Morpho, which has just completed a $50 million financing, is an innovative DeFi lending protocol.

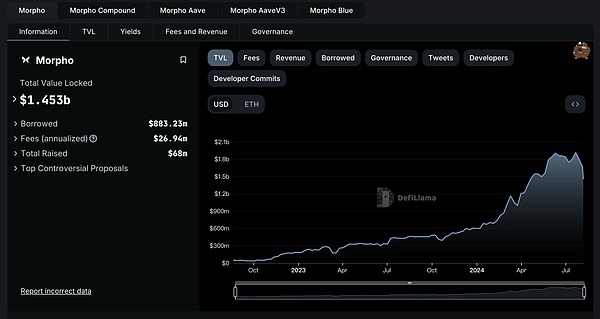

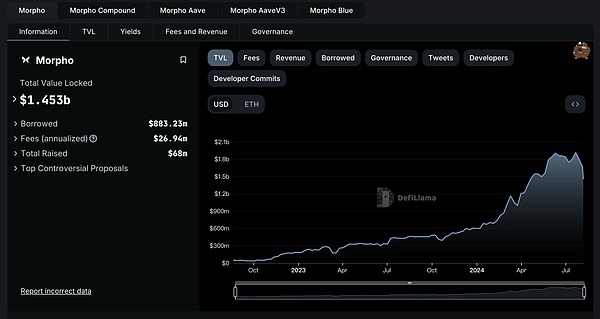

According to DeFiLlama data, Morpho's total locked volume (TVL) has reached $1.4 billion, the borrowed volume (Borrowed) is also more than $880 million, and the total financing has reached $68 million.

So, what kind of project is Morpho, which can make such achievements in the DeFi field, let the chain teahouse take you to find out.

To explain Morpho clearly, you must first understand the entire DeFi lending track.

Morpho's high financing this time is enough to prove that the decentralized lending market has become an important part of the DeFi field. The capital capacity of decentralized lending has always been among the best. At present, TVL (total locked volume) has surpassed DEX (decentralized exchange) to become the track with the largest capital capacity in the DeFi field.

In terms of its business model, the decentralized lending market has achieved PMF (product market fit), that is, it has found a sustainable business model in a decentralized environment. Although the early market relied on high token incentives, the market is now gradually moving towards a healthier model, relying on organic demand rather than subsidies to maintain operations.

But in general, the market concentration of the lending track is high, and the head protocols occupy most of the market share. Major players such as Aave and Compound have formed a clear moat by relying on their strong brand power and long-term security records.

In addition, lending protocols need to find a balance between liquidity and security. Although the peer-to-pool model provides high liquidity, it has low capital efficiency; while the peer-to-peer model has high capital efficiency but insufficient liquidity.

Morpho provides a new solution by combining the two models:

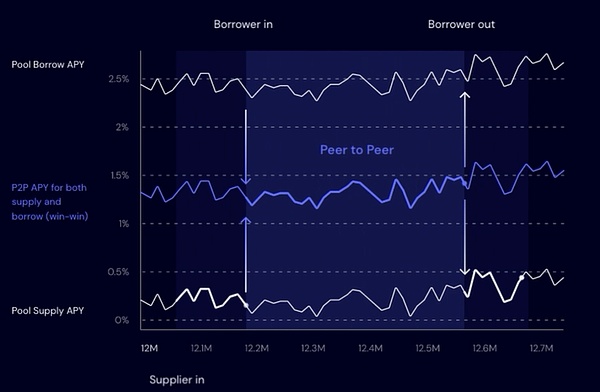

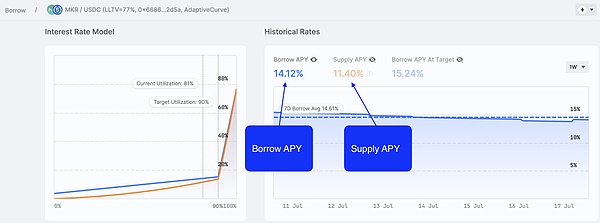

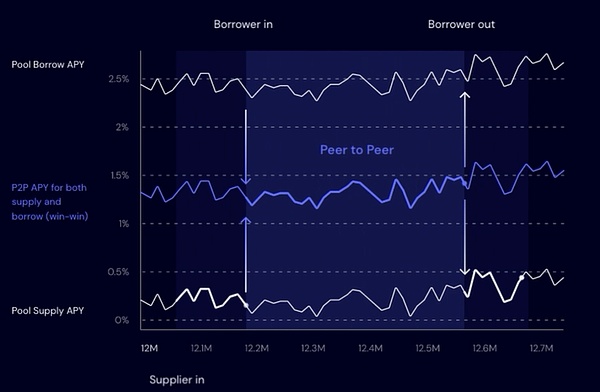

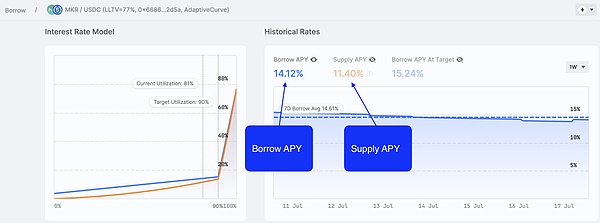

As a peer-to-peer (P2P) layer built on lending pools such as Compound and Aave, Morpho introduces its unique interest rate mechanism: combining P2P and peer-to-pool (P2Pool) matching, users can borrow at a better interest rate, solving the problem of high borrowing interest rates and low supply interest rates caused by low utilization of lending pools, and improving capital efficiency. At the same time, Morpho also maintains the same liquidity and liquidation guarantees as the underlying protocol, and users can obtain the annual yield (APY) of the underlying pool or better P2P APY.

In short, traditional lending pool protocols (such as Compound and Aave) have the problem of high borrowing interest rates and low deposit interest rates caused by low utilization of the capital pool. Morpho achieves capital efficiency by directly matching borrowers and lenders, offering higher deposit yields and lower borrowing costs.

For example, Xiao Ming applies to borrow 1 ETH provided by Xiao Hong to Morpho, and they obtain an improved interest rate through P2P matching. The entire process is automatically handled by Morpho, and users do not need to make additional transactions.

Morpho's matching engine ensures 100% utilization, maximizes economic efficiency and minimizes Gas costs by sorting users and matching borrowers and lenders.

More specifically, when suppliers and borrowers are matched peer-to-peer, Morpho's optimizer is free to choose the P2P interest rate, but must choose within the spread of the underlying protocol (between Lending APY and Borrowing APY) to ensure that it is beneficial to both parties.

For example, when Xiaohong becomes the first supplier of the Morpho optimizer, her funds will be deposited into the base liquidity pool. When Xiaoming enters as a borrower, the Morpho optimizer will automatically take Xiaohong's funds out of the pool and match them directly to Xiaoming, so that both parties can get a better interest rate.

Therefore, whether the user uses Morpho directly or deposits the cToken obtained after depositing assets into compound into Morpho, they can get the lender APY normally. Similarly, when matching with a borrower, both will get the improved P2P APY, which is higher than the lender APY and lower than the borrower APY, which is a better incentive for both parties.

In terms of the matching mechanism, the Morpho optimizer uses a priority queue data structure to match users based on the amount they want to borrow or lend. New suppliers' liquidity is matched with the largest borrower first, and so on, until all the supplied liquidity is matched or there are no more borrowers. Similarly, new borrowers' needs are matched with the largest supplier first, and so on, until all borrowing needs are met or there are no more suppliers.

If the match fails, Morpho uses the underlying protocol's liquidity pool as a fallback mechanism to ensure that both supplier and borrower needs are met. Morpho DAO selects a P2P interest rate between the base protocol's Lending APY and Borrowing APY through the p2pIndexCursor parameter.

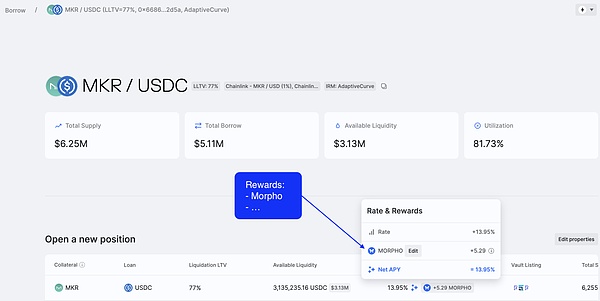

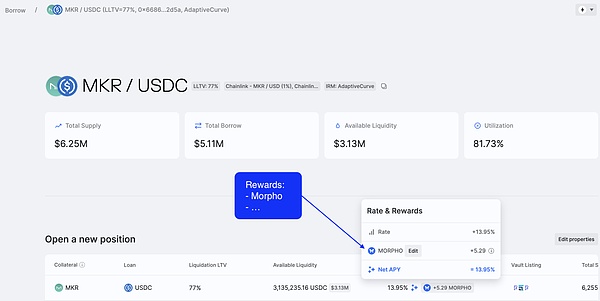

The Morpho optimizer protocol automatically accumulates rewards distributed by the base protocol on behalf of users, which means that users can claim rewards just like using the base protocol directly. In addition, the Morpho optimizer distributes its own Morpho rewards to its users to further incentivize users.

In addition, Morpho seamlessly integrates with existing DeFi lending protocols such as Compound and Aave, maintaining the same liquidity and security features. This essentially means that Morpho's business is to use Aave and Compound as capital buffers to provide interest rate optimization services to depositors and borrowers through matching. Users do not need to worry about liquidity issues and can borrow and lend at any time.

Morpho Evolution: Morpho Blue

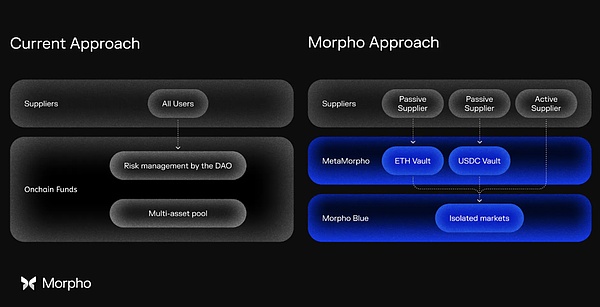

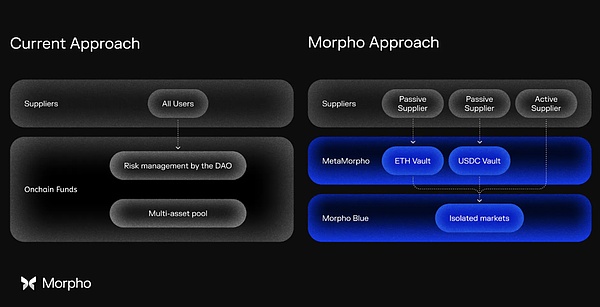

Previously, Morpho's initial version, Morpho Optimizer, ran on Compound and Aave to improve the efficiency of its interest rate model. However, as a result, the growth of Morpho Optimizer was limited by the current underlying lending pool design, which relied heavily on its DAO and trusted contractors to monitor and update hundreds of risk parameters or upgrade large smart contracts every day.

After the transformation, Morpho launched Morpho Blue.

Morpho Blue is a non-custodial lending protocol implemented for the Ethereum Virtual Machine (EVM). It provides a new trustless primitive that is more efficient and flexible than existing lending platforms.

It enables the deployment of minimal and isolated lending markets by specifying one loan asset, one collateral asset, one liquidation loan-to-value ratio (LLTV), and one oracle. The protocol is trustless and is designed to be more efficient and flexible than any other decentralized lending platform.

Morpho Blue's lending markets are independent. Unlike multi-asset pools, the liquidation parameters of each market can be set without considering the riskiest asset in the basket. Therefore, suppliers can lend at a higher LLTV while taking on the same market risk as when supplying to a multi-asset pool with a lower LLTV.

In addition, collateral assets are not lent to borrowers. This alleviates the liquidity requirements needed for liquidations to function properly in current lending platforms and enables Morpho Blue to provide higher capital utilization. In addition, Morpho Blue is fully autonomous, so there is no need to introduce fees to pay for platform maintenance, risk managers, or code security experts.

It is worth noting that Morpho Blue has permissionless asset listing capabilities. Markets with any collateral and loan assets and any risk parameterization can be created. The protocol also supports permissioned markets, enabling a wider range of use cases, including RWA and institutional markets.

Its permissionless risk management also shapes Morpho Blue into a simple basic building block, allowing more logical layers to be added on top of it. These layers can enhance the core functionality by handling risk management and compliance, or simplify the user experience for passive lenders. For example, risk experts can set up non-custodial curated vaults to allow lenders to passively earn returns. These vaults rebuild the current multi-collateral lending pools, but built on a trustless and efficient protocol.

MetaMorpho is an open source (GPL) protocol for Morpho Blue that enables any lending experience with optimized rates and transparent risk management to be built on top of Morpho Blue. MetaMorpho vaults accept passive capital and deposit it into Morpho Blue markets. Liquidity is rebalanced across markets to manage risk and optimize returns.

MetaMorpho simplifies the lending process by allowing users to delegate risk management to risk experts who manage the vault, just like they do on Aave or Compound.

Each MetaMorpho vault can meet the needs of users with different risk profiles by depositing funds into markets with different collateral assets and different parameters.

In other words, MetaMorpho enables any lending experience to be created on top of a trustless and efficient primitive, Morpho Blue, such as Aave, Compound, Spark, Flux, and all their forks.

MORPHO Token

The Morpho Token (MORPHO) is the governance token of the Morpho protocol. The Morpho DAO, which is composed of holders and proxies holding MORPHO tokens, is responsible for governing the Morpho protocol. The governance system uses a weighted voting system, where the number of MORPHO tokens held determines the weight of the vote.

Holders can vote on changes to the protocol, including deployment and ownership of smart contracts, enabling or disabling the Morpho optimizer and Morpho Blue’s fee switch, front-end hosting decentralization, and governance of the DAO treasury.

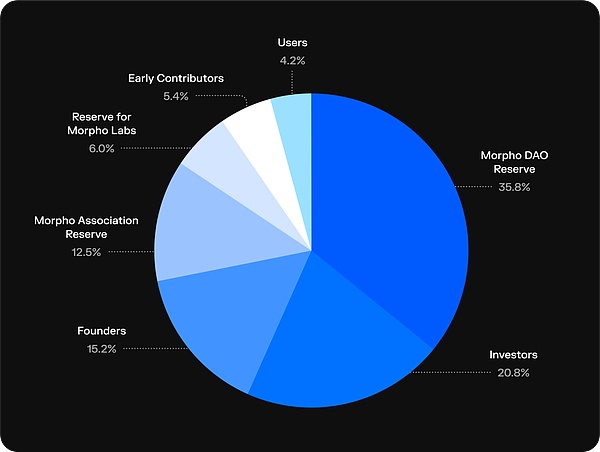

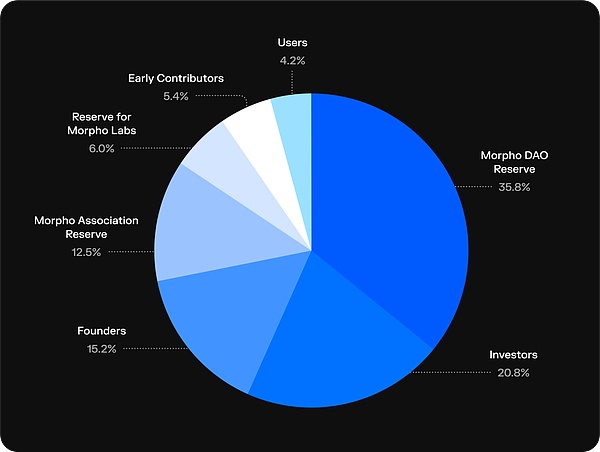

As of June 2024, MORPHO is distributed as follows:

Users: 4.2%

Early Contributors: 5.4%

Morpho Labs Reserve: 6.0%

Morpho Association Reserve: Morpho DAO Reserve: 35.8% As a non-circulating token, although Morpho tokens have been issued and used in voting decisions and project incentives, they are in a non-transferable state. Therefore, there is no secondary market price. Users and investors who receive tokens can participate in voting governance, but they cannot sell them.

While most DeFi projects achieve token liquidity within a few weeks, Morph DAO believes that it may take several years to achieve a long-term and sustainable ecosystem. Therefore, user allocations will be made not only during the Morpho optimizer, but also in future protocols.

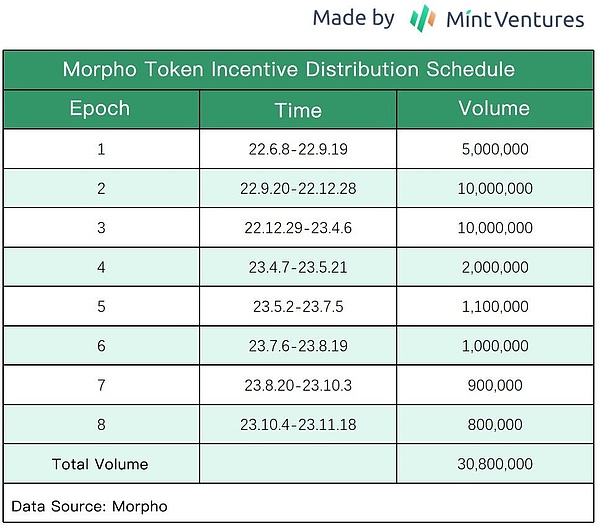

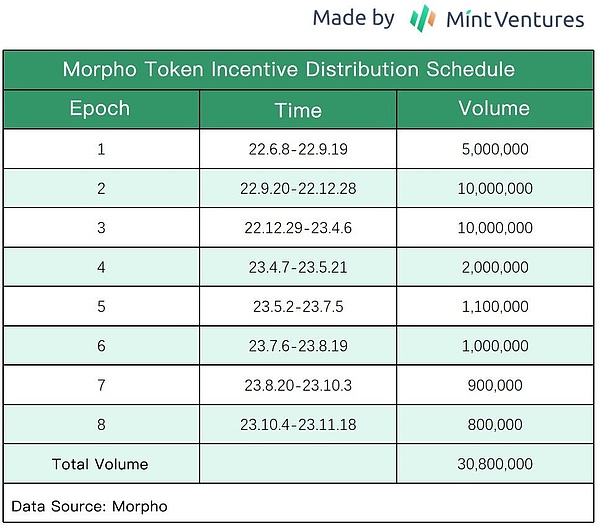

Morpho's token incentives are determined in batches, quarterly or monthly, which allows the governance team to flexibly adjust the intensity and specific strategies of incentives according to market changes.

Although there is no market price for tokens in the early stage, users holding tokens can still participate in the governance decisions of the protocol. This sense of participation and governance rights themselves have intrinsic value, which can motivate users to hold and use tokens.

In addition, users holding tokens can enjoy unique features and privileges within the protocol. For example, token holders can get higher lending rates, lower fees, or priority participation in new feature testing. These privileges and features increase the actual use value of tokens and bring real benefits to users even in the absence of market prices.

Future Outlook

Many people have asked before, will Morpho be a potential rival to Aave, and will it become one of the three giants of DeFi lending?

The raising of these questions is enough to prove the potential of Morpho.

The launch of Morpho Blue is a possible threat to Aave: Although Aave has a strong market share and user base, Morpho has the potential to attract more users to its platform through its flexible and efficient solutions. On the other hand, Aave also has the ability to build interest rate optimization functions similar to Morpho to meet user needs and maintain its market position.

Moreover, Morpho has shown strong business growth momentum in the lending market, especially after the launch of Morpho Blue.

Morpho Blue opens the lending market, allowing anyone to create a lending market based on the protocol, choosing collateral, lending assets, oracles, loan-to-value ratios (LTV) and liquidation ratios (LLTV), etc. This flexibility and efficiency provides users with a richer market choice, in line with the free market principles of decentralized finance (DeFi).

In addition, Morpho has accumulated $1.4 billion in funds under management. Although it is not close to Aave's $7 billion level, these funds are currently concentrated in the interest rate optimizer function, but there are many ways to import them into new functions.

Morpho token budget is sufficient and flexible, and it can attract users through subsidies in the early stage. Morpho's stable operation history and capital volume have enabled it to accumulate certain security and brand, increasing user trust.

In short, as an innovative DeFi lending protocol, Morpho has sufficient market potential and technical advantages. However, to stand out in the fierce DeFi market, Morpho needs to continue to innovate, while focusing on user experience and market education, ensuring security and stability, and establishing an effective governance mechanism. Can Morpho occupy a place in the future DeFi ecosystem? Let us wait and see.

Reference link:

https://mint-ventures.medium.com/will-rapidly-growing-morpho-become-a-formidable-challenger-to-aave-6ea3cbffad1d

https://docs.morpho.org/morpho-blue/tutorials/track-rates/

https://en.thebigwhale.io/article-en/morpho-the-killer-app-for-decentralised-finance

Edmund

Edmund