Author: David Hoffman, Bankless; Translator: Baishui, Golden Finance

Meme coins have sparked a strong discussion.

Some see them as degenerate distractions - inefficient, zero-sum games at the expense of others. Others see them as a grassroots reaction to the top-down influence of elites and venture capital.

We all know the debate - the industry has had such conversations countless times. However, like many aspects of cryptocurrency, the arc of meme coins is dynamic and adaptive, not inert.

There is reason to be optimistic about the future of meme coins.

The term meme coin has been overused and too broad. Not all tokens labeled meme coins fit the stereotype of empty, inert gimmicks. Some tokens started out as meme coins but later evolved into something more, but due to inertia, people still end up labeling them meme coins.

Platforms like Pump.fun have achieved token creation, increased token numbers, and democratization. Of course, with low barriers to entry, most of these tokens were created with ease — a funny name, a quirky picture — meant for entertainment and little else. However, amid the noise, some memes have gained substance and driven value in unexpected ways.

Pump.fun, Clanker, and Token Launchpads make it incredibly easy to create liquid tokens. Permissionlessness and accessibility are core value propositions of our industry.

More Convenient

The direction of the crypto industry has been to increase the accessibility of token creation for the average individual.

The history of cryptocurrency is one of increasing accessibility to token creation. Every bull run brings new mechanisms:

2013: People learn that it’s not hard to fork Bitcoin’s codebase and create a new blockchain.

2017: Ethereum introduces ERC-20 tokens without launching a full blockchain.

2021: NFTs and minting mechanisms unlock another token standard and distribution mechanism, turning quirky images into speculative assets.

2024: Pump.fun combines token minting and AMM liquidity, all packaged into a simple interface.

This model goes beyond tokens. Why are there so many L2s? Because Optimism's OP stack reduces the cost of creating rollups. Conduit takes it a step further by creating a front end for L2 creation.

The latest innovation in token creation is Clanker, an LLM Warpcast account where Warpcast users can simply tag Clanker with a stock symbol and an image, and Clanker will automatically mint tokens and launch Uniswap V3 pools, skipping the front end entirely.

Beyond Meme Coins

Critics often conflate token launchpads like Pump.fun or Clanker with the tokens they produce. While many of the tokens that appear on these platforms are classic meme coins, the launchpads themselves are neutral tools.

For example:

GOAT is the token associated with the first AI agent, from Pump.fun. GOAT is now a valid investment for those who want exposure to the Truth Terminal IP. Is there cash flow? No. Is there a direct correlation between GOAT and Truth Terminal? No, the relationship is tenuous and indirect. Will the price of the token increase as the Truth Terminal brand scales? I don't know, it's not investment advice, but it could be, that's why people buy GOAT.

ANON was launched on Clanker to facilitate access to ZK anonymous Farcaster accounts. If you have enough ANON tokens, you can anonymously tweet from Anon Farcaster and Twitter accounts. That's practicality.

We should learn to distinguish between tokens and launchpads. Pump.fun is not a meme coin launchpad. It is a token launchpad. Good launchpads only make memecoin issuance easier.

New Creation Mechanisms

Let’s discuss the benefits of token launchpads. We can moralize about the products they produce later.

In 2023 and 2024, crypto was plagued by a high FDV, low float token distribution meta.

The Points + High FDV Low Float meta was created by an unfortunate confluence of factors, primarily an excess of venture capital and the most draconian regulatory environment crypto has ever seen.

As a result of this confluence, the Points and Airdrop meta emerged and was adopted by sophisticated, extractive airdrop sycophants that created toxic and perverse incentives, fake metrics, and little to no actual value distributed to the intended stakeholders.

Meme coins are the exact opposite token distribution mechanism.

You can be the 7th person to buy a token with a market cap of less than $1 million and 100% liquidity of the token supply.

This token generation mechanism has merit!

On day one, the entire supply of tokens is on the market. That’s good. This eliminates different classes of investors locking up tokens. Everyone gets the same valuation. Everyone is an investor on the same level.

Still, there are still insiders and cabals that could sabotage tokens when they are created via launchpads. Furthermore, the principal-agent problem between token creators and token buyers has not been solved. Fully liquid token launches do not solve fundamentally human problems. Humans are imperfect and easily corruptible.

Regardless, the ability to launch a token with 100% supply on the market and instant AMM liquidity is a novel and valuable mechanism with strong merits that we should not throw away despite its easy abuse.

We should add it to our tool belt of token creation mechanisms, alongside ICOs and NFT mints, as an efficient way to launch and distribute tokens.

All Tokens Start as Memes

I encourage people to consider the potential of creating a token for your project using a platform like Pump.fun or Clanker.

Imagine a founder has a promising idea for a product or service. They believe it has value and plan to work long-term to realize its potential. To support their project, they decide to launch a token, either to decentralize governance, manage system risk, collect fees, or for any other possible reason.

This founder could:

All of these are valid options, and every founder should consider the merits of each.

Let’s consider the last one specifically. Let’s assume that this founder also launches a token early in the project’s lifecycle. Perhaps because they can, they make the token before building any other part of the project. If this is the setup, then the token is a meme. The founders have an idea for a plan, maybe a document. They share it with others, trying to get the meme into other people's brains, but it's still a meme nonetheless.

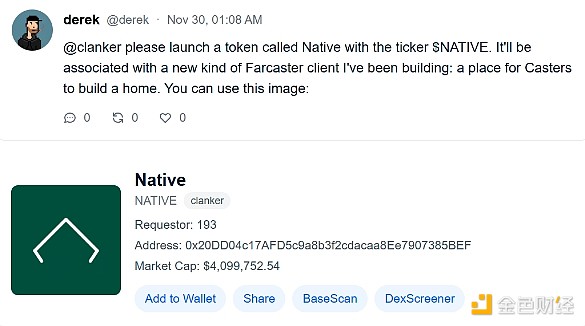

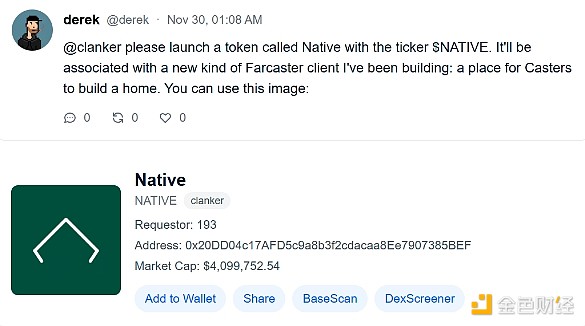

Take the recent Clanker token $NATIVE as an example. This Derek requested a token for his Farcaster project, which was apparently intended to build a new type of Farcaster client.

Maybe that's where the story ends! Maybe Derek had no intention of building Native, he just requested a Clanker token with a 1-tweet-long story about possibly building Native. Maybe Derek has been working on Native for over a year. Who knows! I certainly don't. Derek needs to prove it to the market. But, nonetheless, the token is fully liquid and potential buyers can make their own decisions based on the information they have.

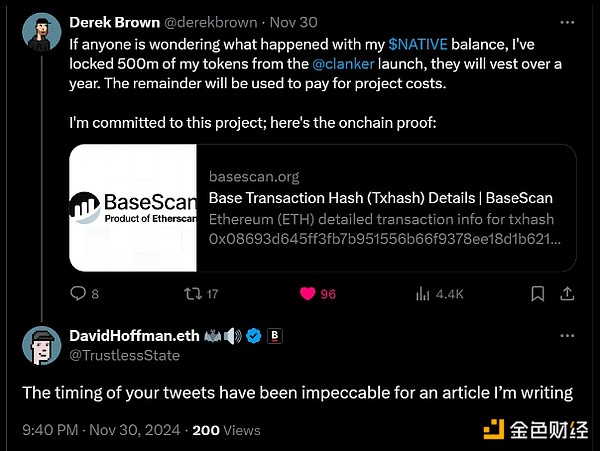

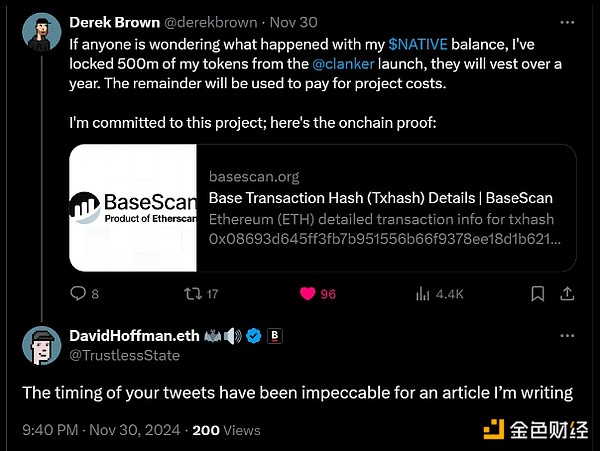

There is definitely a big principal-agent problem here. Founders can talk about their project as a means of convincing people to buy the token they created, and then they can dump the token, which may have been the plan all along.

After writing the above, Derek tweeted that he has locked up the token supply for a year! That guy minted his own tokens, bought his own supply (cheap), and then chose to tie himself to the mast. Legitimate projects with legitimate efforts can emerge from token launchpads, even if they also mainly launch worthless meme coins!

This is what we saw with many ICOs in 2017, and in addition, the industry as a whole has woken up to the idea of VC psychological warfare to spin stories around worthless projects. The principal-agent problem exists regardless of the token creation mechanism. It’s just that different groups of people are doing the psychological analysis.

Nevertheless, Pump.fun and Clanker tokens started out as memes and now represent valid efforts to build something truly revolutionary. Again, refer to ANON and GOAT. People just call these meme coins based on their creation mechanism, but they are not meme coins!

Mechanics of Improving Memecoins

There are multiple ways to improve the principal-agent gap between token developers and token buyers when using a token launchboard.

What if, instead of owning a portion of the token as an upside risk mechanism, the developer owns the rights to transaction fee revenue?

This is the mechanism Flayer is building with their incoming token launchboard, Flaunch. They are building a Uniswap V4 Hook to add some additional features and mechanisms to their token launchboard.

1. Transaction Fee Management

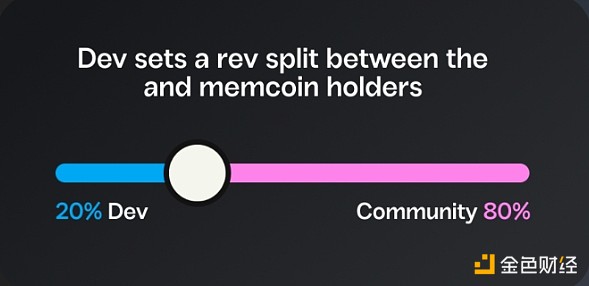

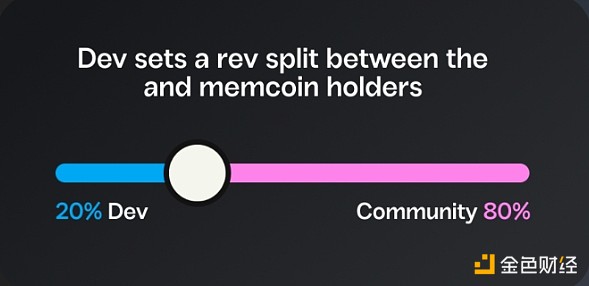

Tokens launched on Flaunch have revenue split between the developers and the community. Like Pump.fun, Flaunch takes a percentage of all transaction fees that pass through its platform. Unlike Pump.fun, Flaunch returns these transaction fees directly to the token developers and token holders (the community).

The developer of the token controls the revenue split between the developers and the community. This is a parameter set at the launch of the token and can be anywhere between 100% community, 0% developers and 20% community, 80% developers. The community must receive at least 20%.

The fees collected by the token community can be used to purchase tokens and add them to LPs, and as trading volume increases, the price and liquidity of the token will increase. They call this a "progressive buy wall" and it's a great narrative. The fees collected by the developers can be used to fund their Lambos, or can be reinvested into the project to fund development and growth.

This is a more consistent mechanism that helps to narrow the gap between the principal and the agent. Through this mechanism, developers can monetize transaction fee revenue. They no longer have to sell a certain amount of tokens to fund development. This is highly consistent with NumberGoUp, as transaction fee revenue increases proportionally with the token price.

2. NFT Ownership

Who the “developer” of a Flaunch token is is determined by the owner of the NFT. Each token release on Flaunch comes with a 1/1, which is where the development transaction fee revenue comes from.

This NFT becomes a composable object, and further structures can be built around it. You can put that NFT into a multisig and have it governed by a team. Alternatively, the NFT can be governed by a DAO token vote, either a previously launched token or a new governance token.

The possibilities only expand from here.

So, has my stance on Memecoin changed?

Recently, I received some criticism on Twitter for my apparent pivot to Memecoin. Indeed, aside from the occasional appreciation of Dogecoin, I have never expressed support for meme coins, and I have expressed my preference for productive assets over the inertia of meme coins many times on Bankless.

I do think that Dogecoin may represent the best case scenario for meme coins. Dogecoin is a wholesome story of a community coming together under the banner of funny dog pictures and working together to increase the market value of Dogecoin in the name of good vibes. Additionally, Dogecoin has donated a significant amount of money to a variety of charities, including clean water projects in Africa, bee conservation efforts, the American Cancer Society, education, animal welfare, homeless support, and of course, my favorite, sending the Jamaican bobsled team to the Olympics in 2014.

Despite this, there will still be normal, run-of-the-mill, inert meme coins. These tokens will continue to draw the ire of many because they have a hard time convincing anyone that they are anything other than a speculative PvP insider game with major agency issues that are difficult to sustain.

My preference for productive assets with development arcs remains the same, but my appreciation for the broader potential of memecoins is even broader.

First, I began to envision a world where memecoins play a much larger role in the internet economy than most people currently imagine.

What if the memecoin economy grows to a size that rivals that of the traditional stock market? Crypto protocols and markets are designed to be supersets of the existing financial system, offering unprecedented flexibility and reach. Memecoins can leverage this foundation to become a massive economic ecosystem in their own right. Listening to the vernacular of Zoomers and Generation AI makes it clear: Memes are at the core of internet culture, and memecoins will naturally play an important role in internet finance.

While meme coins are currently in a speculative hype cycle similar to ICOs or NFTs, and may face a market liquidation, they will remain a permanent fixture in the cryptocurrency space. The need to get in on something new and exciting early will never go away. In this sense, I’ve come to accept the long-term potential of meme coins and changed my perspective.

Secondly, as shown throughout this article, I see increasing opportunities for meme coins to evolve into something greater than the memes they were born from. Through additional mechanisms, these tokens can be transformed into foundational “currency legos” that support more physical systems. As meme coins have the potential to evolve into something more sustainable and productive, their palatability to me has also increased.

Let’s Explore Meme Coins Together

We are people with agency. I choose to believe that we can harness the power of memecoins that people clearly love and build mechanisms to move memecoins toward good, rather than toward disgusting.

When Pump.fun added live streaming, it began optimizing for attention and virality, and we all know the cost of optimizing for this outcome. When Pump.fun removed live streaming, the platform took an important step away from depravity and toward health. With this simple trick, it weakened the incentive for deplorable behavior and created space for more productive outcomes.

I think there are more tricks and mechanisms that can continue to improve the nature of memecoins. The memecoin industry is massive and here to stay. There is a lot of resources left to be extracted in the memecoin space to create sustainable value.

So, here’s a call to startups! Build memecoin infrastructure to help memecoins become more valuable. Help solve the principal-agent problem that exists in all token creation events.

Clanker and Pump.fun both produce unbreakable meme coins. These tokens have no backdoors — no one can mint more tokens, and no one can create honeypot traps. These are examples of token infrastructure that helps keep users safe.

There are more mechanisms like this. Let’s find them!

JinseFinance

JinseFinance