Author: Pantera; Compiler: Plain Language Blockchain

Cryptocurrency has once again become the focus of everyone's attention, and as prices soar, investors need to know when to start to be vigilant. Based on historical data and price trends since 2013, the crypto market may need some time to continue to expand, enter the bubble zone, and reach unsustainable highs.

The only suspense now is which event will trigger the next bear market (most likely to start in 2025).

In this article, we explore what are the real signals that indicate that the market has reached its peak? These signals are actually obvious, but they are often ignored or misunderstood. Technical analysis on YouTube and Twitter (X) is not necessarily reliable, because most of the so-called "experts" are just guessing.

However, the current market is on the verge of the final sprint, and the parabolic trend is about to start. The opportunity has come, but while we look forward to new highs in prices, we must also be prepared for the inevitable price plunge.

In short, our only goal is to identify the market frenzy in time before the bubble bursts, make money and exit smoothly. The journey may be exciting, but if you want to win, you have to know when to quit!

In December 2022, 8 indicators showed entry signals, and by 2023, the remaining two indicators also appeared one after another, and the market ushered in a wave of sharp rebounds. When most people are panicking, some people take the opportunity to buy at the bottom. When most people panic, some people buy boldly when "blood is flowing".

Unlike the general sentiment in the market, when some of the following indicators begin to flash red lights, it is necessary to be vigilant. Although the market cannot be accurately predicted now, it is necessary to prepare for a rainy day.

Without further ado, here are the top ten indicators to focus on when a new bubble is about to burst. When these indicators start flashing, it is time to jump off the "boom train".

01 Top 10 Signs of a Market Top

1) Cryptocurrency is heavily promoted on TV

TV shows, financial news, and websites suddenly have a strong interest in cryptocurrencies, and reports on cryptocurrency prices will increase rapidly and be overwhelming. However, apart from speculation, there are few real applications, and perhaps only a few projects are pursuing actual application scenarios and goals.

When mainstream media reports are intensive, this is a danger sign. Usually, it means that the market is overheated and may collapse soon, especially after these reports attract a large number of new investors. Entertainment shows with little financial knowledge will also start discussing cryptocurrencies because it has become a hot topic and can attract the audience's attention.

After the cryptocurrency bubble becomes mainstream again, it will only last for two or three months at most.We have seen the same situation in 2013, 2017, and 2021. The end of 2024 to the beginning of 2025 will be no exception. We are not yet in the frenzy phase, so don’t worry too much until you see a noticeable increase in media attention.

2) Celebrities and influencers are collectively supporting crypto

Celebrity and social media influencer “endorsements” are often financially counter-indicators, especially those with shady financial endorsements.

I published a research article on this topic in early 2021, analyzing events in 2017 (although there have been more similar cases in the following years):

Celebrities and influencers have almost the same impact on cryptocurrency prices, and their promotions are almost as effective. In addition to Twitter (X), TikTok, and Instagram, you will also see top Twitch streamers promoting some shady cryptocurrencies and platforms. These promotions usually happen at the top of the market, and most of the top streamers will not even disclose how much they are paid when promoting cryptocurrencies, but instead pretend to be very interested in cryptocurrencies.

Whether it is a celebrity, influencer, or streamer, the common point that they all suddenly start to promote cryptocurrencies on a large scale is that they have no idea what cryptocurrencies are really used for.

3) Increased Scams

As we’ve seen in the past, scams become rampant as markets approach their peaks.

Scammers will redouble their efforts, and various scams will emerge one after another, such as fake exchange websites, large-scale phishing attacks, and fake projects or Ponzi schemes that run away with the funds.

Billions of dollars in cryptocurrencies will be cashed out into fiat currencies, which will cause a large amount of capital outflows from the market and impact market liquidity.

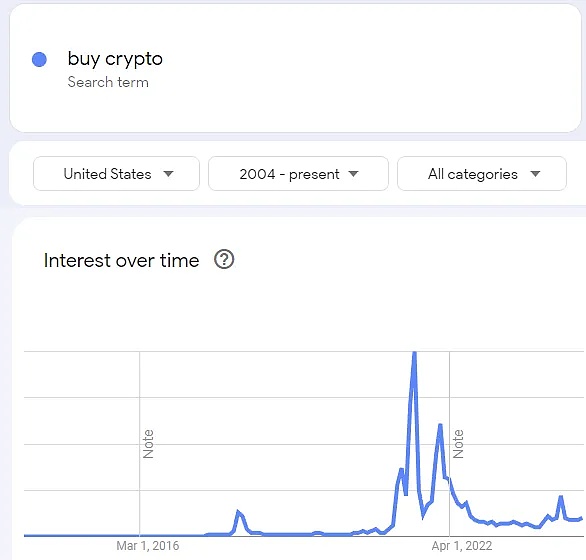

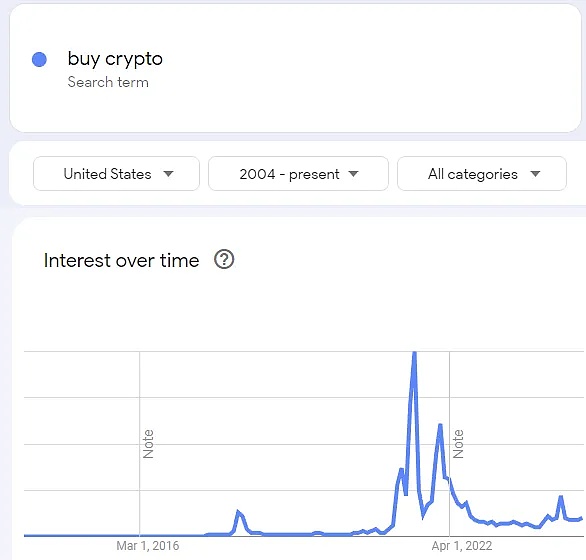

4) Google Trends “Buy Cryptocurrency” indicator

It used to be common to see “Buy Bitcoin”, but this is no longer the case, for a variety of reasons that we won’t discuss here.

The key point is that this chart lags by several weeks. It does not reflect the current interest in cryptocurrencies, but lags by about one week.

Here is the chart and how to interpret it:

When we see a parabolic uptrend like we saw in 2021, it is great news for those already invested, but it means high risk for newcomers. This is the nature of the market and you need to decide which side you want to be on.

When we see a parabolic uptrend like we saw in 2021, it is great news for those already invested, but it means high risk for newcomers. This is the nature of the market and you need to decide which side you want to be on.

Right now, this chart shows that early investors are starting to profit, while new investors are facing greater financial risks.

During the frenzy phase, it is time to consider selling rather than making unwise investment decisions.

When this sentiment is high, you must act quickly and decisively.

Selling strategies can vary, but as a reminder, it is generally not ideal to exit your investment completely.

5) Retail panic

Massive retail panic (FOMO) is a reliable indicator of a market top. Fear of missing out is a common psychology that can easily lead to unwise investment decisions.

While FOMO can be "shorted", be careful as the market may remain irrational for some time.

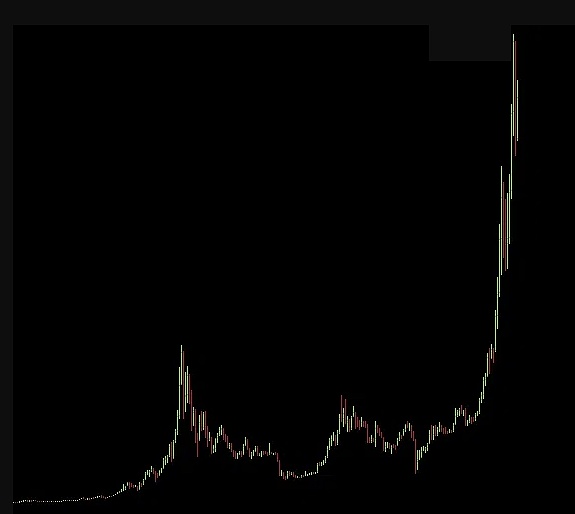

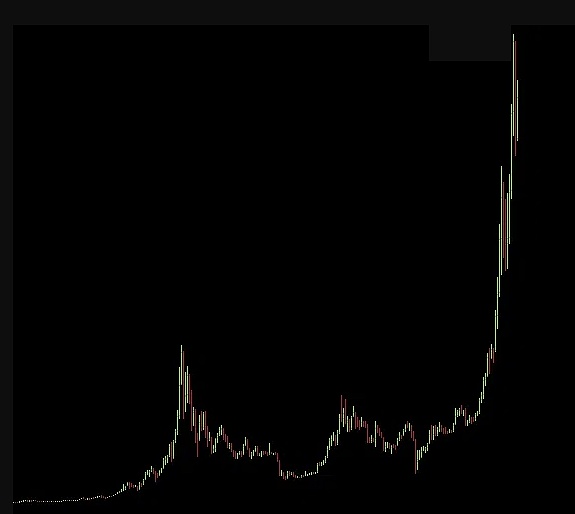

6) Prices soar to unrealistic levels (wait for parabolic movement)

You all know that buying in this situation should be avoided:

However, at the peak of the market, trading volume always reaches a peak.

However, at the peak of the market, trading volume always reaches a peak.

This is when most potential investors (usually the target group of retail investors) will enter the market to buy.

At the same time, the smart money that bought early will quickly but silently exit the market because the news and publications they control will still look positive.

7) Cryptocurrency Becomes a Status Symbol

Owning cryptocurrencies has become a status symbol.

You’ll see people wearing cryptocurrency logos on social media, hats, clothing, and accessories.

When cryptocurrencies start to be seen as trendy, it often means that the market is driven more by social sentiment than fundamentals, which usually indicates that the market is about to peak.

When cryptocurrencies suddenly become a status symbol, be prepared to “sell”.

8) Exchanges Glitch

During periods of increased market activity, major CEX/DEXs often glitches due to large numbers of users accessing them at the same time.

This surge in activity usually occurs around the peak of the market, when everyone is rushing to buy or sell.

While this indicator suggests that the market may be overheated, it alone cannot determine the beginning of a bear market and needs to be combined with other indicators for comprehensive judgment.

9) Cycle Position

The halving event is a timer for the market cycle, and the bull market cannot end so quickly. The positive effects of the halving usually take 12 to 18 months to show up.

Prices may rise sharply in an instant, and the parabolic trend may start at any time in the remaining four months of 2024.

However, prices may also plummet at any time during this period, but these plunges usually recover quickly, indicating that the parabolic trend is almost inevitable.

So far, every bull market has had such a moment, causing investors to panic in the early stages. Exchanges have made billions of dollars through market fluctuations, so flash crashes are inevitable.

There is no bear market yet, and it is almost impossible to appear in 2024, although the profitability of each cycle is lower when the market cycle approaches its limit. Most likely, these indicators will start to sound the alarm in the first quarter of 2025.

10) Your barber bought crypto

I have no problem with any profession, barbers are an important profession, but if you ignore all other indicators and don’t see that you are in a bubble, then your barber may be the last and only indicator you need.

So, when prices continue to rise for a long time, remember to visit your barber regularly, such as once a month. However, your barber must take the initiative to bring up this topic, otherwise this indicator may not work.

11) Conclusion

Here is another prediction I made for 2021:

After the market peaks, Bitcoin will fall sharply and then enter a two-year bear market.

The current parabolic trend appears to have ended, and if it continues to rise, it will most likely top next time, but I don't think it will.

I think the market has peaked and it may take until 2024 before it hits higher highs again.

— Pantera (March 3, 2022)

Just looking at a single indicator is not enough to make you uneasy. Often, we need a combination of multiple indicators to raise alarms. However, the 10th indicator has the potential to be a significant warning sign on its own.

It is important to note that none of these indicators currently suggest that the market has topped. While there is most likely a bubble, there is still a lot of room to run before it bursts. None of the indicators are showing red lights at the moment, and we are now at 0/10, so the chances of the bull market ending here and not going parabolic are almost zero.

Once you see most or all of the indicators appearing, it may already be too late, so be careful about the crypto influencers you follow.

Don't get too worried just yet, but make sure to research actual indicators that will help you make sound investment decisions.

Currently we are seeing all the dips being filled, interest is slowly rising, and no indicators are giving a clear signal to sell. However, overconfidence is probably the eleventh indicator I ignore. So, while we may be observing various analysis and signals, the situation can change at any time, and all we can do is manage risk effectively.

JinseFinance

JinseFinance

When we see a parabolic uptrend like we saw in 2021, it is great news for those already invested, but it means high risk for newcomers. This is the nature of the market and you need to decide which side you want to be on.

When we see a parabolic uptrend like we saw in 2021, it is great news for those already invested, but it means high risk for newcomers. This is the nature of the market and you need to decide which side you want to be on. However, at the peak of the market, trading volume always reaches a peak.

However, at the peak of the market, trading volume always reaches a peak.