Original title: Boom Times... Delayed

Author: Arthur Hayes, Founder of BitMEX; Translator: Deng Tong, Golden Finance

Like Pavlov’s dogs, we all thought that the correct response to rate cuts was BTFD. This behavioral response is rooted in recent memories of low inflation in peacetime under the United States. Whenever there is a threat of deflation, which is terrible for holders of financial assets (that is, rich people), the Federal Reserve (Fed) responds forcefully by pressing the Brrr button on the printing press. The US dollar is the global reserve currency, creating easy monetary conditions for the world.

The effect of global fiscal policy to fight the pandemic ended the era of deflation and ushered in the era of inflation. Central banks belatedly acknowledged the inflationary impact of COVID-19, defended monetary and fiscal policies, and raised interest rates. Global bond markets, most importantly the US bond market, believe that our monetary masters are serious about defeating inflation. However, the assumption is that central bankers will continue to increase the price of money and reduce the money supply to appease the bond market. This is a very questionable assumption given the current political climate.

I will focus on the U.S. Treasury market because it is the most critical debt market in the world due to the role of the U.S. dollar as the world's reserve currency. All other debt instruments react in some way to Treasury yields, regardless of the currency issued. Bond yields combine market expectations for growth and inflation. The Goldilocks economic scenario is growth with little inflation. The Big Bad Wolf economic scenario is growth with high inflation.

The Federal Reserve has convinced the Treasury market that it is serious about fighting inflation by raising its policy rate at the fastest pace since the early 1980s. From March 2022 to July 2023, the Fed has raised interest rates by at least 0.25% at every meeting. During this period, the 10-year Treasury yield never exceeded 4%, even as the government-manipulated inflation index hit a 40-year high. The market is satisfied that the Fed will continue to raise rates to eliminate inflation, so long-term yields will not converge gradually.

US Consumer Price Index (white), 10-year US Treasury yield (gold), Fed Funds Cap (green)

This all changed at the August 2023 Jackson Hole Central Bastard Conference. Powell said that the Fed will pause its rate hikes at its upcoming September meeting. But the specter of inflation still haunts the market. This is mainly because inflation is mainly driven by increased government spending and shows no signs of abating.

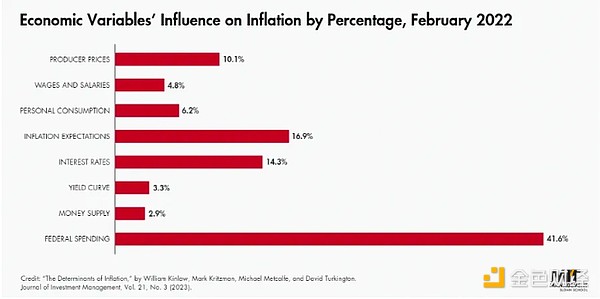

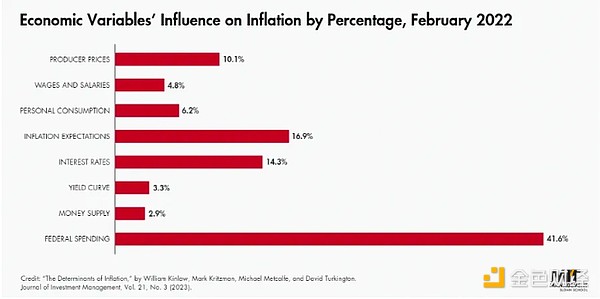

MIT economists found that government spending is the culprit for inflation.

On the one hand, politicians know that high inflation will reduce their chances of re-election. But on the other hand, providing voters with free stuff through currency devaluation will increase their chances of re-election. If you only dole out goodies to your inner circle, but the payers of those goodies are the larger of the hard-earned savings of your opponents and supporters, then the political calculation favors more government spending. As a result, you will never be voted out of office. This is exactly the policy pursued by the administration of U.S. President Joe Biden.

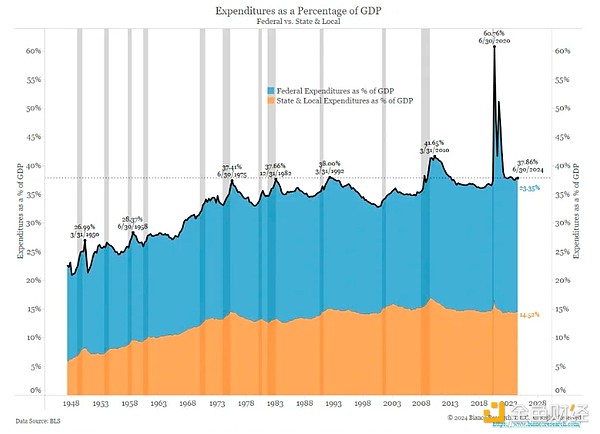

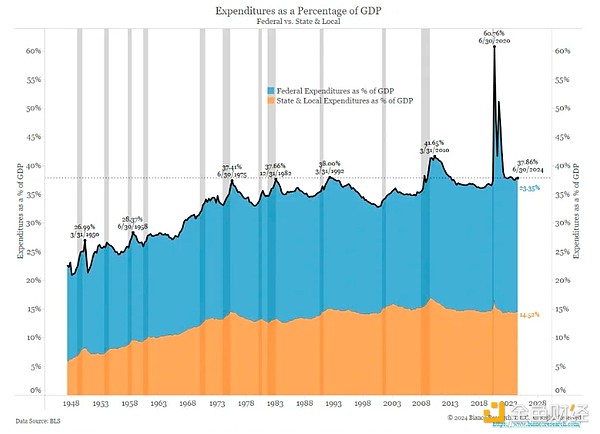

Total government spending is at its highest level in peacetime. Of course, I use the word "peaceful" relatively, focusing only on the feelings of the citizens of the Empire; the past few years can hardly be described as peaceful for the poor souls who have died and continue to die because American-made weapons have fallen into the hands of those who advance democracy.

Spending is not a problem if taxes are raised to pay for the generous spending. However, raising taxes is a very unpopular thing for current politicians. Therefore, it did not happen.

Against such a fiscal backdrop, Fed Chairman Powell hinted at the Jackson Hole conference on August 23, 2023 that they will pause rate hikes at the upcoming September meeting. The more the Fed raises rates, the more it costs the government to finance the deficit. The Fed can put a stop to this wanton spending by making it more expensive to finance the deficit. Spending is the main driver of the Fed's attempt to quell inflation, but it refuses to continue raising rates to succeed. Therefore, the market will have its work cut out for the Fed.

After the speech, the 10-year Treasury yield began to rise rapidly from about 4.4% to 5%. This was quite astonishing considering that even with inflation at 9% in 2022, the 10-year yield was only hovering around 2%; 18 months later, after inflation fell to about 3%, the 10-year yield was heading for 5%. The rise in interest rates led to a 10% correction in the stock market and, more importantly, revived concerns that regional banks in the United States would fail again due to losses in their Treasury portfolios. Faced with rising costs to finance the government deficit, reduced capital gains tax revenue due to falling stock markets, and a potential banking crisis, bad girl Yellen stepped in to provide dollar liquidity and end the rout.

As I wrote in my article Bad Girl, Yellen gave forward guidance that the US Treasury would issue more Treasury bills (T-bills). The net effect of this was to pull money out of the Fed’s reverse repo program (RRP) and into Treasury bills, which could be re-used throughout the financial system. The announcement, made on November 1, 2024, kicked off a bull market in stocks, bonds, and most importantly, cryptocurrencies.

Bitcoin was volatile from late August to late October 2023, but after Yellen’s injection of liquidity, Bitcoin took off and hit an all-time high in March of this year.

What is the future of BTC?

History never repeats itself, but it always rhymes. I didn’t realize this in my previous article, Sugar High, where I talked about the impact of Powell’s salary adjustment. I was a bit perturbed because I was a consistent view on the positive impact of the upcoming rate cut on risk markets. On the way to Seoul, I happened to glance at my Bloomberg Watchlist, where I track the daily changes in the RRP. I noticed that it was higher than the last time I checked, which was puzzling because I expected it to continue to fall because the U.S. Treasury issued net T-bills. I dug a little deeper and found that the rise began on August 23, the day Powell adjusted his payroll policy. Next, I considered whether the surge in the RRP could be explained by window dressing. Financial institutions often lie about the position of their balance sheets at the end of the quarter. With respect to the RRP, financial institutions usually deposit funds into the facility at the end of the quarter and withdraw them the following week. The third quarter ends on September 30, so window dressing does not explain the surge.

Then I thought, could money market funds (MMFs) be selling T-bills in search of the highest and safest short-term dollar yields and parking cash in the RRP as T-bill yields fall? I have plotted a chart below of 1 month (white), 3 month (yellow) and 6 month (green) T-bills. The vertical lines mark the following dates: Red line - when the BoJ raised rates, Blue line - when the BoJ capitulated and announced that it would not consider future rate hikes if they thought the market was not reacting well, Purple line - the day of the Jackson Hole speech.

Money market fund managers must decide how to get the most return from new deposits and maturing T-bills. The RRP yield is 5.3% and if the yield is slightly higher, the funds will be invested in T-bills. Starting in mid-July, the 3 month and 6 month T-bills yields fell below the RRP yields. However, this is mainly due to market expectations of a significant easing by the Fed as the strong yen triggered the unwinding of carry trades. The 1-month Treasury yield is still slightly higher than the RRP yield, which makes sense as the Fed has not given forward guidance on a September rate cut. To confirm my guess, I plotted a chart of RRP balances.

RRP balances generally declined until August 23 when Powell gave a speech at Jackson Hole and announced a September rate cut (indicated by the vertical white line in the above chart). The Fed will meet on September 18 and the Fed Funds rate will be cut by at least 5.00% to 5.25%. This confirms the expected movement of the 3-month and 6-month T-Bills, with the 1-month T-Bill yield starting to close the gap. RRP yields only fall the day after a rate cut. Therefore, between now and September 18, this instrument offers the highest yield of all suitable yield instruments. Predictably, RRP balances began to rise immediately after Powell's speech as money market fund managers maximize current and future interest income.

While Bitcoin initially surged to $64,000 on the day of Powell's salary adjustment news, it has given back 10% of its fiat dollar price over the past week. I believe Bitcoin is the most sensitive instrument tracking the state of fiat liquidity in the U.S. dollar. Once RRP began to rise to about $120 billion, Bitcoin plummeted. Rising RRP eliminates money as it sits inert on the Fed's balance sheet and cannot be re-used in the global financial system.

Bitcoin is extremely volatile, so I accept the criticism that I may have read too much into one week's price action. But my interpretation of events fits the observed price action so well that it cannot be explained by random noise. It's easy to verify my theory. Assuming the Fed does not cut rates before the September meeting, I expect Treasury yields to remain firmly below the RRP. Therefore, RRP should continue to rise, and Bitcoin will at best fluctuate around these levels, and at worst slowly decline to $50,000. Let's see how it goes.

My shift in perspective has my hand hovering over the buy button. I'm not selling crypto because I'm a short-term bear. As I'll explain, my pessimism is temporary.

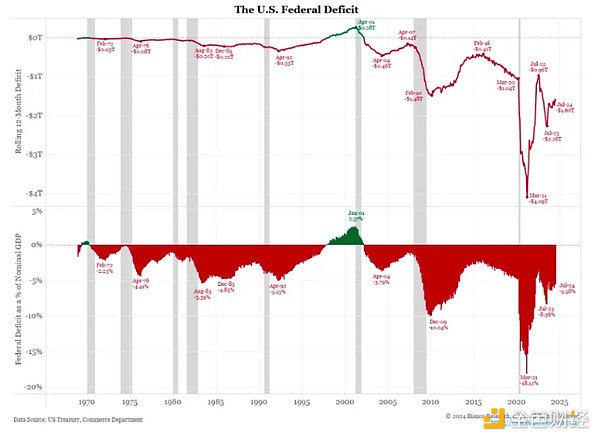

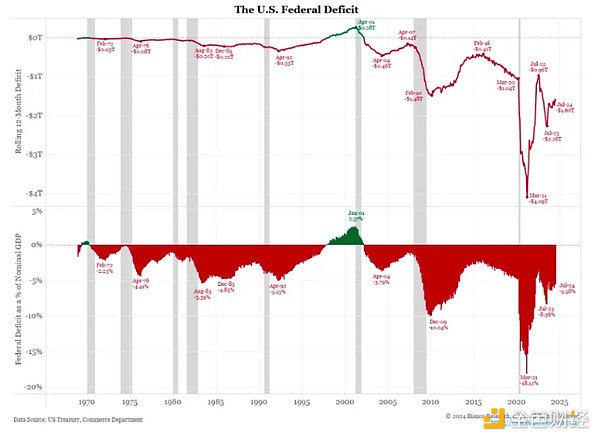

Runaway Deficits

The Fed has done nothing to control the most important factor in inflation: government spending. Governments will reduce spending or increase taxes only when they can no longer afford to finance their deficits.The Fed’s so-called restrictive policies are just rhetoric, and its independence is a cute story taught to gullible followers of economists.

If the Fed doesn’t tighten conditions, the bond market will tighten. Just as the 10-year Treasury yield unexpectedly rose after the Fed paused its rate hikes in 2023, the Fed’s 2024 rate cuts will spur yields toward a dangerous 5%.

Why is a 5% yield on the 10-year Treasury so dangerous to the health of the financial system under the rule of the United States? To answer the question, it’s because this is the level at which bad girl Yellen felt the need to step in and inject liquidity last year. She knows better than I do how broken the banking system is as bond yields rise; I can only guess at the extent of the problem based on her behavior.

Like a dog, she has conditioned me to expect a response when certain provocations are given. A 5% 10-year Treasury yield will prevent the bull market from having a strong run. It will also reignite concerns about the health of the balance sheets of banks that are not “too big to fail.” Mortgage rates will rise, reducing housing affordability, a big issue for American voters this election cycle. All of this is likely to come to pass before the Fed cuts rates. Given these circumstances and Yellen’s unwavering loyalty to Democratic Manchurian candidate Kamala Harris, these red bottoms will sweep across the “free” markets.

Obviously, bad girl Yellen will not stop until she has done everything possible to ensure the election of Kamala Harris as President of the United States. First, she will begin to draw down the Treasury General Account (TGA). Yellen may even provide forward guidance on her desire to drain the TGA so that the market will quickly react as she wishes… with more force! She will then instruct Powell to stop quantitative tightening (QT) and possibly restart quantitative easing (QE). All of these monetary policies are bullish for risk assets, especially Bitcoin. Assuming the Fed continues to cut rates, the size of the money supply injections must be large enough to offset the rising RRP.

Yellen must act quickly or the situation could turn into a full-blown voter confidence crisis in the US economy. That would mean Harris’ death at the ballot box…unless some mail-in ballots are miraculously found. As Stalin might have said, “It’s not the people who vote; it’s the people who count the votes.” I kid…I kid ;).

If this happens, I expect intervention to begin by the end of September. At best, Bitcoin will continue to fall between now and then, while altcoins will likely fall into a deeper trough.

I was on record saying that the bull run would resume in September. I changed my mind, but that does not affect my positioning in any way. I am still long in an unleveraged manner. The only additions to my portfolio are increasing position sizes in solid shitcoin projects that are trading at increasingly steep discounts below my perception of fair value. The tokens of projects whose users pay real money to use their products will surge once fiat liquidity taps predictably increase.

For those professional traders with monthly PNL goals or weekend warriors using leverage, soz, my short-term market predictions are no better than selling crypto. I have a long-term bias that the idiots running the system will resort to printing money to solve all problems. I write these articles to contextualize current financial and political events and see if my long-term assumptions are still valid. But I promise that one day my short-term predictions will be more accurate...maybe...I hope ;).

JinseFinance

JinseFinance