Specialized vs. General-Purpose ZK: Which is the Future?

ZK Stack, dedicated vs. general-purpose ZK: Which one is the future? Golden Finance, the line between dedicated and general-purpose ZK is blurring.

JinseFinance

JinseFinance

Author: Diana Biggs, 1kx; Translation: 0xjs@金财经

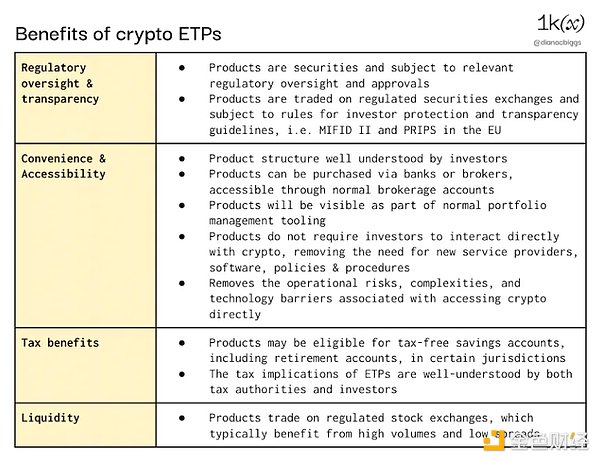

Exchange-traded products (ETPs) provide retail and institutional investors with a convenient, popular Regulated and low-cost access to a range of fundamental investments, including cryptocurrencies.

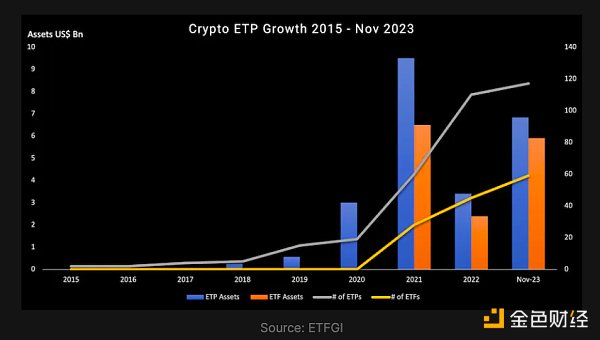

Since Sweden launched the first product to track Bitcoin in 2015, cryptocurrency ETPs have grown from being primarily in Europe to an expanding global footprint, and from just 17 products at the end of 2020 to today of approximately 180 transactions. As more and more TradFi institutions join the ranks of crypto-native company offerings, the role of ETPs in not only expanding investors’ access to cryptocurrencies, but also in the overall acceptance and integration of cryptocurrencies into global financial markets, changes. It's becoming more and more obvious.

This article provides an overview of crypto ETPs, including currently available product types, operating models, regional overview, and developments within this rapidly evolving landscape.

Exchange-traded products (ETPs) are a class of financial products traded daily on a regulated stock exchange during regular trading hours that track the returns of an underlying benchmark, asset, or portfolio.

ETPs are mainly divided into three types: exchange-traded funds (ETFs), exchange-traded notes (ETNs) and transactions Traded Commodities (ETC). ETFs are investment funds, while ETNs and ETCs are debt securities. ETCs track physical commodities like gold and oil, and ETNs are used for all other types of financial instruments. Thirty years since the first ETF was created in 1993, ETPs have evolved from stock market tracking products into arguably one of the most innovative investment product categories, offering investors a range of innovations Investment opportunities in the underlying assets.

Note: While "ETP" is the general term for this type of product, the term "ETP" is sometimes used as a category term for products traded on debt stock exchanges.

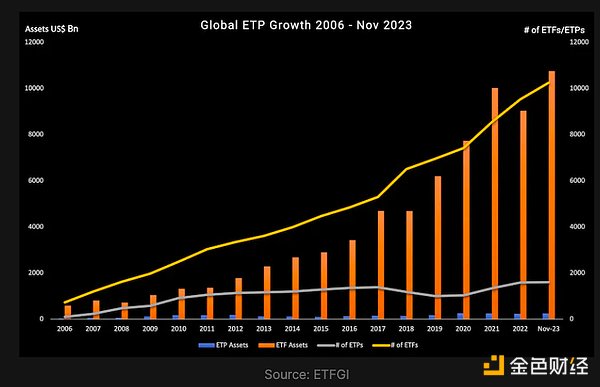

Especially over the past two decades, this category of products has experienced continuous growth, reaching 11,859 products and 23,931 out of 718 providers listed on 81 exchanges in 63 countries around the world Among them, ETFs account for the largest share of assets, accounting for US$10.747 billion, accounting for 98% of the total ETP assets of US$10.990 billion (data from ETFGI as of the end of November 2023). Oliver Wyman expects ETF growth to accelerate in recent years, predicting the market will grow at an annual rate of 13% to 18% from 2022 to 2027.

ETP’s convenience and accessibility make it the Cryptocurrencies, a popular tool that opens up new asset classes and investment strategies to investors, are no exception.

ETP’s convenience and accessibility make it the Cryptocurrencies, a popular tool that opens up new asset classes and investment strategies to investors, are no exception.

The first-ever Bitcoin ETP was launched by XBT Provider (later acquired by Coinshares) in 2015 on Nasdaq in Sweden g launched. Growth in the market had been relatively modest until the second half of 2020, when the number of products began to increase strongly, which continues today, both from new crypto-native entrants and traditional issuers. In February 2021, Canada won the competition for the world's first Bitcoin ETF, and Purpose Investment launched the Purpose Bitcoin ETF on the Toronto Stock Exchange. While cryptocurrency ETPs structured as debt securities still far outnumber cryptocurrency ETFs in volume and AUM, we expect this to begin to change, particularly as the U.S. spot ETF market opens up.

Cryptocurrency products The number has grown steadily, especially over the past three years, reaching 176 crypto ETFs and ETPs as of November 2023, according to ETFGI. Assets invested in these products grew 120% in the first 11 months of 2023, from $5.79 billion at the end of 2022 to $12.73 billion at the end of November 2023.

For crypto natives, the idea of encrypted ETPs may seem counterintuitive: introduce intermediaries, and the technology ultimately makes us Ability to eliminate intermediaries. However, as easy-to-understand and regulated investment products, these products provide exposure to cryptocurrencies to a wider audience of investors who may not have access to the asset class for various reasons. For example, retail investors may lack the tools, time, risk tolerance, and technical expertise to invest directly in cryptocurrencies. ETPs are structured as traditional securities and are open to institutional investors who may be limited to investing in these types of instruments or wish to avoid direct holdings of cryptoassets for regulatory, compliance, technical or other reasons.

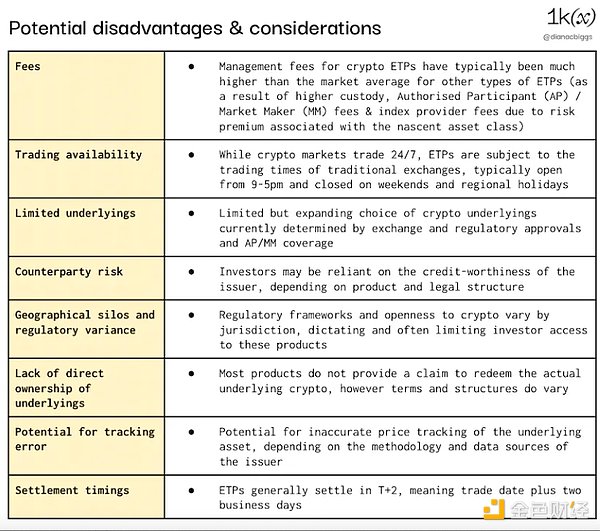

With direct purchase of crypto There are also potential disadvantages and considerations with these products compared to currencies (as not all investors will consider these to be disadvantages). These include fees for cryptocurrency ETPs to date being much higher than typical fees for these products (although these fees are already falling as competition increases); limited trading availability on traditional exchanges compared to the 24/7 market for cryptocurrencies ;Based on jurisdiction and investor type based on regulatory approvals, counterparties, tracking error, currency risk and settlement timing.

Note: Regional restrictions Examples include European cryptocurrency ETPs that are generally not registered under the U.S. Securities Act of 1933 and therefore cannot be offered to U.S. investors; the UK FCA prohibits the sale of cryptocurrency ETPs to retail investors

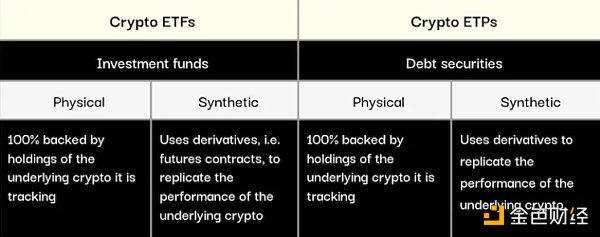

Broadly speaking, Cryptocurrency ETPs are divided into two product categories: ETFs or ETPs; and two product types: physical (also known as is asset-backed) or synthetic.

The structure of an ETF is a fund, and the holdings of the ETF are fund shares. The fund is usually legally separated from its issuing entity through a trust, investment company or limited partnership to ensure that investors' holdings are protected in the event of the bankruptcy of the parent company/issuer. ETFs are often subject to additional rules and transparency requirements depending on their jurisdiction; for example, ETFs registered in the EU and sold to EU investors are often subject to UCITS (Undertakings for Collective Investment in Transferable Securities). ) regulations, which impose diversification requirements such that a single asset cannot represent more than 10% of a fund's assets.

Most crypto ETFs today are spot or futures products. Spot ETFs have direct ownership of the underlying crypto assets and are guaranteed by an independent custodian. With futures ETFs, the issuer does not hold the underlying cryptocurrency but instead purchases futures contracts on the asset. As a result, these products do not directly track the spot price of the underlying asset, are generally considered to introduce greater complexity and cost, and are less transparent and intuitive for investors.

Cryptocurrency ETPs (in this case, using the term to refer to products other than ETFs) are structured as debt securities. While their structural requirements are less stringent than ETFs, their disclosure requirements are very similar.

Physical crypto ETPs are secured debt securities that are 100% backed by the underlying cryptocurrency holdings they track. Cryptoassets are physically purchased and held by an independent third-party custodian under the supervision and control of a designated trustee, who holds rights and interests on behalf of ETP holders and is responsible for organizing redemptions in the event of the issuer's bankruptcy.

Synthetic ETPs are unsecured debt obligations, meaning the issuer does not need to hold the underlying asset the product is tracking, but instead uses derivatives and swaps to track financial performance (the exact structure and terms will vary). Synthetic ETPs therefore carry greater counterparty risk, as there is no legal requirement that the product be backed one-to-one by the underlying physical asset. XBT Provider (a Coinshares company) and Valor are two crypto ETP issuers that offer synthetic products.

Overall, most cryptocurrency ETPs on the market are physical products, as many investors prefer the transparency and reduced counterparty risk that this structure provides.

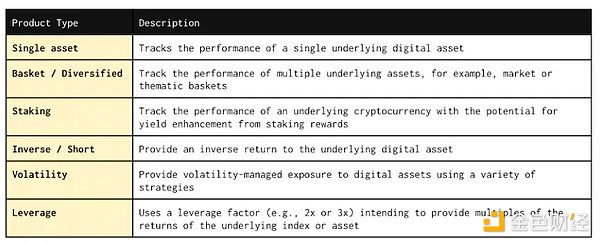

Cryptocurrency ETPs initially started as single digital asset tracking products. Today, the range of cryptocurrency ETPs available on the market also includes single assets, baskets of assets, Staking, inverse and leveraged products, and certain indices designed to manage volatility.

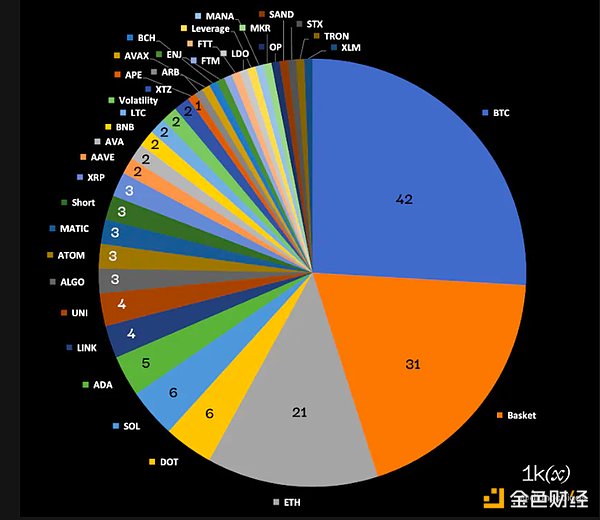

From the underlying securities Look, according to data recently compiled by BitMEX Research, excluding stocks and OTC funds, plus additional data, we found that among the 162 cryptocurrency ETPs, Bitcoin, Ethereum and basket products accounted for 58%, and other products Accounting for 58%. 42% consists of long-tail single digital assets, as well as short, volatility and leveraged products.

Data for 162 crypto ETPs (excluding stocks and OTC funds); Source: BitMEX Research, 1kx Research

Among these 162 products, 121 are ETPs and 41 are ETFs, of which 16 are futures ETFs and 11 are U.S. spot Bitcoin ETFs awaiting launch. Staking products, which mean investors can benefit from the proceeds from the pledges they hold, currently include 14 types: 13 ETPs and 1 ETF.

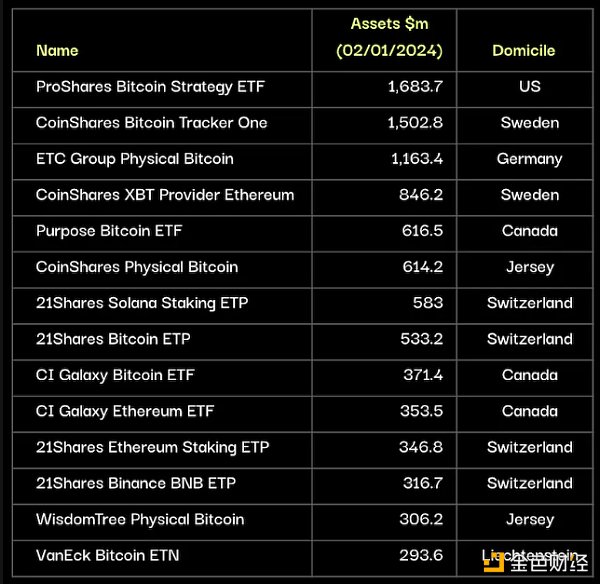

Largest cryptocurrency by AUM ETP is the ProShares Bitcoin Strategy ETF, a U.S.-based futures product with $1.68 billion in assets held based on available data as of January 2, 2024.

As shown in the table below, 9 of the 14 top cryptocurrency ETPs track Bitcoin (64%); Among the remaining five, three track Ethereum, one tracks Solana, and one tracks BNB.

Source: BitMEX Research, 1kx Research

Of these 14 products, 4 are registered in Switzerland (both from the publisher 21Shares), 3 are registered in Canada, 2 in Jersey, 1 in Germany, 1 in the United States, and 1 in Liechtenstein.

Of the top 14 products by asset, 4 are ETFs: 3 are spot ETFs and 1 is a futures ETF. Of the ETPs, eight were physical products and two were synthetic products.

There are several limitations to consider when bringing new crypto ETPs to market. These include regulatory and stock exchange requirements and approvals, liquidity requirements, investor demand, and the availability of public price data and fiat trading pairs. That said, as more players enter the market and seek to capture market share and differentiate, and as regulatory, service provider and investor understanding and acceptance of this asset class increases, we See continued product innovation by issuers and index providers.

Create ETP from the issuer (i.e. the investment company that issues the product or Trust) begins by preparing a prospectus for regulatory approval. These may vary by jurisdiction, but generally they include details of the issuer, including the identity of its directors and financial statements, product and program design, including an overview of the underlying assets, intended markets and services Provider, comprehensive overview of potential risks, details of asset valuation (NAV) and NAV calculation methodology, fees and redemption process.

After obtaining regulatory approval and successfully engaging the necessary service providers, the issuer must apply to be listed on the stock exchange. Rules regarding which types of products (i.e., asset-backed or futures) and the underlying assets (i.e., cryptoassets) are eligible for listing vary from exchange to exchange.

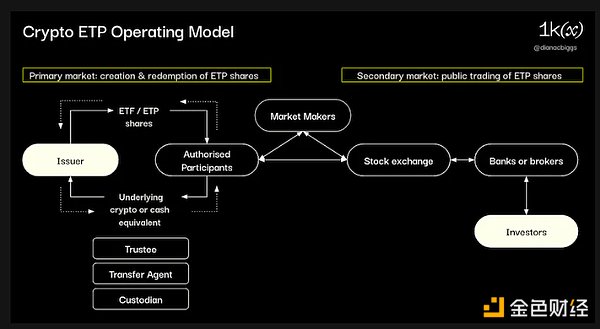

A service provider's operating model and scope may vary depending on product type, jurisdiction and issuer's program design. An overview of a typical model is as follows:

In the primary market, the issuer exchanges product shares with AP in exchange for the underlying crypto assets ("physical objects") or cash equivalents, and transfers the underlying crypto assets as needed. Cryptoassets are delivered to or from a designated custodian. Depending on the structure, transfer agents and trustees may be involved in liquidating collateral and transferring funds.

While AP manages primary market creation and redemption, market makers provide liquidity in the secondary market, ensuring continuous, efficient trading.

Investors buy and sell products on the secondary market, usually placing orders through a bank or broker, who in turn trades on the relevant stock exchange directly or through other intermediaries Execute the order.

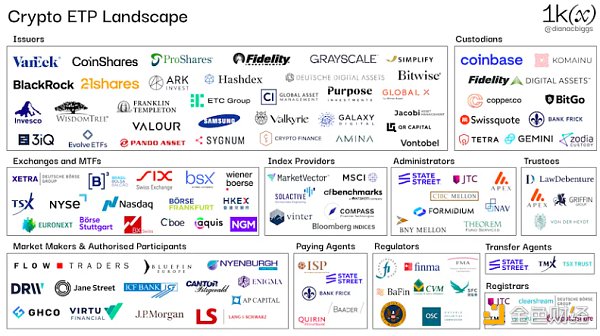

The issuer is responsible for the overall design and creation of the ETP, coordinating and managing relevant intermediaries throughout the product life cycle. Regulation of issuers varies from jurisdiction to jurisdiction and is not necessarily required. However, regulators assess issuers during the prospectus approval process, as do exchanges during the listing process, where requirements may include corporate governance, capital requirements and regular audits. Issuers usually set up independent special purpose vehicles (SPVs) to issue products. Initially, most crypto ETP issuers were crypto-native companies such as Coinshares, 21Shares, 3iQ, Hashdex, and Valour, with an increasing number in recent years Traditional financial firms were joined, including WisdomTree, VanEck, Invesco, Fidelity and those awaiting SEC approval, BlackRock and Franklin Templeton.

The custodian holds the underlying cryptocurrency that physically backs the product. Customers used by ETP issuers include Coinbase, Fidelity Digital Assets, Komainu, BitGo, Copper, Swissquote, Tetra Trust, Zodia Custody and Gemini.

Market Maker (MM) is a liquidity provider hired by the issuer to provide two-way quotations on the exchange in accordance with the terms of the contract. Provide necessary liquidity for ETP. These include Flow Traders and GHCO.

An authorized participant (AP), typically a bank or broker-dealer, has the authority to create and redeem product shares directly with the issuer on a daily basis. They do this by delivering the underlying asset or its cash equivalent to the issuer in exchange for newly created ETP shares or by returning the shares to the issuer in exchange for the underlying asset or cash. Participants' interest in cryptocurrencies, particularly in assets other than BTC and ETH, may vary based on factors such as regulatory uncertainty and market conditions. APs active in the crypto ETP space include Flow Traders, GHCO, Virtu Financial, DRW, Bluefin, and Enigma Securities. JP Morgan, Jane Street and Cantor Fitzgerald & Co were recently listed as APs in U.S. spot Bitcoin ETF filings.

The Index Provider is responsible for creating, designing, calculating and maintaining the indices and benchmarks tracked by the ETP. These provide transparency and reliability to issuers and investors. In some jurisdictions, index providers are regulated, for example in the EU, there is the European Benchmark Regulation (BMR). LiveIndex providers that jump into crypto ETPs include MarketVector Indexes, CF Benchmarks (acquired by Kraken in 2019), Vinter (Sweden’s crypto-native index provider), Bloomberg and Compass.

The willingness of exchanges and MTFs to list cryptocurrency ETPs will first be determined by local regulations and regulatory approval of the issuer’s prospectus, and then become Business decisions determined by respective issuer and product qualification requirements, which often include an assessment of multiple parameters of the underlying asset, such as liquidity, compliance, publicly available pricing information and risk mitigation. Rules for what types of products can be listed vary by exchange; for example, Germany’s Xetra only lists asset-backed ETPs, while SIX Swiss Exchange has special rules for eligible cryptocurrency underlyings.

A trustee may be responsible for protecting assets and representing the interests of ETP holders or investors. Their specific roles and responsibilities may vary depending on the specific structure and legal arrangements of the ETP. Trustors active in crypto ETPs include Law Debenture Trust Corporation, Apex Corporate Trust Services, Bankhaus von der Heydt, and Griffin Trust.

The administrator supports the overall operational management of ETP. Their services may include accounting, regulatory compliance, financial reporting and shareholder services. Managers active in crypto ETPs include State Street, JTC Fund Solutions, BNY Mellon, Formidium, NAV Consulting, Theorem Fund Services and CIBC Mellon Global Securities Services.

Other service providers that may play a role in the ETP program and product life cycle include, but are not limited to, payment agents (responsible for registering new ETP The unit and obtains the ISIN from the local agency), a transfer agent (which can be used to maintain) records of shareholders and other responsibilities, a calculation agent, which is used to calculate the net asset value of the underlying assets, and a registrar, which is used to maintain shareholder records. Depending on the product type, issuer and jurisdiction, these various roles and responsibilities may overlap and/or be performed by different parties.

ETP charges a management fee, also known as an expense rate or sponsorship fee, to cover the cost of managing and operating the product, which is calculated annually as a percentage of the position, and Deducted from net asset value on a daily or periodic basis. Many early cryptocurrency ETPs were able to charge hefty fees of up to 2.5%, while typical ETP fees range from 0.05% to 0.75%. Crypto ETPs charge 2.5% AUM when alternatives charge as low as 0%, illustrating the stickiness and first-mover advantage of these products.

We expect fees to be a key differentiator for new products going forward, as is now seen with U.S. spot ETFs. Of the fees announced so far, Invesco/Galaxy waived fees for the first six months and the first $5 billion in assets, while Fidelity charged a 0.39% fee.

Cryptocurrency ETPs originated in Europe, and the first Bitcoin product was launched in Sweden in 2015 and was XBT Provider (2017 Synthetic tracking ETP issued by Coinshares). In Europe, cryptocurrency ETP issuers benefit from the single market because once the ETP prospectus is approved by one European national regulator, the product can also be listed in other member states, subject to notification and approval (known as a "passport" prospectus )). Sweden’s SFSA remains a popular choice for European cryptocurrency ETP prospectus approval. Germany is another jurisdiction that has approved cryptocurrency ETP prospectuses, and cryptocurrency ETPs have good availability on various trading venues, such as those from leading exchange groups such as Deutsche Börse and Stuttgart Börse Group.

ETPs remain the dominant product type in Europe, and the lack of true crypto ETFs in Europe is largely due to UCITS (Undertakings for Collective Investment in Transferable Securities) regulations. Overall, most European ETFs comply with UCITS regulations in order to benefit from the pan-European passport, which allows the sale of these ETFs to retail investors in other EU member states in addition to the country of registration, as well as the guarantees and investor protection provided by these regulations. . However, UCITS rules and requirements are currently incompatible with single-asset tracking products such as Bitcoin ETFs. For example, UCITS diversification requirements include that any single asset must not exceed 10% of the fund and that the underlying assets must be qualifying financial instruments. In June 2023, the European Commission tasked the European Securities and Markets Authority (ESMA) to investigate the need to update UCITS rules and pay attention to crypto-assets. However, the purpose of the move appears to be to determine whether more rules and investor protections are needed rather than to expand the types of products that qualify. The deadline for ESMA comments is 31 October 2024.

In 2016, Switzerland became the second jurisdiction after Sweden to approve and list a cryptocurrency ETP after Vontobel Bank launched Bitcoin on the SIX Swiss exchange Track products. Subsequently, the world’s first crypto index product was launched in Switzerland in November 2018, a basket of physically-backed ETPs consisting of Bitcoin (BTC), Ethereum ( ETH), Ripple (XRP) and Litecoin (LTC ). SIX Swiss exchange has special rules for cryptocurrencies, including that “when applying for a temporary trading license, the cryptocurrency must be one of the 15 largest cryptocurrencies by market capitalization in U.S. dollars,” and according to our research, the cryptocurrency Currency has the widest range of products with a cryptocurrency base of any trading venue worldwide. BX Swiss also allows products with a cryptocurrency base, with rules including that the base currency must be within the top 50 cryptocurrencies by market capitalization.

In October 2020, the UK Financial Conduct Authority (FCA) banned the sale, marketing and distribution to retail investors of any reference to "unregulated transferable crypto-assets" ” derivatives or ETNs. Many cryptocurrency ETPs are listed on the UK Aquis exchange and are only available to professional investors.

Canada was the first country to approve a Bitcoin ETF, with Purpose Investments launching its first product on the Toronto Stock Exchange (TSX) in February 2021, followed by The Ethereum ETF was launched in April of that year. In October 2023, 3iQ launched staking of its Ethereum ETF, with staking rewards credited to the fund, a first in North America. Other Canadian crypto ETF issuers include Fidelity Investments Canada, CI Global Asset Management (CI GAM) in partnership with Galaxy, and Evolve Funds.

Canada was the first to approve a Bitcoin ETF, followed closely by Brazil. The Brazilian Securities and Exchange Commission (CVM) approved the first Bitcoin ETF in Latin America in March 2021. Coin exchange-traded funds (ETFs). Brazilian crypto ETF issuers include crypto asset managers Hashdex and QR Capital, as well as Galaxy-partnered Itaú Asset Management.

To date, only cryptocurrency futures ETFs have been approved by the SEC and are available to investors. ProShares launched the first Bitcoin futures ETF on October 19, 2021, becoming one of the most heavily traded funds in market history, attracting more than $1 billion in assets in its first few days of trading.

Source: Bloomberg, via Bloomberg Senior ETF Analyst Eric Balchunas.

Two years from now, in 2023 On October 2, 2019, ProShares, VanEck, and Bitwise launched the first batch of U.S. Ethereum futures ETFs. Futures products generally require more understanding from investors and come with additional fees and the risk of tracking errors and performance degradation due to frequent rebalancing. The fact that the underlying futures contracts trade on the Chicago Mercantile Exchange (CME) under the regulation of the Commodity Futures Trading Commission (CFTC) is a popular theory why futures ETFs were approved before spot ETFs.

The Winklevoss twins first submitted an application for a U.S. spot Bitcoin ETF in July 2013, but the application was repeatedly rejected in the years that followed. Ten years later, on June 15, 2023, BlackRock, the world’s largest asset management company, submitted an application for the iShares Bitcoin Trust Fund. The power of their brand, coupled with their stellar track record (BlackRock has only been rejected once out of 575 ETF applications, according to Bloomberg Senior ETF Analyst Eric Balchunas), is a game changer and is helping U.S. Bitcoin Spot ETFs have become one of the most anticipated ETFs.

On August 29, 2023, the tide turned further, when the U.S. Court of Appeals for the District of Columbia Circuit ruled in favor of Grayscale in the case of Grayscale v. SEC (22-1142), saying that the SEC decision Blocking its proposed Bitcoin ETF is “arbitrary and capricious.”

Fast forward to today, 11 issuers have filed for spot Bitcoin ETFs and are under SEC review ( Links to Form S-1, which includes prospectus documents and SEC-collected Additional information and exhibits, as filed on December 26, 28, and 29, 2023): BlackRock (iShares), Grayscale (conversion of existing OTC trusts), 21Shares & ARK Invest, Bitwise, VanEck, WisdomTree, Invesco Galaxy, Fidelity, Valkyrie, Hashdex and Franklin Templeton. Meetings between the SEC and issuers have increased in recent weeks, and the SEC is requiring all issuers to move to cash creation, meaning the exchange of assets for the creation and redemption of ETF shares must occur in cash rather than in kind. Typically, the exchange of assets in creations and redemptions between the AP and the ETF issuer occurs in-kind for efficiency reasons. While the SEC has not publicly stated its rationale for requiring cash only, it is likely that the SEC does not want to be seen as approving APs (usually large banks and brokers) for cryptocurrency trading.

As of the evening of Friday, January 5, 2024, all 11 filers had submitted revised 19b-4 s, which recommended that exchanges change their rules to enable trading of the products. These must be approved by the SEC's Division of Trading and Markets.

Excerpt from Bloomberg’s U.S. spot Bitcoin ETF status on January 5, 2024

Source: Bloomberg via James Seyffart on X , January 5, 2024

The final step is for the SEC to sign the final S-1 form. The market currently expects this to happen around Wednesday, January 10, with listing and trading likely to be completed as soon as 24 to 48 hours thereafter.

We will closely monitor fund flows and trading volumes during the first week of trading to assess competitive dynamics among the 11 issuers. Larger ETFs are favored by investors for a variety of reasons, including cost efficiency, liquidity, and reduced risk. Therefore, the amount of seed capital in an ETF can provide a competitive advantage. Bitwise's S-1 filing on December 29 showed initial interest as high as $200 million, and Blackrock revealed seed sales of $10 million. It is worth noting that there were rumors on January 5 that they may have prepared $2 billion in the first week of trading. Eric Balchunas, senior ETF analyst at Bloomberg, pointed out that considering the seed investment from other funds, this is a good pair for the asset management company. is "on-brand," although the amount would be far greater than any ETF previously launched.

BlackRock, VanEck, Ark & 21Shares, Fidelity, Hashdex, Invesco & Galaxy and Grayscale have also submitted applications for US Ethereum spot ETFs, with the SEC’s first final deadline of 2024 May 23rd.

One year after the US SEC’s approval, the Hong Kong Securities and Futures Commission (SFC) approved a cryptocurrency futures ETF in October 2022, and asset management company CSOP The first two funds (one Bitcoin and one Ethereum) were launched on December 16, 2022. The SFC and the Hong Kong Monetary Authority issued a joint notice in December 2023 setting out guidance on cryptocurrency investment products, noting that “in light of recent market developments,” the SFC will now accept applications for cryptocurrency spot ETFs. The updated SFC guidance states that both physical and cash creation and redemption models are permitted. Cryptocurrency ETPs issued overseas and not specifically approved by the Securities Regulatory Commission are still only available to professional investors.

More and more investors are looking to add cryptocurrencies to their portfolios, and ETPs offer a familiar, convenient and Regulated access to this investment. Driven by this demand, both crypto-native and traditional asset managers continue to participate and innovate in these products. The expected approval of U.S. spot ETFs by 2024 could serve as a catalyst for their growth and availability globally.

As this space continues to evolve, areas we will focus on include:

Intensified issuer competition ( and the intensity of competition) on fees and ETP traffic from other regions and issuers, and the potential consolidation and/or exit of smaller players in the longer term

In Supported by the marketing power of leading global asset managers such as BlackRock, there has been a shift in consumer and institutional awareness and acceptance of cryptocurrencies

As a result, willingness to engage with cryptocurrencies Increase in the number of currency partner exchanges, asset managers, distributors and other institutional players and service providers that accept these products and integrate them into advisory models Timeline

The evolution of institutional staking, including the growth of staking products available to investors and the development of liquidity solutions for issuers, such as institutional staking provider Kiln recently Validator NFT Launched

Growth of on-chain structured products: As we all know, we believe the future is on-chain, recent collaboration between 21Shares parent company 21.co and Index Coop Relationships show how ETP issuers are starting to move in this direction

ZK Stack, dedicated vs. general-purpose ZK: Which one is the future? Golden Finance, the line between dedicated and general-purpose ZK is blurring.

JinseFinance

JinseFinanceMany people still confuse FHE with ZK and MPC encryption technologies, so this article will compare these three technologies in detail.

JinseFinance

JinseFinanceSolana’s “Actions and Blinks” simplify transactions and voting operations through browser extensions, while Farcaster on Ethereum enhances social network interoperability and user data privacy protection through decentralized protocols.

JinseFinance

JinseFinanceThe passage of a Bitcoin spot ETF opened the door to the cryptocurrency market for many new buyers, allowing them to allocate Bitcoin in their portfolios. However, the passage of an Ethereum spot ETF has a less obvious impact.

JinseFinance

JinseFinanceBlackRock, ARK Invest and WisdomTree submitted a revised Bitcoin spot ETF proposal yesterday, adopting the Cash Creation Method

JinseFinance

JinseFinance JinseFinance

JinseFinanceThe fate of Genesis Trading, DCG and GBTC continues to hang by a thread.

Bitcoinist

BitcoinistThe DeFi space continues to bring up disruptive innovations that cut across different industries and economies. The internet community has ...

Bitcoinist

BitcoinistWhen crypto bull market profits dry up, the best way to keep gains coming is by using leverage to open ...

Bitcoinist

BitcoinistOptimism and Arbitrum are two of the largest Layer 2 (L2) solutions utilizing Optimistic rollup technology to scale the Ethereum network. This article will make a comprehensive comparison.

Cointelegraph

Cointelegraph