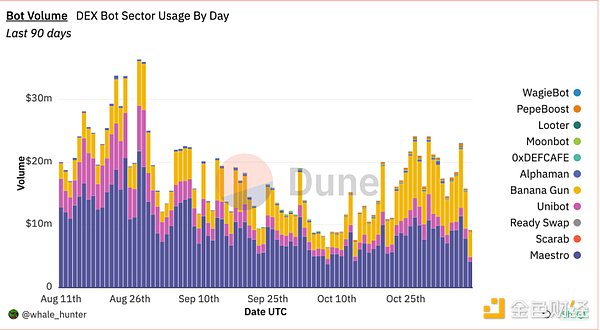

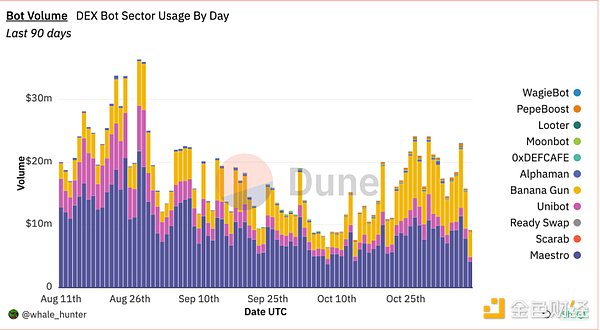

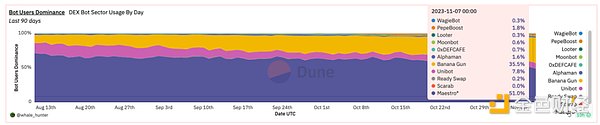

Some data show a roller coaster trend, but Banan Gun’s total trading volume still ranks second in the Bot track

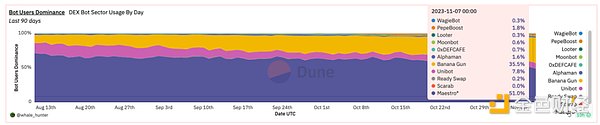

In the fierce competition on the BOT track, Banana Gun's performance is particularly eye-catching, especially its significant growth in key data indicators. This track shows significant fluctuations in overall data, especially in terms of transaction volume, number of transactions (number of Tx) and number of users.

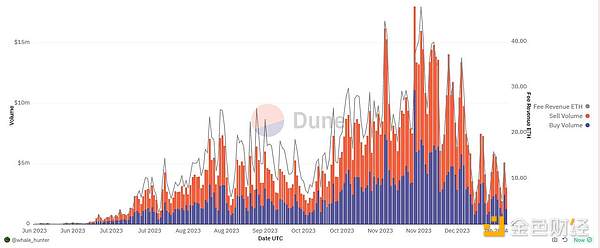

Specifically, Banana Gun’s trading volume has dropped from nearly 30 million US dollars per day at its peak. About 10 million, the number of Tx has also dropped from the daily highest of 80,000 to 40,000. However, the decline in the number of users is relatively small, with the average daily number still remaining at around 10,000, which provides opportunities for emerging forces such as Banana Gun to break through.

The following is an introduction to the Banana Gun project and the reasons why its data performance is on a roller coaster.

The preferred token sniping tool for users on the Ethereum chain, Banana Gun has two core functions: fast and safe

Banana Gun is a telegram robot whose main function is to help users quickly snap up tokens in the cryptocurrency market, and is particularly good at opening sniper operations. This feature makes Banana Gun attract much attention among users on the Ethereum platform, making it one of their preferred sniper tools.

Similar to its competitor Unibot, the emergence of Banana Gun marks the popularization of sniper operations in the crypto trading field. Traditionally, sniping has been the exclusive domain of the technically proficient, requiring a deep understanding of smart contracts and the ability to configure them. But Banana Gun has simplified this process through the automation features of its platform, making it easy for ordinary users to participate. Users only need to provide the contract address, and Banana Gun can automatically handle the rest of the operations, such as identifying method IDs, calculating tax rates, and setting the maximum transaction volume, etc., which lowers the user's technical threshold.

Banana Gun's unique value lies in its concentration on automation and emphasis on rug pull (fraud) defense. It provides users with an extra layer of security by privately executing user-set Ethereum transactions. This private transaction mechanism not only reduces costs in high gas fee environments, but also protects users from sandwich attacks – strategies that exploit the order of transactions by placing transactions before and after user transactions. Banana Gun can even reverse a transaction if it detects it may have been clipped, a nuanced feature its competitors such as Maestro lack.

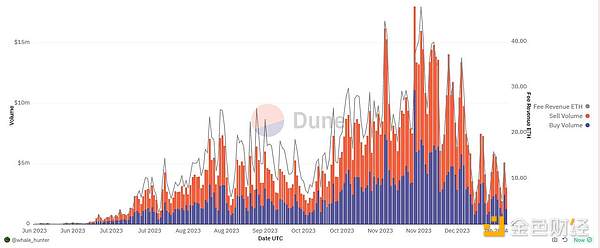

In this field, transaction speed is extremely important. Since its launch, Banana Gun has become one of the fastest retail shopping robots on the market. Since its launch in early June 2023, it has quickly attracted approximately 700 daily active users and has a cumulative user base of more than 12,000.

In terms of user interface, Banana Gun adopts a unique design. Once the user completes the purchase, the interface automatically switches to the selling channel. This design allows the user to focus more on the sales strategy. This is different from the design of other snap-up bots, which often handle buying and selling operations on the same interface, which can lead to user confusion.

These innovative features of Banana Gun, including its simplified operating procedures, enhanced safety performance and efficient interface design, make it a popular choice among BOT It stands out on the track and becomes an important tool in the crypto trading world. Nonetheless, its future development and continued competitiveness in the market still require observation of market response and long-term user acceptance. As the crypto market continues to grow and user needs diversify, the role and importance of Banana Gun and other similar tools will continue to evolve.

With the blessing of key performance, Banana Gun’s data performance continues to rise, with a significant increase

In the TG Trading Bot track, Banana Gun’s rapid rise is particularly notable. From the data point of view, Banana Gun not only achieved stable growth in transaction volume and number of transactions, but also achieved significant breakthroughs in the number of users. In early September, Banana Gun successfully surpassed Unibot and climbed to the second position in the market with about 35% of users. As the once market leader, Unibot's data and number of users continued to decline after the currency price reached an all-time high (ATH), with the number of users even falling below 10%.

The reason why Banana Gun can stand out in such a market environment is due to its series of innovative strategies and advantageous functions. Banana Gun initially attracted a large number of new users through airdrop campaigns and subsequently successfully consolidated this user base through its unique MEV Bribe Snipe feature and relatively low 0.4% service fee. More importantly, Banana Gun continues to make progress in product innovation. The recently launched limit order with Bribe function has won widespread praise from the market and brought significant profits to users. In terms of MEV Bribe’s ability to snipe new coins, Banana Gun is already clearly ahead of other competitors on the market. According to data, in the past ten days, the total amount of bribes paid by Banana Gun users to MEV Builder has exceeded 1700E, far exceeding Maestro’s 65E, while Unibot has not yet shown the same competitiveness in this field.

In addition, BananaGun officially announced recently that the total transaction volume of its agreement has reached an astonishing US$388 million, making it a leading player on the BOT track. Solid second place. At the same time, the single-day trading volume on its token chain also hit a new high, reaching 8.65 million US dollars, and brought 28 ETH in handling fee income. In order to further enhance user participation, BananaGun also plans to increase the reward to 15%, thereby providing users with higher fee rebates.

In general, the key to Banana Gun’s rapid rise on the BOT track lies in its rapid response to market dynamics and continuous product innovation, as well as significant improvements in key data indicators.

Detailed explanation of $Banana's token economic model: the proportion of tokens available for circulation in pre-sales and liquidity pools is 25% h3>

The economic strategy and market behavior of the $Banana token are built around its unlocking plan, liquidity and tax policy. This strategic layout aims to balance token supply with market demand while providing incentives for holders and users.

According to published information, the liquidity and unlocking plan of $Banana tokens are as follows:

1. Founding Token: 20% of the supply, i.e. 2,000,000 tokens, can be circulated immediately without a lock-up period.

2. Advisory airdrop: 5% of the supply, or 500,000 tokens, will be locked for 2 years.

3. Airdrop: 1.2% of the supply, or 120,000 tokens, part of which is reserved for NFT and social tasks.

4. Team token: 10% of the supply, i.e. 1,000,000 tokens, will be unlocked and released in two phases.

5. Group library: accounting for 63.8% of the largest proportion, that is, 6,380,000 tokens, which will be gradually unlocked to the community based on contributions.

The total supply is 10,000,000 tokens, of which 25% are available for circulation in the pre-sale and liquidity pool. Designed to provide sufficient liquidity to the market and reduce price volatility.

The tax mechanism is designed as follows. Each transaction will charge a 4% tax, of which:

1. Token holders: Receive 2% distribution from taxes to reward long-term holding.

2. Team: Receive 1% tax allocation to support the continued operation of the project.

3. Treasury: It also receives a 1% allocation to provide liquidity and ensure market stability.

The project plans to use 500,000 $Banana tokens and $325,000 to provide initial liquidity, establishing the starting market value of $Banana as $1.63M , designed to be consistent with pre-sale prices.

The $Banana token economic model also includes holder revenue sharing and user rewards. The purpose of these measures is to increase user participation and Reward long-term investment:

1. Holder income sharing: a part of the income and taxes from robot trading, this part of the income is only allocated to Users holding unlocked tokens. Although the team's tokens account for a larger proportion, they are not included in the revenue sharing due to lock-in.

2. User rewards: The project encourages users to use the Banana Gun robot for transactions through a reward mechanism. This includes partial rebates on transaction fees, implemented in the form of $Banana tokens, and incentives for users to keep holding through a token revenue sharing program.

$Banana token model aims to promote the growth and stability of token value through various mechanisms:

1. Buy-back mechanism: Use treasury taxes to buy back tokens, aiming to offset the impact of inflation.

2. Adjustment coefficient: It provides the project party with a tool to adjust the issuance volume to respond to market changes.

3. Ape-to-earn strategy: Increase transaction volume and promote economic activity by motivating users to use robot trading.

4. High proportion of income sharing: encourage investors to hold tokens for a long time and reduce market selling pressure.

These strategies and measures of the $Banana token economy are intended to create an ecosystem that rewards participants and protects investors. In this way, $Banana aims to build a healthy token economy that promotes a positive cycle while maintaining a balance between token supply and demand. This balance is achieved through incentives, regulatory tools and market strategies, the final effect of which will depend on the response of market participants and the effectiveness of project execution.

Risks and opportunities coexist: users and investors need to rationally view various situations during the operation of Banana Gun

The market valuation of the Banana Gun project before launch showed investors’ initial confidence, with analysis of pre-sale data revealing an estimate of approximately US$6.48 million. value. This figure is based on the pre-sale amount of 800E and the market price of $1,621 per Ethereum. Taking into account this 20% pre-sale ratio, we come to a more optimistic preliminary market assessment.

However, the market reaction after the token was launched brought a leap in valuation, and the token price soared to $8.493, bringing the fully diluted market value (FDV) to nearly $84.9 million, which is approximately 13 times the project’s initial valuation. This significant growth may indicate that the market has great expectations for the functionality and future potential of the Banana Gun, or it may reflect confidence in the project team and roadmap.

Analysis of potential risks shows that the growth in market valuation is accompanied by a series of considerations. The use of private keys in the project's operating mode presents a significant security challenge, which may become a weak link in the security of user assets. In addition, large pre-sales of tokens may create market selling pressure in the future, affecting the price stability and continued growth of the tokens. Investors need to have a deep understanding of these factors when considering investing.

Furthermore, technical problems in the early stages of the project also highlighted possible shortcomings of the development team in responding to market demands and technical challenges. Investors need to have a comprehensive assessment of the team's technical capabilities, the project's implementation plan, and future maintenance support.

In summary, Banana Gun’s valuation and market performance provide investors with a dynamic perspective, demonstrating its market performance growth potential and acceptance. However, any high-growth market valuation is accompanied by corresponding investment risks, including concerns about project safety, management of market liquidity, and uncertainty about the team's execution ability. While investors enthusiastically pursue potential high returns, they must remain sensitive and alert to these risk factors and make balanced investment decisions to ensure long-term capital appreciation.

Anais

Anais