Source: Future Money

AI continues to gain popularity and the concept of RWA is on the rise. These two tracks that are most closely related to DePIN will become the mainstream of Web3 in the second half of the year.

Crypto Market Summary

1. From August 16 to September 1, BTC tested upward from the $57,000 mark, and quickly dropped to a low of around $58,000 after reaching a high of $64,668 on August 26. The market was subsequently repaired and stabilized at around $60,000. One of the reasons for the large fluctuations is that the sale of Bitcoin and tokens by large institutions such as Mt.Gox and the US government affects the market, leading to increased price fluctuations. Although the probability of a rate cut has increased significantly, uncertainty still exists. In addition, the arrest of Telegram founder Pavel Durov has brought political concerns to Web3, which has caused fluctuations in BTC prices.

2. Several important asset benchmark indices at the financial level have broken through key support levels, and there will be changes in trends in the future. Under the premise that the expectation of interest rate cuts is confirmed, an optimistic outlook can be given.

3. Several obvious trends have emerged in the entire Web3 industry:

1. The continued popularity of AI and the rise of the RWA concept, these two tracks that are most closely related to DePIN will become the mainstream of Web3 in the second half of the year, and will also bring more gameplay and value empowerment to DePIN;

2. The attitude of global supervision towards Web3 is still unclear, but the trend of compliance and centralization will intensify, and the tracks that match it, such as DePIN, RWA, etc., will also explode.

3. Although the time for interest rate cuts has not yet been determined, the probability is increasing, and it is worth paying attention to in the second half of the year.

I. Market Overview

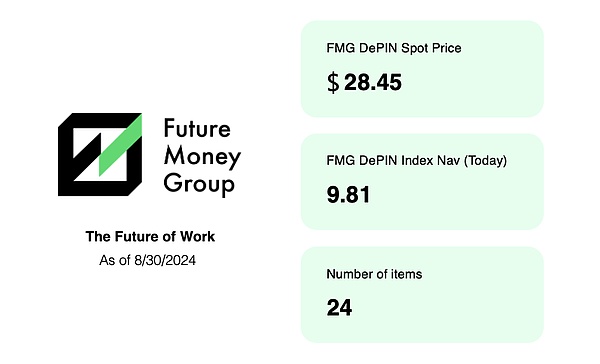

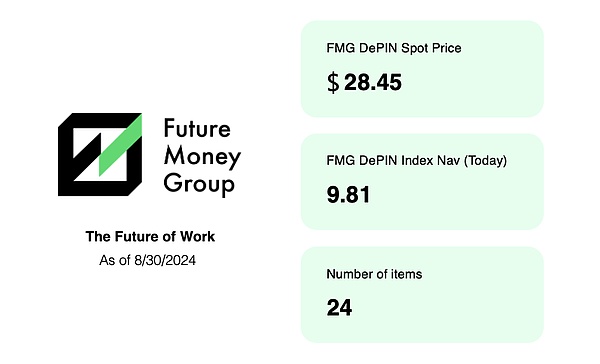

1.1 FutureMoney Group DePIN Index

The FutureMoney Group DePIN Index is a high-quality DePIN portfolio token index constructed by FutureMoney, which selects the 24 most representative DePIN projects. Compared with the previous report, it rose by 9.8%, among which HNT and RENDER showed strong trends, and the DePIN concept had a reversal upward trend.

1.2 Crypto Market Data

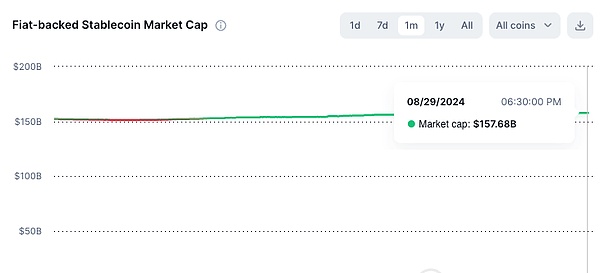

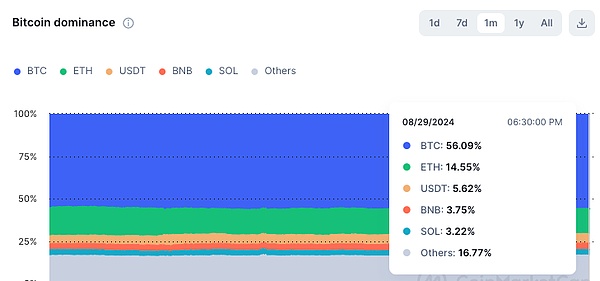

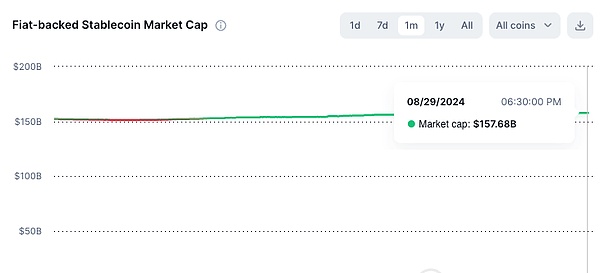

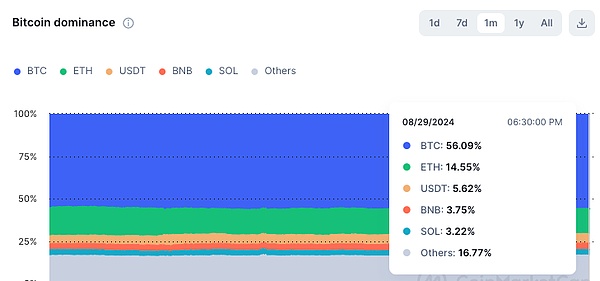

From August 16 to September 1, the market value of stablecoins increased by US$2.6 billion, an increase of 1.6%. Bitcoin's share of the total crypto market value rose slightly to 56.24%.

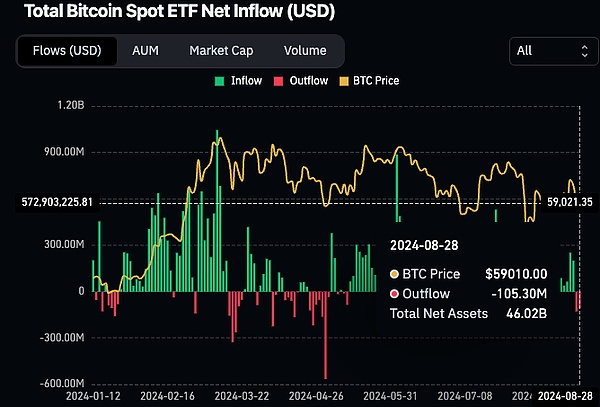

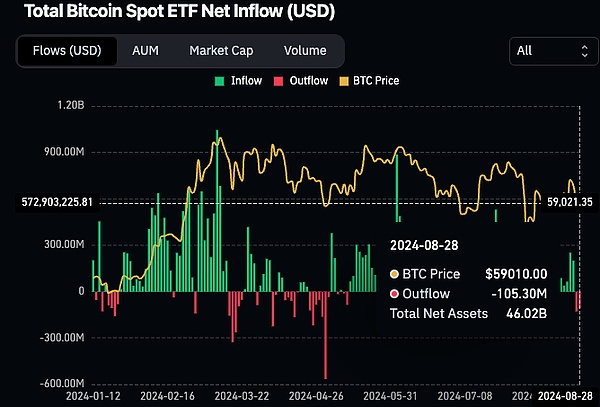

From the trend of Coinglass contract positions, the overall bullish sentiment has a slight advantage. As of now, the long ratio is 53%, the short ratio is 47%, and the long-short ratio is 1.13. The overall panic sentiment is gradually stabilizing. From August 13 to August 28, there were 9 days of net inflow and 3 days of net outflow, showing an overall net inflow trend, with a cumulative inflow of US$478 million.

1.3 Macro data and market reaction to market judgment

Macro:

From a macro perspective, key assets in the traditional financial market (such as gold, oil, treasury bonds and the US dollar) continued the positive trend in the first half of August and are close to breaking through key support levels. This indicates that the macro economy may be about to usher in major changes, but the full impact of these changes may take several months to manifest. In addition, the US consumer confidence index in August rose from 101.9 in July to 103.3, but the rapid rise in debt levels has caused market concerns.

Against this backdrop, weekly unemployment benefit application data and monthly non-agricultural employment data will have an increasing impact on the Web3 industry. In this case, Bitcoin is likely to be the main beneficiary. Therefore, market participants should pay close attention to changes in these economic indicators in order to adjust their investment strategies in a timely manner.

Crypto:

Despite the good net inflow of Bitcoin (BTC) assets, the US Ethereum ETF has experienced five consecutive days of capital outflows, which is the longest period of capital outflows since the product was launched on July 23. As of August 22, the total outflow of funds from the ETH ETF has exceeded US$2.52 billion.

Sectors worth layout:

DePIN, DeFi, RWA, especially those sectors related to important physical and financial targets such as gold, US bonds, and real estate should be taken seriously. Similarly, the AI sector is a very grand narrative. Although the US stock market has punctured the AI bubble to a certain extent some time ago, Nvidia's strong performance and the development prospects of AI are worthy of optimism for its development prospects in the next five years.

II. Hot Market News

2.1 Nvidia’s financial report exceeded expectations, with revenue of $30 billion in the second quarter, a year-on-year increase of 122%

On August 28, Nvidia released its second-quarter financial report after the U.S. stock market closed. Data showed that the company achieved revenue of $30 billion in the quarter, far higher than the market expectation of $28.86 billion, a year-on-year increase of 122%. In terms of net profit, Nvidia achieved earnings of $16.59 billion, exceeding the market expectation of $14.64 billion, a year-on-year increase of 168%.

In terms of full-year performance, Nvidia’s stock price has remained a market leader since the beginning of the year. Whether it is its absolute advantage in the field of artificial intelligence or its continued expansion in the data center and high-performance computing markets, it shows that Nvidia’s fundamentals remain solid. This not only reflects its unshakable leading position in the industry, but also largely revitalizes the broader stock market and the AI-related crypto token market.

2.2 Ant Digital Launches China's First New Energy Physical Asset RWA in Hong Kong

Longxin Group and Ant Digital cooperated to complete China's first RWA project based on new energy physical assets in Hong Kong. As the operator and service provider of the new energy digital platform, New Electric Road, a subsidiary of Longxin Group, used some charging piles operated on the platform as RWA anchor assets. This project was issued on Ethereum, and Longxin Group obtained 100 million yuan in financing through this project. This marks the birth of China's first new energy physical asset RWA, and also means that a new capital channel is opening.

At the same time, RWA has a natural fit with DePIN, which is committed to connecting with the real world. The two sides can achieve complementarity to a large extent and even transform into each other. This provides broad prospects for the deep integration and development of the two in the future.

III. Cryptocurrency market hot spots

3.1 Japanese Prime Minister Fumio Kishida expressed full support for the development of the Web3 industry at the WebX 2024 conference

At the WebX2024 conference on August 28, Japanese Prime Minister Fumio Kishida delivered an important speech, clearly expressing Japan's determination to become a leader in Web3 innovation. He emphasized Japan's positive attitude in promoting the development of this field. One of the important reforms is the abolition of taxation on unrealized gains in crypto assets. This move is expected to greatly increase domestic investment enthusiasm for Web3 companies. Through these efforts, Japan is actively positioning itself as the center of global blockchain innovation.

He also regards Web3 as an important part of Japan's economic strategy and emphasizes the huge potential of Web3 in subverting and reshaping various industries. This potential is highly consistent with the Japanese government's economic reform goals.

3.2 MakerDAO upgrades to Sky Protocol, further moving towards centralization and compliance

MakerDAO recently announced its rebranding plan, changing its name to "Sky" and making a series of upgrades to its core products. Among them, the original decentralized stablecoin DAI was renamed USDS, and the governance token MKR was upgraded and split into SKY. The stablecoin USDS is obtained by exchanging DAI 1:1. In addition, users can also exchange through ETH, USDC, and USDT on the Sky.money website, and users can obtain SKY tokens by depositing USDS on the official website Sky.money.

It is worth mentioning that this series of upgrades by Sky Protocol shows its tendency to develop towards centralization. Sky Protocol's legal terms also include compliance content such as regional restrictions, sanctions transaction restrictions, and VPN tool restrictions, further indicating that it is moving towards stricter compliance standards.

Fourth, Regulatory Environment

Since mid-to-late August, global regulators, represented by the US government, have tightened their attitude towards cryptocurrencies. One of the landmark events is the arrest of Telegram founder Pavel Durov, but Pavel has been released on bail.

At the same time, the US Securities and Exchange Commission (SEC) also issued a Wells notice to Opensea, the world's largest NFT trading market. This means that Opensea may face lawsuits for suspected violations of securities laws. This incident also reflects the strict attitude of US regulators in the field of cryptocurrency and NFT.

In addition, in South Korea, the "Virtual Asset User Protection Act" officially came into effect on August 20, and the number of new coins listed on major cryptocurrency exchanges in the country has decreased significantly. Industry analysts believe that the implementation of the new law has strengthened supervision and directly affected the listing rhythm of new coins in the market.

These events together show that regulators around the world are increasing their supervision of cryptocurrencies and related fields, and this trend may continue in the future and further affect the development of the market.

The content of this article does not constitute investment advice or recommendations. Before making any investment decision, you should consider your financial situation, investment objectives and experience, risk tolerance and ability to understand the nature and risks of the relevant products.

JinseFinance

JinseFinance