Author: Blackrock

As one of the world's largest asset management companies, BlackRock has become increasingly positive about Bitcoin and other crypto assets. From actively applying to promote Bitcoin spot ETFs at the beginning of the year to occupying a dominant position in Bitcoin spot ETF shares, its recognition of the cryptocurrency market is self-evident. Yesterday, it released another 9-page white paper, which elaborated on the unique status of Bitcoin as a major crypto asset and explained the unique value and significance of Bitcoin in the world.

The following is a simplified version:

Is Bitcoin a "risk asset" or a "safe haven asset"? This is one of the most common questions users ask when investing in Bitcoin for the first time.We believe that the unique nature of Bitcoin makes it unsuitable for evaluation using traditional financial frameworks, and its long-term return drivers are largely unrelated to the sources of returns in other portfolios.

While Bitcoin is volatile and has some short-term co-movement with the stock market (particularly during sharp changes in U.S. dollar real interest rates or liquidity), Bitcoin has a low long-term correlation with stocks and bonds, and its long-term historical returns significantly exceed all major asset classes.

Over the long term, we believe that the drivers of Bitcoin adoption are likely to be very different from, and in some ways the opposite of, the global macro factors that drive most traditional financial assets. This article will explain this in detail.

Why is Bitcoin important?

First, we need to understand what fundamentally gives Bitcoin its importance. Since its creation in 2009, Bitcoin has become the first Internet-native monetary instrument to be widely adopted worldwide. Its technological innovation has created a digitally native, global, scarce, decentralized, and permissionless form of money. It is these attributes, these characteristics that have made Bitcoin a breakthrough in the field of currency. It solves the problems that have long plagued currency in history:

1. Bitcoin sets a supply cap of 21 million by hard-coding, which means that it will not depreciate easily.

2. Its global, digital native nature means that it can be transmitted around the world in an almost real-time and almost zero-cost manner, breaking the barriers inherent in transferring value across political borders.

3. Its decentralized, permissionless nature makes it the world's first truly open-access monetary system.

Although other crypto assets have been created since Bitcoin's breakthrough, and in many cases pursue a wider range of application scenarios, Only the top crypto asset Bitcoin has reached a global consensus worldwide. It is this that makes Bitcoin unique in the cryptoasset space as a global alternative to money and an asset with credible scarcity.

Bitcoin’s Path to $1 Trillion Market Cap

Despite Bitcoin’s remarkable growth to date and widespread global adoption,it remains uncertain whether it will ultimately develop into a widespread store of value or global payment asset, and its changing market value reflects this uncertainty.

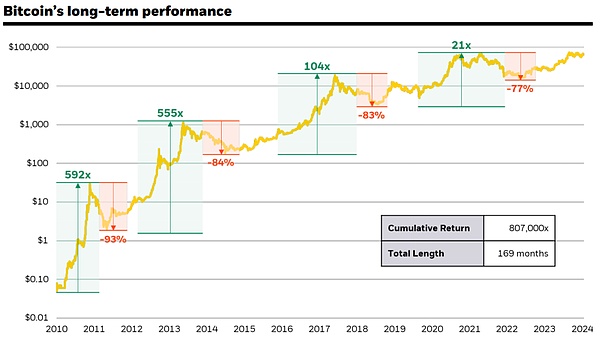

In seven of the past 10 years, Bitcoin has outperformed all major asset classes, with annualized returns exceeding 100%. Even so, Bitcoin has been the worst performing asset in the other three years and has experienced four significant drawdowns of more than 50%. However, through these historical cycles, Bitcoin has demonstrated the ability to recover from significant drawdowns and set new highs, even though these cycles are often accompanied by prolonged bear markets.

These fluctuations in Bitcoin’s price reflect, in part, its prospects of becoming a global alternative to money over time.

This data shows Bitcoin price action from July 19, 2010, to July 31, 2024, with the starting date marking the launch of the first Bitcoin exchange, Mt. Gox.

Source: Bloomberg Bitcoin spot price, as of July 31, 2024.

Assets Uncorrelated with Macro Variables

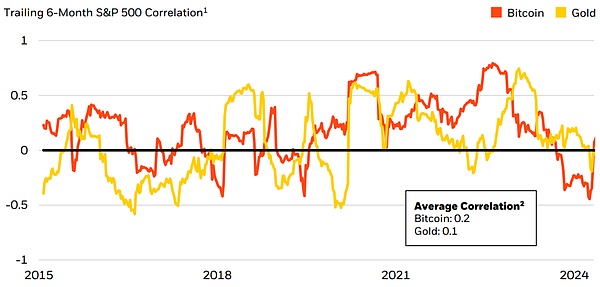

Bitcoin has fewer fundamental correlations with other macro variables, which explains its lower long-term average correlation with stocks and other “risk assets.” While there have been some brief periods when Bitcoin’s correlation has increased—particularly when there have been sudden changes in U.S. real interest rates or liquidity—these have been short-lived phenomena that have failed to establish a clear long-term statistically significant correlation relationship.

1. Bitcoin has a low historical correlation with US stocks and has experienced several periods of disconnection

From the above figure, we can see:

A. 6-month lagged correlation of Bitcoin and gold weekly returns with the S&P 500 index, data coverage period is January 1, 2015 to July 31, 2024.Source: Bloomberg Bitcoin spot price, Bloomberg gold spot price, S&P Global and BlackRock calculations, as of July 31, 2024.B. Average 6-month lagged correlation of Bitcoin and gold weekly returns with the S&P 500 index,Data coverage period is January 1, 2015 to July 31, 2024.

As the first decentralized, non-sovereign alternative to money, Bitcoin has no traditional counterparty risk, is not dependent on any centralized system, and is not driven by the economic conditions of any single country. These characteristics make it fundamentally insulated from certain key macro risk factors, such as banking system crises, sovereign debt crises, currency debasement, geopolitical turmoil, and other country-specific political and economic risks.

In the long term, Bitcoin's adoption path may be driven by the degree of volatility in concerns about global monetary instability, geopolitical discord, U.S. fiscal sustainability, and U.S. political stability.

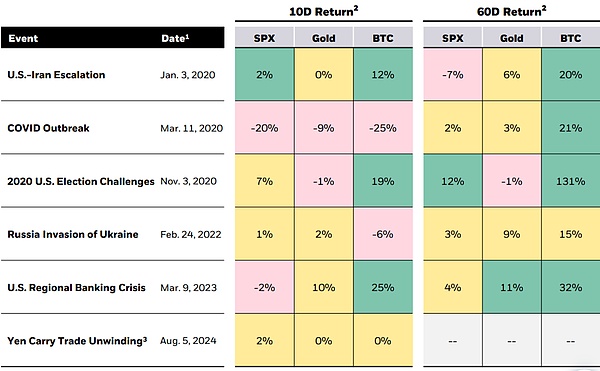

Due to these attributes, Bitcoin has been viewed by some investors as a "safe haven asset" in times of panic, especially during some of the most disruptive global events of the past five years. Notably, during these events, Bitcoin showed a short-lived negative reaction in the early stages before recovering. In our view, these short-term trading reactions, which are often difficult to explain from a fundamental perspective, may be attributed to several factors:

A. As an asset that is traded 24/7 and settled almost instantly, Bitcoin exhibits a high degree of marketability during tight liquidity in traditional markets, especially during weekends.

B. The Bitcoin and crypto asset markets are still relatively immature, and investors' understanding of Bitcoin is still evolving.

In most cases, including the recent global market sell-off on August 5, 2024, Bitcoin recovered to its prior levels within a few days or weeks, and in many cases rose further, as the market began to recognize the positive potential impact of these disruptive events on Bitcoin's fundamentals.

2. Performance of S&P 500, gold and Bitcoin during major geopolitical events

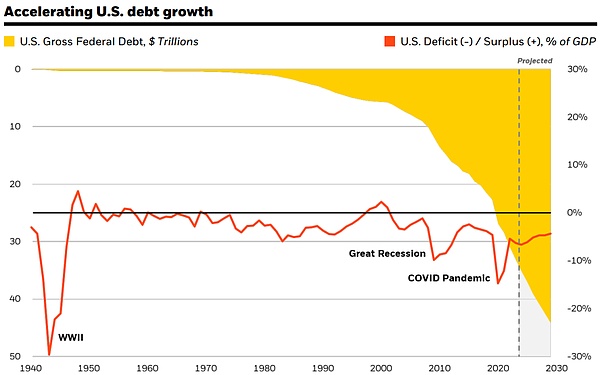

3. U.S. debt dynamics are again in the spotlight

Against this backdrop, U.S. and global concerns about the U.S. federal deficit and debt situation have heightened interest in Bitcoin as a potential alternative reserve asset to hedge against future events that could affect the dollar. This trend also appears to be evident in other countries with significant debt accumulation. Based on our market experience, this explains an important reason for the recent broad increase in institutional interest in Bitcoin.

Yellow part: Total US federal debt/trillion dollars

Red line: US deficit (-)/surplus (+) as a percentage of GDP

Bitcoin is still a high-risk asset

Although the previous analysis shows certain characteristics of Bitcoin, this does not change the fact that Bitcoin as an independent asset is still very risky.As an emerging technology, Bitcoin is still in the early stages of full popularization and whether it can become a global payment asset or a value storage tool in the future is still uncertain. In addition, Bitcoin has experienced violent fluctuations and faces a variety of risks such as regulatory challenges, uncertainty in the path of popularization, and an immature ecosystem.

However, the key point is that these risks are unique to Bitcoin and not common to traditional investment assets. Thus, a pure “risk on” vs. “risk off” framework may not work for Bitcoin.

From a portfolio perspective, this is why Bitcoin can serve as a diversifier when held in a modest manner, while its high volatility can significantly increase portfolio risk when held in larger positions.

Summary

While Bitcoin has moved in tandem with equities and other “risk assets” in the short term, over the long term its fundamental drivers are significantly different and in many cases opposite to those of most traditional investment assets.

As the global investment community faces increasing geopolitical tensions, concerns about the U.S. debt and deficit situation, and political instability around the world, Bitcoin may be viewed as a unique asset that can hedge against some of the fiscal, monetary, and geopolitical risks that other assets in a portfolio may be exposed to.

Summary

Original title: Bitcoin: A Unique Diversifier

Original link: https://www.blackrock.com/us/financial-professionals/literature/whitepaper/bitcoin-a-unique-diversifier.pdf

Original author: Samara Cohen, Robert Mitchnick, Russell Brownback, Blackrock

Translation: Vernacular Blockchain

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cointelegraph

Cointelegraph Future

Future Cointelegraph

Cointelegraph