Author: Jack Inabinet, Bankless; Compiler: Baishui, Golden Finance

EigenLayer is undoubtedly the most anticipated airdrop opportunity in the history of cryptocurrency, but is the airdrop after the token drop inevitable for EIGEN and the broader Ethereum ecosystem?

EigenLayer is at the forefront of re-staking, creating a shared security market that allows developers seeking to create decentralized networks to circumvent the difficulties associated with bootstrapping and operating their own trust networks, lowering the entry barrier to creating these networks and empowering the long tail of cryptographic security applications.

The EIGEN airdrop alone is expected to rank among the largest airdrops in cryptocurrency history, and depositors can easily receive increased allocations from the Liquidity Re-staking (LRT) protocol and Active Validation Services (AVS)!

In anticipation of these upcoming airdrops, nearly 5 million ETH (worth about $15.5 billion) has been reallocated to EigenLayer, but there are growing concerns that the yields generated by the protocol's AVS will not satisfy depositors in a post-EIGEN airdrop world.

Market participants deposit EigenLayer not out of their own generosity, but because they believe that doing so will generate financial returns that exceed their opportunity costs, or through alternative strategies (e.g., depositing for decentralized exchanges).

While EigenLayer currently supports delegation to AVS, they have not yet generated a yield, meaning that depositors are simply speculating on future airdrops that will compensate them.

In the absence of actual income, imaginations can run wild when predicting valuations, but their inevitable arrival may pour cold water on the collective delusion that "EigenLayer is easily worth tens of billions of dollars"; if AVS yields disappoint, the protocol will find it increasingly difficult to justify high valuations.

Many AVSs are not directly comparable, however, Celestia (a blockchain that provides data availability services similar to EigenDA) only generates a few thousand dollars in revenue per year, which is a pittance for a $12 billion network that relies on high levels of token inflation to attract investors to protect its network.

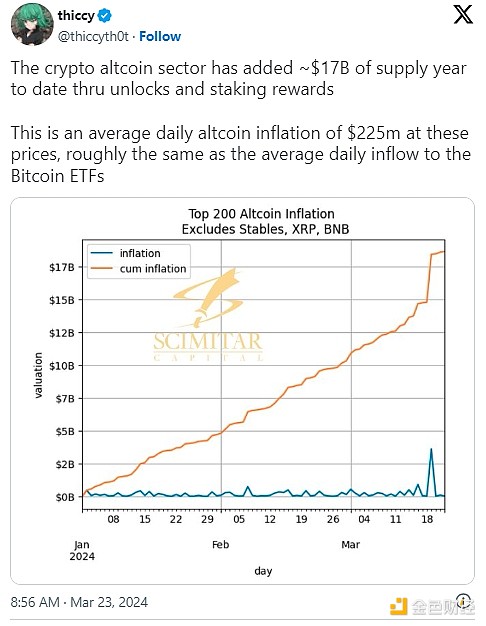

AVSs must employ their own inflationary token economics to provide security, which only exacerbates the oversupply of alternatives that the market has been struggling to digest in recent weeks.

To avoid a massive exodus of TVL in the event of insufficient AVS yields, EigenLayer will likely only distribute a small fraction of the total tokens it intends to airdrop in the first round, thereby fulfilling the promise of future EIGEN rewards as a carrot to incentivize depositors.

Unfortunately, if the market begins to scrutinize the sustainability of this, it may view EigenLayer as overvalued, negatively impacting the perceived value of future airdrops and causing TVL to drain from the protocol until an equilibrium is reached where remaining depositors feel they are adequately compensated for their opportunity cost of capital.

Speculators seeking to maximize EigenLayer opportunities often do so with high leverage, fueling demand for a variety of crypto applications, from general money markets to yield-splitting protocols.

While high-yield EigenLayer opportunities benefit the entire Ethereum DeFi ecosystem, depositors’ dissatisfaction with implied returns could unwind positions, eroding yields and triggering negative consequences for projects that rely on successful re-staking.

Furthermore, EigenLayer has been a major sink for ETH since December, with deposits growing 6,100% in less than 5 months. If marginal inflows of ETH from EigenLayer users seeking airdrops are diverted to selling while abandoning DeFi protocols that facilitate speculative activity, the price of ETH and other related crypto assets will be adversely affected.

By aiming for greatness and catalyzing a revolution in cryptoeconomic security, EigenLayer makes its airdrop front-running an obvious strategy, but the rewards in crypto do not come without risk, and it is questionable whether EigenLayer’s current deposit levels are sustainable.

While the protocol is free to mint and inflate its tokens, market participants must buy the ever-increasing supply or the token price will fall.

While the concept EigenLayer is pursuing is certainly laudable, it remains to be seen whether restaking is truly the next great crypto innovation, or just another crypto pipe dream that relies on token inflation that is unsustainable and generates little to no real revenue.

If the latter scenario proves to be true, EigenLayer will be relegated to the “bad idea” bin, dealing a major blow to the Ethereum ecosystem and losing a critical shared narrative.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Olive

Olive Bankless

Bankless Twitter

Twitter Cointelegraph

Cointelegraph 链向资讯

链向资讯