Author: Marcel Pechman, CoinTelegraph; Compiler: Deng Tong, Golden Finance

On October 21, the price of Bitcoin fell to $67,000, erasing the gains of the previous three days. Some analysts said that one reason for the pullback was that investors reduced their exposure to Bitcoin due to concerns about the impact on traditional markets.However, indicators of Bitcoin derivatives remain very stable.

Despite concerns that many economies may lose momentum or that confidence in the ability of governments to refinance their debts is waning, Demand for Bitcoin derivatives as a hedging tool remains stable. If whales or arbitrageurs expect further declines, these indicators will reflect greater volatility.

Bitcoin futures show no signs of bearish bets

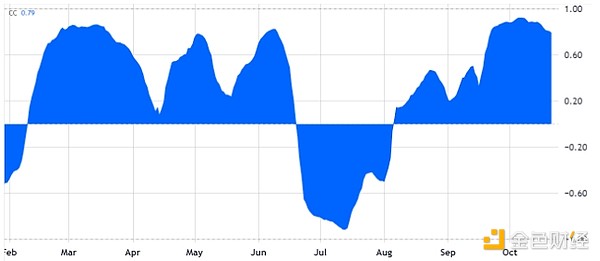

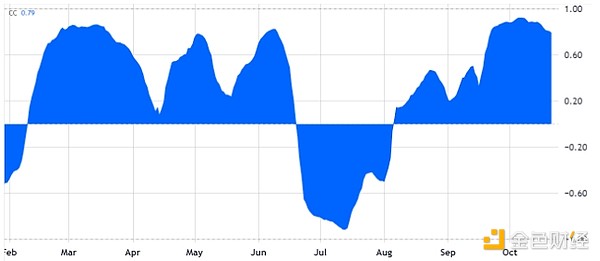

In a neutral market, the Bitcoin futures premium is usually between 5% and 10%, and was only slightly affected on October 21. The rise in monthly BTC futures prices reflects the extension of the settlement cycle, and premiums above 10% indicate bullish sentiment.

Bitcoin 2-month futures annualized premium. Source: laevitas.ch

The annualized premium (base rate) in October remained above 9%. On the 21st, Bitcoin retested the $67,000 support level. However, before drawing conclusions, it is important to confirm whether this sentiment is limited to the Bitcoin futures market. Based on the price chart alone, Bitcoin’s price action appears to mirror the intraday performance of the stock market. S&P 500 futures (green) vs. Bitcoin/USD (blue). Source: TradingView

The 10-year U.S. Treasury yield "will test the 5% threshold in the next six months," driven by rising inflation expectations and concerns about government fiscal spending, Arif Husain, head of fixed income at T. Rowe Price, told Bloomberg. Yields rise as investors sell bonds, indicating that traders are seeking higher returns.

Husain noted that the government will "issue a lot of new debt" to the market, while the Federal Reserve attempts to shrink its balance sheet to curb inflation and prevent the economy from overheating. The cost of interest on U.S. debt has exceeded $1 trillion on an annualized basis, prompting the central bank to consider lowering interest rates.

Bitcoin prices have not yet decoupled from stocks

Amid the uncertainty of the macroeconomic environment, fear, uncertainty and doubt (FUD) have greatly influenced Bitcoin's price trend.

While Bitcoin is often considered uncorrelated to traditional markets (having demonstrated periods of complete decoupling from the S&P 500), the 40-day correlation has remained above 80% over the past month, indicating that the two asset classes move closely together.

Bitcoin 40-day correlation with S&P 500 futures. Source: TradingView

Unlike mid-July to mid-September, when Bitcoin exhibited a negative or negligible correlation with the S&P 500, recent data suggests that both markets are driven by similar factors. The growing correlation between Bitcoin and gold, which exceeded 80% on October 3, further supports this hypothesis.

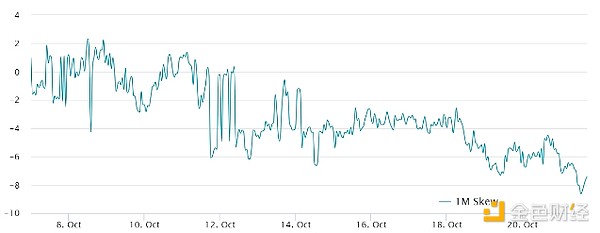

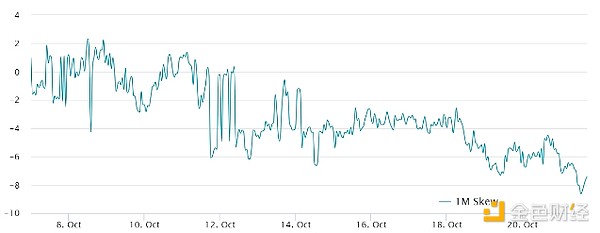

The Bitcoin options market also reinforces the argument for derivatives resilience. The 25% Delta Skewness indicator shows that put (sell) options are trading at a discount compared to equivalent call (buy) options.

Bitcoin 1-month options skew, put options. Source: Laevitas.ch

Usually, a deviation between -7% and +7% is considered neutral, and the current indicator is at the border of a neutral to bullish market.

In short, derivatives traders did not react in panic to Bitcoin’s recent price drop. If traders expected prices to fall further, the bias would have shifted toward zero or higher. Overall, Bitcoin derivatives continue to be resilient.

Edmund

Edmund