Author: Yashu Gola N Source: cointelegraph Translation: Shan Ouba, Jinse Finance

Bitcoin needs to hold above the 200-week exponential moving average, await the implementation of the Fed's implicit quantitative easing, and see a return of US liquidity after the government shutdown ends in order to avoid falling into a deeper bear market.

Key Points

As long as the key trend lines are held, Bitcoin's bull market structure will remain intact.

The Fed's liquidity policy and US fiscal policy will likely determine Bitcoin's next major trend.

This week, Bitcoin's price plummeted by more than 8%, falling below the $100,000 mark for the first time since June, with long-term holders selling approximately $45 billion worth of Bitcoin.

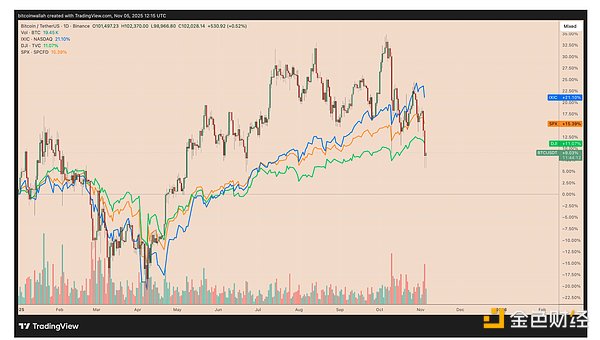

BTC/USD vs. Nasdaq, Dow Jones, and S&P 500 Year-to-Date Chart

BTC/USD vs. Nasdaq, Dow Jones, and S&P 500 Year-to-Date Chart

The sharp decline in artificial intelligence-related stocks triggered widespread risk aversion in the market, further exacerbating the Bitcoin sell-off.

Data source The Kobeissei Letter points out that Bitcoin has corrected by about 20% since hitting an all-time high on October 6, officially entering bear market territory.

Despite this, some indicators suggest that Bitcoin may still avoid a full-blown bear market, but several key conditions need to be met first.

The weekly moving average must hold

Bitcoin is currently trading above the 200-week exponential moving average (EMA), which is currently around $100,950 and is a key long-term support level that has defined every major pullback since the end of 2023.

Whenever Bitcoin tests this level after a significant rally, it rebounds sharply and makes new highs, which confirms that this moving average is a structural bottom for the market.

During this 22% pullback, the Bitcoin/USD (BTC/USD) trading pair has been holding the same support level.

Its weekly Relative Strength Index (RSI) also remained near the support level of 45, an area historically often a precursor to major bull market reversals. As long as Bitcoin can hold the bottom support of the 200-week exponential moving average and the RSI, the overall bull market structure will not be broken. However, if both are broken, the risk of Bitcoin falling into a deeper bear market correction will increase significantly. The Fed's Implicit Quantitative Easing Could Save Bitcoin Bulls Former BitMEX CEO Arthur Hayes believes that US fiscal policy will eventually force the Federal Reserve to expand its balance sheet again, this time through what he calls implicit quantitative easing. The US Office of Debt Management's Q3 2025 report shows that the US annual deficit is close to $2 trillion, financed through the issuance of Treasury bonds. In a recent report, the Federal Reserve acknowledged that traditional buyers such as foreign central banks and US households have not absorbed the increasing supply of Treasury bonds, and hedge funds have become marginal buyers. These funds rely on overnight repurchase agreements, which are used to borrow cash against Treasury bonds. Hayes writes that when cash is scarce, the Federal Reserve's Standing Repurchase Facility (SRF) quietly intervenes to provide more loans, creating new dollars behind the scenes, similar to the effect of quantitative easing. Hayes believes that as the deficit widens, the use of the SRF will increase, implicitly boosting market liquidity and supporting the bullish outlook for risk assets like Bitcoin. Hayes states that if the Fed's balance sheet expands, it will positively impact dollar liquidity and ultimately drive up the prices of Bitcoin and other cryptocurrencies. However, Hayes notes that the market may continue to fluctuate until the US government shutdown ends and liquidity conditions improve. Fortunately for bulls, the shutdown issue may be resolved soon. On the Polymarket platform, a growing number of traders are betting that the shutdown will end as early as next week. For example, as of Wednesday, the percentage betting on a resolution between November 8th and November 11th had jumped to 36% from 22% last week. Similarly, the percentage betting on a resolution between November 12th and 15th also rose from 17% to 28%. Currently, the U.S. Treasury is issuing large amounts of Treasury bonds—which depletes dollar liquidity—and its Treasury General Account (TGA) balance is about $150 billion higher than the $850 billion target, meaning that these funds have not yet flowed back into the economy. This temporary liquidity crunch is one of the reasons for Bitcoin's recent decline. Hayes warns that with the four-year anniversary of Bitcoin's all-time high in 2021 approaching, many traders may mistake this stagnation for a market top. However, he believes the underlying liquidity situation for the US dollar is quite the opposite: once governments resume spending and liquidity flows back in, it will signal the start of Bitcoin's next upward surge. Hayes writes: "This system only has two modes—printing money or destroying money. We're currently in the latter, but this won't last long."

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Cointelegraph

Cointelegraph