Source: Chainalysis; Compiled by: Deng Tong, Golden Finance

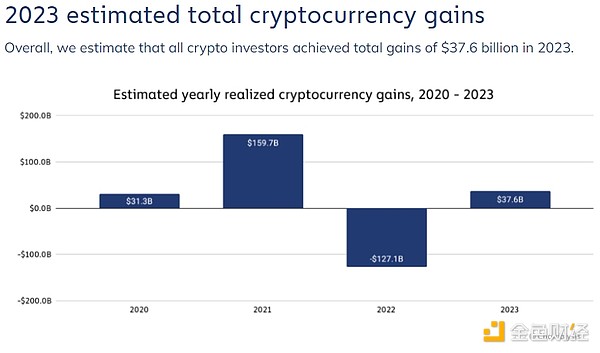

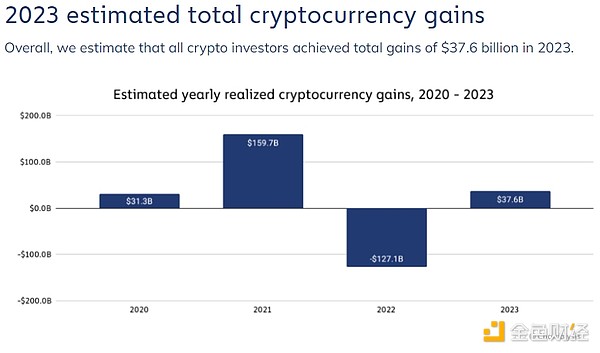

2023 is a year of recovery for the cryptocurrency market. After a challenging 2022, asset prices and market sentiment have continued to rise during the year. it has been improved. But how are investors actually doing? In this article, we share our estimates of cryptocurrency returns in 2023, including a breakdown of estimated returns by country, based on investor interactions with centralized exchanges.

Research methodology: How we calculate cryptocurrency returns and estimate returns by country

We use blockchain The data above estimates investors’ crypto returns based on the flow of crypto assets into and out of the service, where these assets can be transferred in and out of fiat currencies. Specifically, we first measure on-chain macro flows for a selected set of assets that represent approximately 80% of the total market capitalization of all cryptocurrencies and trade on major centralized exchanges that offer crypto-to-fiat conversions. We then estimate the overall collective return for each asset by measuring the difference between the dollar value of all withdrawals from the asset and the value of all deposits from the asset. This approach is based on the fact that any deposits to provide on-ramp services represent a potential conversion to cash, thereby realizing any gain or loss on the asset. While the method is not perfect, it gives us a strong estimate of returns on popular assets traded on centralized exchanges.

Once we have used this method to estimate the crypto asset earnings of users of each service we track, we divide these earnings based on each country's share of web traffic on each service's website assigned to each country. This combination of transaction data and web traffic is also the same framework we use to calculate our annual Global Cryptocurrency Adoption Index.

Although this total That's well below the $159.7 billion gain during the 2021 bull market, but it represents a sharp recovery from an estimated loss of $127.1 billion in 2022. Interestingly, our total return estimate for 2023 is lower than for 2021, despite crypto asset prices growing at similar rates in both years. One possible explanation for this is that Investors in 2023 are less likely to convert crypto assets into cash because unlike 2021 , the previous all-time high has not been surpassed at any point in 2023, so prices are expected to rise even higher.

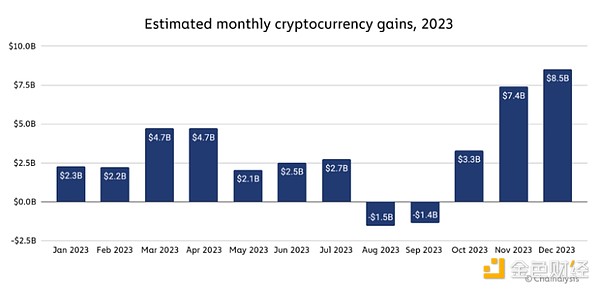

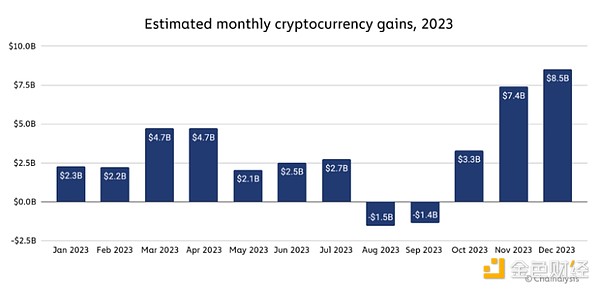

The cryptocurrency’s gains had been relatively steady throughout the year before two consecutive months of declines in August and September. Gains have since surged, with gains in November and December dwarfing all previous months.

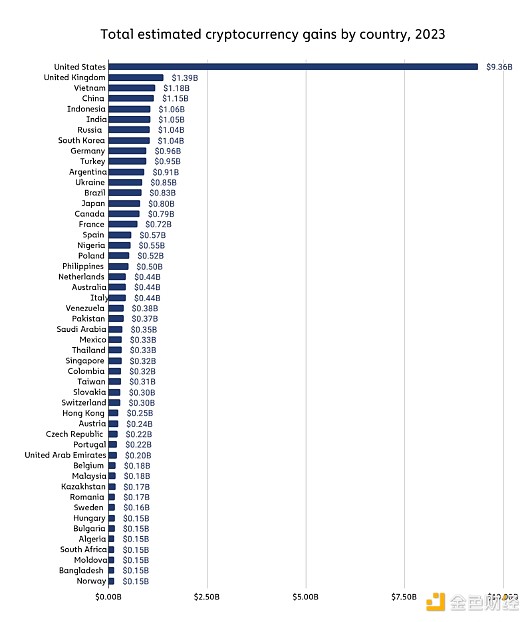

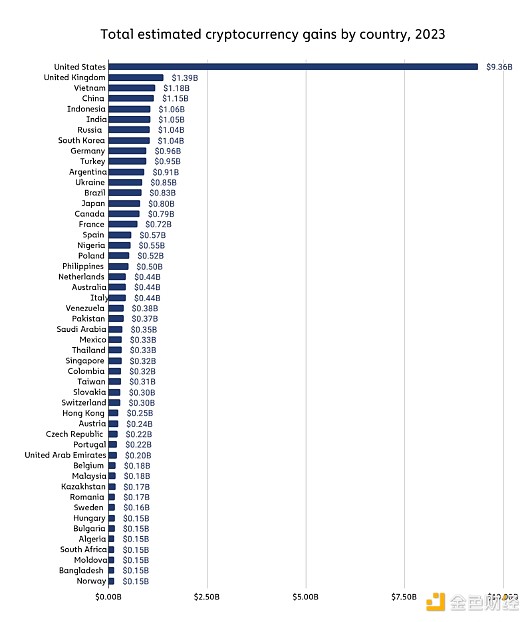

Estimated cryptocurrency income in various countries in 2023

The United States leads the way in cryptocurrency gains in 2023, reaching an estimated $9.36 billion. The UK ranks second with an estimated $1.39 billion in cryptocurrency gains.

Interestingly, We also see residents in some upper-middle-income and lower-middle-income countries appear to have made huge gains, Especially in Asia, such as Vietnam, China, Indonesia and India, their estimated revenue exceeds US$1 billion, ranking among the highest in the world. All countries are ranked in the top six. We previously noted in our 2023 Cryptocurrency Geography Report that countries in these income categories, especially lower- and middle-income countries, show strong cryptocurrency adoption rates that have remained significantly resilient even during the recent bear market . Our return estimates suggest that many investors in these countries benefit from embracing this asset class.

What are the big trends in 2024?

The positive trend from 2023 so far has continued into 2024, with prominent crypto assets such as Bitcoin hitting all-time highs amid the approval of Bitcoin ETFs and increased institutional adoption. If these trends continue, we may see gains more in line with those seen in 2021. As of March 13, Bitcoin was up 65.4% in 2024 and Ethereum was up 70.2%.

JinseFinance

JinseFinance