Bitcoin: The “barometer” of global liquidity

BTC, Bitcoin: The "weathervane" of global liquidity Golden Finance, Is the bull market of cryptocurrency still there? Will Bitcoin break through upwards?

JinseFinance

JinseFinance

Author: Sam Callahan, Lyn Alden Compiler: Block unicorn

Abstract

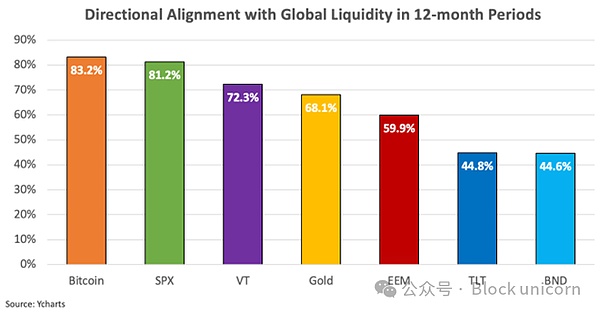

In any given 12-month period, Bitcoin moves in the same direction as global liquidity 83% of the time, a higher rate than any other major asset class, making it a powerful indicator of liquidity conditions.

Bitcoin has a high correlation with global liquidity, but is not immune to short-term deviations caused by special events or internal market dynamics, especially during periods of extreme valuations.

Combining global liquidity conditions with Bitcoin on-chain valuation metrics provides a more nuanced view of Bitcoin cycles, helping investors identify moments when internal market dynamics may temporarily decouple Bitcoin from liquidity trends.

Introduction

Understanding how asset prices move with changes in global liquidity has become critical for investors looking to enhance returns and effectively manage risk. In today’s markets, asset prices are increasingly influenced by central bank policies that directly impact liquidity conditions. Fundamentals are no longer the primary driver of asset prices.

This has been particularly evident since the Global Financial Crisis (GFC). Since then, these unconventional monetary policies have increasingly become the dominant force driving asset prices. Central bankers have used liquidity levers to turn markets into one big trade, and as economist Mohamed El-Elrian put it, central banks have become “the only game in town.”

Stanley Druckenmiller echoed the same sentiment, saying, “Earnings don’t drive the market, it’s the Fed Board…watch the central banks and watch what’s happening with liquidity…most people in the market are looking for earnings and conventional indicators. Liquidity is what drives the market.”

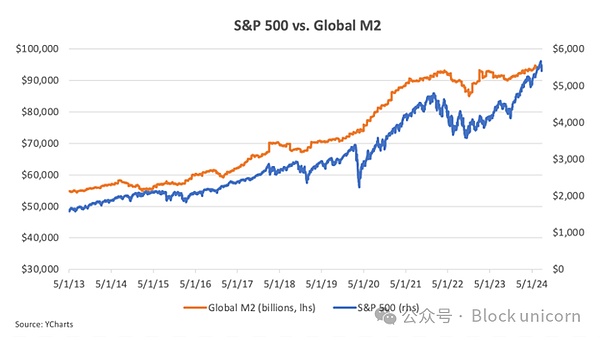

This is particularly evident when we examine how closely the S&P 500 has tracked global liquidity since the GFC.

The interpretation of the above chart comes down to simple supply and demand. If there is more money to buy something, whether it is stocks, bonds, gold or Bitcoin, the prices of these assets will generally rise. Since 2008, central banks have injected more fiat money into the financial system and asset prices have responded accordingly. In other words, monetary inflation feeds asset price inflation.

Against this backdrop, it becomes critical for investors to understand how global liquidity is measured and how different assets react to changes in liquidity conditions in order to better navigate these liquidity-driven markets.

How to Measure Global Liquidity

There are many ways to measure global liquidity, but for this analysis, we will use global M2 – a broad measure of money supply that includes physical currency, demand accounts, savings deposits, money market securities and other forms of easily accessible cash.

Bitcoin Magazine Pro provides a measure of global M2 that aggregates data from the eight largest economies: the United States, China, the Eurozone, the United Kingdom, Japan, Canada, Russia, and Australia. It is a good measure of global liquidity because it reflects the total amount of money available for consumption, investment, and borrowing around the world, and another way to think of it is as a measure of the total amount of credit creation and central bank money printing in the global economy.

One nuance here is that global M2 is denominated in U.S. dollars. Lyn Alden explained why this is important in a previous article:

The reason why it is denominated in U.S. dollars is that the U.S. dollar is the world's reserve currency, and therefore the primary unit of account for global trade, global contracts, and global debt. When the dollar is strong, countries' debts become harder. When the dollar is weak, countries' debts become softer. Global broad money denominated in U.S. dollars is like a great measure of world liquidity. How fast are fiat units being created? How strong is the dollar relative to other global currency markets?

When global M2 is denominated in U.S. dollars, it captures both the relative strength of the dollar and the pace of credit creation, making it a reliable measure of global liquidity conditions.

While there are other ways to measure global liquidity (such as considering short-term government debt or the global foreign exchange swap market), for the rest of this article, when you read "global liquidity," please understand it as "global M2."

Why Bitcoin May Be the Purest Liquidity Barometer

Over the years, there is one asset that has shown a strong correlation with global liquidity: Bitcoin. As global liquidity expands, Bitcoin tends to thrive. Conversely, when liquidity contracts, Bitcoin tends to suffer. This dynamic has led some to call Bitcoin a "liquidity barometer."

The chart below clearly shows how the Bitcoin price tracks changes in global liquidity. Similarly, comparing the year-over-year percentage changes in Bitcoin and global liquidity also highlights that the two appear to move in tandem, with Bitcoin's price rising when liquidity increases and falling when liquidity decreases. As can be seen in the above chart, Bitcoin's price appears to be highly sensitive to changes in global liquidity. But is it the most sensitive asset in the market today? Generally speaking, risky assets are more correlated with liquidity conditions. In a good liquidity environment, investors tend to adopt a risk-on strategy and move capital to assets that are perceived to be high risk and high return. Conversely, when liquidity tightens, investors typically move capital to assets they perceive to be safer. This explains why assets such as equities typically perform well in an environment of rising liquidity.

However, equity prices are also affected by other confounding factors that are unrelated to liquidity conditions. For example, equity performance is driven in part by factors such as earnings and dividends, so their prices are also tied to economic performance. This can have a negative impact on the pure correlation of equities with global liquidity.

In addition, U.S. equities benefit from passive inflows from retirement accounts such as 401(k)s, which further influences their performance regardless of liquidity conditions. These passive inflows may buffer U.S. equities when liquidity conditions fluctuate, potentially reducing their sensitivity to global liquidity conditions.

Gold's relationship with liquidity is more complicated. On the one hand, gold benefits from rising liquidity and a weaker U.S. dollar, but on the other hand, gold is also seen as a safe haven asset. In periods of shrinking liquidity and risk-averse behavior, as investors seek safety, demand for gold may increase. This means that even if liquidity is drained from the system, the price of gold can hold up well. Therefore, gold’s performance may not be as tightly correlated to liquidity conditions as other assets.

Like gold, bonds are also viewed as safe haven assets, so their correlation to liquidity conditions may be lower.

This brings us back to Bitcoin. Unlike stocks, Bitcoin does not earn or pay dividends, nor does it have a structural bid that affects its performance. Unlike gold and bonds, at this stage in Bitcoin’s adoption cycle, most capital pools still view it as a risk-on asset. This makes Bitcoin perhaps the purest correlation to global liquidity relative to other assets.

If this holds true, then this is a valuable insight for Bitcoin investors and traders alike. For long-term holders, understanding Bitcoin’s correlation to liquidity can provide deeper insights into the drivers of its price over time. For traders, Bitcoin provides a tool to express views on the future direction of global liquidity.

This article aims to delve deeper into the correlation between Bitcoin and global liquidity, compare it to other asset classes, identify periods when the correlation breaks down, and share insights on how investors can use this information to their advantage in the future.

Quantifying the Correlation Between Bitcoin and Global Liquidity

When analyzing the correlation between Bitcoin and global liquidity, it is important to consider both the strength and direction of the relationship.

The strength of the correlation reveals the degree of association between the two variables. The higher the correlation, the more predictable the impact of changes in global M2 on Bitcoin's price, both in the same direction and in the opposite direction. Understanding this degree of association is key to measuring Bitcoin's sensitivity to changes in global liquidity.

Bitcoin's strong sensitivity to liquidity is evident when analyzing data between May 2013 and July 2024. During this period, Bitcoin's price had a correlation of 0.94 with global liquidity, reflecting a very strong positive correlation. This suggests that Bitcoin's price is highly sensitive to changes in global liquidity over this timeframe.

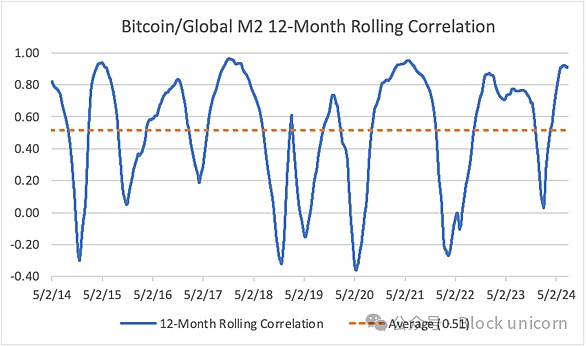

Looking at the 12-month rolling correlation, Bitcoin's average correlation with global liquidity drops to 0.51. This is still a moderately positive relationship, but significantly lower than the overall correlation.

This suggests that Bitcoin's price is not as closely tied to annual changes in liquidity. Furthermore, when examining the 6-month rolling correlation, the correlation drops further to 0.36.

This suggests that Bitcoin's price deviates more and more from its long-term liquidity trend as the timeframe shortens, suggesting that short-term price movements are more likely to be influenced by Bitcoin-specific factors rather than liquidity conditions.

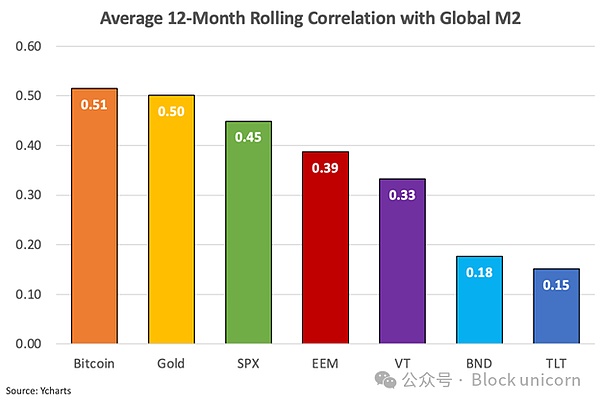

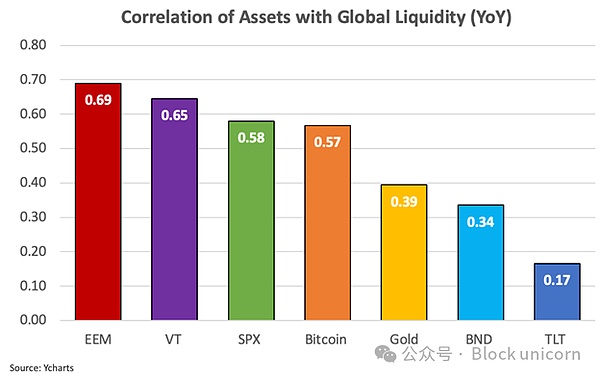

To better understand Bitcoin's correlation with global liquidity, we compared it to other assets, including the SPDR S&P 500 ETF (SPX), Vanguard Global Equity ETF (VT), iShares MSCI Emerging Markets ETF (EEM), iShares 20+ Year Treasury Bond ETF (TLT), Vanguard Total Bond Market ETF (BND), and gold.

Over a rolling 12-month period, Bitcoin has the highest average correlation with global liquidity, followed closely by gold. Equity indices are the next most correlated, while, as expected, bond indices have the lowest correlation with liquidity.

When analyzing the correlation between assets and global liquidity by year-on-year percentage change, stock indices show a slightly stronger correlation than Bitcoin, followed by gold and bonds.

In terms of year-on-year percentage, stocks may have a higher correlation with global liquidity than Bitcoin, one reason being Bitcoin's high volatility. Bitcoin's price often fluctuates significantly within a year, which can distort its correlation with global liquidity. In contrast, stock indices' price fluctuations are usually less pronounced and more closely match the year-on-year percentage change of global M2. Nonetheless, Bitcoin's correlation with global liquidity is still quite strong in terms of year-on-year percentage change.

The above data highlights three key points: 1) the performance of stocks, gold, and Bitcoin is closely related to global liquidity; 2) Bitcoin's overall correlation is strong compared to other asset classes, and the correlation is highest over a rolling 12-month period; 3) Bitcoin's correlation with global liquidity weakens as the time frame shortens.

Bitcoin's Directional Consistency with Liquidity Makes It Unique

As we mentioned earlier, a strong positive correlation does not guarantee that two variables will always move in the same direction over time. This is especially true when an asset (such as Bitcoin) is volatile and may temporarily deviate from its long-term relationship with a less volatile indicator (such as global M2). This is why combining the two aspects - strength and direction - can provide a more complete understanding of the interaction between Bitcoin and global M2.

By examining the directional consistency of this relationship, we can better understand the reliability of their correlation. This is especially important for those interested in long-term trends. If you know that Bitcoin tends to track the direction of global liquidity most of the time, you can more confidently predict its future price direction based on changes in liquidity conditions.

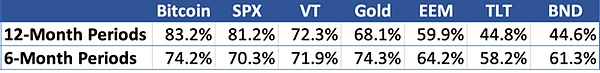

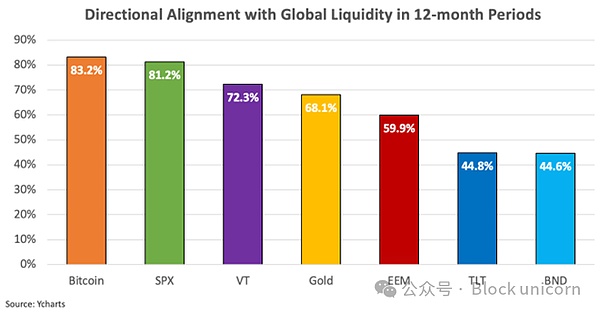

In terms of directional consistency, Bitcoin has the highest correlation with the direction of global liquidity among all assets analyzed. In a 12-month cycle, Bitcoin moves in the same direction as global liquidity 83% of the time and 74% of the time in a 6-month cycle, highlighting the consistency of the directional relationship.

The chart below further illustrates Bitcoin's directional alignment with global liquidity over a 12-month period compared to other asset classes.

These findings are noteworthy because they show that while the strength of the correlation may vary by time frame, Bitcoin's price direction is generally consistent with the direction of global liquidity. Moreover, its price direction is closer to global liquidity than any other traditional asset analyzed.

This analysis shows that the relationship between Bitcoin and global liquidity is not only strong in magnitude, but also consistent in direction. The data further confirms the view that Bitcoin is more sensitive to liquidity conditions than other traditional assets, especially over longer time frames.

For investors, this means that global liquidity may be a key driver of Bitcoin's long-term price performance, and this factor should be considered when evaluating Bitcoin market cycles and predicting future price movements. For traders, this means that Bitcoin provides a highly sensitive investment tool that can express a view on global liquidity, making it a top choice for investors with strong beliefs about liquidity.

Identifying Breaking Points in Bitcoin’s Long-Term Liquidity Relationship

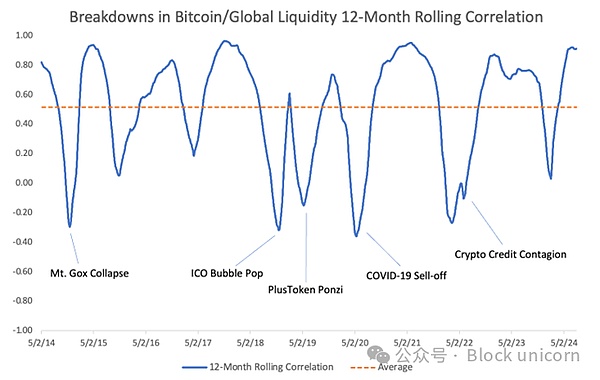

Despite Bitcoin’s strong correlation with global liquidity in general, the findings suggest that Bitcoin’s price tends to deviate from liquidity trends over shorter rolling periods. These deviations may be caused by internal market dynamics having a greater impact than global liquidity conditions at certain points in Bitcoin’s market cycle, or they may be driven by episodic events that are unique to the Bitcoin industry.

Episodic events are events within the cryptocurrency industry that cause a rapid shift in market sentiment or trigger large liquidations. Examples include events such as large corporate bankruptcies, exchange hacks, regulatory developments, or the collapse of Ponzi schemes.

Looking back at historical instances of weakening 12-month rolling correlations between Bitcoin and global liquidity, it is clear that Bitcoin’s price tends to decouple from liquidity trends around major industry events.

The chart below illustrates how Bitcoin’s correlation with liquidity breaks down around these major events.

The panic and selling pressure triggered by key events such as the collapse of Mt. Gox, the collapse of the PlusToken Ponzi scheme, and the crypto credit crisis caused by the collapse of Terra/Luna and the bankruptcy of several crypto lenders were largely disconnected from global liquidity trends.

The COVID-19 market crash in 2020 provides another example. Bitcoin initially fell sharply amid widespread panic selling and risk aversion. However, as central banks responded with unprecedented liquidity injections, Bitcoin quickly rebounded, highlighting its sensitivity to liquidity changes. The collapse of the correlation at the time can be attributed to a sudden shift in market sentiment rather than changes in liquidity conditions.

While it is important to understand the impact of these episodic events on Bitcoin’s correlation with global liquidity, their unpredictability makes it difficult for investors to act. That being said, I expect the frequency of these “black swan” events to decrease over time as the Bitcoin ecosystem matures, infrastructure improves, and regulation becomes clearer.

How Supply-Side Dynamics Impact Bitcoin’s Liquidity Correlation

Beyond the occasional event, another notable pattern in periods where Bitcoin’s correlation with liquidity has weakened is that these instances often coincide with times when Bitcoin’s price reached extreme valuations and subsequently fell sharply. This was evident at the peak of the bull runs in 2013, 2017, and 2021, when Bitcoin’s correlation with liquidity decoupled as its price fell sharply from its highs.

While liquidity primarily affects the demand side of the equation, understanding the distribution patterns on the supply side can also help identify periods when Bitcoin may deviate from its long-term correlation with global liquidity.

The primary source of available for sale is older holders who profit as Bitcoin’s price rises. New issuance of block rewards also adds supply to the market, but in much smaller quantities and will only continue to decrease with each halving event. During bull markets, old holders typically cut their positions and sell to new buyers until demand is saturated. At this saturation point, the bull market peak typically occurs.

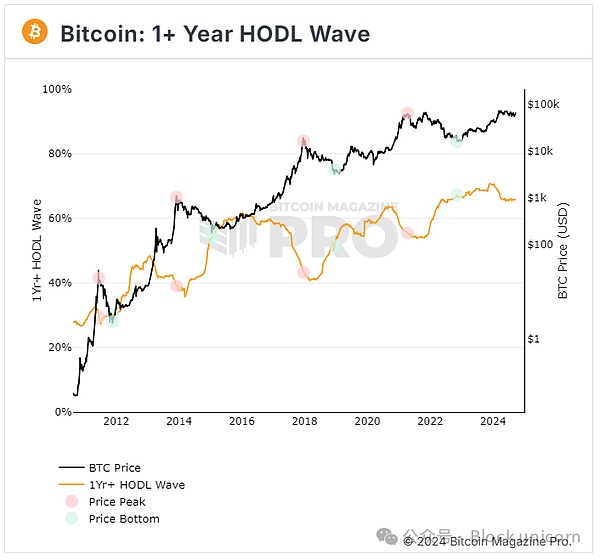

A key metric to assess this behavior is the Bitcoin 1+ Year HODL Wave Chart, which measures the number of Bitcoins held by long-term holders (at least one year) as a percentage of the total circulating supply. Basically, it measures the percentage of the total available supply held by long-term investors at any given point in time.

Historically, this metric falls during bull markets as long-term holders sell, and rises during bear markets as long-term holders accumulate. The chart below highlights this behavior, with red circles indicating cycle peaks and green circles indicating bottoms.

This illustrates the behavior of long-term holders during Bitcoin cycles. Long-term holders tend to take profits when Bitcoin appears to be overvalued, and they tend to accumulate when Bitcoin appears to be undervalued.

Now the question becomes..."How do you determine when Bitcoin is undervalued or overvalued so that you can better predict when supply will flood or drain from the market?"

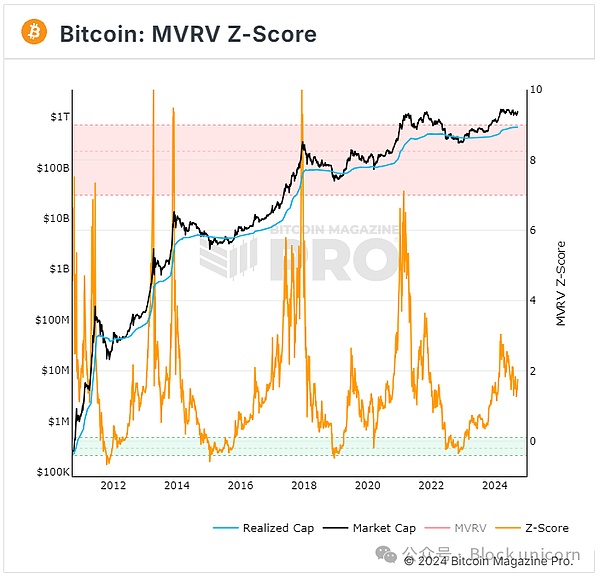

Although the dataset is still relatively small, the Market Value to Realized Value Z-Score (MVRV Z-score) has proven to be a reliable tool for identifying when Bitcoin has reached extreme valuation levels. The MVRV Z-Score is based on three components:

1.) Market Value - The current market cap, calculated by multiplying the price of Bitcoin by the total number of Bitcoins in circulation.

2.) Realized Value — the average price of each Bitcoin or Unspent Transaction Output (UTXO) when it last transacted on-chain, multiplied by the total circulating supply — is essentially the on-chain cost basis for Bitcoin holders.

3.) Z-score — a measure of how far market value deviates from realized value, expressed as a standard deviation, highlighting periods of extreme overvaluation or undervaluation.

When the MVRV Z-score is high, it means there is a large gap between the market price and the realized price, which means many holders are sitting on unrealized profits. This is intuitively a good thing, but it can also indicate that Bitcoin is overbought or overvalued — a good time for long-term holders to sell Bitcoin and take profits.

When the MVRV Z-score is low, it means the market price is close to or below the realized price, indicating that Bitcoin is oversold or undervalued — a good time for investors to start accumulating.

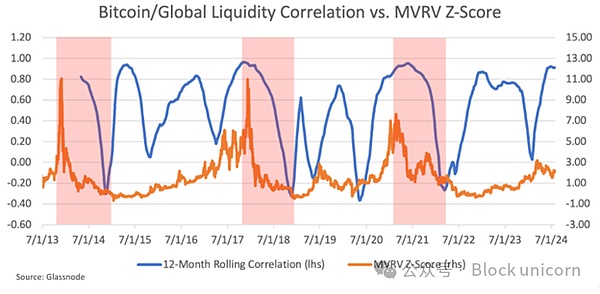

When the MVRV Z-score overlaps with the 12-month rolling correlation between Bitcoin and global liquidity, a pattern begins to emerge. When the MVRV Z-score drops sharply from its all-time highs, the 12-month rolling correlation appears to break down. The red rectangle below highlights these time periods.

This suggests that when Bitcoin’s MVRV Z-score begins to fall from its highs and the correlation with liquidity breaks down, internal market dynamics, such as profit-taking and panic selling, may have a greater impact on Bitcoin’s price than global liquidity conditions.

At extreme valuation levels, Bitcoin's price action tends to be driven more by market sentiment and supply-side dynamics than by global liquidity trends. This insight is valuable for traders and investors because it can help identify rare instances where Bitcoin deviates from its long-term correlation with global liquidity.

For example, suppose a trader firmly believes that the U.S. dollar will fall while global liquidity will rise over the next year. Based on this analysis, Bitcoin would be the best vehicle to express his view because it is the purest indicator of liquidity in the market today.

However, these findings suggest that traders should first assess Bitcoin's MVRV Z-score or a similar valuation metric before entering a trade. If Bitcoin's MVRV Z-score indicates overvaluation, traders should remain cautious even in a liquid environment because internal market dynamics could override liquidity conditions and drive price adjustments.

By monitoring Bitcoin's long-term correlation with global liquidity and its MVRV Z-score, investors and traders can better predict how Bitcoin prices will respond to changes in liquidity conditions. This approach enables market participants to make more informed decisions and potentially increase their odds of successful outcomes when investing or trading Bitcoin.

Conclusion

Bitcoin's strong correlation with global liquidity makes it a valuable macroeconomic bellwether for investors and traders. Compared to other asset classes, Bitcoin's correlation is not only strong, but also has the highest degree of directional consistency with global liquidity conditions. One can think of Bitcoin as a mirror reflecting the rate of global money creation and the relative strength of the U.S. dollar. Unlike traditional assets such as stocks, gold, or bonds, Bitcoin's correlation with liquidity remains relatively pure.

However, Bitcoin's correlation is not perfect. These findings suggest that the strength of Bitcoin's correlation decreases over shorter time periods, while also demonstrating the importance of identifying periods when Bitcoin's correlation with liquidity is prone to breaking down.

Internal market dynamics, such as episodic events or extreme valuation levels, can cause Bitcoin to temporarily break away from global liquidity conditions. These times are critical for investors to watch as they often mark price corrections or accumulation periods. Combining global liquidity analysis with on-chain metrics, such as the MVRV Z-score, can provide a better understanding of Bitcoin’s price cycles and help identify when its price may be driven more by sentiment than by broader global liquidity trends.

Michael Saylor once famously said, “All your models are destroyed.” Bitcoin represents a paradigm shift in money itself. Therefore, no single statistical model can perfectly capture the complexity of the Bitcoin phenomenon, but some models can be useful tools to guide decision-making, even if they are imperfect. As the old saying goes, “All models are wrong, but some are useful.”

Since the global financial crisis, central banks have distorted financial markets through unconventional policies, making liquidity the primary driver of asset prices. Understanding how global liquidity is changing is therefore critical for any investor looking to successfully navigate markets today. In the past, macro analyst Luke Gromen has described Bitcoin as “the last fully functional smoke alarm” due to its ability to signal changing liquidity conditions, and this analysis supports that claim.

When the alarm goes off for Bitcoin, investors would be wise to listen in order to manage risk and position themselves appropriately to seize future market opportunities.

Appendix

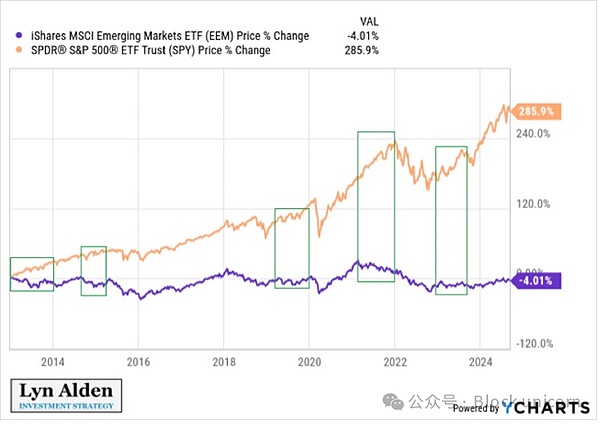

An interesting finding from this analysis is that international equity ETFs such as EEM and VT have a weaker correlation with global liquidity than the S&P 500. Traditionally, investors have expressed their views on global liquidity through emerging market stocks. There are a number of reasons for this:

1.) Emerging market stocks are generally riskier than developed market stocks. As a result, they are widely believed to be more sensitive to changes in global liquidity conditions.

2.) Emerging market stocks do not have the same structural buying from retirement accounts as U.S. stocks, which may distort their relationship with global liquidity.

3.) Emerging markets are heavily dependent on foreign financing. According to the Bank for International Settlements, emerging market economies currently hold trillions of dollars worth of U.S. dollar-denominated debt. This makes them more sensitive to changes in global liquidity because when liquidity tightens and the dollar strengthens, it becomes more expensive for these countries to repay their dollar-denominated debt. In addition to the increased repayment costs, it will also be more expensive for them to continue borrowing in the future.

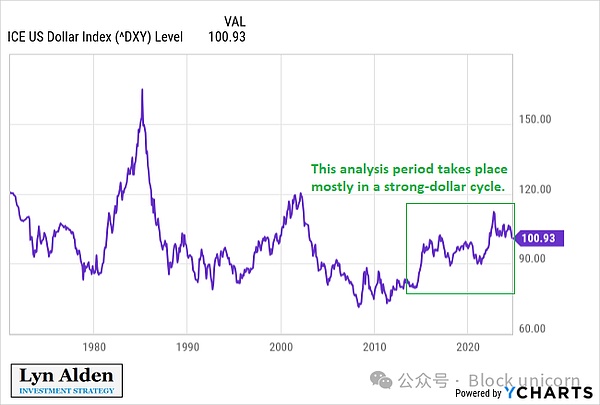

During the period when these correlations were analyzed, the U.S. dollar was in a strong dollar cycle, which put pressure on emerging market economies and affected the entire data set.

Thus, over the past decade, the S&P 500 has outperformed the EEM, reflecting the challenges that emerging markets face in a strong dollar environment.

Looking at the two charts together, it is clear that there have been multiple divergences in the price action of SPY and EEM over this time frame, with SPY rising while EEM fell or moved sideways.

The chart below highlights the divergence between SPY and EEM at different points in time, showing that when SPY rose, EEM fell or moved sideways.

This divergence explains why the EEM's correlation with global liquidity may not be as strong as readers expect during this period. It would be a useful exercise to conduct this analysis over a longer timeframe, including the entire emerging market cycle, where we would examine the EEM's correlation with global liquidity during strong and weak dollar cycles.

Similar to Bitcoin, the EEM is subject to specific risks that could temporarily break its long-term correlation with global liquidity. Unusual events occurring in emerging market economies could temporarily disrupt its correlation with global liquidity trends. These unusual events could be specific to a country or region and include political instability, geopolitical risk, natural disasters, currency devaluation, foreign capital flight, local regulatory developments, and financial/economic crises.

Investors and traders need to be aware of these risks before attempting to use the EEM to express a view on global liquidity. The analysis shows that Bitcoin has a stronger correlation, but also moves more often in line with global liquidity than the EEM. In addition, Bitcoin offers several advantages: It is a decentralized asset that is not directly affected by regional economic instability and is therefore less susceptible to local idiosyncratic events. Bitcoin is also a global asset, reducing the impact of country-specific events and regulatory changes. This makes it a more consistent indicator of global liquidity than the EEM, which can be significantly affected by emerging market-specific issues. Bitcoin therefore provides a purer reflection of global liquidity trends.

BTC, Bitcoin: The "weathervane" of global liquidity Golden Finance, Is the bull market of cryptocurrency still there? Will Bitcoin break through upwards?

JinseFinance

JinseFinanceBehind the growing prosperity of MEME culture, there is actually a contest of interests involving multiple forces. Participants from all parties are the key force in promoting the continuous heating of the MEME market, and some even use their skills to seize huge profits and become direct beneficiaries of this feast.

JinseFinance

JinseFinanceSam Kadihan is a research analyst at Swan Bitcoin, a financial institution focusing on the cryptocurrency sector. He mainly studies Bitcoin market trends, macroeconomic dynamics, and the intersection of digital assets and traditional financial markets.

JinseFinance

JinseFinanceRekt Builder's investigation reveals Ledger Live's covert user activity tracking, raising serious privacy concerns for Ledger hardware wallet users.

Kikyo

KikyoNotable participants include zkSync, Solana, thirdweb, alongside well-known brands such as Google, Manchester United, and Hugo Boss.

Samantha

Samantha Coinlive

Coinlive Detailed Post-Mortem and Next Steps

Others

OthersMultiple crypto investment firms received a “warning” label on lending protocol Clearpool for draining almost the maximum amount of credit from their credit pools.

Coindesk

CoindeskVIA is trying to solve one of the most critical problems in Web3: poor cross-chain experience.

Ftftx

FtftxBancor’s new liquidity mining strategy promises to bring organic on-chain liquidity and make DeFi staking easier for DAOs.

Cointelegraph

Cointelegraph