Author: PAUL VERADITTAKIT; Source: Vernacular Blockchain

“Meme” is defined as a unit that transmits cultural ideas, and it has been closely linked to crypto culture for 10 years.

The first Memecoin was launched in 2014 as a light derivative of Bitcoin, marking the birth of Memecoin and reaching a peak market value of $75 billion in the 2021 bull market.

Recently, the Memecoin market has seen explosive growth. An ERC-20 token with the theme of "Pepe the Frog" has risen by 400% in less than a year, with a market value of $2 billion. Another Memecoin, which symbolizes a purple hat and was launched on the decentralized social network Farcaster, has a market value of more than $1 billion, exceeding Farcaster's own valuation. Finally, there is the Memecoin of a dog wearing a knitted hat, which has risen to fame on Crypto Twitter for its viral appeal, has risen more than 20 times since the beginning of the year, and currently has a market cap of about $4 billion.

A social graphic representing the Memecoin of a dog wearing a knitted hat

Memecoins are coming on strong, and this article will explore why. We will provide a framework to better understand Memecoins, examine the evolving infrastructure that supports them, and discuss how they can significantly enhance network participation.

1. Memecoin relies on attention

A key realization is that Memecoin thrives on attention. In the Memecoin world, attention is crucial; attention drives community behavior, surrounding attention, and price fluctuations of Memecoin.

You will often see people promoting Memecoin in the comments section of Twitter. This behavior stems from a simple fact: the price of Memecoin ultimately depends on the attention it receives. The more attention a Memecoin receives, the more potential buyers it has. If the associated Meme is interesting or attractive, these potential buyers are more likely to make a purchase.

Community members promote memes to attract attention to their tokens

In addition to sharing memes on social media, Memecoin enthusiasts also come up with creative ways to attract attention to their tokens. For example, the Memecoin community of dogs wearing knitted hats raised $700,000 for a campaign to display their meme on the iconic Las Vegas Sphere. As a result, the token's value rose by 25% in anticipation of the attention brought by this publicity stunt.

Sometimes, Memecoins take advantage of existing attention rather than generating it themselves. For example, prediction markets like PredictIt and Polymarket let users bet on the outcome of the presidential election, while attention-based "Politifi" memecoins were developed around presidential candidates to speculate on public interest around the candidates. As the 2024 election date approaches, speculation on these "Politifi" memecoins, and therefore prices, have increased significantly.

So which memecoins are performing well? Those that people think will attract the most attention.

2. The Importance of Distribution

When evaluating a memecoin, token distribution remains one of the key factors that many potential buyers look at.

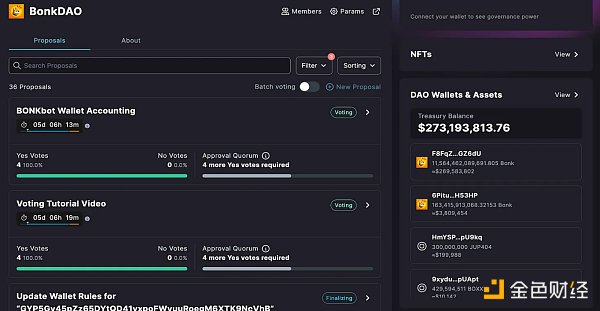

Some memecoin projects decide to reserve tokens for teams and other initiatives. In addition to airdropping tokens to community members and developers, many projects choose to set aside a portion of the supply for marketing activities, teams, and DAOs.

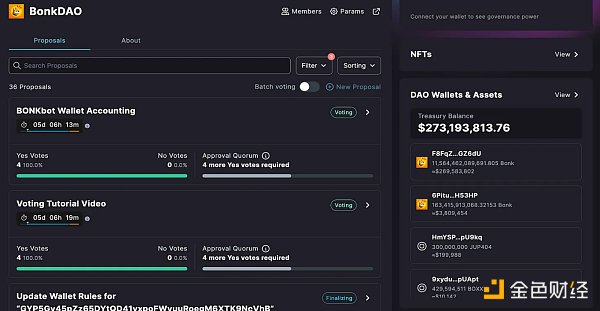

Setting aside a portion of the supply creates stronger incentives and increases the chances of long-term success. By allocating tokens with limited options to themselves, the team is incentivized to be more actively involved in the project and ensure the success of the token in the long run. Second, DAOs can be used to fund large initiatives.

Memecoin DAO Governance Initiative

Other Memecoins, such as the one depicting a dog wearing a knitted hat, may be seen as "more organic." In addition to initially providing liquidity, tokens must be acquired on the open market. While this strategy may mean it’s harder to raise funds and market projects, fair distribution remains a crucial factor for many Memecoin enthusiasts.

3. Memecoin trading opens up huge new market opportunities

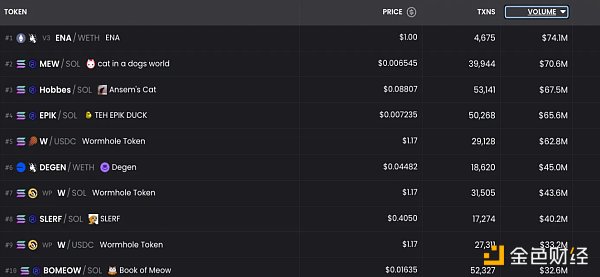

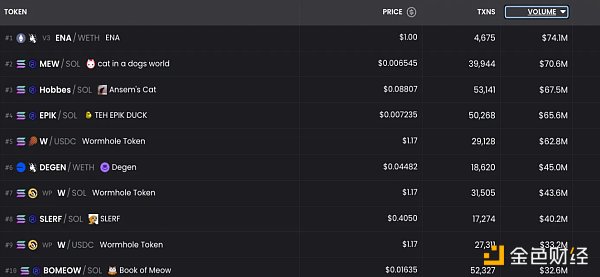

The Memecoin market is becoming huge - the total market value of the top ten tokens is currently over $50 billion. Memecoin’s on-chain transaction volume is staggering - Solana’s daily transaction volume of over $1 billion comes mainly from Memecoin. Just check the top ten tokens on Dexscreener at any time:

Therefore, builders have valuable market opportunities. Tools and applications designed for creating and trading Memecoin are gaining a lot of attention. For example, Bonkbot is a simple Telegram trading bot that makes it easy to trade Memecoin on Solana. In just 5 months, it has already made over $23 million in revenue.

Not only is it easier to trade Memecoin using platforms like Bonkbot - there is also infrastructure being built to make the process of launching a Memecoin even simpler. To launch a Memecoin, you typically need to create a token, set up a liquidity pool with funds on a decentralized exchange like Uniswap or Raydium, and promote the project.

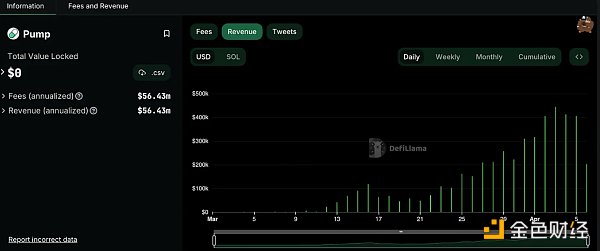

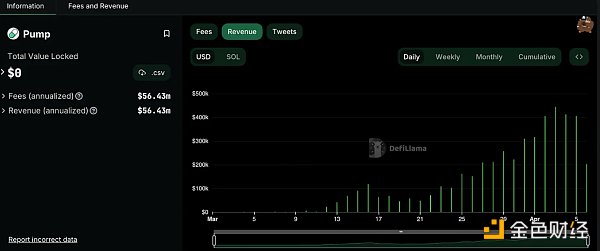

Pump.fun, a platform that allows users to launch Memecoins with one click, is one such example - thousands of users have used their platform to launch and discover the latest Memecoins. It is currently generating hundreds of thousands of dollars in revenue per day through transaction fees!

Pump.fun daily income (Source: DefiLlama)

4. How Memecoin drives mass distribution

Memecoin combines the fun of sharing memes with financial incentives to encourage purchases, turning ordinary memes into "super-charged" memes. The community behind the first memecoin, incentivized by holding tokens, developed the "what a surprise" dog meme into a movement that attracted the attention of Elon Musk and others. Understanding and applying the incentivized mass distribution properties of memecoins can not only significantly enhance or supercharge memes, but also transform other aspects of cryptocurrency.

Memecoin accelerates the distribution of memes due to incentives

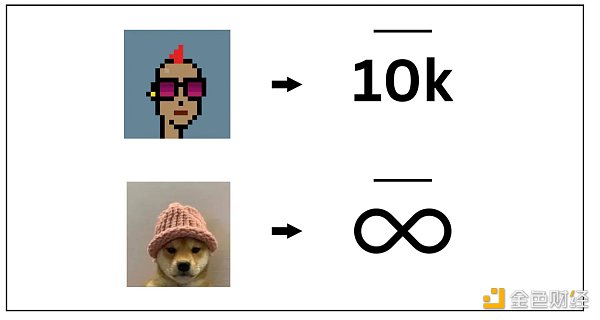

One area where the characteristics of Memecoin can be exploited is NFTs. Currently, most NFTs have performed poorly in this bull run. Why? They have a distribution problem.

While the scarcity of NFT collections makes them an excellent luxury asset, only a limited number of participants are incentivized to increase the visibility of the collection. Avatar collectibles like Cryptopunks, with a supply cap of 10,000, can serve as venerated status symbols. However, that same cap limits the fan base to a maximum of 10,000 people, limiting the broader engagement and visibility that Memecoin enjoys.

Memecoins, because they are fungible, can have an unlimited number of owners

The introduction of ERC-404s, a new standard that facilitates fractional ownership of NFTs, offers a creative solution to the NFT distribution problem. Projects like Pandora, DN-404, and Asterix are pioneering this space by allowing NFTs to be split into multiple shares, which can be called Memecoin. This means that a single NFT that was traditionally owned by one person can now be divided into many parts. This split expands the opportunity for a wider audience to access collectibles, who are incentivized to create more visibility for the collectibles while still maintaining uniqueness for the person holding the entire NFT.

5. The large-scale distribution of Memecoin stimulates blockchain and application activities

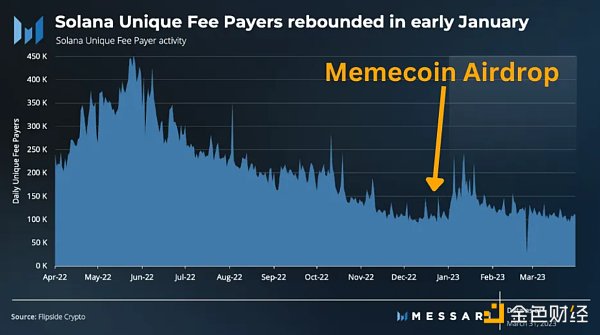

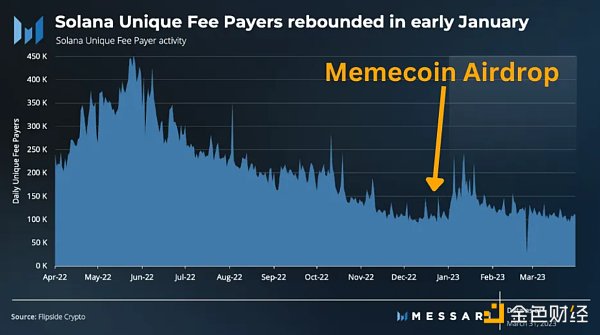

In November 2022, under the impact of the collapse of FTX, the activity of the Solana ecosystem dropped sharply. Many teams had just lost funds in FTX, which itself was closely associated with Solana, reducing community confidence and activity. However, on December 25, 2022, a Memecoin depicting a playful orange Shiba Inu was given to existing developers and users on the Solana network through an airdrop as a way to reward and revitalize the Solana community.

This strategy paid off. The Orange Shiba Inu Memecoin became a rallying point for the Solana community, quickly integrating into hundreds of DeFi protocols and applications on the platform. Users discovered they could earn yield on the Orange Shiba Inu Memecoin, use Memecoin as collateral, and even use Memecoin in games built on Solana. As activity and price surged around Memecoin, community enthusiasm grew in tandem, strengthening developer activity and keeping the chain moving through the bear market.

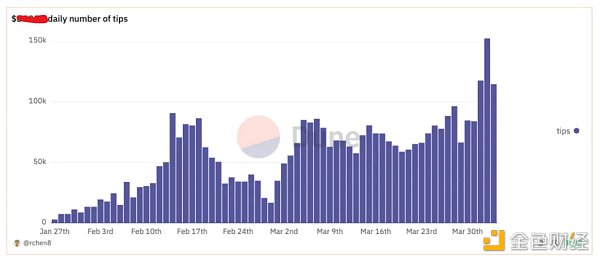

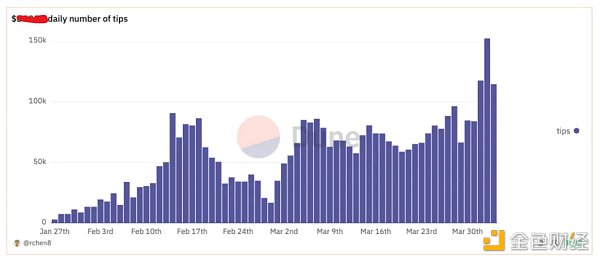

These stories aren’t isolated incidents; Memecoins play a vital role in kickstarting network activity. Take the billion-dollar purple hat Memecoin that originated on Farcaster, which started out as a way to tip users for their posts. Its launch has added extra incentives for users to post, significantly increasing Farcaster's activity. Memecoin has the ability to stimulate community vitality and promote interaction within the platform.

Since its inception, the Farcaster meme coin has been stimulating a large number of Farcaster activities

Recognition of Memecoin as a tool to stimulate network activities is growing. For example, blockchain Avalanche has established a $100 million "culture" fund, and Blast has issued Blast Gold by rewarding users for participating in memecoin activities. Social platforms such as short video platform Drakula have integrated Farcaster purple hat Memecoin to promote activities. I believe more networks and platforms should consider how to use Memecoin to stimulate activity.

6. Final Thoughts - A Trojan Horse Disguised as a Toy

Here are my main thoughts on Memecoin.

First, it is clear to me that Memecoin is not going away. I am watching the next generation adopt Memecoin as a fun social activity. Our current Generation Z Pantera interns are going crazy with their friends on the newly launched Memecoin, and it has become an easy and fun social way to experience the retracements and rallies together.

Second, Memecoin greatly stimulates the vitality of platforms and applications. While they are an incentive mechanism to help spread the "What a Surprise" Meme, memecoins can greatly enhance NFT projects, social protocols, and blockchains as a whole.

In a recent post by Ethereum founder Vitalik Buterin, he laid out interesting ideas about what Memecoin could be used for, focusing on philanthropy and Robin Hood-style games.

I would say that Memecoin is about even more than that. Ultimately, while they may look like a toy, Memecoins are actually a Trojan Horse for crypto — they are the easiest way to get the next generation to experience the latest DeFi applications and introduce them to all things web3. (A Trojan horse is something that is disguised as beneficial or valuable, but is actually deceptive or malicious. Memecoin is like the Trojan Horse of the crypto world, attracting a new generation to DeFi and web3 through its fun appearance.)

JinseFinance

JinseFinance