Interpretation of Binance Research's first half year report

Various information reports are never for learning, but for "checking answers". What is the difference between what I know and what others know? How can I reflect on it?

JinseFinance

JinseFinance

Source: Binance Research

Bitcoin activity continues to accelerate on all fronts. Metrics continue to improve, and the new era of Bitcoin driven by ordinality has made significant progress in both homogeneous and non-homogeneous tokens (“NFTs”). Layer-2 (“L2”) and scalability have become hot topics, and the Bitcoin DeFi space continues to develop. Following the 4th Bitcoin halving in April 2024, Bitcoin’s mining block reward will be halved to 3.125 Bitcoins per block, bringing another supply shock. Meanwhile, Bitcoin spot ETFs were successfully approved in the United States, paving the way for more than $14.7 billion in net inflows (1). Overall, Bitcoin is off to a good start in 2024.

Figure 2: Bitcoin market share continues to rise this year, now over 53%

In this section, we will explore several key Bitcoin indicators and how they have evolved over the course of this year. We will then take a look at the main aspects and developments that lay the foundation for these indicators, while looking ahead to the upcoming year 2024.

Figure 3: Bitcoin’s metrics are moving well, with most up significantly from a year ago

Many of Bitcoin’s key metrics are up, both year-to-date and year-to-date. In addition to the significant increase in market cap, the growth in transaction volume is also noteworthy. The continued growth in Lightning Network capacity is encouraging given its important use cases, while the continued increase in hash rate and mining difficulty are positive indicators of the growing strength of the Bitcoin blockchain. Note that both hash rate and mining difficulty are key indicators of security, with higher values indicating more computing power required to attack the network. Therefore, the continued growth in both numbers suggests that Bitcoin’s resistance to attacks remains strong and is growing.

We can also conduct Bitcoin sentiment analysis, which provides valuable insights into the collective sentiment expressed by market participants and the public at large towards Bitcoin. A related indicator is the Bitcoin Fear & Greed Index, a widely cited sentiment indicator that assesses market attitudes and investor psychology regarding Bitcoin. The index ranges from 0 to 100, with values below 50 representing periods of “fear” and values above 50 representing periods of “greed”. The index is based on a variety of factors such as market share, trading volume, Google Trends, social media sentiment, and price volatility.

As we can see in Figure 4, the indicator fluctuated during the first half of the year, but has recently declined significantly. After spending much of the year in the "greed" zone, the index has quickly fallen into the "fear" zone over the past month, perhaps spurred by the approval of a U.S. bitcoin spot ETF. While this indicator is not comprehensive, it still suggests that traders and markets have become more conservative in recent weeks, perhaps influenced by recent news, including potential selling pressure from the German government's sale of bitcoin and the start of repayments from the defunct trading platform Mt. Gox.

Figure 4: Bitcoin Fear and Greed Index recently fell into fear range

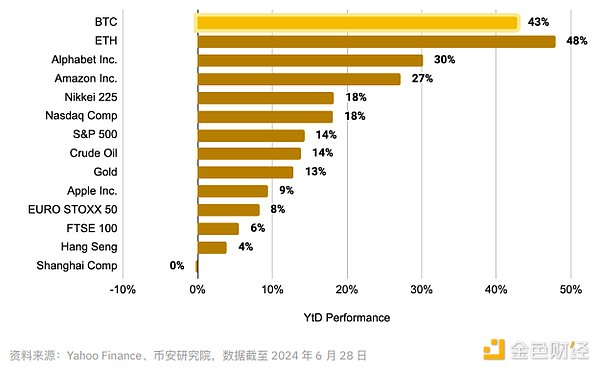

Comparing Bitcoin performance with other TradFi investments, Ethereum and Bitcoin have returned 48% and 43% year-to-date, respectively, once ranking at the top. Alphabet and Amazon stocks are the only two other investments in the control group that have risen more than 25% this year. Major stock market indices are far behind, with many returning only in the single digits. Gold, often touted as a competitor to Bitcoin, is up just 13% this year, while crude oil is up around 14%. The chart further illustrates Bitcoin’s potential diversification advantages and strong performance compared to a pure TradFi portfolio.

Figure 5: Bitcoin and Ethereum outperformed the popular TradFi benchmark control group

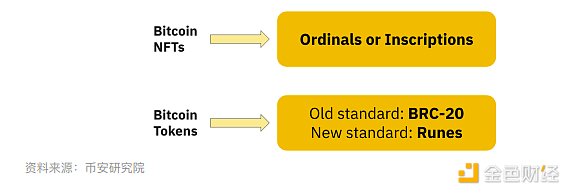

Since the first introduction of inscriptions in December 2022, the Bitcoin fungible token and NFT market has continued to expand and grow. To briefly review, the "Ordinal Theory" proposed by Casey Rodarmor is able to track individual satoshis (the smallest unit of Bitcoin) and give each satoshi a unique identifier. These individual satoshis can then be "engraved" with arbitrary content, such as text, images, videos, etc., to form "inscriptions", which later became Bitcoin NFTs.

Following the initial inscription boom in January-February 2023, the launch of the BRC-20 token in March 2023 led to another significant increase in related activity. Through BRC-20, homogeneous tokens associated with ordinals can be deployed, minted, and transferred on the Bitcoin network. Activity related to inscriptions and BRC-20 continued throughout the spring, then reached a new high in the fourth quarter of 2023, even after the Bitcoin halving in April 2024. This halving event occurred at almost the same time as the launch of the Runes protocol. Runes are another way to add homogeneous tokens to the Bitcoin network, and are another brainchild of Casey Rodarmor, the developer behind the original release of ordinals. BRC-20 is built on ordinal theory and thus inherits some of its complexity, but Runes has nothing to do with ordinal theory and simply extends Bitcoin’s UTXO model to carry arbitrary balances of homogeneous tokens, making it more efficient than BRC-20.

Figure 6: Terminology Review

Indicators

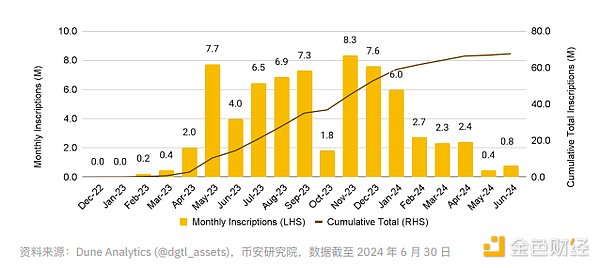

Since the first inscription was released in December 2022, 67 million inscriptions have been minted on the Bitcoin blockchain, generating more than 6,875 Bitcoins (about $414 million) in fees.

Figure 7: The monthly number of Bitcoin inscriptions has continued to decline this year, partly due to the introduction of Runes

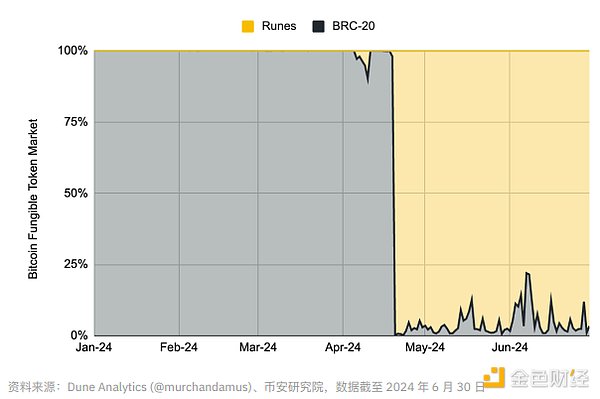

For BRC-20, its total market capitalization is approximately US$1.3 billion, down about 50% since January. $ORDI, the first BRC-20 token contract to be deployed, remains the most successful and popular token to date, and is currently listed on multiple major exchanges. ORDI has a market cap of over $600 million, representing over 50% of the total BRC-20 market cap. We should also note that for over a year, most inscriptions have been text-based (i.e. BRC-20 tokens). However, metrics show that Runes have significantly cannibalized BRC-20 market share since their launch on April 20. In fact, Runes have, on average, captured over 95% of the Bitcoin fungible token market since their launch.

Figure 8: Runes take up the majority of the Bitcoin-homogeneous token market

From all Bitcoin transactions, Runes transactions have accounted for an average of over 60% since its launch. It is encouraging to see that while standard Bitcoin transactions still dominate, various emerging Bitcoin markets are also introducing new activities and fee income sources. Figure 9: Since its launch in April, Runes has accounted for an average of 61% of all Bitcoin transactions. Figure 10: To date, Runes has generated more than 2,500 Bitcoins (about $145 million) in fees. While not game-changing, the fact that Inscriptions, BRC-20, and Runes have generated an extra 4,000+ BTC (~$233 million) in fees this year is certainly welcome, especially considering Bitcoin just went through a halving event. Note that Bitcoin miners are paid in two ways: block rewards and transaction fees, with block rewards halving every four years. The halving event just took place in April 2024, which caused the block reward to drop from 6.25 BTC to 3.125 BTC. Given that the block reward will eventually decrease to zero, transaction fees must rise to ensure miners' income.

One of the defining events of the first half of this year was the approval of the BTC spot ETF in the United States in January. This will help inject a new source of institutional demand into the Bitcoin market, increasing the diversity and depth of investment interest compared to previous cycles. Today, all types of US institutional investors, from hedge funds to pension funds, can easily enter the cryptocurrency market in a simple and intuitive way. ETF wrappers are well known and accepted by institutional investors and are an excellent way to introduce some conservative investor groups to the cryptocurrency market.

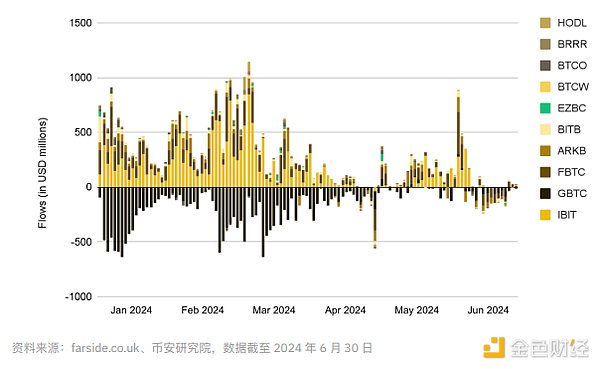

To date, the ETF’s cumulative inflows have reached $14.7 billion, with total holdings exceeding 865,000 BTC (approximately $52 billion).

Figure 11: More than $14 billion has flowed into new BTC spot ETFs, an average of $122 million per day

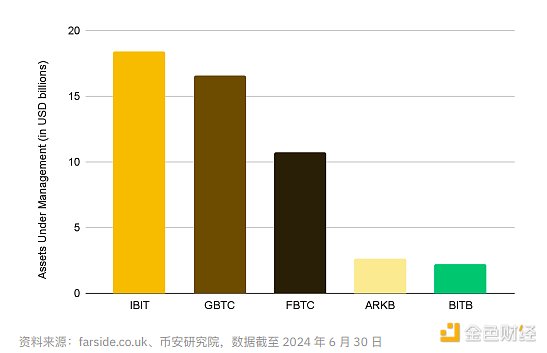

While institutional interest is currently focused on Bitcoin, more and more people expect that institutions will also begin to favor Ethereum in the near future (more on this later). In terms of leading ETF providers, BlackRock dominated with inflows exceeding $17.7 billion. Grayscale and Fidelity also performed well, with the three companies together accounting for more than 80% of the market share.

Figure 12: BlackRock, Grayscale, and Fidelity dominate the U.S. BTC spot ETF market

Other countries have also shown interest, including Hong Kong’s approval of Bitcoin and Ethereum spot ETFs in April. Although trading volumes are relatively limited compared to the U.S. (7), this is a step in the right direction. European ETPs are essentially the same product as US spot ETFs and have also seen significant growth since their introduction in 2015. Total AUM of European crypto ETPs (8) has grown by around 130% from around $5.3 billion in July 2023 to over $12 billion this year.

SEC filings show that the largest holders of US BTC spot ETFs are primarily hedge funds, asset managers and banks. While it is encouraging to see firms such as Morgan Stanley among the top ten holders, it is worth noting that the top ten also includes many hedge funds, which typically focus on short-term strategies rather than long-term holdings. That said, we should also note the participation of traditional institutional investors, such as the Wisconsin Investment Council. It will be interesting to see what types of investors these products attract in the second half of this year.

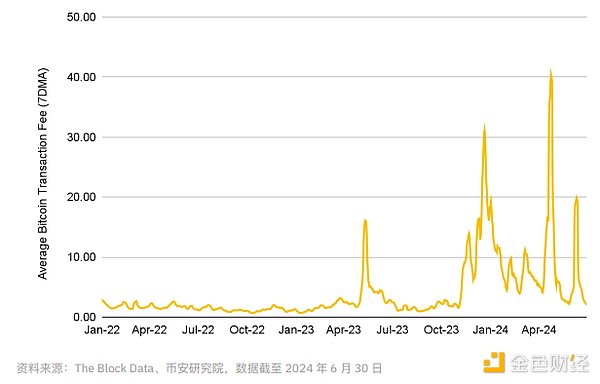

1. Bitcoin L2:Innovations are emerging in the Bitcoin space, which have had a significant impact on transaction fees (as we have previously highlighted). In fact, as shown in Figure 13, between 2022 and 2023, the average annual transaction fee for Bitcoin increased by 175%, from $1.5 to $4.2. This pattern continues to this day, with the average Bitcoin transaction fee exceeding $8.8 in 2024. This further demonstrates the importance of Bitcoin scalability and L2, which can be used to alleviate the congestion problems of Bitcoin L1 and provide users with a lower fee venue for Bitcoin transactions.

Figure 13: The average annual transaction fee of Bitcoin has risen from $1.5 in 2022 to $4.2 in 2023, and in 2024, it has reached $8.8 so far

Although some people believe that Bitcoin is only used for currency transactions, L2 still has its necessity. Last year, 152 million transactions were processed on the Bitcoin network(9). Bitcoin has just passed the 1 billion mark. If users are already complaining about L1 congestion and rising fees at a time when transaction volumes are relatively low, then this is clearly a cause for concern. If Bitcoin is to achieve mass adoption around the world, scalability solutions are essential. Various teams are working on solutions, including veteran players such as Lightning Network, Stacks, and RGB. New teams are also making their mark, including Citrea and Merlin’s Bitcoin zero-knowledge rollups. 2. More Bitcoin DApps are coming: Ordinals and inscriptions are indirectly ushering in a new era of Bitcoin’s expressive renaissance. Many new Bitcoin projects have either just launched in the past year or are currently being funded and developed. This includes projects of all types, from Bitcoin money markets to Bitcoin staking and re-staking. Such activity is expected to continue into the second half of this year. Also worth mentioning is BitVM, which was launched in December 2023. It aims to expand the Bitcoin network by introducing smart contract capabilities without making major changes to Bitcoin's existing infrastructure. BitVM operates in a similar way to optimistic rollups on L1 chains. Developments related to this protocol may help expand Bitcoin's functionality far beyond its current level, while also creating a more secure way to bridge BTC to secondary layers. Although BitVM is still in its early stages of development and it is too early to judge its development trend, it is still an area worth continuing to watch.

3. ETF Dynamics:

a. Potential size compared to gold: Given that Bitcoin is often referred to as “digital gold,” we can use the gold ETF market as a potential comparison to estimate the market size of Bitcoin ETFs. As of writing, the gold ETF market is approximately $105 billion to $110 billion (10). The U.S. BTC spot ETF market is approximately $52 billion, about half the size of the gold ETF market.

b. TradFi lags: Traditional financial institutions are generally cautious, especially when it comes to emerging markets and technologies such as cryptocurrencies. So while spot ETFs were approved in January, not all financial advisors and asset managers are ready to commit money right away. The education and marketing process may take months, and some funds may choose to wait and see how other funds perform, and so on. So, in all fairness, there should be more investors joining in the coming months and years, and there may be stronger inflows as more traditional investors are willing to accept Bitcoin.

“…Although spot ETFs were approved in January, not all financial advisors and asset management companies are ready to invest immediately. The process of knowledge popularization and marketing may take several months, and some funds may choose to wait and see the performance of other funds...”

c. Indirect impact: It can be said that the biggest impact of the approval of the US BTC spot ETF is that it has increased the recognition of the cryptocurrency industry in the traditional financial market. For some of these participants, spot ETFs are just the starting point for entering the vast cryptocurrency ecosystem. Their next stop may be Ethereum, BNB Chain, Solana, DeFi, NFT, games, etc. For other participants, the recognition and support of BlackRock, the world's largest asset management company, may inspire them to start getting involved in Bitcoin. And many professionals who combine traditional finance with emerging technologies have opened up a new development path with the support of large-scale participants in the market. The above impacts and their possible future consequences are perhaps the most important and exciting part of US cash ETFs, and we may see their results in the coming months or years.

Figure 14: Summary of the current status of major L1 (data as of the first half of 2024)

From a high-level metric perspective, Ethereum is clearly in the lead in terms of market cap, average transaction volume, annual revenue, total locked value in DeFi, and total number of developers. BNB Chain is a solid second in metrics such as market cap and total number of developers, and has the second lowest average transaction fee. It is worth noting that Ethereum leads by a wide margin in total number of developers, with BNB Chain, Solana, and Avalanche having similar total number of developers, while Tron has a relatively small developer community.

As shown above, Ethereum is still maintaining good momentum and is ahead of other L1s in many key metrics. The narrative in the first half of the year is mainly centered around re-staking and its various related markets, EIP-4844, the growing DeFi space, and the US ETH spot ETF.

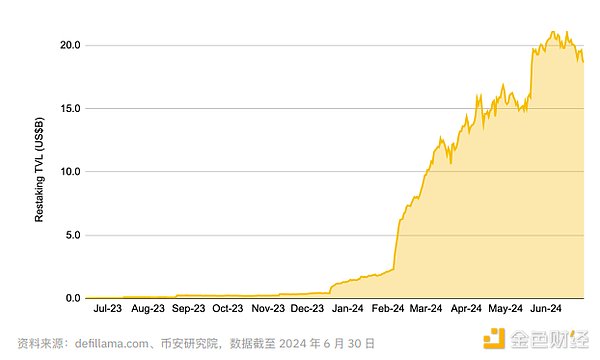

❖ Restaking dominates the headlines: Restaking allows users to repurpose staked tokens to provide security for other applications. Restaking has been the dominant narrative for Ethereum over the past six months.

➢ EigenLayer, one of the first large-scale projects to launch in the space, has driven this narrative and captured the majority of the market’s TVL. EigenLayer currently has a TVL of $14 billion (11), accounting for more than 85% of the entire market.

Figure 15: TVL in the re-staking space has exploded this year, now exceeding $16 billion

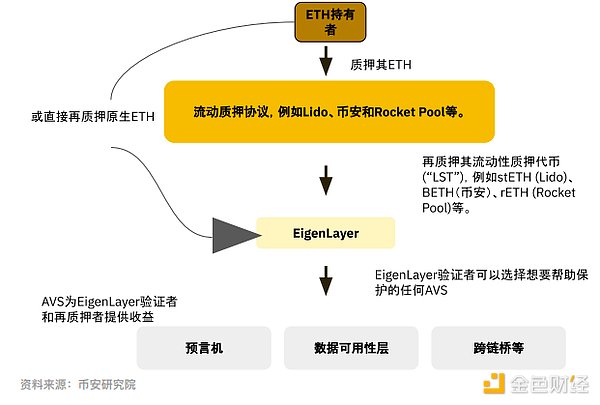

➢ To briefly review, through EigenLayer, Ethereum stakers can re-use staked ETH to secure other applications, namely Active Verification Services (AVS). Stakers can choose these services and earn income from them. In return, they agree to grant EigenLayer the additional right to forfeit their staked ETH.

Figure 16: Simple illustration of how EigenLayer works

❖ EigenLayer launched its mainnet in April, and at the same time launched its first AVS, the data availability (DA) layer EigenDA .

❖ Other notable platforms entering the restaking market include Karak and Symbiotic. Karak focuses on multi-chain restaking, supporting Arbitrum, Mantle, BNB Chain, Karak Network, and Ethereum. Symbiotic focuses on Ethereum, but accepts a wide range of ERC-20 tokens for restaking.

❖ Dencun Upgrade and EIP-4844: The Ethereum Dencun hard fork went live in March, bringing nine major changes to the network. The most notable of these is EIP-4844 (also known as Proto-danksharding), which allows users to benefit from lower L2 transaction gas fees. This is an important milestone on the road to Ethereum scalability and lays the foundation for full Danksharding in the future.

➢ EIP-4844 introduces "Blob", which provides L2 with a more fuel-efficient way to publish transaction data. Blob stores large amounts of data off-chain and uses a pricing mechanism called "Blob Gas", which operates independently of the Ethereum gas fee market. In addition, the data is temporarily stored for about two weeks, not permanently.

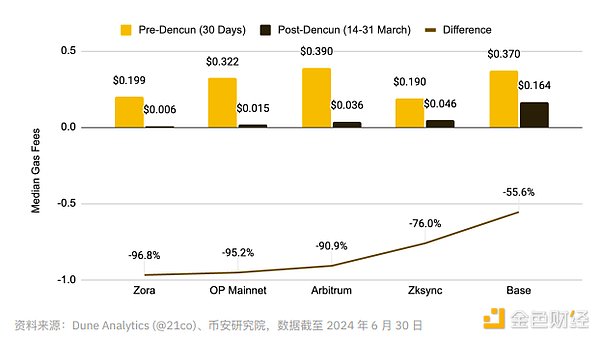

Figure 17: After the Dencun upgrade, many L2 transaction fees dropped by 90%

➢ After the launch of EIP-4844, L2 transaction fees dropped significantly across the board. As shown in the figure above, after the Dencun upgrade, the median fuel fee of the main L2 dropped by more than 90%. Currently, on most major L2 networks, it costs less than $0.01 to send ETH, and the cost of exchanging tokens is generally less than $0.1.

❖ ETH spot ETF: Following the approval of the US BTC spot ETF in January, many people in the market speculated how long it would take for the ETH spot ETF to be approved. By May, most people believed that it was unlikely to be approved before the summer. However, surprisingly, at the end of May, the US Securities and Exchange Commission approved the listing of several ETH spot ETFs.

➢ Currently, issuers and the SEC are communicating on the details of their ETFs, and they are expected to be listed and traded in the coming weeks.

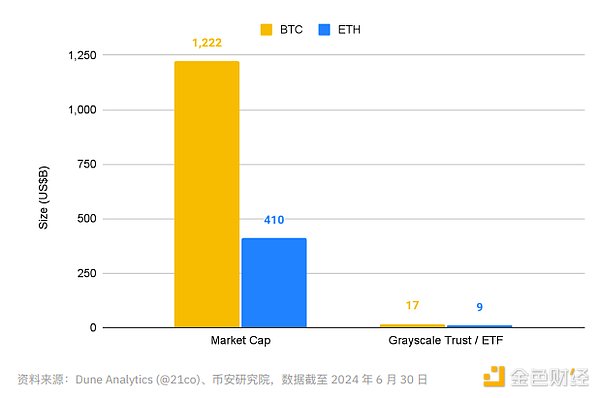

➢ Some predict that ETH ETF flow will be comparable to BTC ETF, while others predict that ETH ETF flow will be sluggish. We can draw a more accurate conclusion through the following two comparable data: (i) Ethereum’s market value is about 32% of Bitcoin; (ii) The size of Grayscale Ethereum Trust is about 58% of Grayscale Bitcoin ETF (Grayscale Bitcoin ETF is converted from the original Grayscale Bitcoin Trust Fund.

Figure 18: Ethereum’s comparable volume is 30% to 60% of Bitcoin. What does this mean for its ETF flow?

❖ Future Development:

➢ Pectra Upgrade: Pectra is scheduled to launch an update in the first quarter of 2025 and will be the next major upgrade of Ethereum, including a series of updates to the execution layer and consensus layer.

■ Major additions include: EIP-7002 (increasing the flexibility of re-staking and staking pools), EIP-7251 (increasing the maximum effective balance of Ethereum validators from 32 ETH to 2048 ETH, which helps reduce system complexity), EIP-7594 (introducing peer-to-peer data availability sampling to further optimize L2), EIP-7702 (improving account abstraction functions), etc.

BNB Chain BNB Chain has always maintained its leading position in L1 and continued to make progress in multiple directions. Its major progress in the first half of the year includes: opBNB development, improving decentralized data storage capabilities through BNB Greenfield, and starting to pay attention to meme coins. BNB Chain's position in the DeFi field remains solid, and its TVL of more than $7 billion ensures that it remains the third largest DeFi chain. PancakeSwap is still the leading DeFi DApp with a TVL of approximately $1.5 billion; Venus is closely behind with a TVL of $1.4 billion.

❖ opBNB is on track: opBNB is the BNB Chain optimistic aggregation L2 solution, based on the OP Stack, and is EVM-compatible, with up to 5,000 transactions per second (“TPS”) and an average gas fee of approximately 0.001 Gwei (worth <0.001 USD). In fact, the recent Haber hard fork, which uses Blobs (similar to Ethereum’s EIP-4844), further reduced the average gas fee by 90%. opBNB also supports Native Account Abstraction (“AA”) and optimizes account abstraction transactions. These factors complement each other and make opBNB attractive to developers working on applications such as games that require high-frequency microtransactions.

➢ Since its launch in September last year, opBNB has recorded more than 1.1 billion transactions from approximately 3.5 million daily active accounts. Leading DApps include derivatives platform KiloEx, APX Finance, and PancakeSwap.

Figure 19: opBNB’s number of daily active accounts has steadily increased, exceeding 3.5 million at the time of writing

❖ BNB Greenfield Update: BNB Greenfield provides decentralized data storage infrastructure within the broader BNB Chain ecosystem. It is a storage-oriented blockchain where users can create, store and exchange data that they fully own. Through the native cross-chain bridge, all data stored in BNB Greenfield can be easily transferred to the BNB Smart Chain for use by BNB Chain DApps and new BNB Greenfield DApps. Related use cases include website hosting, cloud storage, blockchain data storage, publishing, personal data marketplaces, etc.

➢ Since launching its mainnet in Q4 2023, BNB Greenfield has ~2.15 TB of storage and executed 6.8 million transactions involving ~35,000 addresses. Notable participants include infrastructure players CodexField, Aggregata, and Rido.

Figure 20: BNB Greenfield’s network usage continues to rise, with strong growth in the second half of the first half

❖ Memecoins and Airdrops: BNB Chain has launched a series of community activities in the past few months, including focusing on memecoins and airdrops.

➢ Battle of Meme Innovation: BNB Chain has invested $1 million through this campaign to promote memecoin innovation within the ecosystem. $100,000 was distributed in the first phase, and the remaining $900,000 will be distributed in the second phase. These funds will be used to support liquidity pools to develop and grow the most promising meme projects on BNB Chain.

➢ Airdrop Alliance: This program is a collaboration between BNB Chain and high-quality projects that have not yet issued tokens to airdrop tokens to users with traceable past activities on BNB Chain and opBNB. BNB Chain recently launched the third phase of the program, which will distribute more than 8 million tokens. ➢ BNB Incubation Alliance: Launched in partnership with Binance Labs, this program aims to support and promote the development of early-stage blockchain projects through a series of global events. Winning projects can quickly enter the Most Valuable Builder (“MVB”) program, receive BNB Chain funding support, and use BNB Chain’s issuance as a service (“LaaS”) package. The initial series of events will be held at EthCC in Brussels, Bitcoin 2024 in Nashville, Token 2049 in Singapore, Binance Blockchain Week in Dubai, and DevCon / EthGlobal in Bangkok.

❖ Future Development: ➢ New Node Clients: The BNB Chain team has been working with Paradigm to evaluate, test, and improve Reth (a node client for Rust-based Ethereum and BSC). There are currently two BNB node clients, and this will be the third. BNB Chain also hopes to build the next generation of high-performance node clients on top of this. ➢ Focus on gas-free infrastructure: BNB Chain will launch support measures to allow DApps to connect users without gas-fee tokens, including Paymaster based on smart contracts.

Solana performed well in 2024, with continued increase in on-chain activity and increasing market attention.

Figure 21: Solana’s active addresses have shown clear positive momentum over the past year

❖ Memecoin Home: Memecoins have been the dominant narrative over the past six months. As will be covered later in this report, memecoins have been the best performing sub-sector this year, with a year-to-date return of over 279%.

➢ Solana has been at the heart of the memecoin market, with many traders choosing Solana when trading memecoins. This is due to a number of factors, with relatively low transaction fees and a complete and tight product suite being the main highlights. Solana has also created some natural memecoin activity, airdropping BONK memecoins to owners of Solana Saga phones, making it one of the leading memecoins in this cycle.

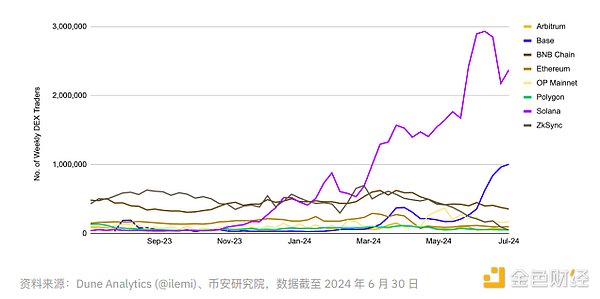

➢ As can be seen in Figure 22, Solana has seen a significant increase in the number of weekly DEX traders compared to other players in the market. While not entirely due to memecoin trading, it is undoubtedly the main driver of development.

Figure 22: Solana’s weekly DEX trader count surges

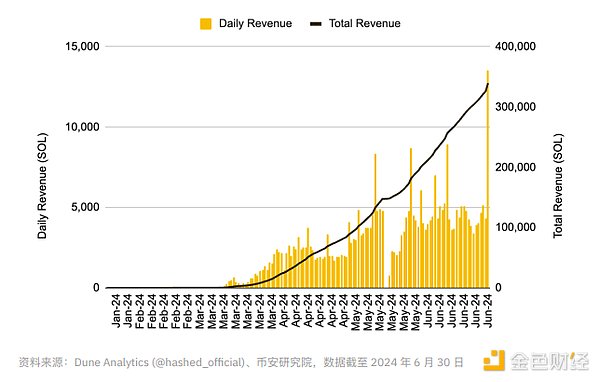

➢ The launch and development of Pump.fun is also important to Solana’s meme coin narrative. Pump.fun is a simple platform dedicated to creating and trading memecoins, ensuring that each token is issued fairly, with no pre-sales and no allocations to teams, solving typical problems such as unfair distribution and runaway scams. Given that users can create and deploy a new memecoin at a price of 0.02 SOL in just about 2 minutes, the platform has indeed helped the development of the Solana memecoin trading market. More than 1.1 million new memecoins have been deployed through Pump.fun, and the platform has generated more than 308,000 SOL (about $42 million) in revenue.

Figure 23: Pump.fun has generated over $42 million in revenue since launch

❖ DePIN: The Decentralized Physical Infrastructure Network (“DePIN”) remains one of the most interesting innovations in the cryptocurrency world and deserves close attention. DePin projects are typically infrastructure projects that leverage blockchain technology and cryptoeconomics to incentivize individuals to allocate funds or rent out resources to create a transparent and verifiable decentralized infrastructure network. Examples include Hivemapper, a community-driven decentralized mapping service, and Helium, a cryptocurrency-powered 5G cellular network.

➢ DePin is a class of DApps that can only be done on Solana, due to Solana’s localized fee market and high throughput (relative to other major networks, which are often EVM-based and may not be suitable for Solana’s intensive use cases). As a result, Solana has played an integral role in hosting important DePin projects such as Helium, Render, and Hivemapper. In addition, a host of new projects such as Ambient and Natix, both of which focus on collective environmental and geographic data, have recently raised funds to continue developing their products.

➢ Projects in this space are progressing quite well. For example, Hivemapper has mapped over 20% of the global road network (13), and Helium’s mobile hotspot coverage is expanding across North America, Europe, and East Asia. It will be interesting to watch how these projects develop, as well as how emerging protocols perform, and will be particularly important, as chains such as Polygon and Arbitrum have also entered the DePIN space and may compete with Solana.

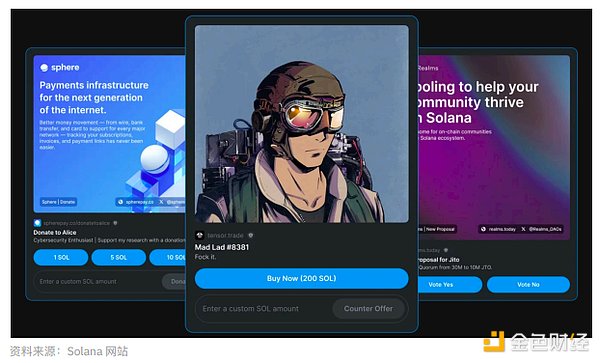

❖ Solana Actions and Blinks: Solana recently announced the launch of Solana Blinks (short for Blockchain Links). Actions are APIs that redirect transactions to the Solana chain, while Blockchain Links convert Solana Actions into shareable links. In other words, on-chain actions can be triggered anywhere a shareable link can be used. In practice, this means users can mint NFTs, vote on proposals, donate, redeem tokens, etc. directly on the X timeline. Essentially, Blinks allows users to perform blockchain transactions anywhere their link has been shared and access Solana DApps from any platform that can host a link.

Figure 24: Users can interact with Blinks directly and perform various on-chain activities without leaving the website they are on

➢ Many leading Solana protocols have integrated Blinks. Drift Protocol will allow users to go long/short tokens directly on X , while Meteora will allow users to trade memecoins on the timeline. Users can mint Tensor NFTs, vote on Helium proposals, use Sanctum for liquidity staking, or redeem tokens on Jupiter while scrolling X timelines. While this emerging primitive is still in the early stages of development, we look forward to seeing how it develops in the future and the innovations that Actions and Blinks may bring.

❖ Future Developments:

➢ Firedancer: Solana’s next-generation independent validator client, its release has been highly anticipated and is expected to be launched later this year or early next year.

■ Solana currently has two clients: the original Solana Labs client and another client built by Jito Labs. However, Jito Labs is a fork of the original Solana Labs client, so if a bug shuts down one client, it’s possible that the other client would be affected as well. Firedancer, on the other hand, is completely independent and is even written in a different language (the original client is in Rust, while Firedancer is in C++). ■ Firedancer’s main advantage is that it improves the reliability and resilience of the network, meaning that if a bug shuts down other clients, the network can still run on Firedancer. Additionally, Firedancer is designed to significantly improve Solana’s scalability: in testing, Firedancer was able to process over 1 million transactions per second (14), well above Solana’s current average of 3,000-4,000 (15). Firedancer will also help reduce latency and improve the performance of Solana DApps. All of these factors together create a more robust blockchain and bring more exciting possibilities for high-throughput DApps.

➢ Saga Chapter 2: Solana’s Saga phone is tightly integrated with the blockchain, providing users with a convenient way to easily manage digital assets. It sold out in late 2023 due to strong demand. This can be attributed in part to the rise of memecoins, especially BONK. At the time, Saga owners were given BONK airdrops, and many of the shares they received were later worth more than the price of the phone itself (16).

■ Solana then opened pre-orders for the second-generation device, Saga Chapter 2. The phone is expected to be released in 2025, and pre-order users have already received two airdrops. ➢ Scalability: Recently, Light Protocol announced that it has partnered with Helius Labs, another Solana development company, to introduce ZK compression technology to Solana. This is an expansion technology that aims to further reduce the cost of on-chain computation, using zero-knowledge proofs and call data (somewhat similar to how Ethereum L2 works). Its solution is currently in the testnet stage. Recently, Solana L2 Sonic, which focuses on games, also raised $12 million. Sonic is currently in the development network stage, and five game studios have developed on its basis. Its mainnet and token are expected to be launched in the third quarter.

❖ Avalanche:Avalanche released Teleporter in March. This is a communication protocol designed to improve the interconnectivity between subnets. Teleporter facilitates the transfer of tokens, NFTs, and messages between subnets. There are currently about 125 subnets, but less than 50 of them have validators.

➢ The gaming sector has always been the focus of attention, with the announcement of the launch of the (17) MapleStory Universe subnet being the most notable.

➢ The Avalanche Foundation continues to support the ecosystem. It has established a $100 million Culture Catalyst (18) grant program (for Avalanche-based memecoins) and a $50 million Vista Program(19) (for Avalanche-based tokenized assets, i.e. RWAs).

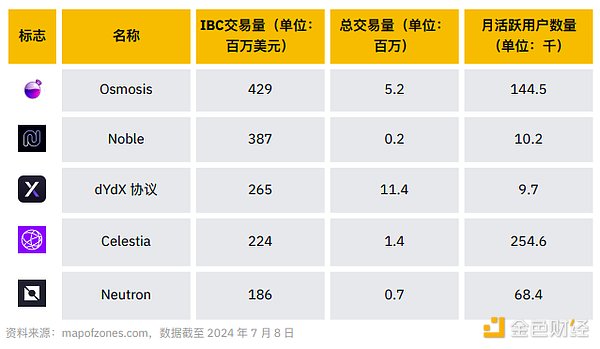

❖ Cosmos:The Cosmos ecosystem is centered around the Cosmos Hub, an application chain secured by the $ATOM token. Multiple other application chains, called “Zones,” are connected to the Cosmos Hub and use the Inter-Blockchain Communication (“IBC”) protocol to communicate and transfer data between each other. A “Hub” is essentially a Zone that facilitates communication with multiple other Zones. The Cosmos Hub was the first Hub to emerge, but many other Hubs have become more active than the Cosmos Hub (20). Other leading Hubs include Osmosis, Celestia, Axelar, and Noble. At the time of writing, there are 80 active Zones supporting IBC in the Cosmos ecosystem, with a market cap of over ~$31 billion.

Figure 25: On-chain activities of the top five Cosmos application chains in the past 30 days

➢ Replicated Security and Mesh Security: Last year, Cosmos began to focus on shared security, released Replicated Security and announced the launch of Mesh Security. However, apart from the decision of Neutron and Stride application chains to use Replicated Security, there has been no further news on the development of these two projects.

➢ Babylon Chain is coming soon: Babylon is a Cosmos project that aims to enhance the security of Cosmos application chains and other Proof of Stake (PoS) chains by leveraging Bitcoin’s security guarantees. Babylon has integrated 50 chains on its testnet with a total market value of more than $9.8 billion (22). These include most of the top Cosmos application chains, such as Osmosis, Injective, Akash, Sei, Stride, Evmos, etc.

■ Babylon uses a hybrid model that combines Proof of Stake (PoS) and Proof of Work (PoW), and adds IBC for communication, which can be seen as an effort to leverage the strengths of Ethereum, Bitcoin, and Cosmos. This is a promising new blockchain design and we will be watching its development closely as its mainnet launch approaches.

❖ Tron: As a stablecoin settlement chain, Tron continues to perform well, with its custody of USDT accounting for more than 50% of the total issuance (23). Additionally, Tron’s DeFi TVL remains second despite being comprised of only ~34 protocols, compared to Ethereum’s 1,000+ and BNB Chain’s 770+. (24) JustLend and JustStable are the leading protocols on the chain. Earlier this year, Justin Sun also announced (25) that Tron is developing a Bitcoin L2 solution.

❖ TON:TON has made significant progress in both popularity and narrative recognition over the past year. Its market cap has grown from ~$8 billion in January to over $18 billion by the end of June, while TON’s transaction volume and number of addresses have continued to rise. Perhaps the most notable development of the TON network is its integration with the Telegram messaging app (which has over 800 monthly active users). Other recent Telegram games such as Hamster Kombat (which plans to airdrop tokens on TON (27)) and Notcoin have also been in the spotlight. ❖ Fantom: Fantom is constantly making news, and the Fantom Foundation recently announced that it will be launching a new L1 network, Sonic. Sonic will have a native L2 cross-chain bridge to Ethereum and will reportedly process transactions at speeds of up to 2,000 transactions per second (“TPS”). They also recently announced that they raised $10 million in funding and allocated 200 million $FTM to migrate DApps and partners to Sonic. ❖ Berachain: One of the emerging L1s that has entered the market in recent months, it is more eye-catching among the products of the same period. Berachain adopts a novel liquidity proof consensus mechanism, focusing on establishing system liquidity within Berachain's DApp ecosystem and aligning all stakeholders through a three-token model. Berachain recently launched the testnet V2 version and plans to launch the mainnet in the next few months.

❖ Cardano:Cardano’s DeFi TVL hit a new high in the first half of the year, exceeding $500 million in March, but has since fallen back. Cardano is also preparing for its upcoming Chang hard fork (expected to be launched at the end of July), which will make its governance fully decentralized.

❖ NEAR Protocolhas been very active, especially focusing on the sub-industry of AI combined with cryptocurrency. They are about to release a data availability (“DA”) solution, NEAR DA.

Various information reports are never for learning, but for "checking answers". What is the difference between what I know and what others know? How can I reflect on it?

JinseFinance

JinseFinanceBlockchain modularity has developed its own vitality, and the good growth trend shown by Layer-2 (L2) in 2023 will continue into 2024.

JinseFinance

JinseFinanceResearchers at Binance recently launched their CPT (Capital, People, Technology) framework.

JinseFinance

JinseFinanceFederal Reserve, Binance, Research Report, Binance Research Institute CPI Index Analysis: The possibility of a US interest rate cut in September increases. Golden Finance, the probability of a rate cut in September rose to more than 80% after the data was released.

JinseFinance

JinseFinanceThis article explores the development of Web3 in June 2024 to provide an overview of the current state of the ecosystem. We analyze the performance of the cryptocurrency, DeFi, and NFT markets before previewing major events to watch out for in July 2024.

JinseFinance

JinseFinanceThis article outlines a recent report from Binance Research that discusses the major developments in the cryptocurrency market over the past month.

JinseFinance

JinseFinanceBerachain secures $100M Series B led by Brevan Howard Digital & Framework Ventures. Plans expansion to key regions. Rising VC interest in crypto startups evident with 32% Q1 increase in investments, March hitting $1B.

Huang Bo

Huang BoEight months after launching the first version of the Universal Data License (UDL), Arweave development incubator Forward Research has released UDL version 0.2.

JinseFinance

JinseFinance JinseFinance

JinseFinanceAlameda Research is on thin ice if we’re to believe the latest report.

Bitcoinist

Bitcoinist