Author: JieXuan Chua, Brian Chen, Binance Research; Translation: 0xjx@黄金财经

I. Key Points

In recent months, the hot topic of discussion in the crypto community has been tokens with high valuations and low initial circulation. This market structure has raised concerns about the limited sustainable upside for traders after the TGE.

Data from CoinMarketCap and Token Unlocks confirm the growing trend of tokens being issued with low circulation and high valuations. Notably, approximately $155 billion worth of tokens are expected to be unlocked from 2024 to 2030. Such a large number of tokens pouring into the market will create selling pressure if there is no corresponding increase in buy-side demand and capital inflows.

Factors such as the influx of private market capital, aggressive valuations, and optimistic market sentiment have contributed to the trend of tokens being issued at high fully diluted valuations (“FDV”).

The current market conditions require investors to be more discerning and prudent, considering fundamental aspects of projects such as token economics, valuations, and products. Project teams may also need to consider the long-term impacts associated with token economics design.

VCs continue to play an important role in our industry and can work with project teams to ensure fair supply distribution and reasonable valuations.

Second, Market Observation

In recent months, the hot topics discussed in the crypto community have been tokens with high valuations and low initial circulation. This market structure has raised concerns about limited sustainable upside for traders after the TGE.

This concern is not unfounded. It has become a common phenomenon that tokens are issued with low circulation and most of the tokens are released in the future. Under bull market conditions, these tokens may rise in price rapidly due to limited liquidity available for trading at the time of issuance. However, it is clear that this price growth is unsustainable when a wave of token supply is unlocked.

In addition, the FDV of newly issued tokens is comparable to established layer 1 or DeFi tokens that have stood the test of time and have user appeal. Overall, market participants are now aware of the impact of those low circulation and high FDV tokens.

In this report, we explore this market trend in more detail. We first detail our observations on the increasing number of high FDV tokens issued and discuss the potential market impact and its significance. We then analyze the root causes of this trend, especially private market activities that may be a contributing factor. Finally, we make some recommendations to identify and mitigate the negative impact of this trend, with a focus on recommendations tailored for investors and project teams.

2.1 Low Circulation, High FDV

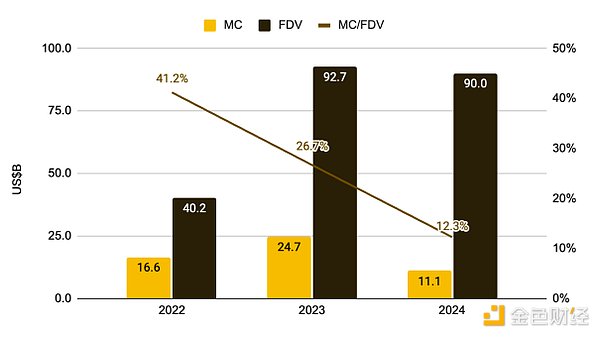

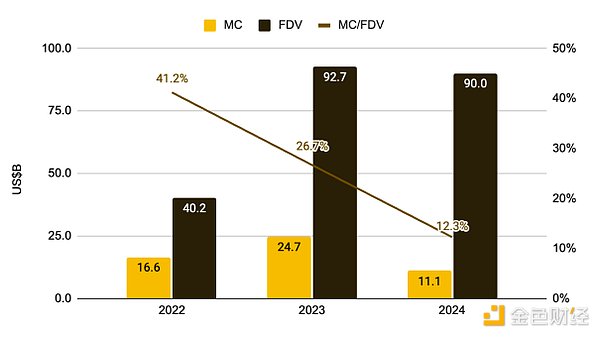

There is a clear trend of recently issued tokens being issued at high valuations and low circulation. This is particularly evident when we compare tokens issued in the past few years - the ratio of market capitalization ("MC") to FDV for tokens issued in 2024 is the lowest. This indicates that a large number of tokens will be unlocked in the future.

Figure 1: MC/FDV of tokens issued in 2024 is the lowest in the past three years

Source: Twitter (@thedefivillain), CoinMarketCap, Binance Research, as of April 14, 2024

Figure 1 shows the market capitalization and FDV of tokens issued in the past three years, highlighting the widening gap between these metrics over time. It is worth noting that although 2024 has just begun, the FDV of tokens issued in these months is already close to the total amount in 2023, which highlights the prevalence of overvalued tokens.

The MC/FDV for tokens issued in 2024 is 12.3%, and a large number of tokens will enter circulation in the future. This also means that in order for these tokens to maintain current prices in the next few years, approximately $8 billion of demand-side liquidity needs to flow into these tokens to match the increase in supply. Although market cycles may change, this may not be easy.

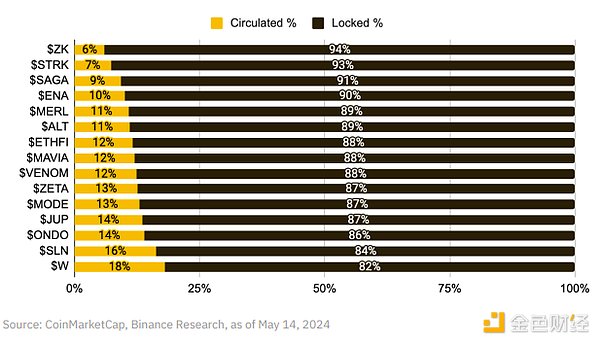

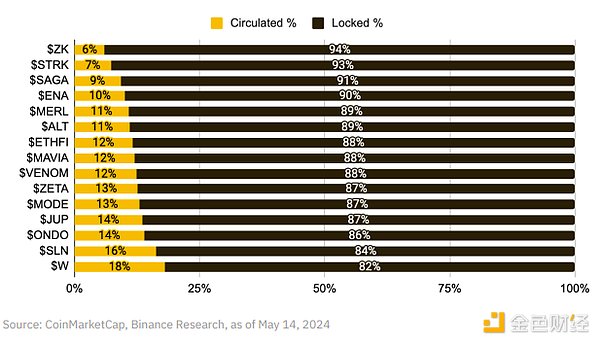

Examining some recently issued tokens reveals the root cause of the high FDV in 2024. Figure 2 shows several tokens issued in recent months and their percentage of circulating and locked supply. With circulating supply as low as 6% and no one exceeding 20%, the root cause is obvious.

Figure 2: Recently issued tokens have extremely low circulating supply

Source: CoinMarketCap, Binance Research, as of May 14, 2024

For the same demand, low circulating supply contributes to higher initial token prices, which in turn drives higher FDV.

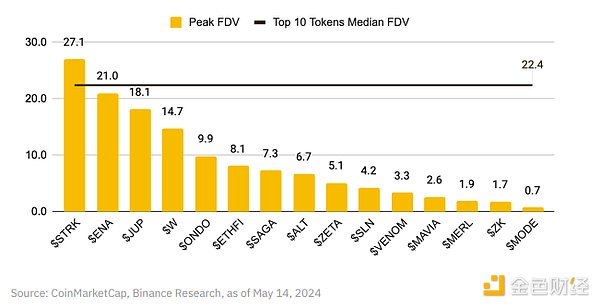

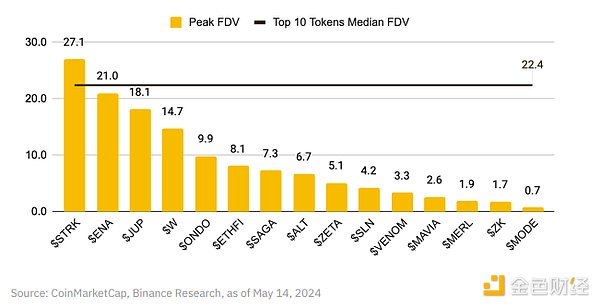

Comparing the peak FDV of the same set of tokens to the median FDV of the top ten tokens on the market (excluding BTC, ETH, and stablecoins) gives a sense of the relative valuations of recently listed tokens. At their peak, some tokens had valuations similar to the largest tokens on the market, which have been around for years.

Figure 3: At their peak, some recently issued tokens had valuations similar to the largest tokens on the market

Source: CoinMarketCap, Binance Research, as of May 14, 2024

It is important to note that FDV alone does not paint a complete picture, and they are not as meaningful as FDV ratios (such as FDV/Total Value Locked, FDV/Revenue, etc.) because these ratios take operational metrics into account.

In the past few months, many projects have issued their tokens, many with low circulation and high FDV. Due to the large number of such projects, we have only selected a few for presentation. Please note that this is only to illustrate the prevalence of low circulation and high FDV tokens and does not reflect a negative assessment of the value or potential of the selected projects, as there are many other factors at play.

2.2 Market Impact and Its Significance

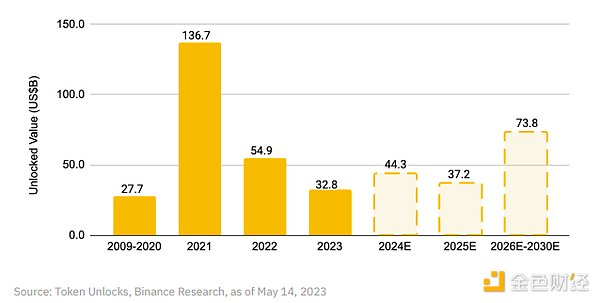

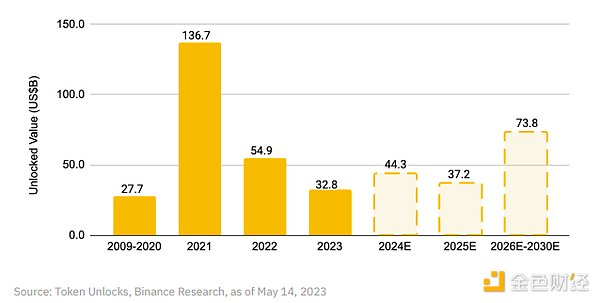

The issuance of tokens with low circulation has an impact on market dynamics, especially increasing selling pressure. According to the report of Token Unlocks, approximately $155 billion of tokens are expected to be unlocked from 2024 to 2030.

While this number is an estimate, its significance is clear - a large amount of token supply is expected to be released in the next few years, and many tokens will face significant selling pressure without corresponding capital inflows.

Given this, it is crucial for investors to understand the token unlocking schedule and track it to prevent being caught off guard when tokens undergo large-scale unlocking.

Figure 4: $155 billion to be unlocked in the next few years

Source: Token Unlocks, Binance Research, as of May 14, 2023

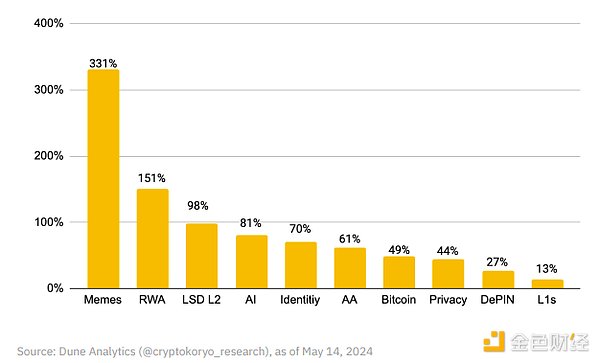

A related observation is that meme tokens have outperformed other tokens so far this year. In addition to significant awareness and strong speculative demand, their token supply structure has also played a role in this year's rally.

Figure 5: Meme tokens have become the best performing theme so far this year

Source: Dune Analytics (@cryptokoryo_research) as of May 14, 2024

Most Meme tokens were already unlocked and in circulation at the time of the TGE, eliminating selling pressure from future dilution. Many had an MC/FDV ratio of 1 at the time of issuance, meaning that holders would not be further diluted by the issuance of tokens. This structure has played a role in the appeal of Meme tokens, especially as awareness of the impact of large-scale token unlocks has increased. While the success of Meme tokens should not be attributed entirely to dissatisfaction with low circulating supply tokens, it is clear that retail investors have shown great interest in Meme tokens, even if these tokens may lack utility.

Similar to the famous “GameStop short squeeze” event in the stock market, many retail investors see meme tokens as a means to counter the advantages gained by institutions in private rounds. This is because meme tokens are usually issued in a way that is open to anyone, and institutional players have little opportunity to acquire tokens at a low price in advance. As a result, meme tokens have become an important theme in the current market, continuing to attract large trading volumes and strong price fluctuations.

III. How did we get to this point?

High valuations, coupled with the continuous selling pressure brought about by token unlocking, are a structural negative for token prices. However, as observed in the previous section, this situation has become more prevalent in recent years. Several factors have contributed to this situation.

3.1 The influx of private market capital

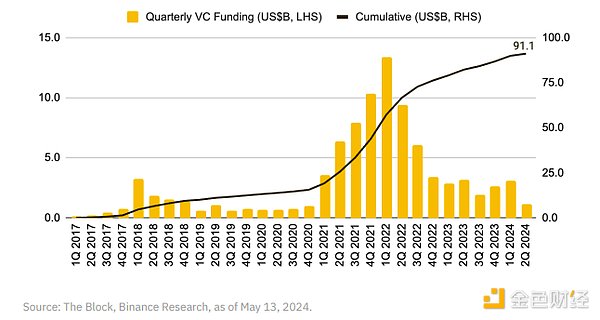

VC funds are increasingly becoming key players in the crypto investment field. Despite the natural fluctuations in investment capital due to market cycles, VC capital flowing into the crypto field has been steadily rising since 2017. Since 2017, total VC funds invested in crypto projects have exceeded US$91 billion, which proves the importance of VC in providing the necessary funds for projects.

Figure 6: VC funding since 2017 has exceeded $91 billion

Source: The Block, Binance Research, as of May 13, 2024

However, the massive increase in investment has also led to a corresponding increase in the influence of VCs in shaping crypto market valuations. As more money flows into the space and VCs participate in more deals, they essentially drive valuations up.

As a result, when tokens are launched on the public market, their prices and valuations are already inflated. In fact, large-scale private market fundraising has led to tokens reaching multi-billion dollar valuations at launch, making it more difficult for public market investors to profit from future growth.

3.2 Aggressive Valuations

The strong market performance this year has boosted sentiment and driven more aggressive deal activity. This has led some investors to be more willing to invest at higher valuations.

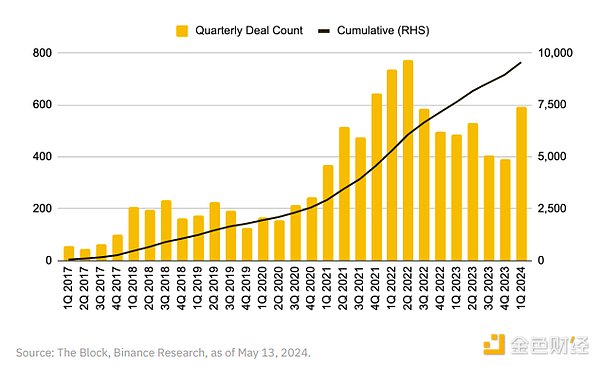

Given that multi-million dollar valuations have become the norm, being cautious about valuations may put VCs at a disadvantage in front of their LPs, as it means missing out on most deals when deal activity is high. While market activity is still below its 2022 peak, the number of crypto deals in the first quarter of 2024 increased by 52.1% month-on-month to reach its highest level in nearly two years.

Figure 7: Deal activity has increased this year

In addition, in a bull market, VCs have an incentive to continue deploying capital. As long as the music keeps on going, high valuations will boost VCs’ performance metrics. In addition, it is advantageous for projects to raise large amounts of funds at high valuations, as this provides them with working capital without significant dilution. This also shows strong support from “smart money”.

Overall, raising funds in private rounds at high valuations means that stakeholders have an incentive to publicly release tokens at higher fully diluted valuations (FDV).

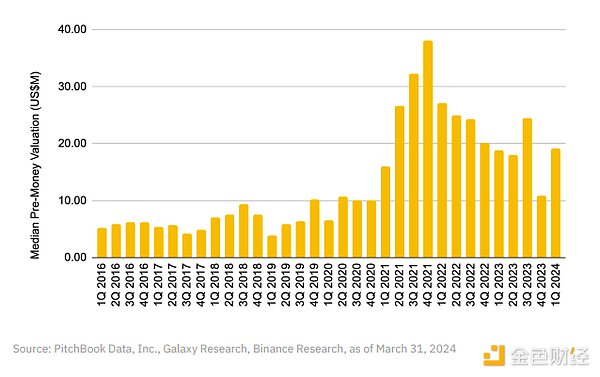

3.3 Optimistic Market Sentiment

With the crypto market capitalization growing by 61% in the first quarter of this year, market sentiment during this period was clearly very positive. CoinMarketCap’s Fear & Greed Index was in the “Greed” and “Extreme Greed” range for 69 of the 91 days in Q1. Accordingly, project teams were able to take advantage of this positive investor sentiment, allowing them to raise funds at higher valuations in Q1.

This is evident from the increase in valuations in Q1. Specifically, VC-backed crypto companies saw their pre-money valuations rebound by more than 70% quarter-over-quarter in Q1 2024. This suggests that, on average, projects were able to raise the same amount of funds with less dilution than in the previous quarter.

Figure 8: Pre-investment valuation rebound in the first quarter of 2024

IV. Some thoughts

4.1 For investors: fundamentals are important

The current market structure makes it even more necessary for investors to be more selective. Considering that many projects have high valuations at the beginning, the probability of "speculating" on new tokens to obtain sustainable returns is low. Most of the upside and easy money opportunities may have been captured by early private market investors.

Whether investing in private rounds or when tokens undergo initial coin offerings (TGEs), investors should conduct thorough due diligence and establish their own investment process. Some fundamental metrics and aspects worth paying attention to include, but are not limited to:

Token Economics: The importance of unlocking schedules and unlocking periods cannot be underestimated, as they directly impact the supply of tokens on the market. Without a corresponding increase in demand, this can lead to excessive selling pressure on the token price.

Valuation: FDV provides a general sense of size, but is not terribly meaningful on its own. Assess valuation ratios relative to other competitors and over time (e.g., FDV/Revenue, FDV/Total Value Locked, etc.).

Product: Consider where the project is in the product lifecycle (e.g., whitepaper stage vs. mainnet launch). Is there product-market fit? Observe user activity (e.g., number of daily active addresses, number of daily transactions, etc.).

People: This includes the team and the community. What is the background of the founders and how do they contribute to the project? How engaged is the community and what are they most excited about the project?

Rather than aggressively chasing the next shiny token, taking the time to evaluate fundamentals will help identify and avoid obvious risks and pitfalls. As Warren Buffett said, “Only when the tide goes out do you discover who’s been swimming naked.” Everything often looks fine until the music stops. Avoid being the last coin holder.

4.2 For Project Owners: Consider Long-Term Development

Running a project is not easy given the numerous aspects and stakeholders that need to be considered. Decisions are complex and it is impossible to satisfy everyone. Nevertheless, we believe that one of the guiding principles for decision making is to consider long-term development.

Token Economics: Launching a token with low circulation and high FDV may help initial price increases due to limited token supply. However, subsequent unlocking will create significant selling pressure on the token. The project’s loyal token holders (arguably one of the most important groups in the community) will suffer as a result. Poor token performance may also discourage new ecosystem participants from joining the network because incentives are reduced.

In this regard, token distribution, unlocking, and vesting schedules should be carefully considered. While token economics is more of an art than a science, with no magic number or methodology, it is clear that recently launched tokens have very low circulating supply, as shown in Figure 2. To mitigate the risk of a sudden increase in supply, teams and investors can consider token burn mechanisms, align vesting schedules with set milestones, and increase initial circulating supply during the TGE.

Product: While tokens can help gain market attention and are a great user acquisition tool, a viable product is key to value creation, user retention, and sustainable growth. Having at least a minimum viable product before a TGE will help investors and users better understand the project’s value proposition and determine product-market fit. In the best case, launching a product with significant user traction can facilitate a successful TGE by boosting confidence and attracting high-quality investors and users. In the long run, products increase the intrinsic value of tokens and help token price performance.

With the rebound in funding activity in Q1, project founders were able to take advantage of the uptick in sentiment to achieve higher valuations. However, while it intuitively makes sense to raise money at high valuations (who would refuse to raise the same amount of money with less dilution?), this comes with long-term consequences. Projects that raise money at a price significantly above intrinsic value will need to justify this premium in future private rounds or on the public market. If they fail to do so, token prices may converge toward their true value. Investors will suffer, and project teams may have difficulty turning around community sentiment.

V. Conclusion

Token economics is undoubtedly one of the most important considerations for investors and project teams. Every design decision comes with a series of benefits and trade-offs. While launching a token with a low initial circulating supply may drive initial price increases, the steady unlocking and issuance of tokens will generate selling pressure, which will have an impact on long-term performance. If such a trend becomes the industry norm, the unlocking of billions of tokens in the next few years will make sustainable growth increasingly difficult unless the corresponding capital inflow can match these unlocks.

VC continues to play a critical role in our industry, and tokens backed by VC are not necessarily bad. Project teams and VCs should work together to ensure that supply allocations are fair and reasonable and valuations are reasonable.

JinseFinance

JinseFinance