Author: Suvashree Ghosh, Sidhartha Shukla, Bloomberg; Compiled by: Baishui, Golden Finance

Bitcoin fell for a fourth straight session as part of a broader cryptocurrency sell-off that contrasted with recent record highs in global stocks.

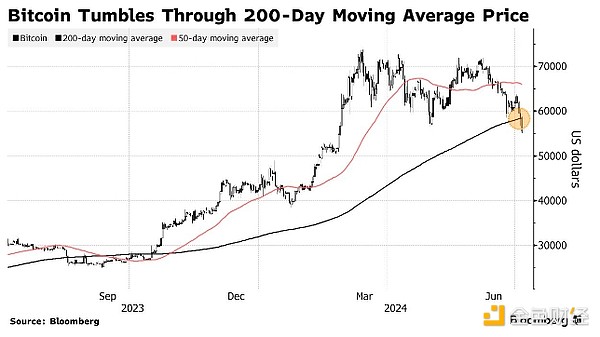

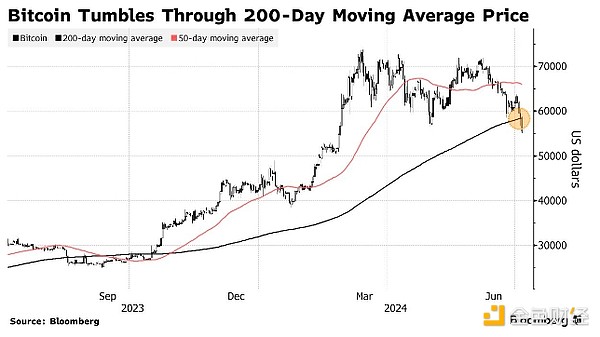

BTC hit its lowest level since February, changing hands at around $54,400. Smaller tokens such as Ethereum, XRP and Cardano suffered larger losses, in some cases more than 10%.

Crypto speculators currently face a series of challenges, including falling demand for U.S. bitcoin exchange-traded funds, signs that the government is disposing of seized tokens and the hard-to-parse impact of U.S. political turmoil.

In addition, managers of the collapsed Mt. Gox exchange are returning large amounts of bitcoin to creditors in stages. Speculators are unsure how much of the $8 billion will eventually be sold. According to Arkham Intelligence, a wallet associated with Mt. Gox moved $2.7 billion worth of tokens on Friday.

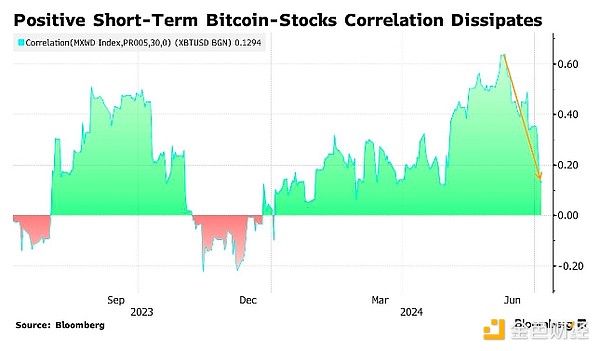

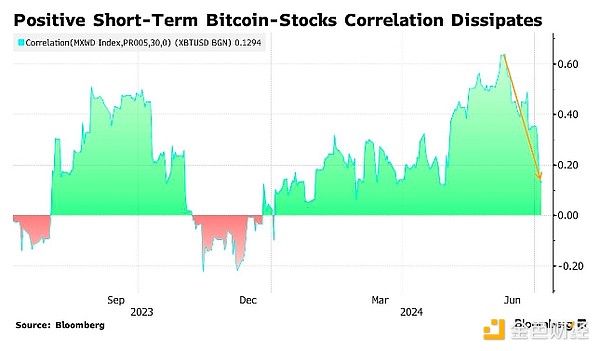

Weakened Correlation

Meanwhile, MSCI Inc.’s global stock index is hovering near record highs, and the short-term 30-day correlation between Bitcoin and the index is falling sharply. The question is whether the risk aversion in the cryptocurrency space is isolated or signals a cautious quarter for mainstream investing after a strong first half for stocks.

“There’s a general lack of attention in the cryptocurrency market right now,” said Stefan von Haenisch, head of trading at OSL SG Pte. “Most of the news that’s circulating right now, like the Mt. Gox sell-off, is more pessimistic in nature.”

Von Haenisch said cryptocurrencies need the Federal Reserve to take a more dovish stance on monetary policy, adding that “One or two rate cuts, coupled with an expansion of the Fed’s balance sheet, are the two key factors that cryptocurrencies are really waiting for.”

Investors are awaiting U.S. jobs data due later on Friday for the latest clues on the outlook for Federal Reserve policy. Recent weak economic reports have bolstered the Fed’s case for loosening monetary policy in the coming months.

Bitcoin hit an all-time high of $73,798 in March, driven by unexpectedly strong demand for the first U.S. ETF. Inflows have since tapered off, sending bitcoin prices lower and casting a shadow over the rest of the digital asset market.

An Ethereum ETF is pending approval, but interest in the products could be mixed if the cryptocurrency sell-off continues.

LIQUIDATIONS

More than $800 million worth of bullish cryptocurrency bets were liquidated in the past three days, Coinglass data showed, one of the largest such liquidations since April.

“Poor liquidity over the weekend will exacerbate any volatility caused by liquidations, even if it’s small,” said Caroline Mauron, co-founder of digital asset derivatives liquidity provider Orbit Markets. At the same time, the return of U.S. investors from the July 4 holiday should help bring some stability, she added.

Operators of the power-hungry computers that underpin the bitcoin blockchain are continuing to take a financial hit from April’s so-called halving, which capped the amount of new tokens they receive for their work. One response among these bitcoin miners has been to sell some of their coin inventory.

Le Shi, head of trading at market making and algorithmic trading firm Auros, said: "The $51,000 to $52,000 range is critical as many bitcoin miners are reaching the break-even point for profitable mining."

JinseFinance

JinseFinance