running it. The USTs held by the bank were worth $100 when purchased, but are currently worth $80. The bank needs cash to meet the deposit outflow. Rather than declaring bankruptcy, an insolvent shit bank can tap the discount window. The bank exchanges the $80 UST for an $80 dollar bill because under current rules, the bank receives the market value of the pledged securities.

To abolish BTFP and remove the associated negative stigma without increasing the risk of bank failure, the Fed and the U.S. Treasury now encourage troubled banks to tap the discount window. However, under current collateral terms, the discount window is not as attractive as it was with the recent expiration of BTFP. Let’s go back to the example above to understand why.

Remember that the value of the UST fell from $100 to $80, which means the bank has an unrealized loss of $20. Originally, the $100 UST was backed by $100 in deposits. But now the UST is worth $80; therefore, if all depositors flee, the bank would be short $20. Under BTFP rules, the bank receives the par value of the underwater UST. This means that the $80 worth of UST is redeemed for $100 in cash when it is delivered to the Fed. This restores the bank’s solvency. But the discount window only provides $80 for the $80 worth of UST. The $20 loss remains, and the bank remains insolvent.

Given that the Fed can unilaterally change collateral rules to balance the treatment of assets under BTFP and at the discount window, the Fed continues its stealth bank bailout by giving the insolvent banking system a green light to use the discount window. Thus, the Fed essentially solves the BTFP problem; the entire UST and MBS balance sheet of the insolvent US banking system (which I estimate at $4 trillion) will be available to support lending when needed with funds printed at the discount window. This is why I don’t think the market forced any non-TBTF banks into bankruptcy after the BTFP ended on March 12.

Banks are often required to finance governments that issue bonds at yields below nominal GDP. But why would private for-profit entities buy something with a negative real yield? They do so because bank regulators allow banks to buy government bonds with little to no down payment. When banks that have insufficient capital buffers against their government bond portfolios inevitably collapse as inflation sets in and bond prices fall as yields rise, the Fed allows them to use the discount window in the manner described above. As a result, banks prefer to buy and hold government bonds rather than lend to businesses and individuals who need money.

When you or I buy anything with borrowed money, we have to pledge collateral or equity to cover potential losses. That’s prudent risk management. But if you are a vampire squid zombie bank, the rules are different. After the 2008 Global Financial Crisis (GFC), world bank regulators sought to force global banks to hold more capital, thereby creating a more robust and resilient global banking system. The system of rules that codified these changes is called Basel III.

The problem with Basel III is that government bonds are not treated as risk-free. Banks must post a small amount of capital for their large sovereign bond portfolios. These capital requirements have proven to be problematic in times of stress. During the market crash in March 2020, the Fed decreed that banks could hold USTs without collateral to back them. This allowed banks to step in and store trillions of dollars worth of UST in a risk-free manner…at least in accounting terms.

When the crisis abated, the supplementary leverage ratio (SLR) exemption for UST was restored. Predictably, as UST prices fell due to inflation, banks went bankrupt due to insufficient capital buffers. The Fed came to the rescue through the BTFP and now the discount window, but this can only make up for the losses caused by the last crisis. How can banks step up and absorb more bonds at the current unattractive high prices?

The US banking system loudly declared in November 2023 that Bud Gur Yellen could not stuff more bonds at them because Basel III forced them to hold more capital in their government bond portfolios. So something had to give because the US government had no other natural buyers for its debt with negative real yields. Here is how the banks politely expressed their precarious situation.

Demand for US Treasuries from some traditional buyers may have weakened. Bank securities portfolio assets have been declining since last year, and banks hold $154 billion less in US Treasuries than they did a year ago.

Once again, the Fed under Powell has saved the day. At the recent US Senate banking hearing, Powell suddenly announced that banks would not be subject to higher capital requirements. Remember, many politicians have called on banks to hold more capital to avoid a repeat of the regional banking crisis of 2023. Apparently, the banks lobbied hard to remove these higher capital requirements. They have a good argument - if you, Bad Gurl Yellen, want us to buy shit government bonds, then we can only make money with unlimited leverage. Banks around the world manage all types of governments; the US is no exception.

The icing on the cake was a recent letter from the International Swap Dealers Association (ISDA) advocating for an exemption for USTs from the SLR I talked about earlier. Essentially, if banks are not required to make any down payments, then they can only hold trillions of dollars in USTs to finance the US government deficit on a future basis. I expect the ISDA proposal will be accepted as the US Treasury ramps up debt issuance.

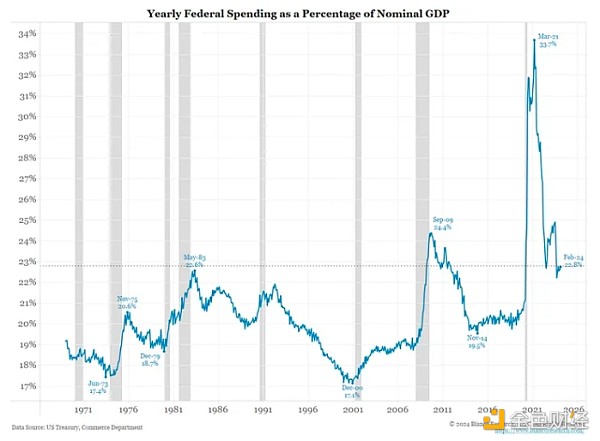

This excellent chart from Bianco Research clearly shows how wasteful the US government is, as evidenced by record high deficits. The two most recent periods of higher deficit spending were due to the 2008 global financial crisis and the baby boomer-led pandemic lockdowns. The US economy is growing, but the government is spending like it’s in a depression.

In summary, the easing of capital requirements and the potential future exemption of the UST from the SLR is a covert way of printing money. The Fed does not print money, but the banking system creates credit money out of thin air and buys bonds, which then appear on its balance sheet. As always, the goal is to ensure that government bond yields do not rise above nominal GDP growth. As long as real rates remain negative, stocks, cryptocurrencies, gold, etc. will continue to rise in fiat currency terms.

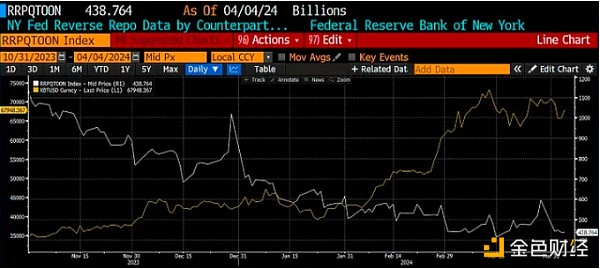

My article “Bad Gurl” dives into how the U.S. Treasury, led by Bad Gurl Yellen, is increasing the issuance of short-term Treasury bills (T-bills) to exhaust the trillions of dollars locked up in the Fed’s reverse repo program (MSRP). As expected, the decline in the MSRP has coincided with a rise in stocks, bonds, and cryptocurrencies. But now that the MSRP has fallen to $400 billion, the market is wondering what the next source of fiat liquidity will be to boost asset prices. Don’t worry, Yellen isn’t done yet, yelling “The loot is about to drop.”

RRP balance (white) vs. Bitcoin (yellow)

The fiat flows I will discuss are focused on US tax payments, the Fed’s quantitative tightening (QT) program, and the Treasury General Account (TGA). The timeline in question is from April 15 (tax due date for the 2023 tax year) to May 1.

Let me provide a quick guide to their positive or negative impact on liquidity to help you understand what these three things mean.

Paying taxes removes liquidity from the system. This is because taxpayers must take cash out of the financial system, such as by selling securities, in order to pay their taxes. Analysts expect tax payments to be higher for the 2023 tax year due to the large amount of interest income received and the solid performance of the stock market.

QT removes liquidity from the system. As of March 2022, the Fed allowed about $95 billion worth of USTs and MBS to mature without reinvesting the proceeds. This caused the Fed's balance sheet to decline, which, as we all know, reduces dollar liquidity. However, what we care about is not the absolute level of the Fed's balance sheet, but the pace of its decline. Analysts such as Joe Kalish of Ned Davis Research expect the Fed to reduce QT by $30 billion per month at its May 1 meeting. The slower pace of QT is good for dollar liquidity as the Fed's balance sheet declines at a slower pace.

When TGA balances rise, it removes liquidity from the system, but when TGA balances fall, it adds liquidity to the system. TGA balances increase when the Treasury receives tax payments. I expect the TGA balance to be well above the current level of about $750 billion as taxes are processed on April 15th. This is negative USD liquidity. Don’t forget that this is an election year. Yellen’s job is to get her boss, US President Joe Biden, re-elected. That means she has to do everything she can to stimulate the stock market, make voters feel rich, and attribute this great result to the “genius” of slow Bidennomics. When the RRP balance finally drops to zero, Yellen will spend the TGA, likely releasing an additional $1 trillion of liquidity into the system, which will boost the market.

The shaky period for risk assets is April 15th to May 1st. At this point, taxes remove liquidity from the system, QT continues to run at its current elevated rate, and Yellen has not yet started to reduce TGA. After May 1st, the QT pace slows down and Yellen is busy cashing checks to drive up asset prices. If you are a trader looking for the right time to enter a brazen short position, April is the best time. After May 1st, it’s back to the business-as-usual schedule… asset inflation initiated by the financial shenanigans of the Fed and the U.S. Treasury.

The Bitcoin block reward is expected to halve on April 20th. This is seen as a bullish catalyst for the crypto market. I agree that it will push prices higher in the medium term; however, price action before and after can be negative. The narrative that the halving is bullish for crypto prices is well-established. When the majority of market participants agree on a certain outcome, the opposite usually happens. That’s why I believe Bitcoin and crypto prices in general will plummet around the halving.

Given that the halving is occurring at a time when USD liquidity is tighter than usual, this will add fuel to the frenzy of selling in crypto assets. The timing of the halving further adds weight to my decision to abandon the trade until May.

To date, I have made full profits on these positions in MEW, SOL, and NMT. The proceeds are deposited into Ethena's USDe and staked to earn huge yields. Before Ethena, I held USDT or USDC and earned nothing, while Tether and Circle earned full treasury yields.

Can the market overcome my bearish bias and continue higher? Yes. I have always been a big fan of crypto, so I welcome being wrong.

Do I really want to see my most speculative shitcoin positions when I two-step on Token2049 Dubai? Hell no.

So, I dump.

No need to feel bad.

If the USD liquidity scenario I discussed above comes to pass, I will have more confidence to imitate all kinds of shit. If I miss out on a few percentage points of gains, but definitely avoid losses in my portfolio and lifestyle, that is an acceptable outcome. With that, I bid you farewell. Remember to put on your dancing shoes, and we will see you in Dubai to celebrate the crypto bull run.

对于那些将见证信贷创造增长的普通人来说,解药是什么?比特币。

JinseFinance

JinseFinance中东冲突加剧不会破坏比特币的关键物理基础设施;随着能源价格飙升,比特币和加密货币将会上涨;新印的数千亿或数万亿美元将为比特币牛市重新注入活力。

JinseFinance

JinseFinanceBitMEX联合创始人Arthur Hayes宣布推出比特币Ordinals系列的新项目Airhead(傻瓜头,如下图所示)正式进入比特币数字收藏品市场。

JinseFinance

JinseFinance作为 BitMEX 的联合创始人和前首席执行官,Arthur 对于加密市场的见解深刻且独到。他在节目中分析了日元的波动对市场的影响,以及美国财政部在政治环境中的角色。

JinseFinance

JinseFinanceArthur Hayes warns of a potential deeper crypto market decline, citing rumours of a major player liquidating assets amid a recent sharp downturn.

Huang Bo

Huang Bo我想创作真实的数字艺术,我将其定义为展示一种表达人类创造力的新方式。我指示 Oyl 团队创建只能使用 Ordinals 技术完成的艺术系列。Oyl 的创意人员提出了Airheads概念。

JinseFinance

JinseFinance两位著名的加密货币市场专家阐明了本轮市场周期中模因币的未来,并预测狗狗币交易所交易基金 (ETF) 可能会很快推出。

JinseFinance

JinseFinance对于像人类这样的社会生物来说,叙事主要是通过群体的“智慧”创造的。 无论好坏,最有影响力的故事是每个人都相信的故事。

JinseFinance

JinseFinance这篇文章旨在解释为什么作为用户参与方式的积分是一种自然演变,它是继过去参与和筹资方法之后的逻辑性发展。

JinseFinance

JinseFinance亚瑟-海斯(Arthur Hayes)警告说,3 月份加密货币市场可能会下跌 20-30% ,理由是美国金融风险和美联储机制即将到期。

Bernice

Bernice