Source: Liu Jiaolian

Dark clouds are pressing down on the city. The north wind is blowing the grass down.

Just as BTC (Bitcoin) is fluctuating around 65k, the economic data of the United States is really worrying: GDP is stalling and inflation is accelerating. How can this be called "economic growth is extremely resilient"? Low growth rate and high inflation, isn't this exactly "stagflation" in economics?

In the currently public statistics, the only thing that does not seem to fit the definition of stagflation is the labor market that is interpreted as "tight". Stagflation leads to high unemployment, while data shows low unemployment. However, if you look at the data carefully, you will find that many of the increased employment statistics are part-time jobs. An American who drives an online car-hailing car in the morning, delivers food in the afternoon, and washes dishes at night will be counted as employed in three positions. A full-time white-collar worker who becomes unemployed and takes on three part-time jobs will instantly turn one job into three jobs. With this kind of statistics, the employment data is rising rapidly, and the unemployment rate is falling rapidly.

Of course, from the perspective of the Phillips curve, in the long run, there is no trade-off between inflation and unemployment. Regardless of the inflation rate, the unemployment rate will tend to its natural rate.

The causes of stagflation are not easy to explain. Economists generally believe that possible reasons include: reduced economic capacity, excessive growth in money supply, and excessive regulation of commodity and labor markets. Looking in the mirror, it is easy to guess the cause of the stagflation in the United States, which is basically "made" by itself:

1. Reduced economic capacity and market regulation: The United States has been engaged in a trade war since 2019, closing its doors to the outside world and raising trade barriers. However, who can fill the gap with its own hollowed-out capacity? Don't you have any idea in your mind? What's even more ridiculous is that the G7 meeting a few days ago actually had the face to criticize others for "overcapacity". Please, you have violated the laws of the free market economy, imposed arbitrary controls on the commodity market, artificially hindered the input of capacity, and caused the problem of insufficient economic capacity, but you are still not talking about facts and politics, and engaging in ideological confrontation. It is really pretending to be confused.

2. Excessive growth in money supply: The United States failed to control the epidemic in 2020. "Throughout 2020, the Federal Reserve printed money crazily, printing 21% of the total amount of dollars printed in the 107-year history of the US dollar in one year."

Economic research believes that stagflation cannot be eliminated simply by the Federal Reserve using monetary policy alone. Because monetary policy faces a dilemma in the face of stagflation: adopting a tight monetary policy, once interest rates are raised, it will be difficult for companies and investors to borrow money, operating costs will increase, and the economy may become more depressed, or even cause a recession and other serious deflation; however, adopting an easy monetary policy, lowering interest rates, and stimulating economic growth, but excessive banknotes will cause hyperinflation, leading to an extreme gap between the rich and the poor.

Stagflation brings recession. The investment strategy at this stage is generally considered to be the best combination of commodities, short-term bonds, cash, and money funds. Gold and Bitcoin, which are generally equivalent commodities with global consensus, have excellent defensiveness at this stage of the economic cycle.

Why did the US dollar cycle fall into a stagflation crisis this time? Because the interest rate hike has not yet destroyed or eaten up any economy of sufficient size. This monster is really hungry at the moment.

Since finance has the nature of value transfer across time and space, it is very strange that the usual robbery is to rob first and then divide the spoils, while the "robbery" of the US dollar interest rate hike is to divide the spoils first and then rob.

Assume an economy to be harvested, the actual value of its assets is 10 trillion US dollars. The US dollar raises interest rates, and the US dollar flows back, withdrawing liquidity. After the US dollar flows back to the United States, it participates in financial idleness, such as lying down and eating high interest rates, or speculating in US stocks. This is a process of redistribution of US dollars. For example, Zhang San has 1 billion and Li Si has 10 billion. After two years of speculation, Zhang San becomes 12 billion and Li Si becomes 2 billion. After two or three years, the economy to be harvested can no longer hold on and collapses, and the total market value of its assets falls to 2 trillion US dollars. The US dollar cuts interest rates, and the redistributed US dollars flow out of the United States to buy at the bottom and harvest the blown-up economy. The process is concretely described as Zhang San rushing out to invest again, using 12 billion to buy assets with an actual value of 60 billion US dollars, and Li Si using 2 billion to buy assets with a value of 10 billion US dollars. The asset prices of the harvested economy rebound as speculators such as Zhang San and Li Si buy, and then continue to rise to overheating, with the market value exceeding the actual value, such as a 1x bubble. Then Zhang San's 60 billion US dollars of assets rose to 120 billion US dollars, and Li Si's 10 billion US dollars of assets also rose to 20 billion US dollars. Compared with their principal of 12 billion US dollars and 2 billion US dollars, they have both risen 10 times. At this time, they may be ready to short again to harvest. So the US dollar cycle will reverse again to cooperate with them to complete the harvest. This cycle repeats.

The key issue here is that the US dollar cycle is artificially controlled by the Federal Reserve alone, and the Federal Reserve serves financial capital such as Zhang San and Li Si, which is determined by the nature of the American capitalist state.

What stage has the current round of strong US dollar cycle developed to? It seems that it is still in the stage of dividing the spoils, and it is a bit like a fishbone stuck in the throat, stuck at this stage and unable to move forward. However, if it is delayed to enter the robbery stage, then the redistribution game will sooner or later implode. At the end of last year and the beginning of this year, a bunch of "financial kneeling tribes" deceived stock investors to speculate in US stocks. They were just jealous of the Americans dividing the future spoils, and they also wanted to be a sickle and share the food. However, if the future spoils are not robbed, the consequences are obvious. The robbers will inevitably fight and harvest each other.

Human social behavior may not be new. Jiaolian still remembers the coin issuance boom in 2017-2018. At the beginning, the leeks were stupid and had a lot of money. Any project issued an air coin, and the project party, angel, institution, community private placement, and coin listing harvested. The first few "robbers", from the project party to the community private placement, ate human flesh and drank human blood, and ate so much that they were fat and full. How many people were free from wealth on the spot? But at the end of the cycle, the bear market came, and the leeks were also cut one after another. The roots of the leeks were dug three feet into the ground and cut cleanly. At this time, the project party that issued the currency again became "eating shit and not catching up with the hot one". The so-called angels, institutions, and community private equity that could not see the situation clearly still jumped in with their eyes closed. Finally, they opened their eyes and saw that the white land was really clean. Where did the leeks go? Oh my God, hurry up and sneak away! Whoever runs first can keep the principal. Run first and cut later, the sickle cuts each other, all kinds of internal strife and tearing, it's so lively, and a mess.

However, unlike the blockchain mutual cutting, which depends on the "strength" of running fast, which can be regarded as "fair competition", the US dollar harvesting game, if it finally enters the sickle mutual cutting game because of the failure of robbery, then who runs first and who runs later may not be able to run away just because you want to.

In recent years, the United States has also opened the eyes of the world. The flexibility of this maritime law system has really been brought to the extreme by others! Robbery? Harvest? Confiscate? What do you mean it's illegal? Wait, I'll work overtime overnight to get you a tailor-made bill! The two houses accelerated the approval process, and the president signed it into effect. The confiscation is legal and well-founded. Why can the new law confiscate old assets? We are not as pedantic as the continental legal system, "the law does not apply retroactively". We can just make a law with unlimited retroactive effect according to the needs!

You said that there has been no precedent for confiscating property from a country that has not declared war on an enemy since World War I and World War II. The two countries are still in a peaceful relationship and confiscating the public and private property of other countries. This is shameless robbery in broad daylight! However, when people are hungry, they will not care about their appearance, let alone a hungry monster?

According to Reuters, on April 20, which was last Saturday, the US Senate passed a package of aid bills to Ukraine, with a total allocation of US$95 billion. Who will pay for this? When the G7 met, they discussed diverting from the previously frozen US$300 billion assets of Russia. The Kremlin spokesman was so angry that he shouted: This is a naked violation of private property rights and is illegal.

As one of the core spirits of capitalism, the protection of private property rights has also been exposed by the Americans: What is the protection of private property rights? Isn’t it just a competition of whose fist is stronger?

In the past 20 years, the Chinese have gone to the American territory to buy properties, mainly real estate and US dollar assets. If the Americans get violent, do they have fists to protect their property? I am afraid not.

People are the butchers, and I am the meat. This is what it means.

You see the high interest rates and high returns of the stock market in the United States, but the Americans are eyeing the principal in your pocket. When the time comes, you will have to spit out both the principal and the interest. Come on, come on, just do your part to "make America great again."

One day, the Americans will make people realize that except for the BTC on the chain where they control the private key, no US dollar assets are safe. Including US dollar stablecoins. This also includes all digital assets in centralized exchanges that are actually controlled by the Americans.

So if you calculate this way, as long as the Americans can still hold on, they will never give up trying again in the official stage, and they must harvest a big fat sheep before they can give up.

If they can't eat the sheep, they can also kill the dog.

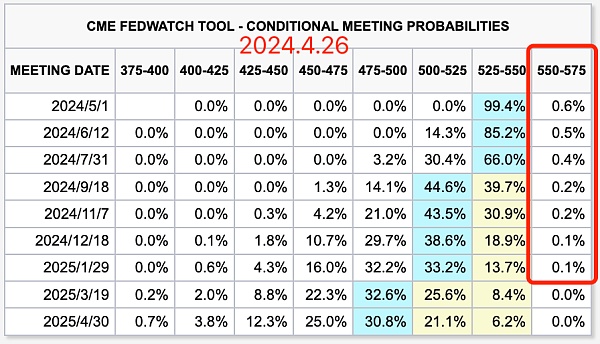

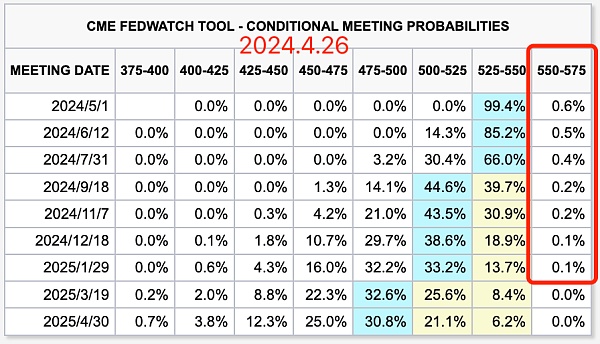

So we saw a magical scene: when everyone felt that the Americans could not bear the high interest rates for a long time, the contract market abnormally began to bet that the Federal Reserve would continue to raise interest rates. Although the probability is still very, very low, some people have actually started to bet on this.

When the "May Fourth Movement" in the United States was surging, would the Federal Reserve really take risks, raise interest rates in anger, and put on a gambling posture of either you die or I die?

JinseFinance

JinseFinance