Author: Matt Weller CFA, CMT; Compiler: Vernacular Blockchain

1. BTC/USD and ETH/USD Key Points

Kamala Harris' economic agenda is seen as potentially inflationary, a trend that could benefit crypto assets at the expense of the dollar if she is elected.

Last week's data highlighted the shift in market focus from inflation to the labor market and consumer health. BTC/USD is still fluctuating within its recent range, but after breaking below key support levels, the technical outlook for ETH/USD remains bleak.

2. Cryptocurrency Market News

The application for Bitcoin spot ETF options has finally gained attention again. Many expect ETF options to be available before November. The Swiss National Bank disclosed that it holds 466,000 shares of MicroStrategy. Goldman Sachs also disclosed holdings of $418 million worth of Bitcoin ETFs. The U.S. government moved 10,000 "Silk Road" bitcoins worth $590 million from one wallet to another, which could be a precursor to another round of long-term unmoved supply sell-off.

While this is not strictly crypto news, U.S. Democratic presidential candidate Kamala Harris unveiled her economic agenda last week. Many of her priorities are considered "populist", including eliminating medical debt for millions of Americans, banning food price gouging, limiting prescription drug prices, providing a $25,000 subsidy for first-time homebuyers, and expanding child tax credits. Many observers believe that these priorities could spark inflation, a development that could benefit crypto assets and hurt the dollar if Harris is elected.

3. Macroeconomic Background

Last week's economic data highlighted a key narrative shift that readers should have been "ahead of" if they have been reading these articles regularly. On the surface, the most influential economic release was Wednesday’s U.S. Consumer Price Index (CPI) report, which provided an early update on how price pressures in the world’s largest economy were changing in July. The report, which came in roughly in line with expectations at around 2.9% year-over-year (3.2% core), was met with a relatively muted reaction from markets as traders have moved away from viewing inflation as the biggest risk to the economy and Fed policy.

Instead, markets are now more focused on the labor market and consumer health. As a result, Thursday’s better-than-expected retail sales report (and the simultaneous release of strong earnings from retail giant Walmart) eased fears of an impending economic slowdown and drastically reduced the number of rate cuts the Fed is expected to deliver this year to less than 100 basis points (or 1%). All else being equal, these developments should have been supportive for risk assets like Bitcoin and Ethereum, but prices clearly disappointed the bulls last week (more on that below).

4. Sentiment and Fund Flows

Our closely watched sentiment indicator, the Crypto Fear and Greed Index, fell to 27 last week. Overall, it is close to the 1-year low set earlier this month, and if there are any positive developments in the coming weeks, it may form a contrarian bullish signal:

Source: Alternative.me

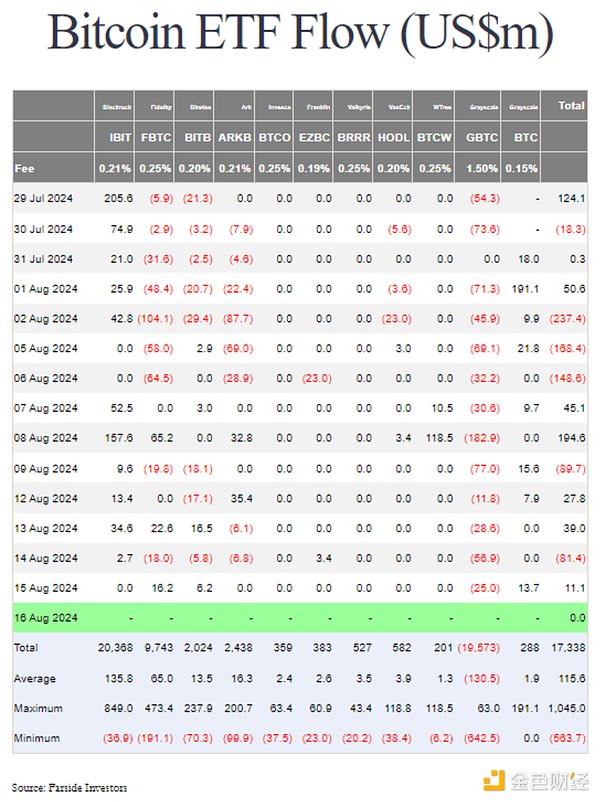

Another way to measure sentiment is to focus on the flow of funds into crypto asset investment vehicles on trading platforms, which remained tepid last week. At the time of writing, with some time until Friday’s data is released, Bitcoin exchange-traded funds (ETFs) have seen slight outflows over the past four days, amounting to -$3.5 million. Inflows from “traditional finance” investors provide gradual demand for Bitcoin and help support prices over the long term.

Source: Farside Investors

Meanwhile, outflows from Ethereum exchange-traded funds, particularly the high-fee legacy Grayscale product (ETHE), are beginning to slow slightly. These outflows have reached nearly 30% of the fund's total in just 3 weeks and are likely to continue in the coming weeks until a more appropriate asset level is reached based on its fee structure.

5. Bitcoin Technical Analysis: BTC/USD Daily Chart

Source: StoneX,TradingView

Despite the impressive recovery of other risk assets such as US stock indices and gold, Bitcoin struggled to get off the ground last week. BTC/USD also saw a “death cross” with the 50-day exponential moving average (EMA) falling below the 200-day simple moving average (MA), suggesting a possible bearish shift in the long-term trend.

These cryptocurrencies have been consolidating in a wide range since March. Currently, they look neutral in the short term, but in the long term, upside is possible ahead. However, a possible drop below 53K could cast doubt on this bullish view.

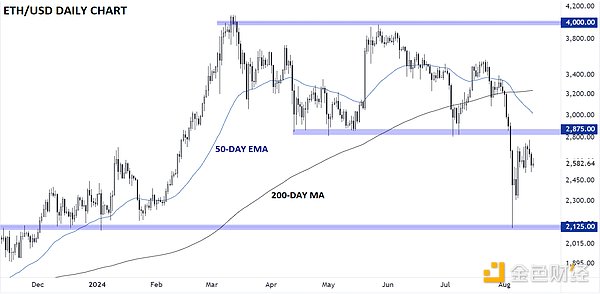

6. Ethereum Technical Analysis: ETH/USD Daily Chart

Source: StoneX, TradingView

Like Bitcoin, Ethereum was relatively weak last week. ETH/USD also saw its own "death cross", with prices below the previous second quarter range, and the technical outlook for the second largest crypto asset is clearly less bullish. ETH/USD is trading well below its 200-day moving average and previous support-turned-resistance at $2,875, currently maintaining a short-term downside bias.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Joy

Joy Jixu

Jixu Joy

Joy Hui Xin

Hui Xin Clement

Clement Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph