Author: Jiaoyang Zaitian

Next week, the financial market is destined to be restless, as the long-awaited interest rate cut by the Federal Reserve may come. According to the latest data from Fedwatch, swap market traders expect the probability of the Federal Reserve choosing a sharp interest rate cut next week to suddenly rise to 50%, while on September 12, Eastern Time, the probability was only 15%.

Affected by the expectation of the Federal Reserve's interest rate cut, the global financial market has now begun to perform. Among them, the US stock market has strongly counterattacked, and the S&P 500 Index and the Nasdaq have achieved the largest single-week gains so far this year, up 4% and 6% respectively; the price of gold has soared, and spot gold has continuously set a record high.

But many people may have overlooked another important financial event next week, that is, the Bank of Japan will hold a meeting on September 20 (Friday) and announce its interest rate decision, which may hide a black swan. I believe most people have not forgotten the global financial Black Monday triggered by the Bank of Japan's unexpected rate hike in early August. Today, this bomb is still there.

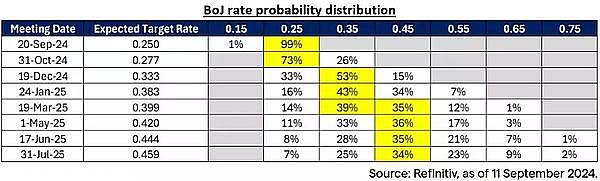

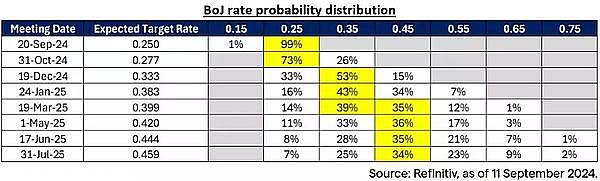

On Wednesday, September 11, Bank of Japan director Junko Nakagawa hinted that rate hikes were still under consideration. This may also be foreshadowing the decision-making content of this Friday's meeting. In view of recent domestic inflation data in Japan and some signals released by Bank of Japan officials, the market expects that Japan still has room for further rate hikes this year, which is generally believed to be in December this year.

Why does the interest rate hike of the Bank of Japan have such a huge impact on the global financial market? Japan has long implemented an ultra-loose monetary policy, and its low interest rate policy has a profound impact on the global financial system. Japan is one of the world's major economies. Its long-term low interest rates have enabled a large amount of international capital to borrow yen to seek higher-yield investment opportunities around the world for arbitrage. The sudden interest rate hike by the Bank of Japan has changed this market expectation, prompting capital to flow back and leading to a repricing of global assets. In addition, the scale of Japan's government debt is huge, and interest rate hikes may increase the debt repayment burden, which in turn affects the global bond market. At the same time, the yen exchange rate has also fluctuated, which has a chain reaction on the international trade and investment environment. Therefore, Japan's monetary policy changes not only have a profound impact on the domestic economy, but also have an impact on global capital flows and financial market stability.

The current cryptocurrency industry has been fully integrated into the global financial system, especially after the Federal Reserve passed the Bitcoin and Ethereum ETFs. The liquidity crisis brought about by the yen rate hike will inevitably affect the cryptocurrency industry. We can see this from the plunge of Bitcoin after the last yen rate hike. On August 5, affected by the yen rate hike, Bitcoin fell by more than 8% on the day, with the highest drop reaching 15%.

Therefore, the interest rate policy of the Bank of Japan next week will inevitably affect the crypto industry again, and everyone should be mentally prepared. However, in the long run, the cryptocurrency industry still has very good development prospects, so there is no need to be overly pessimistic.

JinseFinance

JinseFinance