In the current blockchain world, Berachain may be the most "anti-traditional" project.

Founder Smoky wears a bear head mask every time he appears in public;

The project name "Bera" is a tribute to the famous "hodl" spelling error in the cryptocurrency world;

When other projects are talking about ZK and new programming languages, they chose to build an EVM-compatible Layer1 public chain based on Cosmos technology;

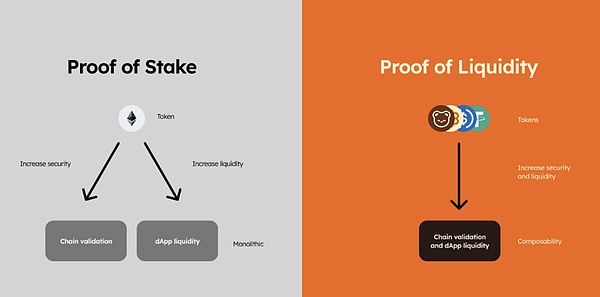

At a time when the transformation from POW to POS has become a trend, they proposed a new POL (Proof of Liquidity) mechanism.

Behind these seemingly nonsensical choices, there is a deep reflection on the pain points of the current public chain.

01 From NFT to Public Chain: A Unique Evolutionary Story

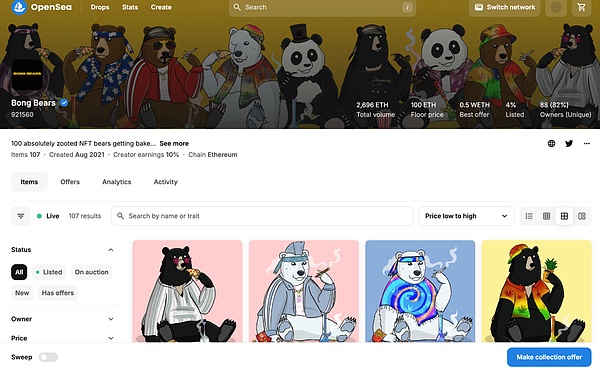

The story of Berachain begins with an NFT project called "Bong Bears". This seemingly random NFT series uses a rebase mechanism similar to OHM: users who hold the first generation of Bong Bears can obtain airdrop rights for subsequent series.

This simple design attracted a large number of users to hold for a long time, and then launched series such as Bond Bears, Boo Bears, Baby Bears, Band Bears and Bit Bears.

Such an NFT project eventually evolved into a public chain project with over 100 million yuan in investment and financing from top institutions and attracted much attention. What is its uniqueness?

02 The Dilemma of Traditional Public Chains and POL's Innovative Solutions

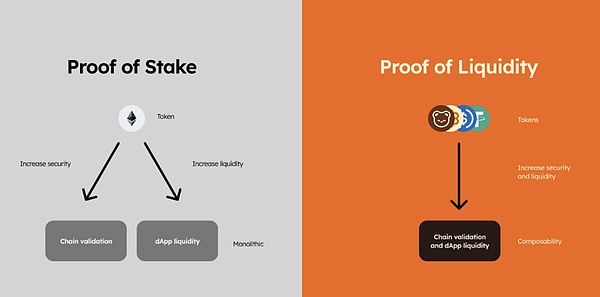

Traditional public chains face a fundamental problem: a large amount of value is locked in the infrastructure level, while builders who truly create value find it difficult to obtain reasonable returns. Verification nodes and token holders receive generous returns through staking, but their contributions are limited to maintaining network security.

Take some public chains as an example, their FDV is as high as 1-10 billion US dollars, but the actual TVL is less than 100 million US dollars, but they have to pay an annualized rate of return of more than 10% to maintain security. This mechanism has led to the emergence of the "ghost chain" phenomenon - the on-chain security is high, but there are almost no practical applications and activities.

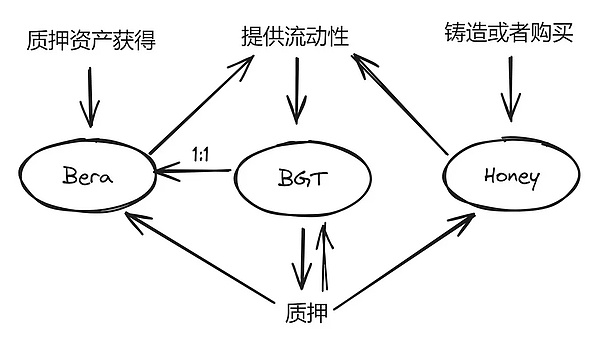

Proof of Liquidity (POL) is a new consensus mechanism proposed by Berachain. Unlike traditional PoS networks that get rewards by staking tokens, POL requires users to provide liquidity to a specific liquidity pool to get rewards. In other words, if you want to earn income in this network, you need to actually participate in the ecological construction, rather than simply locking tokens.

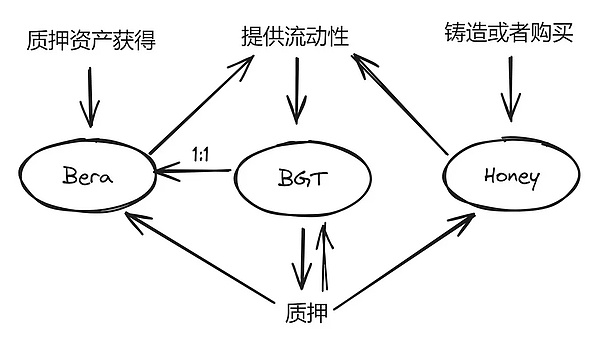

To support this mechanism, Berachain has designed an ingenious three-token system: BGT, as a non-transferable governance token, can be converted to BERA at a 1:1 ratio; BERA is used to pay gas fees and market transactions;

HONEY is a stablecoin that is over-collateralized by high-quality assets. These three tokens work together to build a self-sustaining economic model.

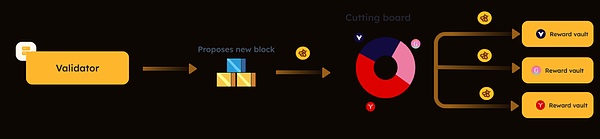

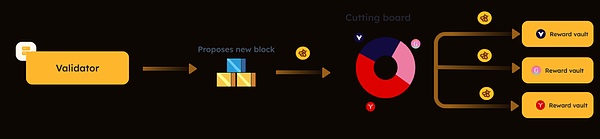

Under the POL mechanism, users receive BGT rewards by providing liquidity, and these BGT can be delegated to verification nodes to participate in network verification. Verification nodes not only participate in block generation, but also can vote to determine the BGT reward allocation ratio of different liquidity pools.

This creates a unique economic model: verification nodes need to carefully consider which projects are most valuable, because their votes directly affect the direction of the ecosystem.

This mechanism design achieves three key breakthroughs:

First, it directly directs network value to the builders and participants of the ecosystem. Each protocol can independently design the way users obtain BGT and create incentive mechanisms to promote ecological development. This direct value distribution model ensures that value creation behavior can be rewarded in a timely and sufficient manner.

Secondly, it establishes a symbiotic relationship between the validator and the project. The income of the validator is closely linked to the success of the project, which motivates them to actively support the development of the ecosystem instead of just focusing on their own staking income.

Finally, it creates a positive incentive loop. The increase in user participation leads to stronger projects, and strong projects attract more users and liquidity, forming a virtuous circle. This mechanism effectively prevents the emergence of the "ghost chain" phenomenon because the network value is directly linked to the actual activities and utility of the ecosystem.

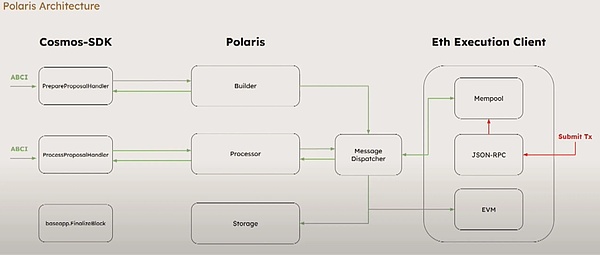

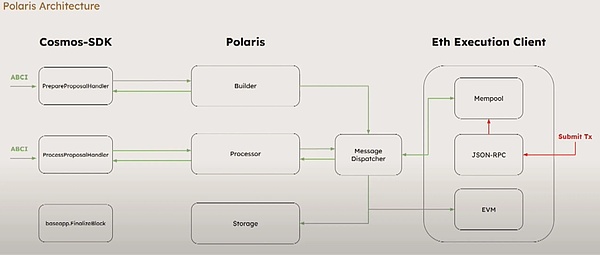

In terms of technical route, Berachain chose to build on Polaris EVM, a decision that brings two major advantages. First, full compatibility with EVM lowers the entry barrier for Ethereum developers; second, as part of the Cosmos ecosystem, Berachain has gained powerful cross-chain capabilities through the IBC protocol. This technical choice provides a solid foundation for the expansion of the ecosystem in the future.

03 Community Culture: From Meme to Strong Consensus

Berachain's community culture construction represents a new community operation idea in the cryptocurrency world. While many new public chains ignore community culture construction, Berachain has successfully built a community ecology with a strong sense of identity and high activity.

This unique community culture is first based on the understanding of Ponzi culture. The Berachain team, initiated by several senior DeFi project veterans, does not shy away from the Ponzi label, but faces it with an open and humorous attitude. This attitude has made the project gain more trust and recognition in the community. Although the outside world often compares Berachain to the next Luna, this comparison ignores the essential differences in the mechanism design between the two.

The second is the meme culture that is deeply rooted in the bones. From the project name "Bera" to the founder Smokey wearing a bear head mask to attend formal occasions, to the unique terms such as "Henlo" and "Ooga Booga" popular in the community, they all show a culture with a strong sense of the Internet, which is completely in line with the current crypto aesthetics and naturally cultivates a strong sense of community identity.

Finally, don't forget that Berachain originated from an NFT project. Starting from the initial Bong Bears, NFT is not only a digital asset, but also a carrier of community culture. Each project in the ecosystem spontaneously associates its NFT series with the Bear theme, forming a unified cultural symbol. This cultural identity is directly reflected in the data: the secondary market listing rate of major NFT series is less than 2%. Compared with simple tokens, these NFTs carry more cultural attributes and a sense of community belonging.

04 Eco-project

Berachain has adopted a bold but practical strategy in ecological construction: the official team will develop the core infrastructure in person.

The founding team realized that if multiple DEX, lending and derivatives platforms with similar functions were allowed to compete with each other, it might lead to meaningless involution and vicious competition.

Therefore, they decided to keep these three most important infrastructures in the hands of the official. More importantly, DEX, lending and perpetual contract platforms are usually the main sources of income in the blockchain ecosystem.

By officially operating these services, Berachain can better return the benefits to BGT holders, provide continuous value support for governance tokens, and thus promote the healthy development of the entire ecosystem.

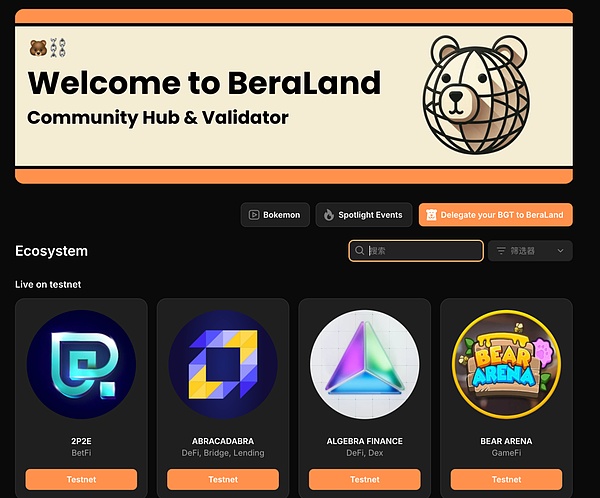

Currently, Berachain has attracted nearly 100 projects, among which DeFi projects dominate, fully demonstrating Berachain's emphasis on liquidity. 15 native projects have received bera incubator or VC investment, with a total of $24.4 million in public financing.

Shogun: Cross-chain transaction infrastructure

Shogun was selected for both the Build-A-Bera program and the Binance S6 incubation project, and is committed to solving the core pain points of cross-chain transactions.

Currently, cross-chain transactions face multiple challenges: users need to manage multiple wallets, handle gas fees for different chains, choose the right cross-chain bridge, and also need to have a deep understanding of each ecosystem. These complexities not only increase the difficulty of operation, but may also lead to inefficient transactions or capital losses.

Shogun solves these problems through an innovative intention execution system. The system introduces a "solver" mechanism to maximize TEV (trader extractable value) by optimizing the transaction path.

Specifically, when a trader sets a transaction intention, solvers will find the optimal execution path in a cross-chain environment: for buy orders, strive to complete the purchase at a price lower than the limit price; for sell orders, seek selling opportunities above the limit price. This mechanism converts traditional MEV into user benefits while providing a trading experience close to that of centralized exchanges.

Infrared Finance: Liquidity Pledge Innovation

Based on Berachain's POL mechanism, Infrared Finance has redesigned the liquidity pledge model based on the three-token architecture. The project provides BGT holders with a value maximization solution through the POL treasury and iBGT liquid pledge derivatives.

The project has received financing support from Binance Labs.

Kodiak: Efficient Liquidity Management

Kodiak is positioned as Berachain's native liquidity center. The project innovatively combines centralized liquidity and automated liquidity management technology to provide the ecosystem with the highest quality liquidity services, thereby supporting the efficient operation of the entire ecosystem. The project received a $2 million seed round investment.

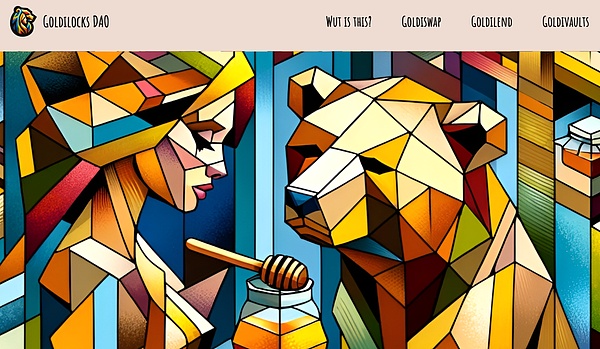

Goldilocks: Innovative integration of DeFi and NFTfi

Goldilocks has completed a $1.5 million financing led by Hack VC and Shima Capital, focusing on building DeFi and NFTfi infrastructure. The project consists of two core components:

Goldiswap: A trading platform based on a custom AMM, using a dual-pool design of FSL (supportive liquidity pool) and PSL (price-supported liquidity pool).

Goldilend: A lending platform built around the Bong Bears NFT series. Its innovation lies in the fact that the minimum valuation of NFT is determined by LOCKS token holders through governance voting, getting rid of the reliance on oracles, and bringing a new value discovery mechanism to NFT finance.

Honeypot Finance: Innovative Trading and Issuance Mechanism

Honeypot Finance has completed multiple rounds of financing of US$1.3 million and built two core products:

DreamPad: A token launch pad using the FTO (Fair Token Offering) model. The feature is that the project party has zero reservations and provides 100% of the tokens to the market to ensure maximum fairness.

HenloDEX: A decentralized exchange using the Batch-A2MM mechanism, which effectively prevents sandwich attacks through innovative trading mechanisms, while providing limit price trading functions to optimize user trading experience and reduce slippage.

More testnet projects can be queried through BeraLand.

05 Participate in the interaction

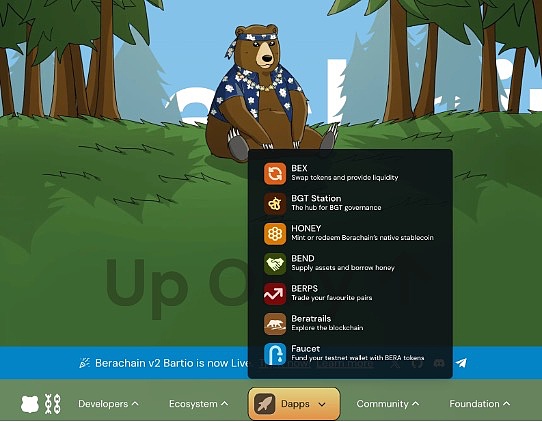

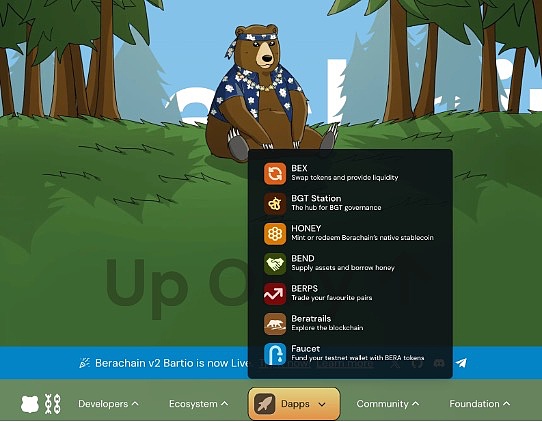

Berachain is running the second version of the testnet Bartio. The most basic interactive participation can refer to the Dapps interface of the official website. As mentioned above, they are all DeFi cornerstones made by Bera officially.

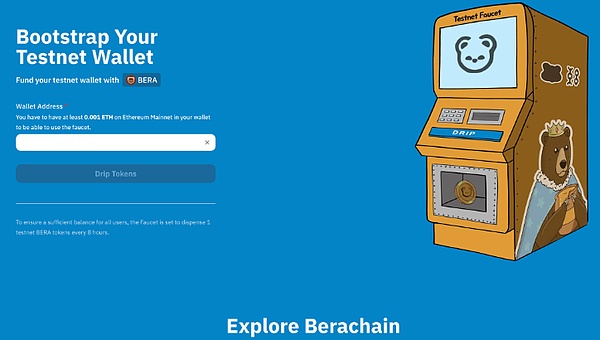

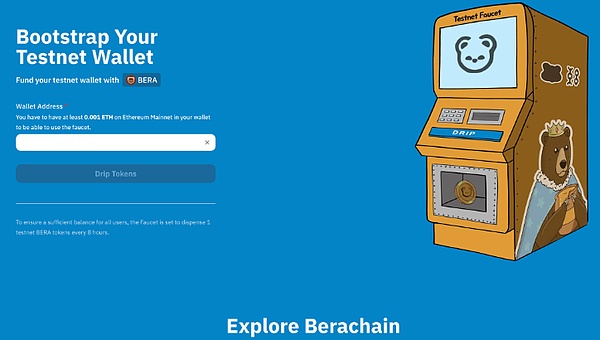

To participate in the interaction, you need to first receive the test coins from https://bartio.faucet.berachain.com/. A small threshold filter has been made. The receiving address needs to have a balance of at least 0.001ETH on the main network. Compared with the situation of "it is difficult to get water" in the previous test network, this round of test network water collection is very smooth.

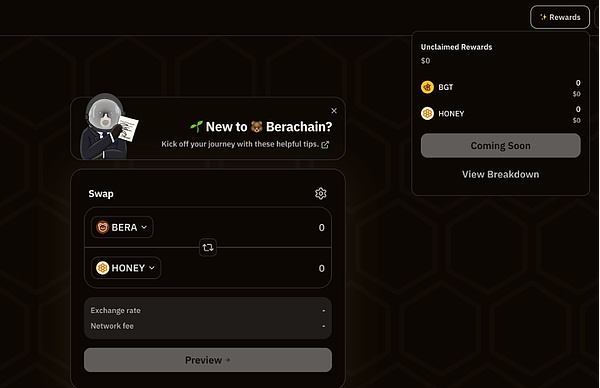

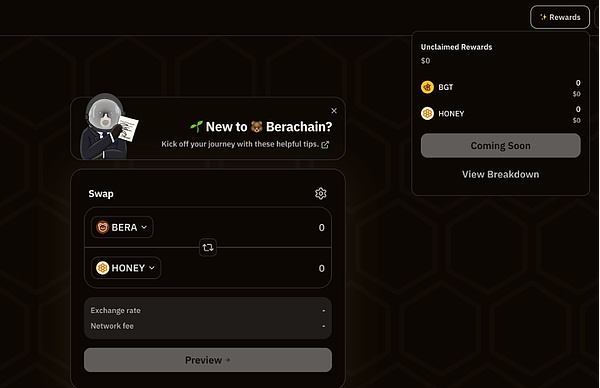

After receiving the test network tokens, you can swap on BEX and exchange the received $BERA for other tokens to provide liquidity. Note that you need to retain some $BERA when exchanging as gas consumption later.

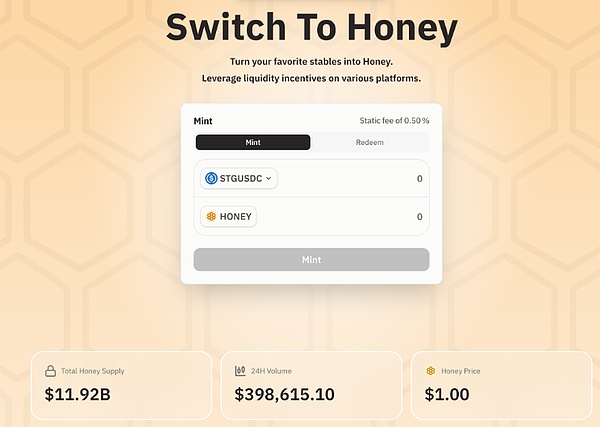

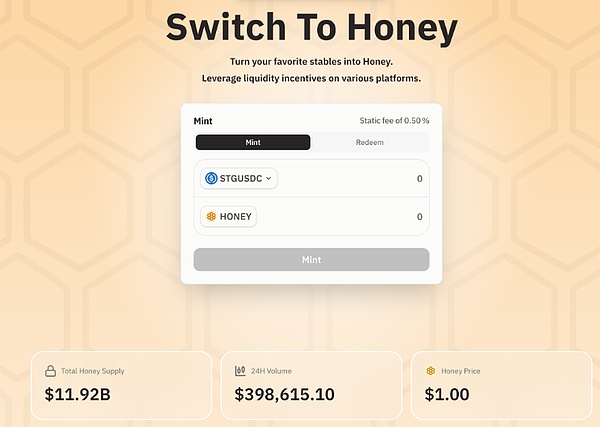

It is recommended to exchange $BERA into stablecoin Dai or STGUSDC, and use it to mint stablecoin $HONEY in HONEY.

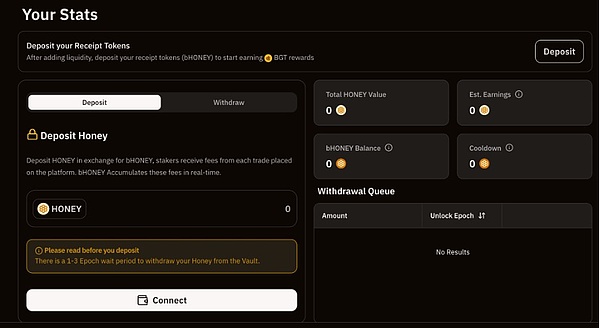

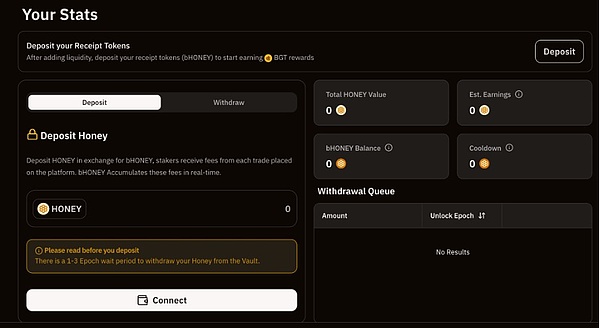

After obtaining $HONEY, pledge it in BERP, get bHONEY, and then pledge it in Station to the corresponding Vault to obtain $BGT income, or directly use it as trading margin to trade derivatives in BERP.

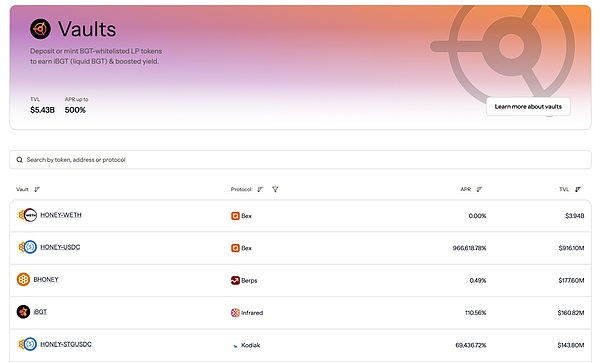

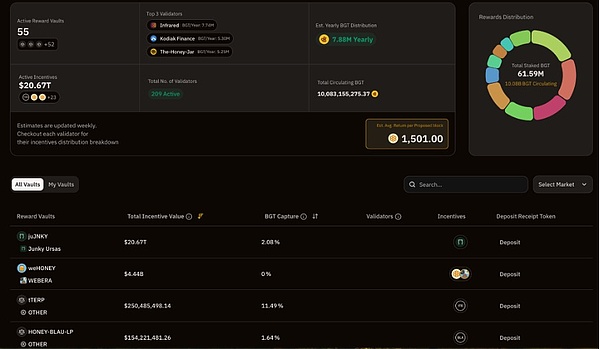

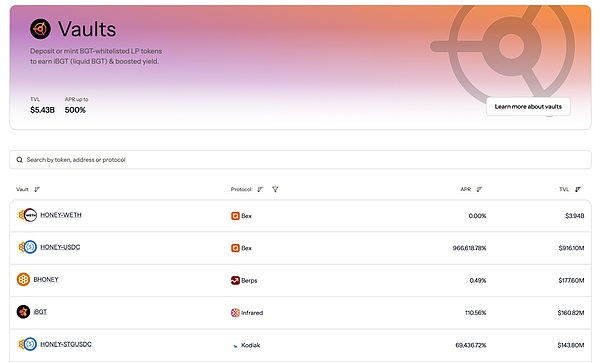

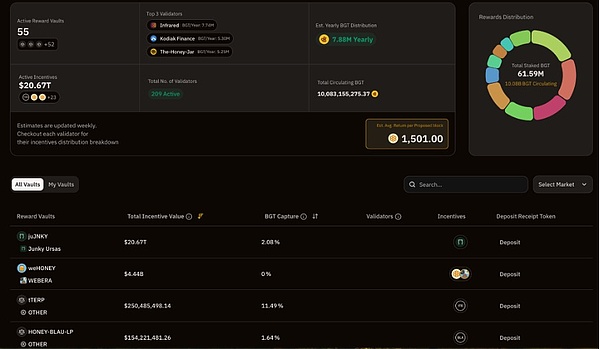

For more project interactions, the Vaults on the BGT Station are a good reference. Different Vaults correspond to different interactive projects. You can judge the popularity of the project according to the BGT Capture indicator, interact to obtain the corresponding tokens, and then deposit them into the Station for income.

06 Summary

In my opinion, Berachain is a very crypto native public chain. It deeply understands the two core elements of the crypto world: liquidity and community.

The team deeply understands that the essence of crypto is liquidity. The project directly faces and embraces the Ponzi property of stepping on the right foot with the left foot. Through the carefully designed three-token and POL mechanism, this characteristic will release huge energy in the bull market. At the same time, the team is well versed in community building.

While maintaining serious public chain research and development, it can also use meme culture to gather users and pool liquidity. A public chain with both a user base and sufficient liquidity, Berachain's mainnet launch is worth looking forward to, and it may bring a new wave of innovation to DeFi.

JinseFinance

JinseFinance