Source: Zuoye Waibo Mountain

Being able to go up and down is the key

strong>ZK/OP/EVM/WASM are adjustments

Currency is a little thought

Since May 2023, the popularity of Inscription and its various derivatives protocols has made Bitcoin has once again become a new high ground for entrepreneurship in the blockchain industry. In this wave, the "legitimacy" established by Bitcoin #UTXO transactions and the "migration" of Ethereum's series of innovations that feed back Bitcoin are two major features.

In terms of orthodoxy, #Ordinal (inscription) and #Runes (runes) are their authors respectively The protocol created by Casey @rodarmor for Bitcoin NFT and FT, but Runes is still in development, but the wave has arrived, and $BTC L2 is already starting to catch on.

In terms of portability,the circulation part of Bitcoin asset issuance is almost always connected to the #EVM ecosystem. Therefore, it is necessary to learn from the L2 development of Ethereum The idea has become an industry consensus. Furthermore, ZK/OP have been packaged and included, but similar to the expansion path of Ethereum, there are many runners and few innovators.

The core of BTC L2 lies in the determination of paradigms and genres. Only by determining the specific technical direction can we bet on high-quality projects. At present, BTC L2 is still in the conceptual stage. The actual start-up phase.

The purpose of my writing this article is to outline the possible development direction of BTC L2, rather than to list current projects, nor to involve too many technical principles (this article does not contain formulas and codes that exceed the elementary school level. You can eat it with confidence~).

1. BTC expansion "add water to the surface, add water to the surface" is not feasible

Before BTC L2 , the more mainstream expression is "expansion", because Bitcoin's weak TPS cannot accommodate slightly larger-scale transactions, such as high-frequency micropayments, expensive Gas Fees and snail-like confirmation speeds that are unbearable. At least some people can't stand it.

It is imperative to expand the capacity, especially in 2017-18, the two major fork projects $BCH/ $BSV were born, which in turn forced the #SegWit upgrade of the Bitcoin main network. Bitcoin’s third Once, a decision was made that went against the ancestors - the block size was expanded to 4MB instead of the 1MB designed by Satoshi Nakamoto.

According to Satoshi Nakamoto’s design, a Bitcoin block header without transaction information is about 80 bytes. According to the block generation time of 10 minutes, each block will only generate approximately 4.2 MB per year. Data, after SegWit expansion, the data volume will increase to 16.8 MB, but the improvement in TPS is minimal, still hovering in single digits.

The paradox arises. The improvement of TPS also requires the cooperation of a series of conditions such as hardware and network speed. If this speed is maintained, in order to achieve better transaction speed, Bitcoin will need to continue to expand. , eventually becoming centralized.

Insighted people believed that capacity expansion should be stopped and instead seek L2. As a result, the first wave of L2 craze was born, and the idea of Lightning Network also sprouted at this time.

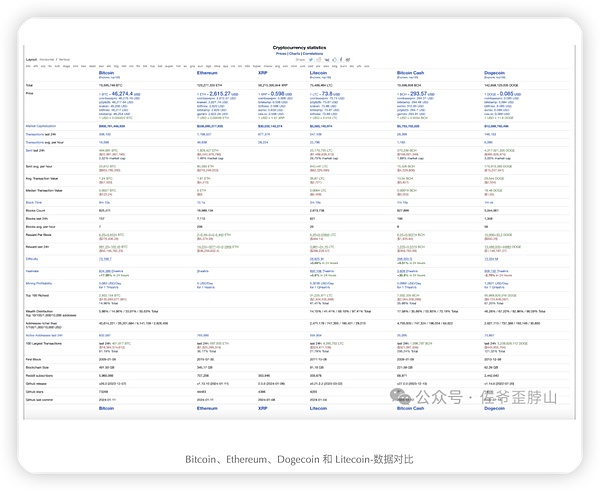

As shown in the picture above, Ethereum It is the product of @VitalikButerin's suggestion that Bitcoin support smart contracts was rejected. $LTC, BCH and @dogecoin are all variants of Bitcoin, which are nothing more than subtle differences in reducing difficulty and increasing speed.

However, certain key elements are missing, which has led to twists and turns in the process of establishing L2 for Bitcoin. The main problems are two:

1. Bitcoin development language Lack of Turing completeness makes it difficult to support any complex functions;

2. Due to hardware level limitations in 2008, the Bitcoin mainnet is indeed too slow and needs to be improved; >

Turing completeness actually refers to computability. The popular understanding is that complex problems can be calculated within limited rules, such as To set up automatic transfers, Ethereum relies on smart contracts to set a rule and it can be executed automatically. However, Bitcoin is a public ledger that can only keep accounts and cannot set up automatic transfers. This brings absolute security, but it also Leading to extreme inefficiency.

The Bitcoin mainnet is very slow and the support functions are too limited. Therefore, the SegWit upgrade was first implemented to greatly expand the block space, and then the #Taproot upgrade, which Inscription depends on, was implemented. Inscription is actually similar to code comments, and it benefits from this.

Based on this, we can first establish a minimalist framework for Bitcoin expansion-L2 development, and then gradually fill in the details:

In 2017/18, L2 carried out early attempts: Lightning Network, ChainX, Stacks (established in 2015);

After the Taproot upgrade in 2021, some L2 attempts based on this were born, and EVM compatibility became standard, such as Liquid Network (forecast in 2020);

After the popularity of Inscription in 2023 , there are many L2 practical methods in Ethereum, such as ZK/OP Rollup, WASM, and multi-signature bridge, and EVM is fully popularized, such as BitVM, BEVM, and Interlay V2. Generally speaking, this is the stage where Rollup-EVM explores and feeds back Bitcoin.

In addition, it should be noted that the division of the three stages is not a substitution relationship, but more an integration. For example, the current BTC L2 basically covers EVM, but it is just an implementation The ideas are different. This article does not describe the history in detail, but only selects representative solutions for interpretation.

2. General L2: Being able to go up and down is the key

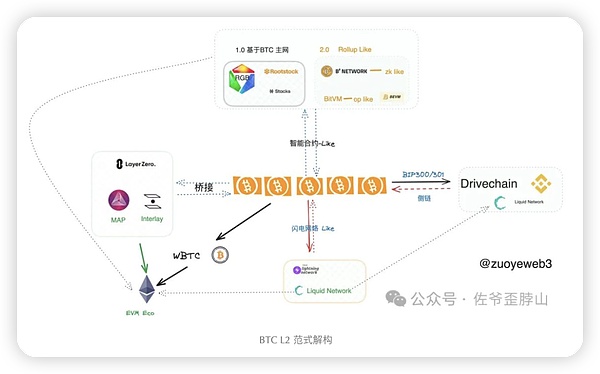

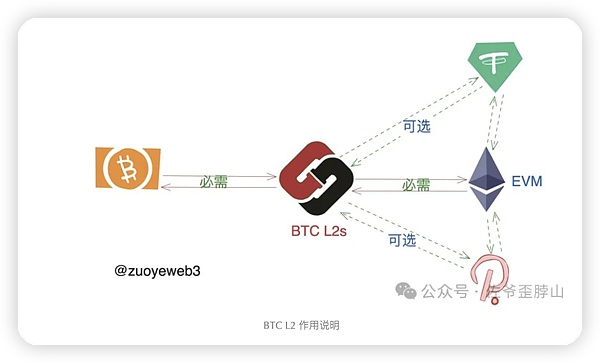

In a nutshell, The current BTC L2 can be divided into four categories, namely lightning network type, bridge type, smart contract type (early based on the main network, now similar to Rollup) and side chain.This division method and technology It doesn’t have much to do with it. The main thing is to examine how it connects to the EVM ecosystem. Unlike Ethereum L2, whose primary consideration is how to connect to the main network, BTC L2 needs to link the three layers of Bitcoin main network, L2 itself and EVM.

Among them, Lightning Network It cannot be connected to EVM. The Lightning Network is also the BTC L2 that is most similar to Ethereum L2, but now it is an alien. In addition, the remaining BTC L2s ideas can be included in the picture above. At the same time, it is not the smart contract class that can support EVM. The above division is only for convenience of explanation to highlight the characteristics of other types.

In terms of development ideas, BTC L2s all need to consider the issue of upper and lower channels, that is, how to let BTC settle in their own L2 and bear the actual use of BTC flowing into EVM,And how to transmit the final results back to the Bitcoin mainnet transaction to use the absolute security of Bitcoin.

Here, we will focus on @WrappedBTC WBTC and the Lightning Network mechanism. In a sense, subsequent solutions can be regarded as decentralization of the former and generalization of the latter. Transformation, WBTC solves the problem of BTC entering EVM and #DeFi, but in a centralized manner. The Lightning Network finally uses Bitcoin for settlement, and the security after settlement is completely consistent with the main network.

How WBTC works

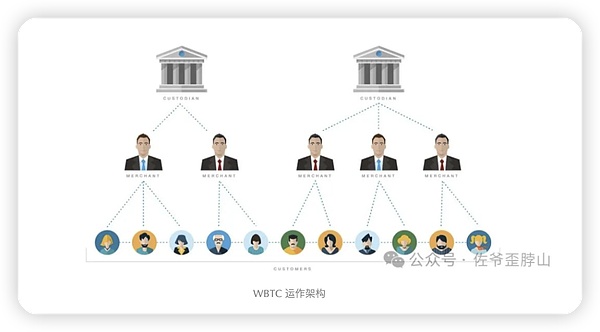

WBTC, the full name of Wrapped Bitcoin, is an ERC-20 token circulating in Ethereum, which is supported by BTC 1:1. In terms of operation, it consists of users - listing - custodians. The specific functions can be divided into acceptance, minting and redemption:

1. To accept WBTC, users need to apply to the merchant, and the merchant will process the user After KYC and AML, the identity is determined, and then the user sends BTC to the merchant, and the merchant sends WBTC to the user;

2. To mint WBTC, the merchant applies to the custodian, and the merchant sends BTC to the custodian, and the custodian Send WBTC to the merchant;

3. To redeem BTC, the merchant applies to the custodian, the custodian returns the BTC to the merchant, the merchant destroys the WBTC, the custodian confirms the merchant's destruction, and the transaction ends.

It can be seen that WBTC operates based on custody and centralized verification. Although there are factors such as DAO, multi-signature and circulation anonymity, it is generally similar to USDT. It is the logic of traditional finance that penetrates into the blockchain. , it is difficult to serve as the cornerstone of BTC L2.

Settlement of Lightning Network Principle

As mentioned earlier, the Lightning Network ultimately uses the Bitcoin mainnet for settlement. Specifically, the Lightning Network opens multiple pledge nodes for BTC and builds a Bitcoin The PoS-like operation network on top of the currency can establish P2P off-chain transaction channels without real-time confirmation, so it is extremely efficient, and the Gas Fee is very low. The off-chain transaction channel will only be closed when the two parties finally want to settle. After entering the final on-chain settlement link, both parties to the transaction need to actually transfer BTC.

Therefore, the Lightning Network takes into account the security of Bitcoin and the convenience of transactions. Of course, because the Lightning Network is not a real-time settlement, there are still security risks,and the Lightning Network is expanded into a universal settlement system. , is another focus of BTC L2 at present.

At this point, the basic ideas of BTC L2 have been sorted out. My original intention is not a technical explanation, so I will omit quite a few implementation details. I also invite experts to explain. .

Next, I will take representative projects in each category as examples to explain the current development status of BTC L2 for your reference when investing or using it.

3. Paradigms and schools: small thoughts on various types of BTC L2

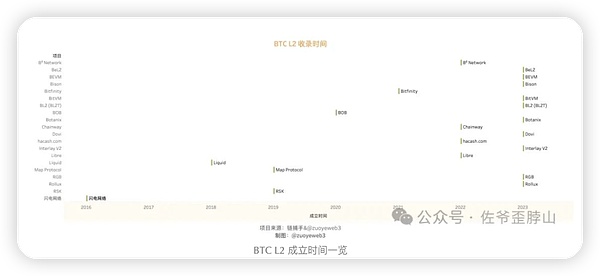

I sorted out the various types of L2 that are currently emerging, and it is obvious that the blowout period Concentrated in 2023, the popularity of Inscriptions has created a focus on funding and technology. At the same time, the accumulation of Inscriptions on the main network has also caused great controversy in the community. For example, Luke hopes to ban Inscriptions, but the miners strongly oppose it out of economic interests. I once said This has been analyzed in detail, and there is a huge debate about restricting inscriptions. Behind the quarrel between developers is a competition for interests.

What can maintain a balance between miners and developers is the large-scale use of L2, transferring such "creations" to L2, and the Bitcoin mainnet is only responsible for the final settlement, such as the Runes protocol. For this purpose,Referring to the development history of Ethereum, Bitcoin may also become "modular" in the future, forming the mainnet--Ordinal(BRC-20)--L2--dApp architecture system.

The above projects themselves There will be changes. This is based on the confirmable establishment time, such as the release of the white paper or the launch of the mainnet, but this does not affect its classification and explanation. The emphasis is on understanding.

Based on the different ways in which BTC goes up and transaction results go down, I have further divided L2. The specific parameters can be divided into BTC mapping method, L2 fund management method, data return method, and auxiliary Based on EVM compatibility, token issuance, etc., a comparison table of existing L2 representative projects of various types is constructed.

It can be found, almost There is no perfect decentralized L2 solution. It needs to be more or less moved off-chain or run using multi-signature, and a balance between efficiency, decentralization and scalability (EVM compatibility) is required.

Take the Lightning Network as an example. This is almost the only L2/scaling solution that has survived in the past era. It fully uses all the characteristics of the Bitcoin main network and does not No tokens have been issued, but the payment channel limits its versatility, and non-real-time settlement also makes it impossible to transfer large amounts.

The subsequent Liquid Network can be regarded as a special Lightning Network with a strong access system. To be more precise, Liquid is a specialized and centralized B-side organization. The Lightning Network variant is more appropriately called a side chain. Although it can reissue and circulate BTC, it cannot be open to all users and the degree of decentralization is too low.

Stacks is more open and is trying to introduce smart contracts. Its plan can be linked to the issuance of sBTC and has certain non-admission features, especially in the future, it will support EVM, but requires miners to pledge BTC. To mine its token STX, which exists more as a governance token and lacks sufficient usage scenarios, it can be understood as an EVM compatibility attempt before Inscription.

Similar to Stacks, there are projects such as RGB and Rootstock. The overall difference is not big, but in terms of decentralization, the issuance of its own tokens has increased or decreased. I judge that this will not be Future mainstream.

The mainstream has emerged, that is, the Rollup L2 solution similar to Ethereum will eventually win. Side chains, Lightning Network, etc., according to the expansion category of Ethereum, do not belong to L2, especially Rollup L2. This article just lumps them together for the convenience of discussion. When it comes to Bitcoin expansion, I estimate that I will also refer to the path of Ethereum.

Specifically for Ethereum Rollup L2, BitVM uses hash locks to introduce BTC, and then uses Bitcoin scripts to store optimistic verification results to ensure security. In essence, the calculation is off-chain. The results are on the chain, but there is a time difference in optimistic verification, especially when it comes to BTC. The efficiency of fund utilization and how to deal with fraud may not be completely consistent with the Ethereum OP scheme. Since the project is still in its early stages, I will continue to pay attention.

Then there is the ZK series L2 B² Network @BsquaredNetwork. At present, it seems (not completely sure) to officially bridge BTC to L2, and then ZK turns out to write Bitcoin scripts to ensure security forever, here The hidden premise is that the generated ZK results are completely correct, and Bitcoin is only confirmed as the final DA layer. The white paper shows that BSQ tokens will be issued, and you can also pay attention to subsequent development ideas.

Another Ethereum-like solution is BEVM, which emphasizes the "synchronicity" of Bitcoin and L2. When BTC is bridged to BEVM, the Bitcoin block header data will be synchronized to maintain data consistency. , PoS consensus is used to generate the final results, and the final results are written into Bitcoin scripts. However, it is necessary to ensure that there are no problems in the operation of the consensus itself. It can only be said that it will take time to verify.

In addition, there is also a bridge + WASM solution. This is one of the few BTC L2s that uses Polkadot as a solution. It is still the familiar bridge issuance of iBTC. The innovation lies in the emphasis on liquidity in the treasury management solution. Sexual market making, encouraging various vaults to put iBTC into DeFi, and secondly, connecting the Near/EVM/Cosmos ecology through a variety of cross-chain bridges. Stacking the bed frame is a test of security, but it has won the Polkadot parachain auction twice. As the main docking solution between Polkadot and Bitcoin, it will also issue INTR tokens, so you can pay attention to it.

Since there is Polkadot, then there must be ICP. Everyone is a heterogeneous chain, and they are all former Ethereum killers and death-level projects. Bitfinity built the EVM-compatible BTC L2 based on ICP. It has good support for BTC assets. It not only allows BTC to be bridged to L2 through threshold signatures, but also allows BRC20 assets to be bridged to L2. However, it is not yet sure how to handle on-chain funds and data return methods. Everyone is welcome to add to it.

We started with the Lightning Network and will eventually return to Bitcoin. The Runes protocol of the founder of Ordinal can also issue tokens. I also classify it as L2. Similar to BRC20, it runs entirely on the Bitcoin mainnet and uses UTXO to implement token issuance. Although it is not currently in use, it is likely to be the next Bitcoin mainnet craze. After all, miners earn money through procedures. Fees, they have enough power to create FOMO to attract funds.

Going back to the beginning of this section, the main idea of each project is to issue tokens, even governance tokens. The siphon effect of BTC is too strong. If the ecosystem is built entirely based on BTC, then only the miners will benefit in the end. L2 may only get a small share of the handling fees. In the business model of Ethereum L2, almost all L2 will eventually issue Tokens, and I think this pattern will also happen with BTC L2. The only problem is that BTC is too strong, and it is not easy to convince users to use BTC to pledge or exchange it for their own governance tokens.

At this point, I have basically sorted out the existing BTC L2 paradigms and representative projects. You can feel that I focus on explaining the BTC L2 classification and the possibility of future development, while omitting the introduction and ecology of each project. , that is not important, what is important is to see the future direction, and the most important thing is to take the right path.

4. BTC L2 imagination:

Multi-layer folding, LSD/LRT detonates liquidity

BTC has only been used as a single purpose of digital gold for a long time, and together with USDT, it has been used as a value measure and trading medium in the crypto market. Although WBTC is enough for daily use, after the inscription, BTC has become an asset issuance platform, whether it is a layer of BRC20 & Ordinal protocol, or the various types of BTC L2 that are booming,all mean that BTC itself has surpassed its previous single function, even as a handling fee, and has generated new growth points due to asset casting, issuance and transfer.

You can continue to imagine that most BTC is not active and is simply used as a means of storing value. However, after the mining reward is halved, coupled with the passage of BTC spot ETF, BTC needs to learn how to survive after converting ETH to PoS, such as the leverage effect of LSD/LRT. The current market value of BTC is around one trillion US dollars. If a large amount of BTC is pledged for L2, its capital efficiency will be reduced.Refer to Blast Only the interest-bearing L2 can attract retail investors and funds to pour into it. The value of BTC itself is enough to support ten times or dozens of times of leverage. It is a pity not to use it as an LSD/LRT linked product.

Due to space limitations, this article lacks in-depth analysis of many projects. I hope that I will have the opportunity to make up for you in the future~

Edmund

Edmund

Edmund

Edmund JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph