When MicroStrategy's market value exceeded $100 billion in the name of "Bitcoin Company", and when SharpLink went public through a backdoor listing and bought 160,000 Ethereums, its stock price soared 500% in a single day, the U.S. stock market is staging a magical plot of "buying coins means getting rich overnight".

From technology giants to traditional companies, more and more listed companies are incorporating cryptocurrencies into their balance sheets, trying to replicate the wealth myth of "coin-stock linkage". At the same time, encrypted payment cards have sprung up like mushrooms after rain, and products such as Crypto.com and Binance Card are vying to open up the channel between on-chain assets and real consumption. A capital competition for the "payment revolution" has quietly begun.

Is this round of enthusiasm a breakthrough for financial innovation, or another carnival of speculative bubbles? When the market value of listed companies is deeply tied to the price of cryptocurrencies, and when payment tools become the traffic entrance of the on-chain ecosystem, are we seeing the "out-of-circle" victory of decentralized finance, or a new routine for traditional capital to reap profits by using crypto narratives? This article will analyze the underlying logic of the strategy of buying coins from US stocks, the reasons for the outbreak of encrypted payment cards, and the risks and opportunities behind the two, to take you through the true face of this dance between encryption and capital.

Buying coins from US stocks: a wealth code or a dangerous game?

Amid the ever-changing capital market, a new phenomenon is attracting everyone's attention - buying coins has become a new strategy for US listed companies to boost stock prices. The rise of this strategy is like a stone thrown into a calm lake, causing ripples. In this wave of buying coins, the cases of MicroStrategy and SharpLink are particularly eye-catching. They are like two unique lighthouses that illuminate the channel of this emerging field, and at the same time have triggered a lot of thinking and controversy.

MicroStrategy: Pioneer in the fusion of coins and stocks

In the wave of US-listed companies buying coins, MicroStrategy is undoubtedly a pioneer, and its successful experience provides valuable reference for other companies. As early as 2020, when cryptocurrencies were not as widely concerned as they are today, MicroStrategy showed extraordinary foresight and boldly included Bitcoin in its asset allocation. The company's CEO Michael Saylor firmly believes that Bitcoin is "a more reliable store of value than the US dollar," and this concept has become the cornerstone of MicroStrategy's strategic transformation.

MicroStrategy's unique gameplay can be summarized by the combination of "convertible bonds + Bitcoin". This innovative capital operation model was unique in the capital market at the time. First of all, from a financing perspective, the company raised funds by issuing low-interest convertible bonds, which was a brilliant move. Since 2020, MicroStrategy has issued such bonds many times, with interest rates as low as 0%, far below the market average. Take November 2024 as an example, it successfully issued $2.6 billion in convertible bonds, obtaining a large amount of cash at almost zero cost. These convertible bonds give investors the right to convert into company shares at a fixed price in the future, which is equivalent to obtaining a call option for investors, increasing the attractiveness of investment; and for the company, it cleverly enriches its capital reserves at a very low cost.

After raising funds, MicroStrategy did not hesitate to invest all of its funds in Bitcoin. The company continued to increase its Bitcoin holdings through multiple rounds of financing, making Bitcoin gradually become a core component of the company's balance sheet. This firm investment in a single crypto asset reflects the company's deep understanding and strong confidence in the cryptocurrency market. In this process, the price trend of Bitcoin has become a key factor affecting the value of the company's assets.

As the price of Bitcoin soared from $10,000 in 2020 to $100,000 in 2025, MicroStrategy started a powerful "flywheel effect". The sharp rise in the price of Bitcoin has caused the value of the company's assets to rise. This significant change has attracted the attention of more investors, who have bought MicroStrategy's shares and pushed the stock price to continue to rise. The rise in stock prices further enhanced the company's market influence and financing capabilities, allowing MicroStrategy to issue bonds or stocks again at a higher valuation, thereby raising more funds to purchase Bitcoin. This cycle has formed a self-reinforcing capital cycle, allowing the company to continue to grow in the capital market.

MicroStrategy's success has not only changed its own asset structure and market position, but also transformed from an ordinary technology company to a highly anticipated "Bitcoin investment pioneer" with a market value of over $100 billion, and provided a textbook example for other U.S. stock companies. It has proved to the market that, under reasonable capital operation and correct market judgment, investing in cryptocurrencies can be an effective way to increase a company's market value and influence, inspiring many companies to follow suit and set off a wave of buying coins in the U.S. stock market.

SharpLink: A new player buying coins through backdoor listings

Under the successful demonstration effect of MicroStrategy, many followers have emerged in the market, #SharpLink Gaming (SBET) is one of the most popular ones. It has made innovative optimizations to MicroStrategy's gameplay, focusing on Ethereum (#ETH), and has taken a unique path of "backdoor listing + buying coins", which has created a stir in the capital market. SharpLink was originally a small gaming company struggling to survive on the Nasdaq. It struggled in the torrent of the market and was once on the verge of delisting. Its stock price once dropped to a staggering $1, and shareholders' equity was seriously insufficient, with less than $2.5 million. The compliance pressure was like a mountain, which made the company breathless. However, such a company with a seemingly bleak future has a valuable resource that makes the giants of the currency circle salivate - the listing status of Nasdaq. This "shell" has become the key to its fate.

In May 2025, a feast of capital was staged on SharpLink. ConsenSys, led by Ethereum co-founder Joe Lubin, joined forces with a number of crypto venture capital companies, such as ParaFi Capital and Pantera Capital, to take a strong shot and led the acquisition of SharpLink through a private equity investment (PIPE) of up to $425 million. They issued 69.1 million new shares at $6.15 per share, quickly gaining more than 90% control of SharpLink. This process was quick and efficient, eliminating the cumbersome procedures required for traditional IPOs or SPACs, and Joe Lubin was appointed chairman of the board. Subsequently, ConsenSys made it clear that it would work closely with SharpLink to explore the "Ethereum Treasury Strategy", and a capital operation drama around Ethereum officially kicked off.

ConsenSys plans to use the $425 million to purchase approximately 163,000 ETH, trying to package SharpLink as the "Ethereum version of MicroStrategy" and vigorously claiming that ETH is a "digital reserve asset." This narrative has caused a strong response in the capital market, like a fire that ignited the enthusiasm of investors. It not only successfully attracted a large influx of speculative funds, but also provided a convenient "public ETH proxy" for institutional investors who could not directly hold ETH, enabling them to indirectly participate in the Ethereum market by investing in SharpLink.

SharpLink's "magic" is far more than that. Its real power is reflected in the subsequent flywheel effect, which can be broken down into a sophisticated three-step cycle. The first step is low-cost fundraising. Through PIPE, SharpLink easily raised $425 million at $6.15 per share. Compared with traditional IPOs or SPACs, this method is like a shortcut. It does not need to go through cumbersome roadshows and strict regulatory processes, greatly reducing costs and allowing companies to quickly obtain large amounts of funds.

The second step is that market enthusiasm pushes up stock prices. When the story of "Ethereum version of MicroStrategy" spread in the market, investors' enthusiasm was completely ignited, and SharpLink's stock price soared like a rocket. The market's pursuit of its stocks is far beyond imagination. Investors seem to be driven by an invisible force and are willing to pay a price far higher than the net value of their ETH holdings. This "psychological premium" has caused SharpLink's market value to expand sharply in a short period of time, creating a small miracle in the capital market. In addition, SharpLink also plans to pledge these ETH tokens and lock them in the Ethereum network. In this way, it can not only increase the security of assets, but also earn an additional 3%-5% annualized return, bringing an additional source of income to the company.

The third step is circular refinancing. With the sharp rise in stock prices, SharpLink stands at a new starting point. By issuing shares again at a higher stock price, the company can theoretically raise more funds and buy more ETH. This cycle repeats itself, like an accelerating flywheel, and the company's valuation is growing like a snowball, expanding in the capital market.

However, behind this seemingly gorgeous capital game, there are huge risks. SharpLink's core business, gambling marketing, has been almost forgotten and ignored in this craze. The $425 million ETH investment plan is seriously out of touch with the company's fundamentals, like a castle built on the beach, lacking solid support. The surge in its stock price is more driven by speculative funds and crypto narratives, rather than based on the growth of the company's actual business and the improvement of profitability. Once market sentiment changes or the cryptocurrency market fluctuates sharply, this seemingly huge valuation bubble may burst in an instant, causing huge losses to investors.

Dilemmas and Challenges of Imitators

In the capital market, when a strategy shows the dawn of success, imitators often flock to it. The rise of the coin buying strategy in the U.S. stock market is no exception. Many companies have tried to copy the successful paths of MicroStrategy and SharpLink, hoping to achieve a surge in market value. However, reality has poured cold water on these imitators, making them deeply realize that success is not easy to copy, and there are many difficulties and challenges behind the coin buying strategy.

GameStop, as a well-known game retail giant, has become famous in the capital market for its retail investors' battle against Wall Street. On May 28, 2025, it also joined the ranks of buying coins, announcing that it would purchase 4,710 bitcoins for $512.6 million, looking forward to replicating MicroStrategy's glory. However, the market's reaction was like a heavy slap in the face. After the announcement, GameStop's stock price not only did not rise, but fell by 10.9%, and investors did not buy into this decision. The reasons behind this phenomenon are worth pondering. Unlike MicroStrategy, GameStop's core business is game retail, and Bitcoin investment has a very low correlation with its main business, making it difficult to form a synergistic effect. Moreover, the market's perception of GameStop is mainly based on its retail business, and its sudden involvement in the field of cryptocurrency has made investors confused and uneasy, and has raised doubts about the company's future development direction.

Addentax Group Corp (ATXG)'s coin purchase plan is more radical and more worrying. The Chinese company, which originally focused on the textile and apparel business, announced on May 15, 2025 that it plans to purchase 8,000 bitcoins and Trump's TRUMP coin by issuing common stock. Based on the bitcoin price of $108,000 at the time, the purchase cost would be as high as more than $800 million. However, the total market value of Addentax Group's stocks is only about $4.5 million, and the theoretical coin purchase cost is more than 100 times the company's market value. This disparity is shocking, and such a large-scale coin purchase plan is undoubtedly a huge challenge for the company's financial situation. Once the price of Bitcoin falls sharply, the company's balance sheet will be hit hard and it may face a serious financial crisis. Moreover, this blind following behavior without regard to its own strength and business relevance has also made investors question the company's decision-making ability, further weakening the market's confidence in the company. Jiuzi Holdings (JZXN), a US-listed company from China, has also joined the seemingly attractive coin buying craze. The company focuses on new energy vehicle retail, and its retail stores are mainly distributed in third- and fourth-tier cities in China. In 2025, it announced plans to purchase 1,000 bitcoins in the next year, with an estimated cost of more than $100 million. At this time, Jiuzi Holdings' total stock market value on Nasdaq was only about $50 million. Similar to Yingxi Group, Jiuzi Holdings' coin buying plan is seriously out of touch with its main business of new energy vehicle retail, and the high coin buying cost has also brought huge financial pressure to the company. In addition, the new energy vehicle industry itself is facing fierce market competition and technological changes. The company's large investment in the field of cryptocurrency may affect the development of its main business and disperse the company's resources and energy.

These imitators' cases show that the coin buying strategy is not applicable to all US-listed companies, and it is not a universal wealth code. For many companies, the lack of fundamental support for buying coins is like building a high-rise on the beach, with an unstable foundation. Without a solid business foundation and profitability as support, relying solely on buying coins to increase market value is like a mirage, illusory and unreliable. Moreover, the cryptocurrency market is extremely volatile, and prices fluctuate like a roller coaster. Once the price of Bitcoin or other cryptocurrencies falls, those companies that blindly follow the trend to buy coins will face huge asset impairment risks, their balance sheets will be overwhelmed, and they may even fall into financial difficulties. Over-reliance on the coin buying strategy may also cause companies to ignore the development of their main business, lose their core competitiveness, and eventually be eliminated in the tide of the market.

Crypto payment cards: the rise of the new favorite of payment

In the booming wave of the crypto asset market, crypto payment cards are gradually emerging and becoming a hot business in the industry. From well-known centralized exchanges such as Binance, Coinbase and Bitget, to Onekey wallets in the field of crypto infrastructure, many institutions have entered this track, trying to build a bridge between crypto assets and the real economy by issuing their own brand of crypto payment cards. Even DeFi applications are not willing to lag behind and are actively planning the card issuance business. For example, the decentralized stablecoin project Hope.money launched HopeCard, and Uniswap DAO also discussed the proposal for issuing VISA cards. The rapid rise of encrypted payment cards has aroused widespread attention and in-depth thinking. What kind of business logic and development potential are behind it?

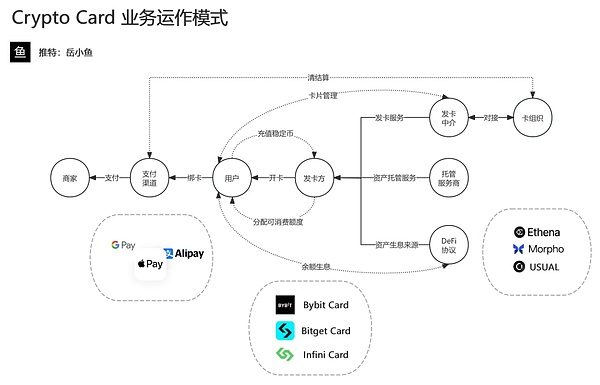

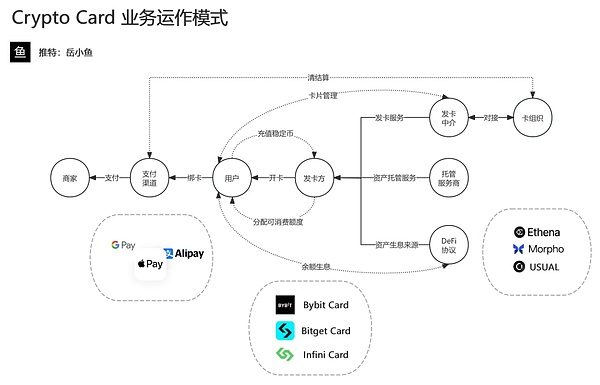

Encrypted payment cards are essentially a bridge connecting the cryptocurrency ecosystem and the traditional payment network. Its operating mode is ingenious and complex. The entire system involves multiple key participants, including users, card issuers, custodians, payment channels, merchants, and card organizations. All parties work together to build a complete payment ecosystem. If users want to use encrypted payment cards, they first need to apply to the card issuer. The card issuer uses the card issuing intermediary to establish contact with card organizations such as Visa and Mastercard to complete the issuance of the card. In this process, the custodian service provider bears an important responsibility to manage the user's cryptocurrency assets, and may invest part of the funds in other areas to obtain returns through reasonable fund operations, thus forming a closed-loop fund management system.

When users use encrypted payment cards for consumption, the entire payment process realizes the real-time conversion of cryptocurrency to legal currency, which is efficient and convenient. Specifically, when users swipe their cards at merchants, the payment request will be processed through the payment channel. The system will quickly deduct the equivalent cryptocurrency from the user's custodial account, convert it into legal currency, and finally complete the payment to the merchant. For merchants, this process is no different from traditional bank card payments and can be easily accepted; for users, it achieves the goal of directly using digital assets for daily consumption, breaking the barrier between cryptocurrency and real consumption.

Today's crypto payment card products have widely integrated mainstream payment methods, further improving the convenience of users. Whether it is mobile payment giants such as Google Pay and Apple Pay, or well-known domestic payment platforms such as Alipay, they have achieved deep integration with crypto payment cards. In the market, many highly-watched crypto payment card products have emerged, such as Crypto.com Visa Card, Binance Card, Bybit Card, Bitget Card, etc. Most of these products are launched by large cryptocurrency exchanges. With the brand influence and user base of the exchanges, they have quickly gained market recognition. On the technical level, some card issuers are actively innovating, integrating DeFi protocols such as Ethena, Morpho, and USUAL, providing users with asset value-added services, organically combining payment and financial management, and building a complete financial service ecosystem from payment to financial management, meeting the diverse financial needs of users.

From the perspective of market size, crypto payment cards have shown great development potential. According to data from The Brainy Insights report, the global crypto credit card market value reached US$25 billion in 2023, and it is expected that by 2033, this figure will soar to more than US$400 billion. Such a rapid growth trend has attracted the attention of many institutions, making the crypto payment card business a battlefield for fierce growth. Although the profit share brought by the payment card itself may be relatively limited for a single protocol, from a strategic perspective, it has extremely high value in terms of user acquisition, ecological construction and capital precipitation. Exchanges hope to attract more users and enhance user stickiness by issuing crypto payment cards, and further expand their business territory; asset management companies regard it as an important entry point for fund management, and realize the effective operation and value-added of funds through crypto payment cards; Web3 project parties also hope to use crypto payment cards to deepen their relationship with users and promote the development and growth of projects. Therefore, despite the meager profits, major institutions are still investing resources and actively deploying encrypted payment card business to seize the initiative in this market full of potential.

The logic behind the emergence of encrypted payment cards

The emergence of encrypted payment cards is like mushrooms after rain, and there are multi-dimensional driving factors behind them. These factors are intertwined and jointly shape the prosperity of this emerging market.

From the demand side, withdrawal security and new payment scenarios have become the two key factors driving the surge in demand for encrypted payment cards. In cryptocurrency trading, withdrawal has always been a headache. Taking the C2C withdrawal model as an example, due to the openness and anonymity of its transactions, it is easy for criminals to use it for money laundering and the development of black and gray industries. When users make withdrawals, they often encounter the situation of being "shot" and having their cards frozen, which brings them great trouble and financial risks. According to relevant reports, many users share their withdrawal experiences online, and there are many cases where funds are frozen due to withdrawal problems, and even face legal risks. The emergence of encrypted payment cards provides an effective solution to this problem. Users only need to bind encrypted payment cards to commonly used payment methods, and they can directly use cryptocurrencies for daily consumption, without having to worry about security issues during the withdrawal process, and realize the safe circulation of funds.

The rise of subscription services such as ChatGPT has also opened up new market space for encrypted payment cards. For technology enthusiasts, experiencing the powerful functions of advanced technologies such as GPT-4 is a pursuit, but OpenAI does not accept mainstream domestic credit and debit card payment methods, which undoubtedly sets an obstacle for them. The card numbers of encrypted payment cards mostly start with 4 or 5 and belong to American card organizations such as VISA, MasterCard or American Express, which can perfectly meet OpenAI's requirements for card types and successfully resolve the embarrassment of geographical restrictions. Users can easily convert cryptocurrencies into US dollars to complete the subscription recharge for GPT-4 Plus membership. Encrypted payment cards also support overseas shopping on foreign e-commerce platforms such as Amazon, eBay, Shopee, etc., as well as subscriptions to other software such as Midjourney and Netflix. With the end of the epidemic, cross-border consumption scenarios have gradually increased. Crypto payment cards have become an ideal choice for users with cross-border consumption needs due to their convenience.

In terms of regulatory arbitrage, encrypted payment cards have also shown unique advantages. From the perspective of geographical distribution, payment settlement providers are mostly concentrated in Europe. This is mainly because the adoption rate of cryptocurrencies in European countries is high, averaging more than 10%, especially among young people and areas with active financial technology. Cryptocurrency acceptance is higher. Consumers' preference for flexible payment methods and the continuous expansion of the stablecoin ecosystem have made crypto payment cards an important bridge connecting traditional finance and the Web3 world. In some countries, banks have high systemic risks. Using crypto payment cards can help people avoid these risks and achieve more flexible financial services. At the tax level, the process of crypto payment cards directly cashing out crypto assets through channels avoids tax collection in some transactions to a certain extent, which has also attracted some users to choose to use crypto payment cards. However, this model of regulatory arbitrage is not a long-term solution. As countries and regions such as Europe and the United States accelerate the promotion and implementation of crypto market-related bills, such as the EU's MiCA requiring relevant business companies to apply for compliance licenses in EU member states and restrict the scope of services, the regulatory environment for crypto payment cards will become increasingly stringent, and the operating space in this gray area will gradually shrink.

Innovation in business models is also an important reason for the emergence of crypto payment cards. On the settlement side, crypto payment cards present a diversified form of operation, among which the most common is the credit card/prepaid card form of stablecoin-consumption limit. When using, users need to recharge stablecoins into their accounts first, and the consumption limit in the card will increase accordingly, and then they can use the limit to make various types of consumption. In this process, the card issuer obtains income through exchange rate differences, handling fees, etc. For example, in the process of converting cryptocurrencies and legal currencies, the card issuer generally charges a handling fee of 0.5%-1%, and the recharge fees generated during the user's recharge process have also become one of the important sources of income for the payment card business. On the chain, some payment cards actively integrate with the DeFi protocol to introduce idle funds in user cards into the income generation mechanism. Taking the integration of Infini and DeFi protocols such as Morpho as an example, it can automatically deploy the user's unspent stablecoin balance to the income agreement, allowing users to obtain on-chain income while consuming. This innovative model not only opens up a new profit channel for card issuers, enabling them to obtain dual benefits from traditional payment channels and DeFi interest, but also provides users with asset value-added services that traditional bank cards cannot match, meets users' diverse financial needs, and further promotes the development of encrypted payment cards.

Future Outlook: Opportunities and Risks Coexist

Looking to the future, encrypted payment cards are expected to gradually evolve from a simple payment tool to a comprehensive ecological entrance. This transformation contains huge development potential, but it is also accompanied by many risks and challenges.

On the positive side, as blockchain technology continues to mature and the cryptocurrency market continues to develop, crypto payment cards will play a key role in promoting the large-scale application of blockchain technology. It can directly integrate on-chain assets into real-world consumption scenarios, greatly shortening the path for users to enter the Web3 world. For users in the traditional financial world, if they want to participate in the crypto market in the past, they need to go through cumbersome processes, but the emergence of crypto payment cards allows them to easily use crypto assets and achieve a rapid connection between the off-chain and on-chain.

Exchanges and DeFi platforms have also keenly captured the value of crypto payment cards and actively promoted their popularization. By organically combining crypto payment cards with business operations, these platforms can innovate and extend protocol functions and create more profit points. For example, payment card users may receive platform points or token rewards when spending, which can be further used for on-chain investment, DeFi mining or other ecological services, thus forming a benign positive feedback loop between users and platforms. This innovative model can not only attract more new users to enter the market, but also enhance users' stickiness and loyalty to the platform. When new users come into contact with Web3, they can first use encrypted payment cards to consume, gradually become familiar with the use and advantages of cryptocurrencies, and then gradually deepen into the on-chain ecology. This "consumption-driven" user guidance method is expected to become the mainstream strategy for Web3 to attract traffic. With the continuous increase in the number of users and the increasing richness of usage scenarios, encrypted payment cards will become an important bridge connecting traditional finance and the Web3 world, promoting the development and growth of the entire industry.

However, the development of crypto payment cards is not smooth sailing, and it faces many severe challenges. Compliance is the primary problem facing crypto payment cards. Due to the particularity of the cryptocurrency market, regulators are more cautious about it, and relevant laws and regulations are not yet perfect. Different countries and regions have different regulatory policies on crypto payment cards, which makes card issuers face a complex compliance environment when conducting business globally. Once regulatory regulations are violated, card issuers may face serious consequences such as huge fines, business restrictions or even closure.

The fierce market competition has also brought pressure to the development of crypto payment cards. As more and more institutions flock to the crypto payment card market, competition is becoming increasingly fierce. Major card issuers must not only innovate and optimize product functions and user experience, but also compete fiercely in terms of price and service. In this case, some weaker card issuers may be eliminated in the competition, and the market structure will face a reshuffle.

Technical risks should not be ignored either. Although blockchain technology has many advantages, it still has performance bottlenecks and security risks. For example, slow transaction processing speed and network congestion may affect the user's payment experience; while security incidents such as hacker attacks and data leaks may cause damage to user assets and seriously damage the reputation and user trust of encrypted payment cards. Therefore, card issuers need to continuously increase investment in technology research and development and improve the security and stability of the system to cope with various technical risks.

Conclusion: A rational view of financial innovation

The emergence of the coin buying strategy of US-listed companies and crypto payment cards are undoubtedly two hot phenomena in the current financial field. They have brought new vitality and opportunities to the market, but they are also accompanied by risks that cannot be ignored. Although the coin buying strategy has brought market value increases to some companies, it is not suitable for all companies. The coin buying behavior without fundamental support is like a castle in the air and may collapse at any time due to market fluctuations.

As a bridge connecting the crypto world and traditional finance, crypto payment cards have shown great development potential, but challenges such as compliance issues, market competition and technical risks are also omnipresent. In this era of change, investors and market participants need to remain rational and calm, have a deep understanding of the logic and risks behind these emerging trends, and make prudent decisions. Only in this way can we seize opportunities, avoid risks and achieve steady development in the wave of financial innovation.

Weatherly

Weatherly