Source: Binance Research, 2024 Semi-annual Report Part 4 I. Market Overview Blockchain modularization has developed its own vitality. The good growth trend shown by Layer-2 (L2) in 2023 has continued into 2024, bringing the total locked value (TVL) of Layer-2 to $43 billion. This shows that in the first six months of 2024 alone, TVL has increased by 90%. The Layer-2 field has also not slowed down. The release of Ethereum Dencun upgrade EIP-4844 has caused a sharp drop in aggregate prices, as L2 transaction fees have dropped by as much as 96.8% after the hard fork. This, combined with the plethora of new and attractive L2s launching in 2024, will continue to drive the L2 ecosystem to new heights by the end of the year.

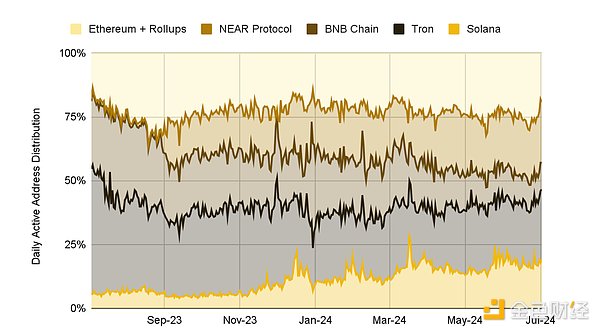

Layer-2s are critical to maintaining the Ethereum ecosystem’s solid position in terms of user activity, even when compared to the most active alternative L1s like Solana and Tron. Currently, the total number of daily active addresses for the Ethereum mainnet and all of its L2s is around 2.1 million. This is equal to the TRON chain that leads on this metric, and higher than the second-ranked Solana, which has 1.6 million daily active addresses.

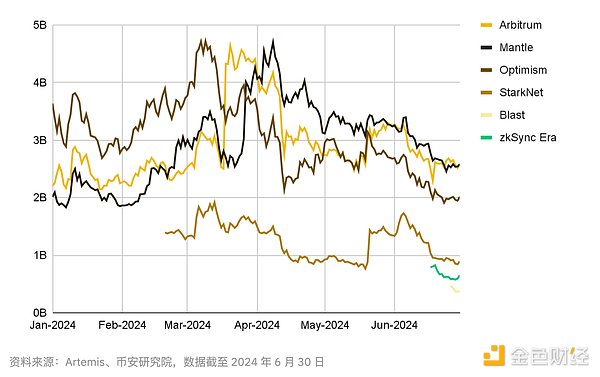

Source: Artemis, Binance Research, data as of June 30, 2024

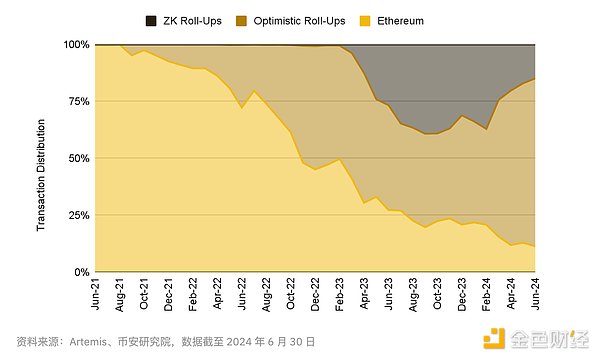

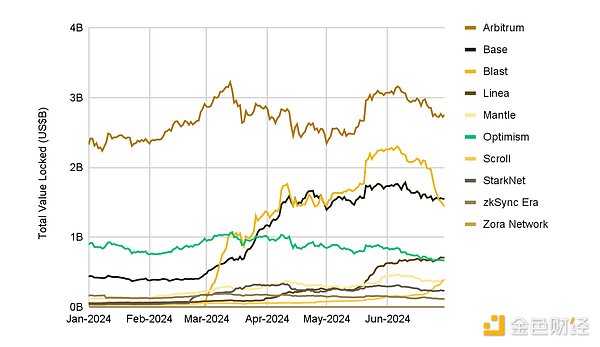

In terms of competition within the Ethereum Layer-2 field, Blast L2 was released in February 2024; at the same time, Arbitrum and Base showed a rapid growth trend, so in terms of market capitalization, optimistic rollups are firmly in the lead compared to other zero-knowledge competitors. Before the launch of Blast, the market share of zero-knowledge rollups has been steadily increasing since the launch of zkSync Era in March 2023.

Figure: Activity on Arbitrum, Blast, and Base grew rapidly in February, putting Optimistic Rollups firmly ahead of Zero-Knowledge Rollups in terms of trading activity.

Due to the rapid growth of Arbitrum and Base, coupled with the launch of Blast in 2024, Optimistic Rollups have captured a major market share, surpassing Zero-Knowledge Rollups.

Figure: Optimistic Rollups have a major market share in terms of TVL, totaling about 80%. Source: l2beat, Binance Research, data as of June 30, 2024 2. Overview of "Optimistic Rollup"

Arbitrum

Although the Arbitrum chain still ranks first in L2 in 2024, its ecosystem has fallen behind Optimism because Base has developed rapidly and Blast has been newly launched, and both use the OP technology stack. However, several new projects plan to use the Arbitrum Orbit stack for the next generation of L3 chains, including ApeChain and Animechain developed by the Bored Ape Yacht Club and the Azuki team respectively. In the future, whether Arbitrum will be able to compete with Optimism's OP stack will depend on the success of these upcoming important blockchains.

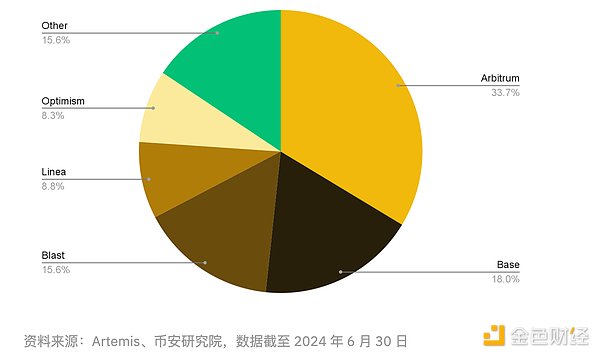

The TVL of the Arbitrum chain itself is still the highest among similar L2s, and it has always occupied the main market share of L2, reaching about 33.7%. At present, the total TVL of all L2s is about US$8.3 billion. (31)

Figure: In terms of TVL, Arbitrum is far ahead of other Layer 2s with a market share of 33.7%, with an overwhelming advantage

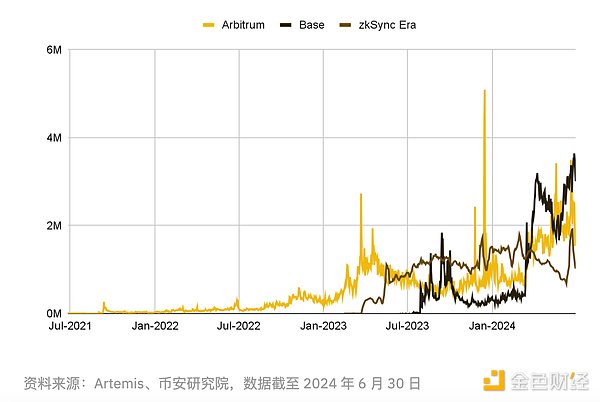

However, Arbitrum's daily transaction volume in 2024 lags behind Base. Base recently set a record high of 3.5 million daily transactions on June 28, surpassing zkSync Era, which was originally ranked second.

Figure: Arbitrum’s daily volume lags behind Base, but remains ahead of zero-knowledge rollups, currently in second place

ARB Token Vesting: While $ARB’s TVL is ahead of other L2s, its market cap is still on par with other optimistic rollup networks, at around $2.3 billion as of writing, on par with Mantle’s $MNT token and slightly above Optimism’s OP token, which currently has a market cap of around $1.8 billion.

Figure: ARB token market value is currently competing fiercely with other L2 governance tokens

The ARB tokens of its investors and team will begin to be unlocked on March 16, coinciding with the beginning of its price decline. From March 16, 92.65 million ARB tokens (worth about $75 million at the time of writing) will be unlocked on the 16th of each month according to the vesting plan for the team and investors. The final unlock will occur on March 16, 2027, when the entire 10 billion ARB token supply will be unlocked and put into circulation. The unlocking of these vested tokens may bring continued downward pressure on the token price in the future.

Arbitrum Brings Gaming and NFTs to its Orbit: Arbitrum Orbit facilitates the permissionless creation of L3s, giving developers more autonomy. On top of this, developers have full access to the ArbitrumNitro stack through Orbit. So far, 2024 has been an exciting year for Arbitrum Orbit. A number of notable teams in the gaming and NFT space have announced that their upcoming “Layer 3” (L3) chains will use the Orbit stack:

Offchain Labs, the team behind Arbitrum, launched the XAI gaming chain. Its December 2023 node sale raised over 13,000 ETH (about $40 million at the time),(34) and the XAI chain went live in March 2024. The XAI token market cap is currently $130 million. For more information on XAI, see the gaming section below.

In February of this year, the Bored Ape Yacht Club’s Apecoin DAO voted to launch its gaming-focused “ApeChain” using Arbitrum Orbit’s technology stack.

The community-driven "$degen" project, a meme coin project spun off from a Farcaster channel, is launching the "DEGEN Chain." The DEGEN Chain is built on Arbitrum Orbit, with Base as the settlement layer and AnyTrust providing data availability.

Proof-of-play, the team behind Pirate Nation, uses the Orbit technology stack to launch its "multi-chain system." The studio said Arbitrum's technology allows games to run entirely on-chain, eliminating unnecessary delays or failures.

Rarible Foundation's Rari Chain was launched as Abitrum L3 through Arbitrum Odyssey. RariChain is a Layer-3 compatible with the Ethereum Virtual Machine (EVM) that embeds an NFT royalty mechanism at the sequencer level.

The team behind the famous NFT project Azuki announced that it will develop AnimeChain, which aims to integrate all content in the Web3 anime field into one chain. The network will include original and third-party anime content, games, merchandise, and NFTs.

Kinto launched its mainnet in May 2024. As an identity-authenticated blockchain, Kinto can support financial institutions and decentralized protocols. Previously, it launched its testnet using OP Stack in May 2023, but switched to Arbitrum Orbit in the fourth quarter of 2023.

With many new L3 chains joining the Arbitrum Orbit ecosystem, observing their development will help determine whether the Orbit stack has the ability to compete with the already thriving OP ecosystem.

Base

Base made great progress in 2024, surpassing the OP mainnet to become the second most popular Ethereum L2 after Arbitrum. The Base chain is Coinbase's native L2 solution, built using the OP Stack and launched in August 2023. Its continued growth in the first half of 2024 shows that it has more staying power than, or even far more than, the initially popular friend.tech application. Only about a year after the launch of the Base mainnet, its TVL has exceeded $1.5 billion, and its on-chain ecosystem is thriving, consisting of more than 200 DApps, most of which are native to this L2 chain.

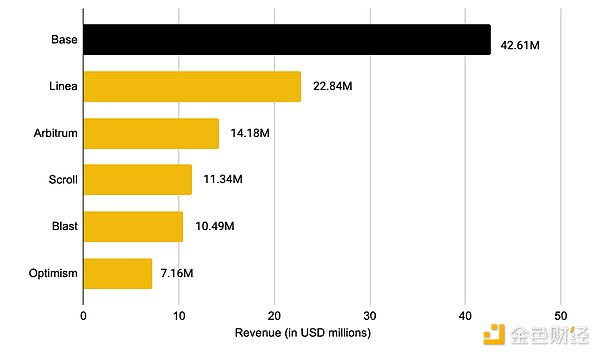

Highest Revenue L2: Year to Date (“YTD”), Base is the highest revenue L2 chain, with revenue of $42.6 million in the first half of 2024, almost double that of second place Linea.

Figure: Base’s revenue surpasses all other aggregates at $42.6 million YTD 2024

Source: Artemis, Binance Research, data as of June 30, 2024

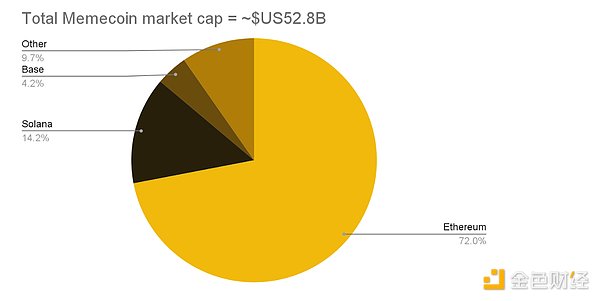

Competing with Solana’s memecoin dominance: The memecoin ecosystem on Base has been growing. Currently, the total market value of memecoins is about $52 billion, of which memecoins on Base currently account for about 4%, ranking third, second only to Solana memecoins, which account for 14%. However, Ethereum is still the place with the highest value of memecoins. As of writing, the total market value of Ethereum native memecoins is about $38 billion.

Figure: Base chain’s total share of the native meme coin valuation market is second only to Solana

Source: Coingecko, Binance Research, data as of June 30, 2024

Base native meme coin $BRETT was particularly successful in 2024. It just launched on February 29th and has already ranked among the top 100 of all cryptocurrencies, with a current market capitalization of over $1 billion.

Home of Coinbase's New Smart Wallet: In June of this year, Coinbase announced the launch of Smart Wallet. The product aims to simplify the onboarding process and eliminate network fees and the need for mnemonics to improve the on-chain experience. Users can create new wallets in seconds and access the blockchain easily and conveniently.

The Smart Wallet technology stack also allows developers to sponsor user transactions, pay network fees and optimize interactions with DApps. This solution can reduce the cost threshold and promote the popularization of blockchain. To eliminate the need to actively manage mnemonics, Coinbase uses offline storage and advanced encryption technology to securely store private keys. In addition, multi-party secure computing (MPC) technology provides further security for private keys, splitting private keys into different parts and storing them in different locations, ensuring that security protection is strong even if one part is leaked.

OP Mainnet

Although the OP Mainnet has lost to the vibrant emerging L2 chains Base and Blast in terms of activity and TVL, the rapid rise of these new players also means that the adoption rate of the entire OP Stack and Superchain ecosystem will increase significantly. Although Arbitrum is still the L2 chain with the highest TVL, with approximately $2.8 billion in locked assets in its on-chain smart contracts, the total TVL of the popular Optimism ecosystem L2 (OP Mainnet, Blast, Base) has exceeded the Arbitrum ecosystem and currently reaches around $3.7 billion. As cross-L2 interoperability rapidly develops through Optimism's Superchain and Arbitrum's Orbit initiative, evaluating the competition between the two may increasingly require comparing comprehensive metrics of all projects using their technology stacks, rather than evaluating each L2 chain individually.

In terms of business model and revenue, Optimism Collective is well positioned to perform well in 2024 due to Base's exponential growth. Under the ongoing agreement between Base, which uses the OP Stack, and Optimism Collective, Base will pay Optimism Collective 2.5% of Base's revenue or 15% of Base's on-chain profits, whichever is higher. In return, Base will receive up to 118 million OP tokens, worth $175 million, over the next six years. Under this arrangement, Base has earned approximately $35 million in profits so far this year, and the Optimism Collective will earn an additional $5.25 million in the first half of this year, in addition to the approximately $13 million in profits earned by the OP mainnet itself.

To assess the future progress of the OP Superchain, we must closely observe whether other Layer 2 solutions using the open source OP Stack are as committed to the Optimism Superchain theory as Base has shown. Base's endorsement, coupled with Coinbase's support, adds credibility to Superchain's potential success. However, not all projects share this view; some may choose to use the open source OP Stack but refuse to contribute to the realization of the overall OP vision.

Error Proofs: When a user submits a transaction to the aggregate network, the transaction is bundled with other users' transactions and forwarded to Ethereum together. These bundled transactions are then collectively recorded on Ethereum's transaction ledger, speeding up transactions and significantly reducing fees. In theory, aggregated transactions must be secured through a cryptographic method called "proof". With this method, observers on Ethereum can verify that the recorded transaction details are accurate. This is particularly important for withdrawals, as it enables users to withdraw funds from the Layer-2 chain through Ethereum rather than the aggregated network.

Without error proofs, users who deposit funds into Optimism would have to trust the aggregated "security committee" to return their funds, but the system is prone to potential human error or bias. With the introduction of error proofs, users only need to trust Ethereum, thereby improving the security and reliability of user transactions. Currently, error proofs have been deployed to the Optimism mainnet, and other chains using the Optimism OP Stack, such as Base and Blast, can also use this technology.

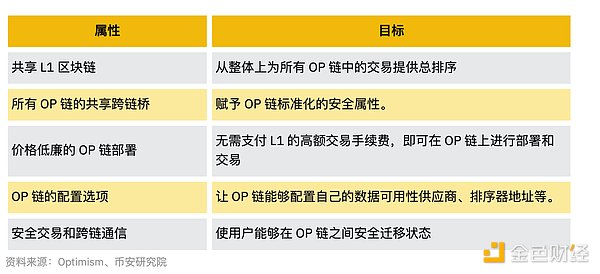

Optimism Superchain continues to grow and develop: Superchain has become the base camp of some popular L2s. According to the definition of Optimism document, Superchain is a "decentralized blockchain platform composed of many chains that share security and the same technology stack (OP Stack). Its interoperability and standardization enable each individual chain to be treated equally by major tools and wallets."

In order to realize the vision of Superchain, Optimism Collective is committed to guiding Optimism to obtain the following properties:

Figure: Properties of Superchain

More and more chains are actively adopting OP Stack, it can be said that this lays the foundation for the ambitious Superchain vision. We must keep a close eye on emerging cross-chain DApps. They use multiple OP chains to obtain liquidity while abstracting the bridging process for end users. This solution will shorten the learning curve required to proficiently use Superchain and its related DApps, which is crucial to achieving large-scale adoption.

Figure: More and more chains are built on OP Stack, which together contribute to its outstanding performance in terms of transaction volume and number of unique addresses

CELO turns to Optimism: In May of this year, the CELO community voted to migrate its L1 chain to the Ethereum ecosystem through OP Stack to become an L2 chain. The proposal states: "OP Stack provides most of the tools needed to deploy L2. Only minor changes are required to support Celo's unique features." OP Stack has been battle-tested by multiple production chains and is compatible with other stacks, such as Polygon's Type 1 ZK solution.

CELO is a mobile-first, carbon-negative blockchain platform that aims to bridge the gap between decentralized finance (DeFi) and the real world. It enables fast, secure and low-cost global payment solutions that can be used by anyone with a smartphone, thereby promoting financial inclusion in emerging markets while empowering individuals.

Ancient8 Launches: Starting in September 2023, after a 10-month testnet phase, the Ancient8 mainnet was officially launched in February this year. Ancient8 is a gaming-focused L2 that integrates the powerful OP Stack and uses Celestia as its data availability layer. It aims to solve the challenges facing scalability and adoption for all-on-chain games and consumer DApps.

Ancient8 has partnered with five games so far:

Onchain Clash: A fully-on-chain game that perfectly blends territorial claims and expansion dynamics, inspired by Pixel War, Go Game, and Paperio.

Omnizone: A fully-on-chain game that combines tactical role-playing elements with a high-stakes battle royale format, running on the full chain.

MasterDuel: An online gaming platform that aims to create a unique environment for players to connect, duel, and earn real rewards in-game.

Wee Pepe: A fully on-chain game featuring Pepe The Frog, where players must build a city on the moon to save the planet Pepe from destruction.

DeWorld: The world's first fully on-chain game that allows players to use NFTs to cultivate and improve their own farms.

Blast

In Q4 2023, Pacman, the anonymous developer behind the Blur NFT marketplace, Crypto X, announced the upcoming launch of Blast L2. Shortly thereafter, the Blur team allowed users to deposit ETH into the Blast cross-chain bridge and promised an airdrop after the Blast mainnet launch. The airdrop incentive attracted more than $2 billion worth of assets to flow into the Blast cross-chain bridge before the mainnet even debuted. Its marketing and airdrop activities, combined with the Blur NFT team’s reputation for building solid products and the backing of renowned VC firm Paradigm, have created a favorable environment for Blast to become the most anticipated L2 to date.

Built on OP Stack, Blast L2’s main feature is that it automatically generates yield for users who hold ETH or Blast’s native stablecoin USDB in their wallets. For ETH holders, yield will be earned through L1 staking, initially through Lido, and automatically transferred to users after ETH is rebased on Blast L2. Users of bridged stablecoins will receive Blast’s automatically rebased stablecoin USDB. USDB yields come from MakerDAO’s on-chain T-Bill protocol. When bridged back to Ethereum L1, USDB can be redeemed for DAI.

Following the launch of the mainnet on February 29, Blast announced the continuation of its airdrop/points campaign, giving users the opportunity to increase their share by interacting with on-chain DApps. The campaign was a huge success: in June this year, the TVL of the Blast mainnet jumped to second place among Ethereum rollup projects.

Figure: In May/June this year, Blast's TVL jumped to second place in Ethereum L2

Source: Artemis, Binance Research, data as of June 30, 2024

However, after the airdrop, Blast's TVL began to fall back below Base. Whether Blast can maintain its TVL and activity levels post-airdrop will reflect the stickiness of its initial user base for the rest of the year.

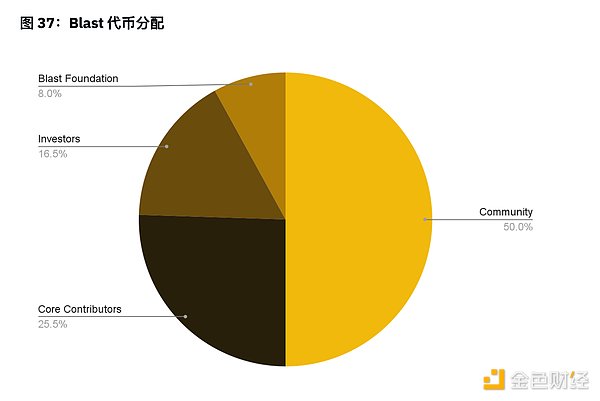

Blast Airdrop: On June 26, early users of Blast L2 were able to claim an airdrop of BLAST tokens. 7% of the total supply was allocated to users who bridged funds to Blast, and 7% to users who interacted with the Blast DApp. The initial airdrop was worth approximately $190.5 million at today’s price of approximately $0.014 per token. The remaining 36% of the supply will be allocated to the community to be distributed through future incentive campaigns. At the time of writing, BLAST has a circulating market cap of $238 million and a fully diluted valuation of $1.36 billion.

Source: Blast, Binance Research, data as of June 30, 2024

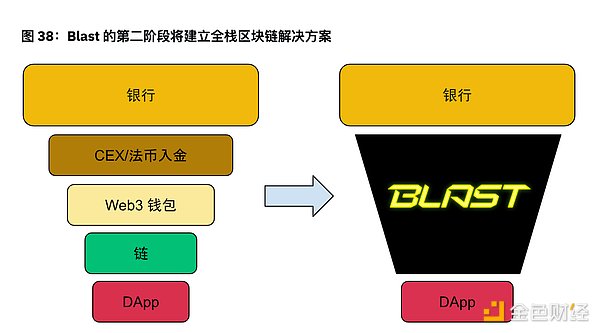

Blast Phase 2: The distribution of BLAST tokens on June 26 marked the end of Blast Phase 1. In Phase 2, the Blast Foundation stated its intention to work with the community to create desktop and mobile wallets specifically for crypto natives. In their Blast Vision blog post, the Blast team draws an analogy between the development approach of existing chains and that of the Android operating system: "Each chain is focused on optimizing the technology of the chain itself while relying on third parties to complete the rest of the stack. This is actually similar to Android's approach, which is to optimize the operating system and rely on third parties to complete the rest. Android's approach has worked well for these chains so far, but has also created a fragmented and friction-filled ecosystem." Blast plans to take a full-stack approach, building everything from software to hardware and optimizing across the entire stack. They see this as similar to Apple's development approach.

Source: Blast, Binance Research

In the next few months, Blast's native DApp, which is committed to bringing users an Apple-like perfect experience, will be released soon. Let us wait and see.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Ftftx

Ftftx