Source: Crypto Market Observation

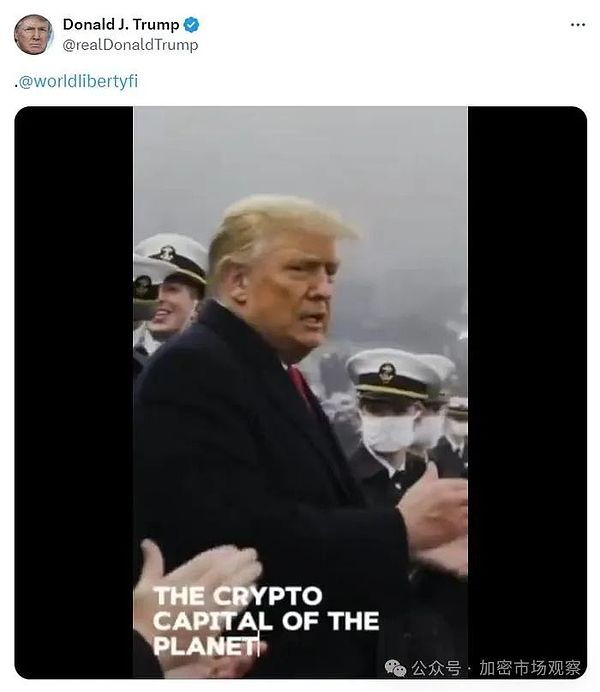

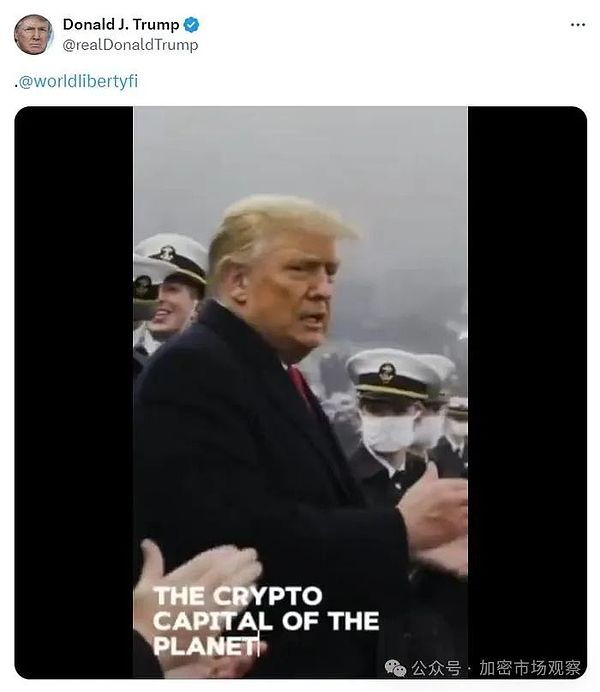

Trump announced yesterday that if elected, he would build the United States into the global crypto capital.

In fact, a few years ago, China was the crypto capital.

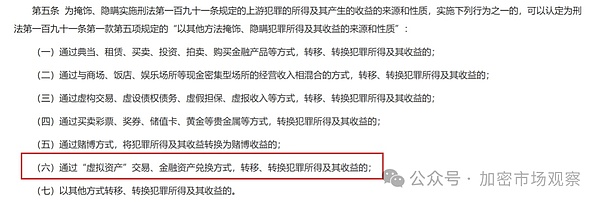

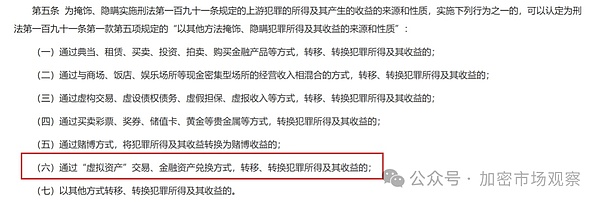

However, under the heavy hammer of policies, only Hong Kong is still fighting to regain this "crypto capital". For example, the Supreme People's Court and the Supreme People's Procuratorate recently clearly listed "virtual asset" transactions as one of the money laundering methods, which made many people nervous.

But don’t worry, what about investment, leasing and other traditional economic activities that are included in the money laundering methods together with virtual asset transactions? As long as the source of your funds is not criminal proceeds, you will not be affected. Therefore, the market of the encryption market has almost no fluctuations~

Taking advantage of this topic, let’s review in depth the Chinese government’s policies on encryption~

01 In 2009, there were masters in the system

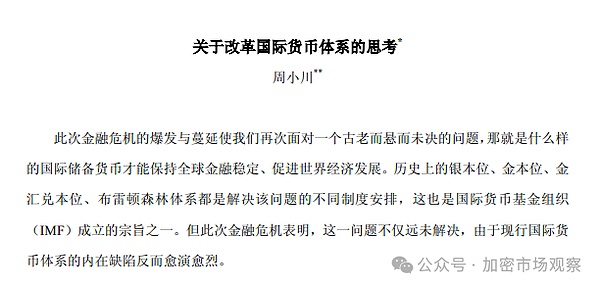

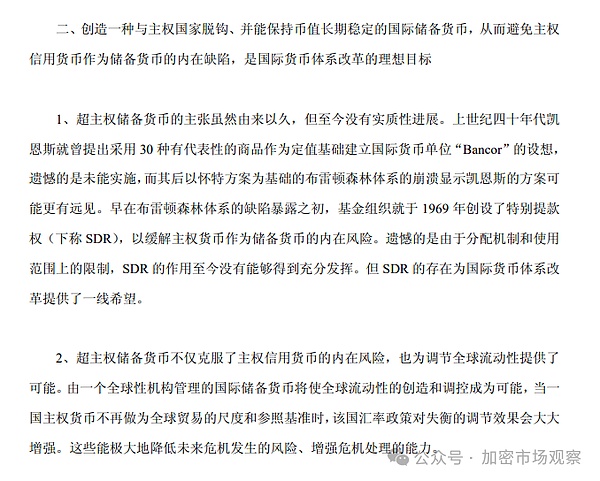

As early as 2009, Zhou Xiaochuan, then governor of the central bank, published an article entitled "Thoughts on Reforming the International Monetary System"

This article focuses on super-sovereign currency, that is, "creating an international reserve currency that is decoupled from sovereign states and can maintain long-term currency stability."

At this time, Bitcoin had only been on the market for 1 year.

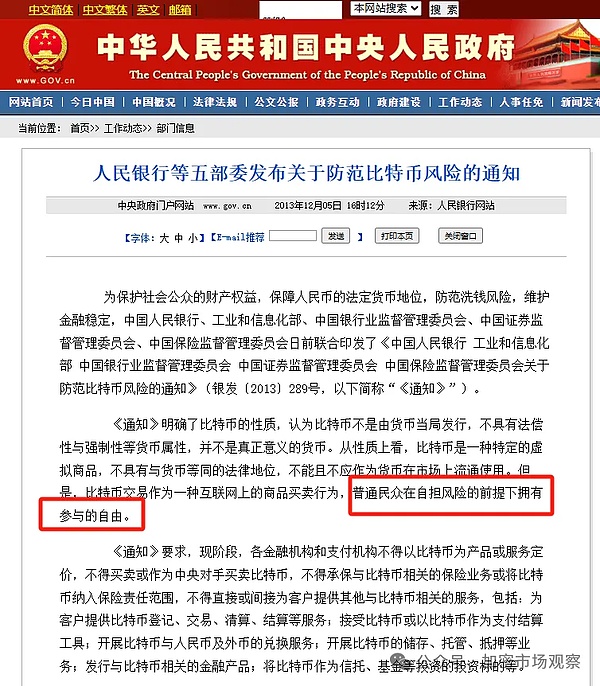

02 2013, free participation

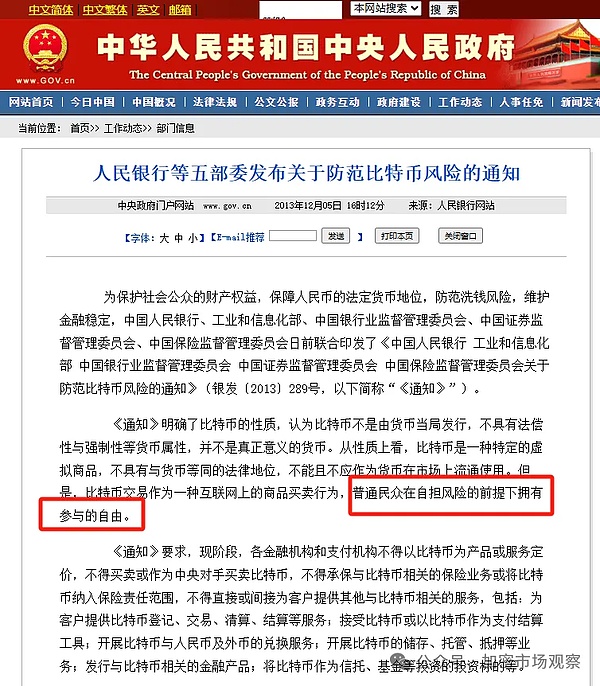

Therefore, China actually paid attention to Bitcoin very early. As early as 2013, when Bitcoin was less than 1,000 US dollars, a notice was issued to let everyone guard against the risks of Bitcoin.

However, in the 2013 notice, the tone was still relatively neutral. It did not recognize the currency status of Bitcoin, but positioned Bitcoin as a "commodity on the Internet" and did not prevent ordinary people from participating freely.

And the impact of Bitcoin on the financial system has actually been noticed by our government's top leaders for a long time.

In 2016, Zhou Xiaochuan said in an exclusive interview with Caixin.com that Bitcoin is a digital currency that does not need a central bank, which shows that our government elites were really powerful at that time!

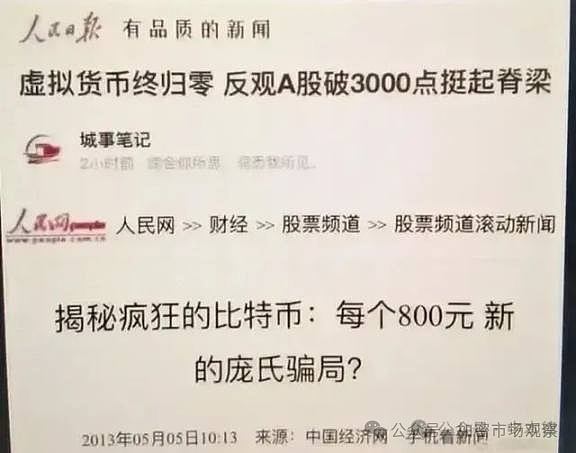

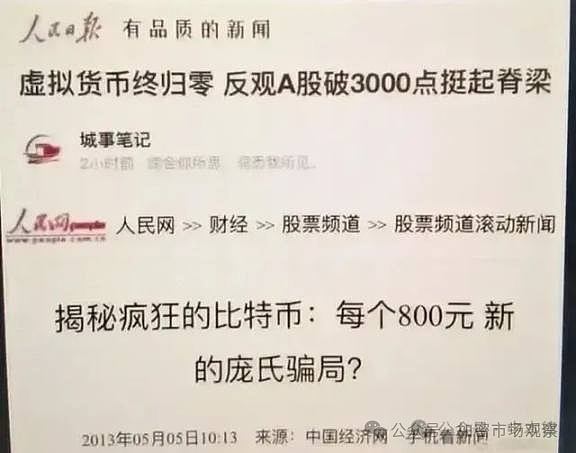

The attack on Bitcoin at that time was mainly verbal, and left two classic headlines:

Virtual currency finally returned to zero, while A-shares broke 3,000 points and stood up.

Uncovering the crazy Bitcoin: 800 yuan each, a new Ponzi scheme?

Now every time the A-share market falls below 3,000 points, crypto-industry friends will post this picture to lash out at the dead

And if a friend really bought 800 yuan of Bitcoin, not only would he have made 500 times the money by now, but he would also be a real OG boss in the crypto-industry, the kind that even the most beautiful people would want to lead their horses and whip them.

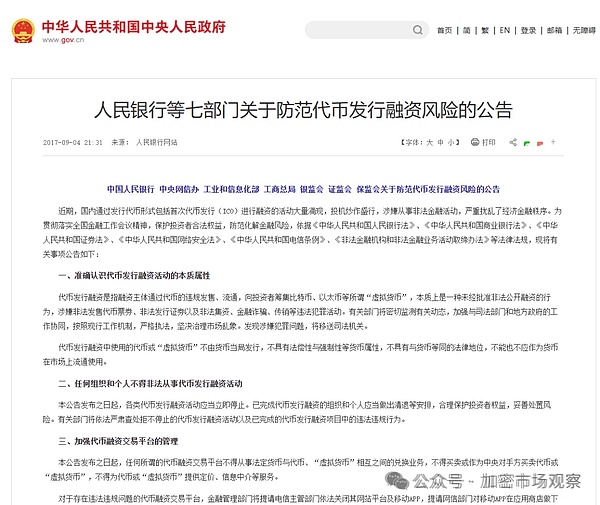

03 2017, a heavy blow

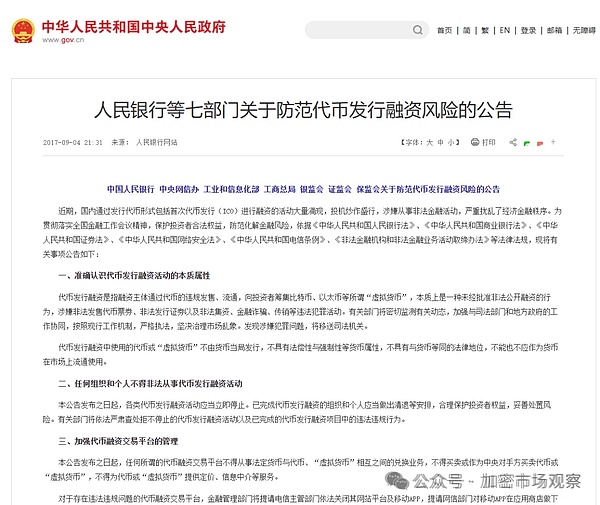

After Ethereum supported one-click coin issuance in 2017, a large number of people of all kinds poured into the crypto-industry, and the country finally couldn't help but start to take action:

On September 4, 2017, the People's Bank of China and seven other ministries and commissions jointly issued the "Notice on Preventing the Risks of Token Issuance and Financing", requiring a ban on virtual currency transactions.

This is the 94 incident that was so popular at the time.

Before this notice was officially issued, the executives of the three major exchanges at the time, BitChina, OKCoin, and Huobi, were said to have all been placed under border control.

Of course, there are some big guys who are well-informed and have fled abroad:

These big guys who have fled are also relatively well-off overseas. Xue Manzi went to Japan and bought a street, named "Manzi Alley", with eleven old townhouses; recently it seems that he has run out of money and returned to Hong Kong to make trouble.

Bao Erye Guo Hongcai purchased a 100-acre manor in Silicon Valley, USA, and named it "Leek Manor".

Changpeng Zhao is now the industry leader, and his Binance is now firmly in the top spot of the exchange.

Justin Sun is also very successful, acquiring Huobi, and his Tron chain is also a mainstream active public chain.

This is the last group photo of Bao Erye, Xue Manzi, and Changpeng Zhao in the mainland.

From then on, Chinese crypto practitioners went overseas one after another, and they couldn't run far.

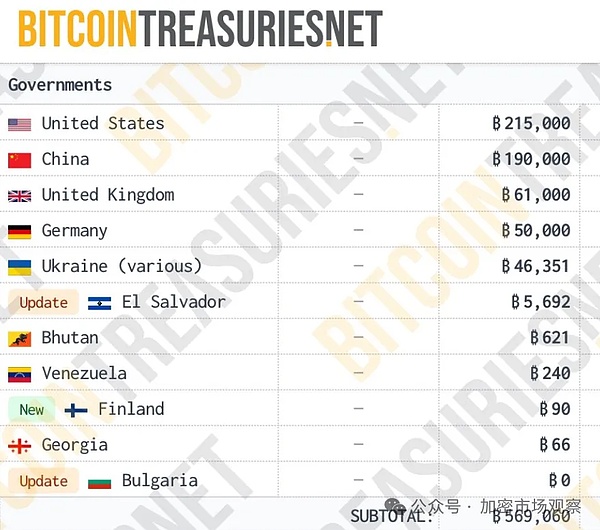

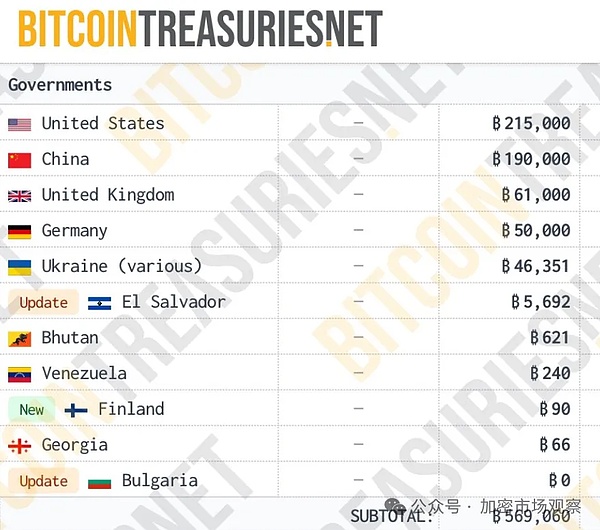

For example, the team of the PlusToken project only went to Sihanoukville, Cambodia, and was arrested by the police across the border. 190,000 bitcoins were seized in one fell swoop, which is worth more than 100 billion yuan today!

These bitcoins also became the source of the 190,000 bitcoins held by the Chinese government.

But friends can guess, does the Chinese government still have these 190,000 bitcoins?

04 2021, the darkest moment

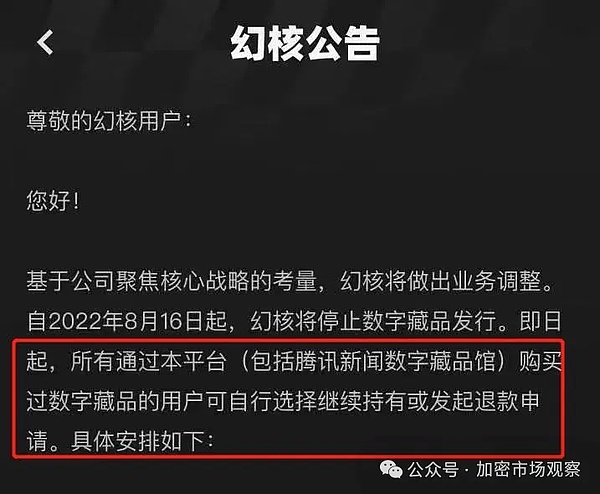

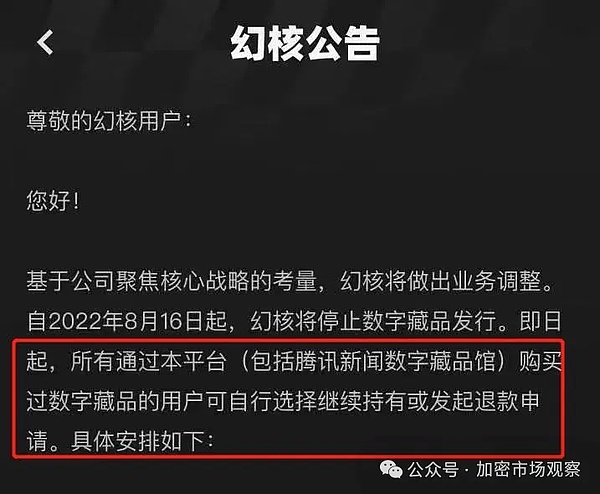

A few years later, it may be that the Chinese government feels that the intensity of cracking down on exchanges and legal currency projects is far from enough. In September 2021, all businesses providing cryptocurrency-related services in the mainland also began to be cleared. At this time, many Internet giants such as Tencent and Alibaba's encryption projects also began to be cleared.

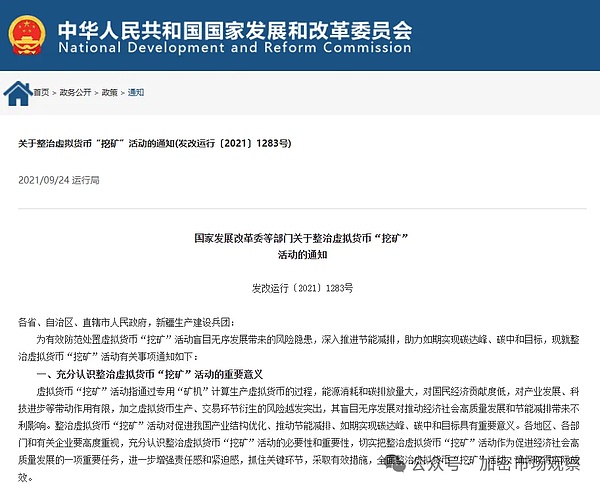

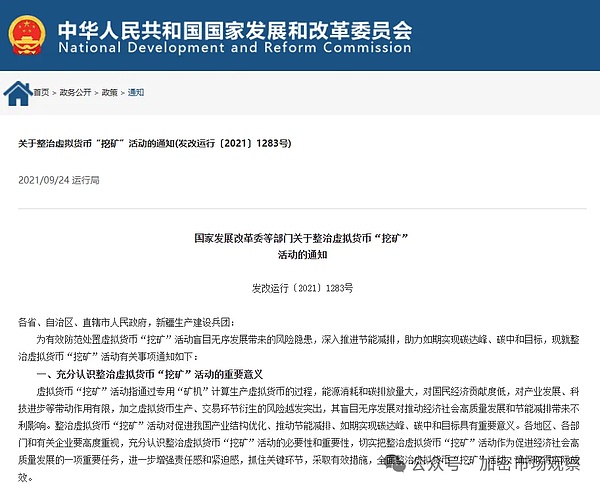

At the same time, it also began to crack down on Bitcoin mining, and stipulated that virtual currency-related business activities are illegal financial activities, and the relevant civil legal acts of ordinary people holding virtual currency are invalid.

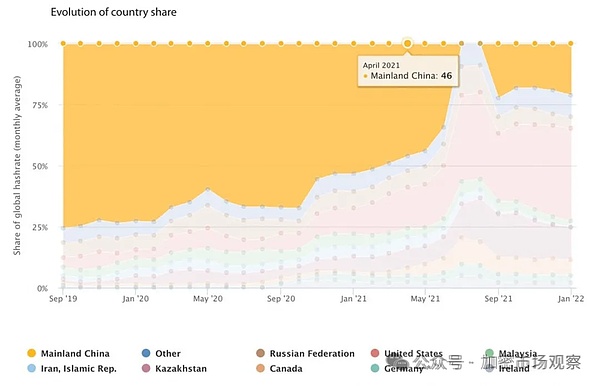

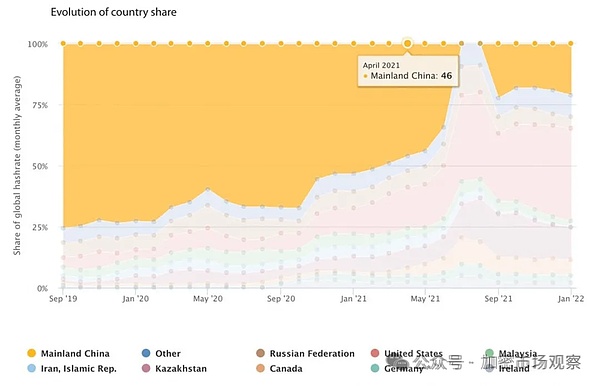

This crackdown caused a large number of miners to go overseas, and the Bitcoin mining computing power in mainland China was once "cleared to zero".

The reason was "energy conservation and emission reduction"

So far, Bitcoin in mainland China has been comprehensively cracked down from mining, trading, to other related services.

It can be said that this is the darkest moment for China's encryption industry. Everything that can be taken away has been taken away.

This may also be the time to rebound from the bottom, right?

05 Mining is back

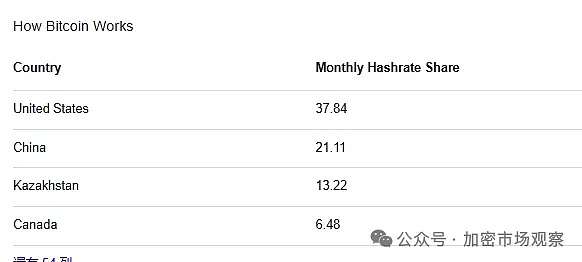

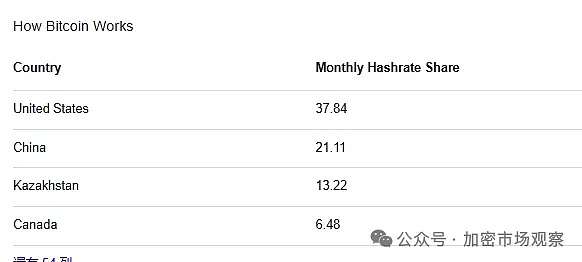

At the end of 2021, not long after the mining ban was issued, Bitcoin mining was back. Now the Bitcoin computing power in mainland China can actually rank second in the world, second only to the United States:

It is said that these computing powers are provided by some mining farms with good relations with the government. In places such as Inner Mongolia where clean electricity resources are abundant, local governments have even issued some "mining licenses"

After all, many places cannot access the Internet and cannot be sold for money, which is a waste.

It is better to use it to mine Bitcoin and make a little money, but to do this kind of business, you must have a strong relationship with the government.

06 Hong Kong opens up to encryption

With Singapore announcing its support for encryption, Hong Kong, as part of China, could no longer hold back. In October 2022, the Financial Services and Treasury Bureau of Hong Kong, China, issued the "Policy Declaration on the Development of Virtual Assets in Hong Kong".

You should know that before Hong Kong announced its support for encryption, it was actually not easy. Because of things like "universal suffrage" and "national security law", a large amount of foreign capital flowed out of Hong Kong and settled in Singapore.

However, Hong Kong's encryption road is not smooth sailing. The VATP license of the exchange that has attracted the most attention from the market has once caused a sensation. It is said that exchanges applying for Hong Kong licenses must clear mainland users, causing mainstream exchanges to withdraw their applications.

While clearing out the major crypto exchanges, traditional Internet giants have entered the market one after another. For example, PantherTrade under Futu, YAX under Tiger Securities, and xWhale under Sina have all obtained the Hong Kong VATP license mentioned earlier.

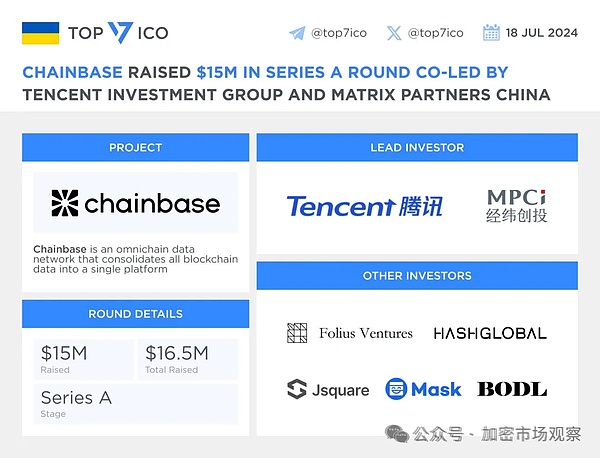

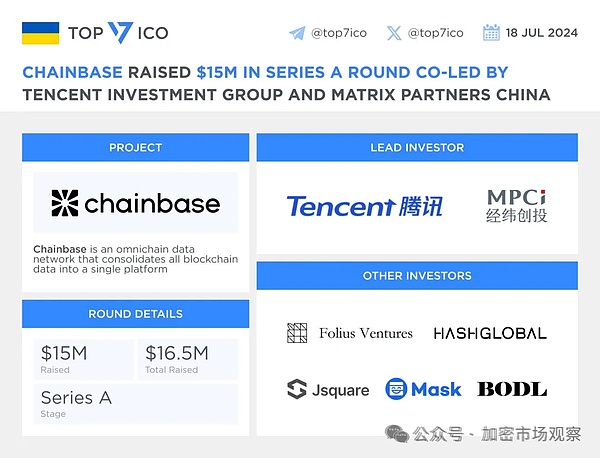

Tencent also teamed up with Matrix Partners China to invest $15 million in Chainbase, a developer of the full-chain data network.

Another Internet giant, JD.com, also quietly entered the Hong Kong Monetary Authority's stablecoin "sandbox"

ByteDance also officially announced its cooperation with Sui through its technology solution subsidiary BytePlus in April this year, and entered the blockchain for the first time.

Ant Financial, a subsidiary of Alibaba, has launched a pilot program for "DBS Treasury Tokens" in cooperation with Singapore's SingBank.

After such a series of operations,

Trump claimed that the reason he turned to this industry was because "If we don't do it, China will take over, or other countries, but it is likely to be China. China attaches great importance to this."

Seeing this information, some friends will ask Da Piaoliang, what do you think? So many Internet giants have entered the encryption industry, will the domestic encryption control measures be relaxed?

Da Piaoliang can responsibly tell everyone that it is impossible!

The reason is actually very simple. Our country has strict foreign exchange control measures, just in case everyone exchanges the RMB in their hands for foreign exchange and runs away.

Because cryptocurrencies are circulated all over the world, the country will definitely not allow ordinary people to hold cryptocurrencies.

07 China can't do without encryption

Just as Zhou Xiaochuan said in 2009, the encryption industry is the industry with the greatest hope of weakening the hegemony of the US dollar. After the outbreak of the Russian-Ukrainian war, the United States excluded Russia from Swift, resulting in almost 100% of Russia's foreign trade being settled in RMB.

What if the RMB is kicked out of Swift? Do we use rubles for settlement?

You should know that the Russian ruble has depreciated 1 million times in the past 36 years!

Therefore, if encryption can ensure stable settlement of foreign trade, then the encryption industry can be regarded as a great merit.

JinseFinance

JinseFinance